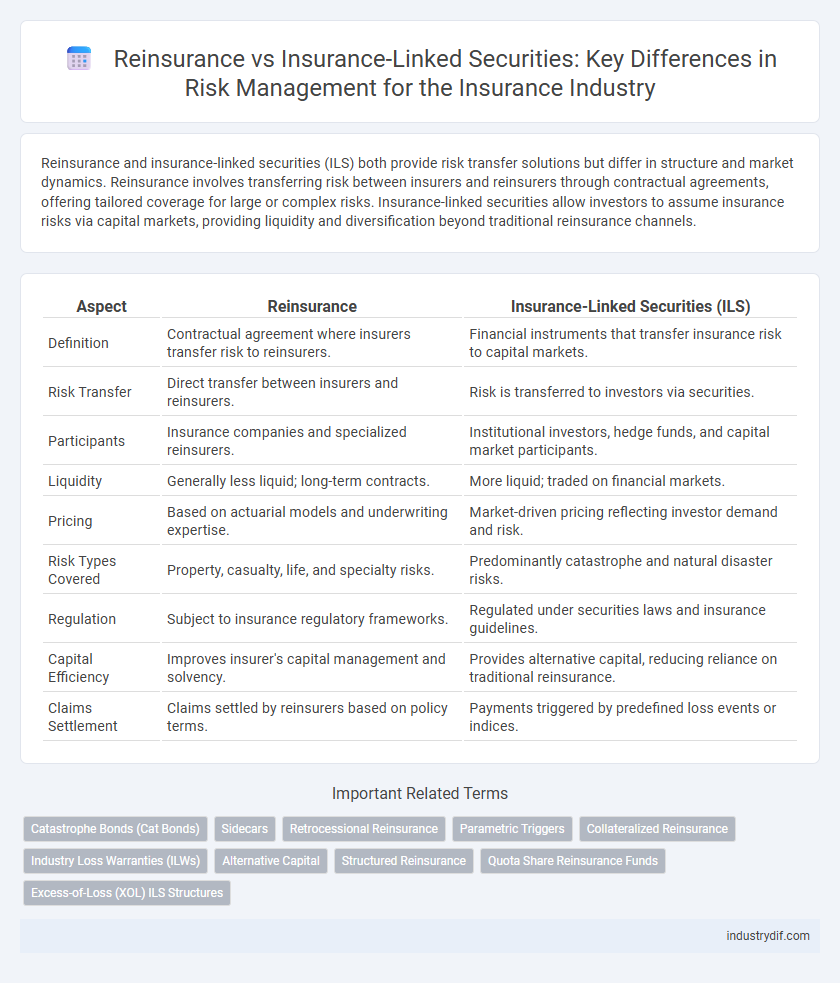

Reinsurance and insurance-linked securities (ILS) both provide risk transfer solutions but differ in structure and market dynamics. Reinsurance involves transferring risk between insurers and reinsurers through contractual agreements, offering tailored coverage for large or complex risks. Insurance-linked securities allow investors to assume insurance risks via capital markets, providing liquidity and diversification beyond traditional reinsurance channels.

Table of Comparison

| Aspect | Reinsurance | Insurance-Linked Securities (ILS) |

|---|---|---|

| Definition | Contractual agreement where insurers transfer risk to reinsurers. | Financial instruments that transfer insurance risk to capital markets. |

| Risk Transfer | Direct transfer between insurers and reinsurers. | Risk is transferred to investors via securities. |

| Participants | Insurance companies and specialized reinsurers. | Institutional investors, hedge funds, and capital market participants. |

| Liquidity | Generally less liquid; long-term contracts. | More liquid; traded on financial markets. |

| Pricing | Based on actuarial models and underwriting expertise. | Market-driven pricing reflecting investor demand and risk. |

| Risk Types Covered | Property, casualty, life, and specialty risks. | Predominantly catastrophe and natural disaster risks. |

| Regulation | Subject to insurance regulatory frameworks. | Regulated under securities laws and insurance guidelines. |

| Capital Efficiency | Improves insurer's capital management and solvency. | Provides alternative capital, reducing reliance on traditional reinsurance. |

| Claims Settlement | Claims settled by reinsurers based on policy terms. | Payments triggered by predefined loss events or indices. |

Introduction to Reinsurance and Insurance-Linked Securities

Reinsurance involves insurance companies transferring portions of their risk portfolios to other insurers to reduce exposure to large losses, thereby stabilizing financial performance. Insurance-linked securities (ILS) are financial instruments that allow investors to assume insurance risk by purchasing securities linked to insurance events, providing an alternative risk transfer mechanism. Both tools enhance risk management in the insurance industry by spreading and diversifying potential losses.

Defining Key Concepts: Reinsurance vs ILS

Reinsurance involves insurance companies transferring portions of their risk portfolios to other insurers to reduce exposure, while Insurance-Linked Securities (ILS) are financial instruments that transfer insurance risk to capital market investors. Reinsurance typically functions through contracts between insurance companies, providing risk pooling and risk management, whereas ILS enables broader market participation by securitizing insurance risks into tradable securities like catastrophe bonds. Understanding these distinctions is crucial for optimizing risk distribution and capital efficiency in the insurance sector.

How Traditional Reinsurance Works

Traditional reinsurance functions as a risk transfer tool where insurance companies cede portions of their risk portfolios to reinsurers in exchange for premiums, stabilizing loss experience and protecting against catastrophic events. This bilateral agreement enables primary insurers to increase underwriting capacity and safeguard solvency by sharing potential large losses. Reinsurers assess the insured risks using actuarial analysis, underwriting expertise, and historical loss data to determine coverage terms and pricing structures.

Understanding Insurance-Linked Securities (ILS)

Insurance-Linked Securities (ILS) are financial instruments that transfer insurance risk to capital market investors, providing alternative risk financing beyond traditional reinsurance. These securities, including catastrophe bonds and collateralized reinsurance, allow insurers to manage exposure to catastrophic events by accessing a broader pool of capital. ILS offer enhanced liquidity and risk diversification compared to conventional reinsurance arrangements, aligning investor returns with the occurrence of insured loss events.

Risk Transfer Mechanisms: Reinsurance and ILS Compared

Reinsurance involves direct risk transfer between insurers, allowing primary insurers to offload portions of their underwriting risk to reinsurers, enhancing capital efficiency and solvency. Insurance-Linked Securities (ILS) transfer risk to the capital markets by securitizing insurance risk into tradable financial instruments like catastrophe bonds, attracting a broader investor base and providing alternative risk financing. Both mechanisms diversify risk portfolios but differ fundamentally in structure, market participants, and capital accessibility.

Market Participants: Reinsurers and Capital Markets

Reinsurers dominate the traditional risk transfer market by underwriting large-scale insurance portfolios and providing stability to insurers through risk pooling. Insurance-linked securities (ILS) attract capital market investors seeking diversified, non-correlated returns by securitizing insurance risks into tradable financial instruments. The collaboration between reinsurers and capital markets enhances risk distribution, increases capacity, and drives innovation in global insurance risk management.

Financial Structures: Treaty, Facultative, and ILS Instruments

Reinsurance financial structures include Treaty and Facultative arrangements, where Treaty covers a portfolio of risks under a contract while Facultative applies to individual risks selectively ceded by the insurer. Insurance-Linked Securities (ILS) utilize capital market instruments such as catastrophe bonds and sidecars to transfer insurance risk to investors, providing alternative risk financing outside traditional reinsurance channels. These structures offer diverse risk management options, balancing risk retention and transfer to optimize capital efficiency and coverage flexibility.

Benefits and Limitations of Reinsurance

Reinsurance offers insurers risk transfer, capital relief, and loss stabilization by sharing large or catastrophic risks with reinsurers, enhancing financial stability and underwriting capacity. Limitations include counterparty risk, potential high costs, and reduced direct customer control compared to Insurance-Linked Securities (ILS), which provide market-based risk transfer with more transparency and liquidity. While reinsurance relies on contractual agreements subject to negotiation and complexity, it remains essential for managing traditional insurance risks despite evolving alternatives like ILS.

Advantages and Challenges of ILS

Insurance-Linked Securities (ILS) offer insurers access to alternative capital, enhancing risk diversification and liquidity compared to traditional reinsurance. ILS can provide greater transparency, quicker capital deployment, and potential cost efficiency but face challenges such as market volatility, limited historical data for accurate modeling, and regulatory complexities. These factors require careful risk assessment and strategic integration within an insurer's overall risk management framework.

Future Trends in Reinsurance and ILS Integration

Future trends in reinsurance and insurance-linked securities (ILS) integration emphasize increased collaboration through innovative risk transfer solutions that blend traditional reinsurance with capital market instruments. The growing adoption of technology such as blockchain and advanced data analytics is streamlining the underwriting and claims process, enhancing transparency and efficiency in both reinsurance and ILS markets. Market participants are focusing on diversification strategies and capital optimization to address emerging risks from climate change, natural catastrophes, and cyber threats, driving a more resilient and adaptive risk management ecosystem.

Related Important Terms

Catastrophe Bonds (Cat Bonds)

Catastrophe bonds (Cat Bonds) serve as a critical financial tool within Insurance-Linked Securities (ILS), transferring catastrophe risks from insurers to capital markets and enhancing risk diversification. Unlike traditional reinsurance, which involves direct risk exchange between insurers and reinsurers, Cat Bonds offer investors a high-yield opportunity by underwriting natural disaster risks, thus providing insurers with alternative capital sources to manage large-scale loss events.

Sidecars

Sidecars in reinsurance enable insurers to access capital from investors, providing a flexible alternative to traditional reinsurance by transferring specific risks to third parties. Unlike Insurance-Linked Securities (ILS), sidecars offer tailored, quota-share participation, allowing for direct involvement in underwriting profits and losses within a defined portfolio.

Retrocessional Reinsurance

Retrocessional reinsurance involves transferring risk from a primary reinsurer to another reinsurer, providing an additional layer of risk management beyond initial reinsurance agreements. Unlike insurance-linked securities (ILS), which securitize risk for capital markets investment, retrocessional reinsurance operates within the traditional reinsurance market, enhancing risk diversification and capital efficiency for insurers.

Parametric Triggers

Parametric triggers in reinsurance activate payouts based on predefined event parameters, such as wind speed or earthquake magnitude, allowing insurers to manage catastrophe risk with rapid, objective claims settlement. In contrast, insurance-linked securities (ILS) use parametric triggers to transfer risk to capital markets, providing investors with exposure to specific event probabilities while offering insurers immediate liquidity upon trigger activation.

Collateralized Reinsurance

Collateralized reinsurance involves the ceding insurer posting collateral to secure reinsurance obligations, providing greater credit protection compared to traditional reinsurance, while insurance-linked securities (ILS) transfer risk to capital markets through tradable financial instruments. Unlike ILS, which offer diversification and liquidity, collateralized reinsurance ensures immediate funds availability and reduced counterparty risk due to fully collateralized agreements.

Industry Loss Warranties (ILWs)

Industry Loss Warranties (ILWs) serve as a key instrument in reinsurance, providing coverage triggered by industry-wide losses exceeding a specified threshold rather than individual policyholder claims. In contrast, Insurance-Linked Securities (ILS) involve the transfer of risks, including ILWs, to capital markets, enabling investors to assume exposure to catastrophic events through tradable financial instruments.

Alternative Capital

Alternative capital in reinsurance markets, such as Insurance-Linked Securities (ILS), provides non-traditional funding sources that enhance risk transfer capabilities beyond conventional insurance contracts. ILS instruments, including catastrophe bonds and sidecars, offer investors exposure to insurance risks while diversifying capital away from traditional reinsurers.

Structured Reinsurance

Structured reinsurance utilizes customized contracts to transfer specific insurance risks between parties, optimizing capital efficiency and risk management. Insurance-linked securities (ILS) securitize these risks into tradable instruments, offering broader market access and liquidity but often with less tailoring than structured reinsurance solutions.

Quota Share Reinsurance Funds

Quota Share Reinsurance Funds provide a proportional risk-sharing arrangement where reinsurers assume a fixed percentage of all policies underwritten, enhancing capital efficiency and risk diversification in the insurance sector. Unlike Insurance-Linked Securities, which transfer specific risks to capital markets through tradable instruments, Quota Share Reinsurance Funds maintain continuous partnerships between insurers and reinsurers, optimizing underwriting capacity and financial stability.

Excess-of-Loss (XOL) ILS Structures

Excess-of-Loss (XOL) Insurance-Linked Securities (ILS) structures transfer catastrophic risk from insurers to capital markets, providing high-yield investment opportunities while protecting against losses exceeding specified thresholds. Unlike traditional reinsurance, XOL ILS offers transparency, fixed terms, and reduced counterparty risk by using collateralized contracts that trigger payouts based on predefined loss events.

Reinsurance vs Insurance-Linked Securities Infographic

industrydif.com

industrydif.com