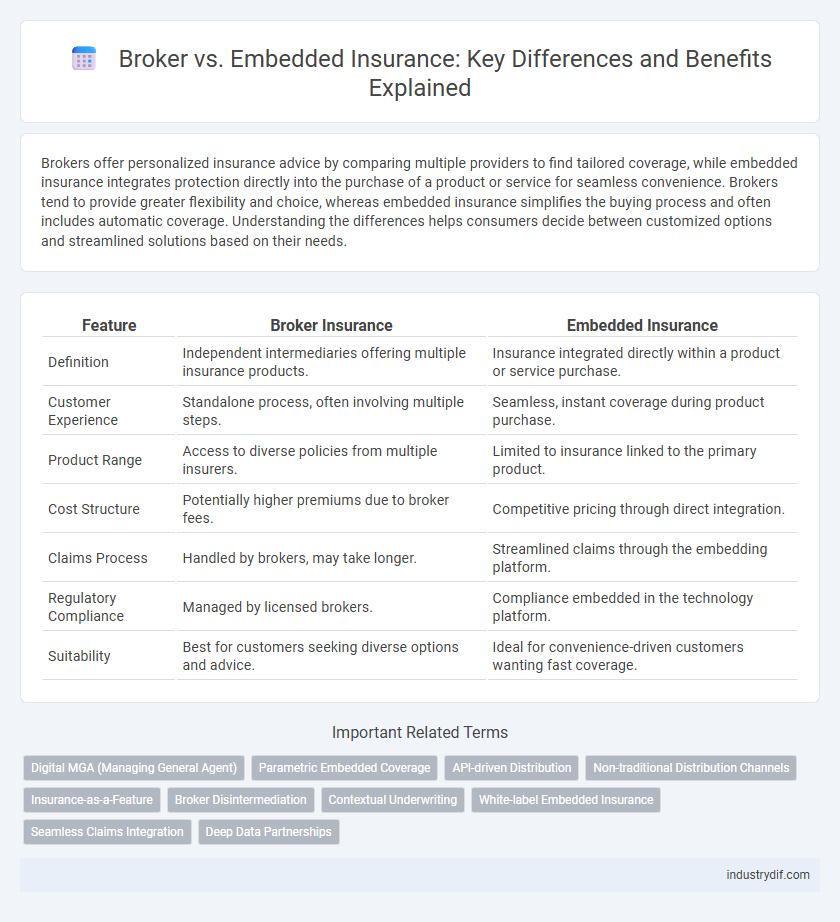

Brokers offer personalized insurance advice by comparing multiple providers to find tailored coverage, while embedded insurance integrates protection directly into the purchase of a product or service for seamless convenience. Brokers tend to provide greater flexibility and choice, whereas embedded insurance simplifies the buying process and often includes automatic coverage. Understanding the differences helps consumers decide between customized options and streamlined solutions based on their needs.

Table of Comparison

| Feature | Broker Insurance | Embedded Insurance |

|---|---|---|

| Definition | Independent intermediaries offering multiple insurance products. | Insurance integrated directly within a product or service purchase. |

| Customer Experience | Standalone process, often involving multiple steps. | Seamless, instant coverage during product purchase. |

| Product Range | Access to diverse policies from multiple insurers. | Limited to insurance linked to the primary product. |

| Cost Structure | Potentially higher premiums due to broker fees. | Competitive pricing through direct integration. |

| Claims Process | Handled by brokers, may take longer. | Streamlined claims through the embedding platform. |

| Regulatory Compliance | Managed by licensed brokers. | Compliance embedded in the technology platform. |

| Suitability | Best for customers seeking diverse options and advice. | Ideal for convenience-driven customers wanting fast coverage. |

Definition of Broker and Embedded Insurance

A broker in insurance acts as an intermediary between clients and insurance companies, helping individuals or businesses compare and purchase the most suitable policies based on their specific needs. Embedded insurance integrates insurance coverage directly within the purchase of a product or service, streamlining the customer experience by offering protection at the point of sale without the need for separate broker involvement. Both models aim to facilitate access to insurance but differ in their approach to distribution and customer interaction.

Key Differences Between Brokers and Embedded Insurance

Brokers act as intermediaries connecting customers with multiple insurance providers, offering personalized advice and a range of policy options, while embedded insurance integrates insurance directly into the purchase of products or services, providing seamless coverage without separate transactions. Brokers typically provide tailored recommendations based on client needs, whereas embedded insurance leverages technology to deliver instant protection within the customer journey. Cost structures differ as brokers may charge commissions or fees, whereas embedded insurance premiums are often built into the product price, emphasizing convenience and immediacy.

How Broker Insurance Works

Broker insurance operates by connecting clients with multiple insurance providers, offering a personalized assessment of coverage options tailored to specific needs. Brokers leverage their expertise to compare policies, negotiate terms, and facilitate claims, ensuring clients receive optimal protection and value. This transparent, client-focused approach contrasts with embedded insurance, where coverage is seamlessly integrated into a product or service without direct broker involvement.

How Embedded Insurance is Distributed

Embedded insurance is distributed directly through non-insurance platforms such as e-commerce sites, travel agencies, and financial service apps, seamlessly integrating coverage options within the customer's buying journey. This distribution method leverages digital APIs and partnerships, enabling real-time policy issuance without requiring separate broker involvement. By embedding insurance products at the point of sale, companies enhance customer convenience and increase uptake rates compared to traditional broker-driven models.

Benefits of Using an Insurance Broker

Insurance brokers offer personalized advice tailored to individual risk profiles, ensuring clients receive coverage that precisely matches their needs. Brokers have access to multiple insurers, enabling competitive pricing and broader policy options unavailable through embedded insurance solutions. Their expertise simplifies claims processes and provides ongoing support, enhancing the overall customer experience and protection.

Advantages of Embedded Insurance Solutions

Embedded insurance streamlines the customer journey by integrating coverage options directly at the point of sale, enhancing convenience and reducing friction. This approach boosts conversion rates by offering tailored policies aligned with specific products or services, increasing relevance and customer satisfaction. Insurers benefit from richer data insights and closer customer relationships, facilitating personalized risk assessment and more efficient claims handling.

Challenges Facing Brokers vs Embedded Insurance

Brokers face challenges such as limited customer reach and reliance on manual processes, leading to slower policy issuance and higher operational costs. Embedded insurance overcomes these barriers by integrating seamlessly within digital platforms, offering instant coverage at the point of sale and enhancing user experience. Regulatory compliance and data security complexities also pose significant obstacles for brokers in contrast to the automated frameworks supporting embedded insurance solutions.

Regulatory Considerations for Both Models

Regulatory considerations for broker and embedded insurance models differ significantly, with brokers typically required to adhere to licensing, disclosure, and fiduciary duty regulations under frameworks like the Dodd-Frank Act or Solvency II. Embedded insurance involves regulatory scrutiny around data privacy, consumer protection, and the integration of insurance products within non-insurance platforms, often governed by both insurance laws and digital commerce regulations. Compliance complexity increases as embedded insurance demands coordination between insurers, platform providers, and regulators to address transparency, risk assessment, and underwriting standards.

Impact on Customer Experience and Engagement

Broker insurance offers personalized guidance and multiple product options, enhancing customer engagement through tailored advice and comparison. Embedded insurance integrates coverage seamlessly within the purchase process, simplifying user experience and increasing convenience by reducing friction points. Both models influence customer satisfaction, but embedded insurance often boosts engagement by delivering instant protection without additional steps.

Future Trends: Broker vs Embedded Insurance

Future trends in insurance indicate a significant shift towards embedded insurance, leveraging digital platforms and AI to offer seamless, context-driven coverage integrated directly into consumer purchases. Brokers will continue to play a crucial role in providing personalized advice and complex risk assessment, but the scalability and convenience of embedded insurance are expected to drive market growth and innovation. Advanced data analytics and API-driven ecosystems will enhance embedded insurance's ability to deliver real-time, tailored policies, challenging traditional brokerage models with greater efficiency and customer engagement.

Related Important Terms

Digital MGA (Managing General Agent)

Digital MGAs leverage advanced data analytics and seamless API integrations to offer embedded insurance solutions that streamline customer experience by embedding coverage directly into third-party platforms. Unlike traditional brokers who act as intermediaries, Digital MGAs control underwriting and claims processes end-to-end, enabling faster policy issuance and tailored risk management in real-time.

Parametric Embedded Coverage

Parametric embedded insurance integrates automatic, data-driven payouts triggered by predefined events, offering seamless protection without traditional claim processes, unlike brokers who manually assess and process claims. This technology-driven model enhances customer experience by providing swift, transparent coverage embedded directly into products or services, minimizing friction and maximizing efficiency.

API-driven Distribution

API-driven distribution in insurance revolutionizes broker and embedded insurance models by enabling seamless integration and real-time quoting, underwriting, and policy issuance. Brokers leverage APIs to access multiple insurers' products instantly, while embedded insurance embeds coverage directly into non-insurance platforms, enhancing customer experience through context-specific risk protection.

Non-traditional Distribution Channels

Non-traditional distribution channels in insurance leverage embedded insurance by integrating policies directly into consumer products and services, enhancing convenience and real-time coverage. Brokers traditionally act as intermediaries offering personalized advice, but embedded insurance streamlines the buying process, reducing friction and expanding access through digital platforms and partnerships across various industries.

Insurance-as-a-Feature

Insurance-as-a-Feature embeds coverage seamlessly within digital products, offering real-time risk protection at the point of purchase, unlike traditional brokers who act as intermediaries comparing multiple policies. This integration enhances user experience by simplifying access and enabling instant claims processing through APIs, driving higher customer engagement and operational efficiency.

Broker Disintermediation

Broker disintermediation in insurance involves bypassing traditional intermediaries to directly connect customers with insurance providers, reducing costs and streamlining the purchase process. Embedded insurance integrates coverage seamlessly into products or services at the point of sale, challenging brokers by limiting their role in customer acquisition and policy management.

Contextual Underwriting

Contextual underwriting in broker models leverages detailed customer interactions and external data to tailor insurance offerings dynamically, enhancing risk assessment accuracy and personalized coverage. Embedded insurance integrates underwriting processes within the point of sale, streamlining customer experience by providing real-time, context-specific policies that align closely with immediate purchase behavior and risk profiles.

White-label Embedded Insurance

White-label embedded insurance seamlessly integrates customizable insurance products within partner platforms, enhancing customer experience by offering tailored coverage options without redirecting users to external brokers. This approach streamlines the purchasing process, reduces friction, and leverages partner brand trust, driving higher conversion rates compared to traditional broker-mediated insurance sales.

Seamless Claims Integration

Embedded insurance offers seamless claims integration by directly connecting coverage with the point of sale, reducing processing time and enhancing customer experience. Brokers facilitate personalized advice and broader product choices but often involve separate claim processes that can delay settlements.

Deep Data Partnerships

Deep data partnerships enable brokers to access comprehensive customer profiles, enhancing personalized policy recommendations and risk assessments. Embedded insurance leverages real-time data integration within platforms, streamlining coverage offers directly at the point of purchase for faster, context-driven underwriting.

Broker vs Embedded Insurance Infographic

industrydif.com

industrydif.com