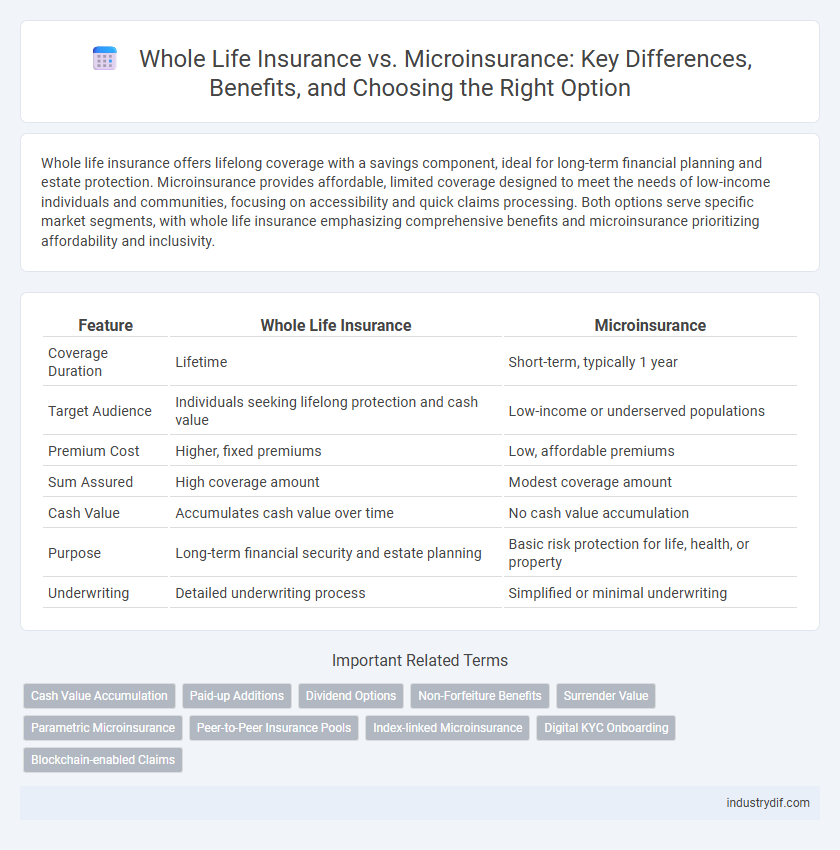

Whole life insurance offers lifelong coverage with a savings component, ideal for long-term financial planning and estate protection. Microinsurance provides affordable, limited coverage designed to meet the needs of low-income individuals and communities, focusing on accessibility and quick claims processing. Both options serve specific market segments, with whole life insurance emphasizing comprehensive benefits and microinsurance prioritizing affordability and inclusivity.

Table of Comparison

| Feature | Whole Life Insurance | Microinsurance |

|---|---|---|

| Coverage Duration | Lifetime | Short-term, typically 1 year |

| Target Audience | Individuals seeking lifelong protection and cash value | Low-income or underserved populations |

| Premium Cost | Higher, fixed premiums | Low, affordable premiums |

| Sum Assured | High coverage amount | Modest coverage amount |

| Cash Value | Accumulates cash value over time | No cash value accumulation |

| Purpose | Long-term financial security and estate planning | Basic risk protection for life, health, or property |

| Underwriting | Detailed underwriting process | Simplified or minimal underwriting |

Introduction to Whole Life Insurance and Microinsurance

Whole life insurance provides lifelong coverage with fixed premiums and a cash value component, offering financial security and a savings feature for policyholders. Microinsurance targets low-income individuals, delivering affordable, simplified coverage tailored to specific risks like health, life, or property with lower premiums and reduced benefit amounts. Both products address different market segments, with whole life insurance suited for long-term financial planning, while microinsurance focuses on accessibility and immediate risk protection in underserved communities.

Key Differences Between Whole Life Insurance and Microinsurance

Whole life insurance provides lifelong coverage with a savings component and higher premiums, making it ideal for long-term financial planning and wealth accumulation. Microinsurance offers affordable, limited coverage tailored for low-income individuals, focusing on basic protection with shorter terms and simpler underwriting. Key differences include policy duration, premium costs, coverage scope, and target demographic, with whole life insurance emphasizing permanence and microinsurance prioritizing accessibility.

Coverage Scope: Whole Life vs Microinsurance

Whole life insurance provides comprehensive, lifelong coverage with guaranteed death benefits and cash value accumulation, catering primarily to long-term financial protection needs. Microinsurance offers limited coverage designed to protect low-income individuals against specific risks, such as health emergencies or natural disasters, with affordable premiums and simplified claims processes. The scope of whole life insurance is broader and more enduring, while microinsurance targets immediate, essential protection within constrained financial means.

Premium Structure Comparison

Whole life insurance features fixed, higher premiums that provide lifelong coverage and build cash value, appealing to long-term financial planning. Microinsurance offers significantly lower, flexible premiums designed for low-income individuals seeking essential protection with minimal financial burden. The premium structure of whole life insurance is less accessible but more comprehensive, whereas microinsurance prioritizes affordability and targeted risk coverage.

Accessibility and Target Demographics

Whole life insurance typically targets middle to high-income individuals, offering lifelong coverage with fixed premiums but often requires higher initial payments, limiting accessibility. Microinsurance is designed for low-income populations, providing affordable, simplified policies with lower premiums and minimal documentation to enhance reach in underserved markets. The gap between these products lies in their accessibility: whole life insurance suits long-term financial planning for wealthier demographics, while microinsurance addresses immediate protection needs for economically vulnerable groups.

Payouts and Claims Process

Whole life insurance offers guaranteed lifetime payouts with the flexibility of cash value accumulation, ensuring policyholders receive a consistent financial benefit. Microinsurance typically provides smaller, targeted payouts designed for low-income individuals, with simplified claims processes to facilitate quick disbursement. The claims process for whole life insurance often involves detailed documentation and longer processing times, whereas microinsurance emphasizes accessibility and minimal paperwork to expedite claims resolution.

Policy Terms and Duration

Whole life insurance offers permanent coverage with fixed premiums and a cash value component, providing lifelong protection and financial security. Microinsurance features short-term policies with limited coverage amounts, designed to be affordable and accessible for low-income individuals or families. The policy duration for microinsurance typically ranges from a few months to a year, contrasting with the lifelong terms common in whole life insurance.

Suitability for Different Financial Goals

Whole life insurance provides lifelong coverage with a cash value component, making it suitable for long-term financial goals like estate planning and wealth accumulation. Microinsurance offers affordable, basic protection targeted at low-income individuals or communities, addressing immediate risks without significant investment. Choosing between them depends on the insured's income level, risk tolerance, and specific financial objectives.

Risk Management in Whole Life and Microinsurance

Whole life insurance provides comprehensive risk management by offering lifelong coverage with guaranteed premiums and cash value accumulation, ensuring financial stability and protection against long-term risks. Microinsurance, designed for low-income populations, focuses on covering specific, short-term risks with affordable premiums and simplified processes, enhancing accessibility and mitigating financial shocks from unforeseen events. Both insurance types serve distinct risk profiles, with whole life prioritizing enduring financial security and microinsurance addressing immediate, localized vulnerabilities.

Choosing the Right Insurance: Factors to Consider

Whole life insurance offers lifelong coverage with a savings component, suitable for individuals seeking long-term financial security and estate planning benefits. Microinsurance provides affordable, targeted protection ideal for low-income populations facing specific risks, such as health emergencies or natural disasters. Evaluating factors like coverage amount, premium affordability, duration, and individual financial goals is essential when choosing between whole life insurance and microinsurance.

Related Important Terms

Cash Value Accumulation

Whole life insurance provides significant cash value accumulation through guaranteed growth and dividends, offering a long-term savings component alongside lifetime coverage. Microinsurance typically lacks substantial cash value accumulation, focusing instead on affordable, short-term risk protection for low-income individuals.

Paid-up Additions

Paid-up additions in whole life insurance significantly enhance policy value by increasing the death benefit and cash value over time, whereas microinsurance typically lacks this feature due to its low-cost, limited coverage structure. Whole life insurance's paid-up additions provide long-term financial growth and flexibility, contrasting with microinsurance's focus on affordable, basic protection without investment components.

Dividend Options

Whole life insurance typically offers dividend options that allow policyholders to receive a share of the insurer's profits, which can be taken as cash, used to reduce premiums, or added to the policy's cash value. Microinsurance often lacks dividend options due to its low-cost, simplified structure aimed at providing essential coverage without profit-sharing features.

Non-Forfeiture Benefits

Whole life insurance offers robust non-forfeiture benefits such as cash value accumulation and paid-up insurance options that secure policyholders' investments even if premiums lapse. Microinsurance typically lacks these extensive non-forfeiture features, focusing instead on affordable coverage for low-income individuals without significant cash value or surrender options.

Surrender Value

Whole life insurance policies typically accumulate a surrender value that policyholders can access upon cancellation, reflecting the cash value built over time through premiums and interest. In contrast, microinsurance often lacks a significant surrender value due to lower premiums and simplified coverage, prioritizing affordability and immediate protection for low-income individuals.

Parametric Microinsurance

Whole life insurance offers lifelong coverage with cash value accumulation, making it ideal for long-term financial planning and wealth transfer, while parametric microinsurance provides affordable, immediate payouts based on predefined triggers such as weather events or natural disasters, targeting low-income populations with a focus on rapid claim settlement. The parametric model reduces administrative costs and fraud risk by automatically activating benefits when specific environmental parameters are met, enhancing financial inclusion in emerging markets.

Peer-to-Peer Insurance Pools

Whole life insurance provides lifelong coverage with fixed premiums and cash value accumulation, typically requiring higher premiums and underwriting standards compared to microinsurance, which offers affordable, limited coverage tailored for low-income individuals. Peer-to-peer insurance pools leverage microinsurance principles by enabling groups to share risks collectively through digital platforms, reducing costs and enhancing accessibility without compromising essential financial protection.

Index-linked Microinsurance

Whole life insurance offers lifelong coverage with fixed premiums and a cash value component that grows tax-deferred, while index-linked microinsurance provides affordable, targeted protection tied to specific indices like weather or crop yields, improving risk management for low-income populations. Index-linked microinsurance leverages real-time data and digital platforms to swiftly trigger payouts, enhancing financial inclusion and resilience in vulnerable communities compared to traditional whole life policies.

Digital KYC Onboarding

Whole life insurance offers lifelong coverage with fixed premiums, requiring comprehensive digital KYC onboarding to verify identity through biometric authentication and secure document upload, ensuring compliance with regulatory standards. Microinsurance utilizes a streamlined digital KYC process, leveraging mobile verification and AI-driven risk assessment to facilitate rapid policy issuance for low-income customers with limited documentation.

Blockchain-enabled Claims

Whole life insurance offers lifelong coverage with fixed premiums and cash value accumulation, while microinsurance provides affordable, targeted protection for low-income individuals. Blockchain-enabled claims processing enhances both by enabling transparent, tamper-proof records, faster claim approvals, and reduced fraud risk, thereby improving trust and efficiency in policy management.

Whole life insurance vs Microinsurance Infographic

industrydif.com

industrydif.com