An insurance agent offers personalized advice tailored to individual needs through human interaction, ensuring complex queries and unique situations are addressed effectively. In contrast, a chatbot advisor provides instant, 24/7 responses using AI-driven algorithms for routine inquiries, policy information, and basic claim support. Choosing between an agent and a chatbot depends on the desired level of customization and immediacy in service delivery.

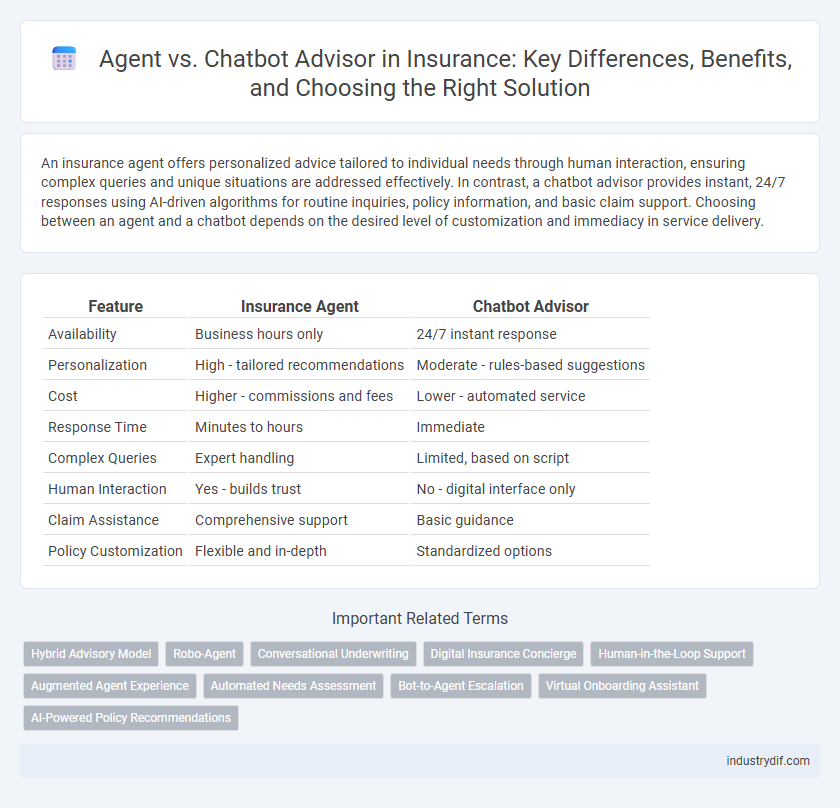

Table of Comparison

| Feature | Insurance Agent | Chatbot Advisor |

|---|---|---|

| Availability | Business hours only | 24/7 instant response |

| Personalization | High - tailored recommendations | Moderate - rules-based suggestions |

| Cost | Higher - commissions and fees | Lower - automated service |

| Response Time | Minutes to hours | Immediate |

| Complex Queries | Expert handling | Limited, based on script |

| Human Interaction | Yes - builds trust | No - digital interface only |

| Claim Assistance | Comprehensive support | Basic guidance |

| Policy Customization | Flexible and in-depth | Standardized options |

Overview: Human Agents vs Chatbot Advisors in Insurance

Human insurance agents provide personalized advice by assessing individual client needs, leveraging their expertise and emotional understanding to guide complex policy decisions. Chatbot advisors utilize AI algorithms and real-time data processing to offer instant, automated responses for routine inquiries and policy management, enhancing efficiency and accessibility. While agents excel in building trust and handling nuanced cases, chatbots improve customer service scalability and 24/7 availability in the insurance industry.

Core Responsibilities: Comparing Agents and Chatbots

Insurance agents provide personalized policy recommendations, handle complex claims processing, and build client relationships through direct human interaction. Chatbot advisors efficiently deliver instant responses to frequently asked questions, assist with basic policy inquiries, and guide users through straightforward transactions using AI-driven algorithms. Agents excel in nuanced decision-making and emotional support, while chatbots enhance scalability and 24/7 availability in insurance customer service.

Customer Experience: Personal Touch vs Automation

Insurance agents provide a personalized customer experience by offering tailored advice and empathy, which builds trust and addresses complex concerns effectively. Chatbot advisors deliver instant, 24/7 support, efficiently handling routine inquiries and policy management through automated responses. Balancing the human touch of agents with the convenience of chatbot automation enhances overall customer satisfaction and engagement in the insurance industry.

Availability and Response Time

Insurance agents provide personalized guidance but often have limited availability during business hours, leading to potential delays in response time. Chatbot advisors operate 24/7, offering instant assistance and immediate answers to common insurance queries. The continuous accessibility and rapid response of chatbots enhance customer experience by reducing wait times and improving service efficiency.

Cost Efficiency for Insurance Providers

Insurance providers experience significant cost efficiency through chatbots by automating routine client interactions, reducing the need for extensive human agent staffing. Chatbot advisors operate 24/7 without salary or benefits expenses, resulting in lower operational costs and faster response times. While agents excel in complex claim handling and personalized service, chatbots drive scalability and reduce overhead, optimizing overall cost management for insurers.

Handling Complex Insurance Queries

Insurance agents provide personalized guidance for complex insurance queries, leveraging their expertise to navigate intricate policies and tailor solutions. Chatbot advisors offer instant responses and basic assistance using AI, but often lack the nuanced understanding required for complicated claim processes or detailed policy customization. Combining human agents with chatbots can enhance customer experience by balancing efficiency with in-depth problem-solving capabilities.

Data Security and Compliance Concerns

Insurance agents and chatbot advisors differ significantly in handling data security and compliance; agents typically follow established protocols tailored to complex regulatory environments, ensuring personalized safeguarding of sensitive client information. Chatbot advisors depend on advanced encryption and AI-driven compliance checks but face challenges in adhering to constantly evolving insurance regulations and preventing data breaches due to automated processes. Both methods require robust cybersecurity frameworks and regular audits to maintain compliance with standards such as GDPR and HIPAA, protecting insured parties' privacy and trust.

Integration with Digital Insurance Platforms

Agent integration with digital insurance platforms enhances personalized customer interactions by combining human expertise with real-time data access and policy management tools. Chatbot advisors streamline service through automated claims processing, instant quote generation, and 24/7 availability, improving efficiency and user experience. Seamless integration of both solutions enables insurers to deliver scalable, responsive support while maintaining tailored guidance for complex inquiries.

Scalability in Customer Support

Insurance companies achieve greater scalability in customer support by leveraging chatbots, which handle high volumes of inquiries simultaneously without fatigue. Human agents provide personalized service but face limitations in managing multiple clients at once, restricting overall scalability. Integrating chatbot advisors with human agents ensures efficient handling of routine tasks while reserving complex issues for skilled representatives, optimizing operational capacity.

Future Trends: Hybrid Models in Insurance Advisory

Hybrid models combining human insurance agents with AI-powered chatbot advisors are transforming the insurance advisory landscape by enhancing customer engagement and operational efficiency. These integrated solutions leverage machine learning algorithms to provide personalized policy recommendations while enabling agents to focus on complex cases requiring human judgment. Predictive analytics and natural language processing continue to evolve, driving the development of seamless, hybrid advisory systems that optimize risk assessment and customer satisfaction in the future of insurance.

Related Important Terms

Hybrid Advisory Model

The Hybrid Advisory Model in insurance combines the personalized expertise of human agents with the efficiency and 24/7 availability of chatbot advisors, enhancing customer experience and operational efficiency. Leveraging AI-driven chatbots for routine queries while reserving complex decision-making for agents optimizes resource allocation and improves policyholder satisfaction.

Robo-Agent

Robo-agents in insurance leverage AI-driven algorithms to provide instant, personalized policy recommendations and claims support, reducing response times and operational costs. Unlike traditional agents, robo-agents analyze vast datasets to optimize customer interactions and enhance risk assessment accuracy.

Conversational Underwriting

Conversational underwriting leverages AI-powered chatbots to collect accurate patient data swiftly, reducing human error and improving risk assessment efficiency compared to traditional insurance agents. Chatbot advisors enable seamless, 24/7 client interactions, accelerating policy issuance while lowering operational costs and enhancing customer satisfaction in the underwriting process.

Digital Insurance Concierge

A digital insurance concierge integrates AI-driven chatbots with human agents to offer seamless customer support, optimizing policy recommendations and claims processing. This hybrid approach enhances user experience by combining personalized interaction with 24/7 automated assistance, driving efficiency and satisfaction in digital insurance services.

Human-in-the-Loop Support

Human-in-the-loop support in insurance leverages agents' expertise alongside chatbot advisors to ensure accurate risk assessment and personalized policy recommendations. This hybrid approach enhances customer satisfaction by combining AI-driven efficiency with human empathy and complex decision-making capabilities.

Augmented Agent Experience

The Augmented Agent Experience combines human insurance agents' expertise with AI-powered chatbot advisors, enhancing efficiency and personalization in client interactions. Leveraging natural language processing and real-time data analytics, this hybrid approach improves policy recommendations and accelerates claim processing while maintaining empathetic support.

Automated Needs Assessment

Automated needs assessment through chatbot advisors leverages artificial intelligence to analyze customer data instantly, providing personalized insurance recommendations without human intervention. Insurance agents rely on experience and nuanced understanding but often require more time to evaluate individual client needs compared to AI-driven chatbots offering consistent, data-driven assessments.

Bot-to-Agent Escalation

Bot-to-agent escalation in insurance enhances customer experience by seamlessly transferring complex claims or policy inquiries from chatbots to human agents, ensuring personalized support and faster resolution. This hybrid approach leverages AI-driven chatbots for initial data gathering while human agents handle nuanced cases requiring empathy and expert judgment.

Virtual Onboarding Assistant

Virtual onboarding assistants in insurance leverage AI-driven chatbots to streamline customer enrollment and policy selection, reducing processing time by up to 50%. Unlike traditional agents, these digital advisors offer 24/7 personalized support, enhancing user experience while minimizing operational costs.

AI-Powered Policy Recommendations

AI-powered chatbot advisors deliver personalized insurance policy recommendations by analyzing extensive customer data and preferences faster than human agents. These chatbots enhance efficiency and accuracy, offering real-time quotes and tailoring coverage options to individual needs without human intervention.

Agent vs Chatbot Advisor Infographic

industrydif.com

industrydif.com