Digital claims automation streamlines the insurance process by reducing manual errors and accelerating claim settlements compared to traditional paper claims. Automated systems enable faster data processing, improved accuracy, and real-time tracking, enhancing both customer experience and operational efficiency. Shifting from paper to digital claims minimizes administrative costs and supports sustainability efforts in the insurance industry.

Table of Comparison

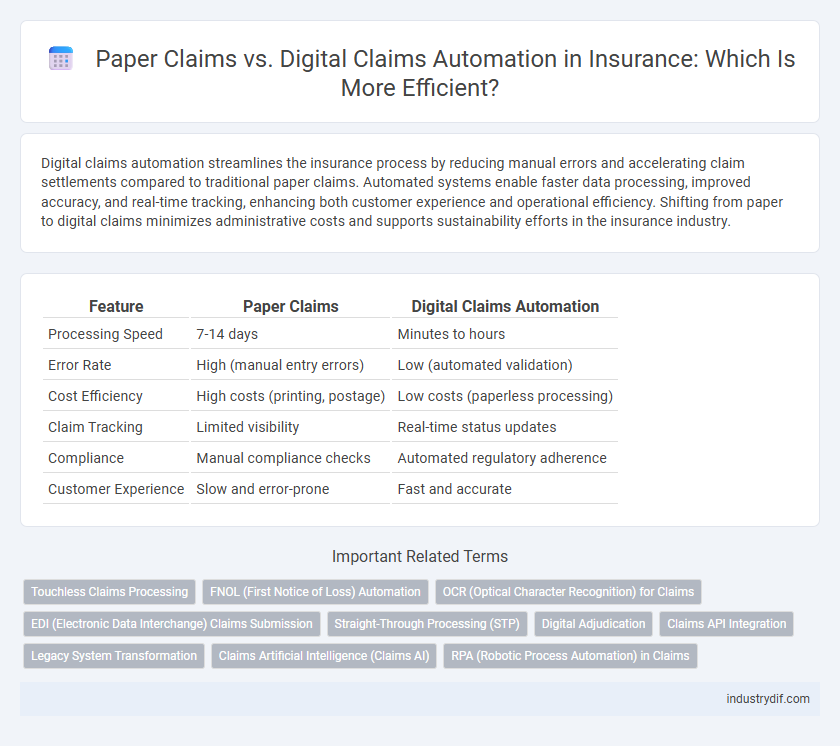

| Feature | Paper Claims | Digital Claims Automation |

|---|---|---|

| Processing Speed | 7-14 days | Minutes to hours |

| Error Rate | High (manual entry errors) | Low (automated validation) |

| Cost Efficiency | High costs (printing, postage) | Low costs (paperless processing) |

| Claim Tracking | Limited visibility | Real-time status updates |

| Compliance | Manual compliance checks | Automated regulatory adherence |

| Customer Experience | Slow and error-prone | Fast and accurate |

Introduction to Paper Claims and Digital Claims Automation

Paper claims involve manually completing and submitting insurance claim forms on physical documents, leading to slower processing times and higher risks of errors or lost information. Digital claims automation leverages advanced software and cloud-based platforms to streamline claim submissions, enabling real-time data validation, faster approvals, and enhanced accuracy. Implementing automated digital claims systems significantly reduces administrative costs while improving customer experience and operational efficiency.

Key Differences Between Paper and Digital Claims Processes

Paper claims require manual data entry, leading to higher error rates and slower processing times, whereas digital claims automation leverages software to streamline data capture and validation. Digital claims processes improve accuracy with automated checks and enable faster claim settlements through real-time tracking and integration with insurance databases. Paper claims often incur higher administrative costs due to physical storage and mailing, while digital claims reduce overhead by utilizing cloud storage and electronic transmission.

Efficiency Comparison: Paper Claims vs Digital Claims

Paper claims processing typically involves manual data entry, longer turnaround times, and higher error rates, resulting in inefficiencies and increased administrative costs. Digital claims automation leverages advanced algorithms and electronic data interchange (EDI) to streamline submission, reduce processing times by up to 70%, and improve accuracy through automated validation. Insurance companies adopting digital claims systems report enhanced operational efficiency, faster claim settlements, and improved customer satisfaction compared to traditional paper-based workflows.

Cost Implications in Claims Management

Paper claims processing incurs higher operational costs due to manual data entry, physical storage, and extended claim cycle times, leading to increased labor expenses and error rates. Digital claims automation reduces administrative costs by streamlining workflows, enhancing data accuracy, and enabling faster claim settlements through real-time validation and automated adjudication. Insurers adopting digital solutions experience significant cost savings, improved resource allocation, and enhanced customer satisfaction in claims management.

Accuracy and Error Rates in Claims Processing

Digital claims automation significantly improves accuracy in insurance claims processing by reducing human errors associated with manual data entry on paper claims. Error rates in digital submissions are substantially lower due to automated validation and standardized data formats, which streamline verification and minimize discrepancies. Insurers adopting digital claims systems report faster resolution times and higher customer satisfaction stemming from enhanced data accuracy and fewer claim rejections.

Impact on Customer Experience

Digital claims automation significantly enhances customer experience by reducing processing times from days to hours and minimizing errors associated with manual entry. Paper claims often lead to delays, lost documents, and lack of real-time updates, causing customer frustration and dissatisfaction. Leveraging automated systems provides transparent status tracking and faster reimbursements, resulting in higher customer retention and positive brand perception.

Compliance and Regulatory Considerations

Paper claims increase the risk of non-compliance due to manual errors and delayed submissions, which can lead to penalties and audits under regulatory frameworks such as HIPAA and GDPR. Digital claims automation enhances compliance by ensuring real-time validation, secure data transmission, and comprehensive audit trails aligned with industry standards. Insurance providers adopting automated systems benefit from improved accuracy and faster regulatory reporting, reducing the likelihood of costly compliance breaches.

Data Security in Paper vs Digital Claims

Paper claims pose significant risks to data security due to physical loss, unauthorized access, and human error in handling sensitive information. Digital claims automation enhances data protection with encryption, secure access controls, and audit trails that track every data interaction. Insurance providers benefit from reduced data breaches and compliance with regulations such as HIPAA and GDPR through digital claims processing.

Implementation Challenges and Solutions

Paper claims in insurance pose implementation challenges such as manual data entry errors, delayed processing times, and increased administrative costs. Digital claims automation addresses these issues by integrating optical character recognition (OCR), robotic process automation (RPA), and cloud-based claim management systems to streamline workflows and improve accuracy. Solutions involve comprehensive staff training, robust IT infrastructure upgrades, and ensuring compliance with data security regulations to maximize the benefits of digital transformation.

Future Trends in Claims Automation

Future trends in claims automation emphasize the shift from paper claims to fully digital processes driven by artificial intelligence and machine learning. Insurance companies are increasingly adopting robotic process automation (RPA) and advanced data analytics to enhance accuracy, reduce processing time, and improve customer experience. The integration of blockchain technology promises secure, transparent claim transactions and fraud prevention, further accelerating the transition toward end-to-end digital claims management.

Related Important Terms

Touchless Claims Processing

Touchless claims processing leverages digital claims automation to eliminate manual data entry and reduce errors, significantly speeding up insurance claim settlements. Paper claims slow down workflows, increase operational costs, and hinder real-time data access, whereas digital solutions enhance efficiency by automating validations and approvals instantly.

FNOL (First Notice of Loss) Automation

Digital claims automation streamlines FNOL processes by reducing manual data entry errors and accelerating claim initiation through real-time information capture. Paper claims delay FNOL response times, increase administrative costs, and hinder accurate loss assessment due to slow data transmission and processing.

OCR (Optical Character Recognition) for Claims

OCR technology in digital claims automation significantly reduces errors and accelerates processing by extracting data from paper claims with high accuracy. Insurance companies utilizing OCR achieve faster claim settlements, enhanced data consistency, and lower operational costs compared to traditional paper claim handling.

EDI (Electronic Data Interchange) Claims Submission

EDI claims submission streamlines insurance processes by enabling secure, standardized electronic exchange of claim data directly between providers and payers, reducing processing time and errors compared to paper claims. Digital claims automation through EDI enhances accuracy, accelerates reimbursements, and lowers administrative costs by eliminating manual data entry and paper handling.

Straight-Through Processing (STP)

Straight-Through Processing (STP) dramatically improves efficiency in insurance claims by enabling seamless digital claims automation, reducing manual intervention and expediting claim settlements. Paper claims significantly increase processing time and error rates, undermining the potential for full STP and causing delays in reimbursement and customer satisfaction.

Digital Adjudication

Digital adjudication streamlines insurance claims processing by automatically verifying, validating, and approving claims using advanced algorithms and AI, reducing errors and accelerating settlements compared to traditional paper claims. This automation enhances accuracy, improves compliance, and provides real-time analytics, enabling insurers to optimize operational efficiency and customer satisfaction.

Claims API Integration

Claims API integration streamlines insurance processes by enabling real-time data exchange between systems, reducing errors common in paper claims and accelerating claim settlements. Digital claims automation through APIs enhances accuracy, lowers operational costs, and improves customer satisfaction by providing faster, transparent claim status updates.

Legacy System Transformation

Legacy system transformation in insurance accelerates claim processing by replacing paper claims with digital claims automation, significantly reducing manual errors and administrative costs. Integrating advanced digital platforms enhances data accuracy, real-time tracking, and compliance, driving operational efficiency and customer satisfaction.

Claims Artificial Intelligence (Claims AI)

Claims Artificial Intelligence (Claims AI) dramatically enhances digital claims automation by accelerating data extraction, error reduction, and fraud detection compared to traditional paper claims processing. Implementing Claims AI enables insurers to optimize claims workflows, improve accuracy, and deliver faster settlements, significantly reducing operational costs.

RPA (Robotic Process Automation) in Claims

Robotic Process Automation (RPA) in insurance claims transforms manual paper claim processing into efficient, error-reducing digital workflows, accelerating claim settlements and improving accuracy. RPA technology streamlines data extraction, validation, and submission, reducing operational costs and enhancing customer satisfaction by minimizing processing time.

Paper Claims vs Digital Claims Automation Infographic

industrydif.com

industrydif.com