Customer service in insurance offers personalized assistance, addressing complex inquiries with empathy and human judgment. Chatbot support excels in handling routine tasks quickly and is available 24/7, enhancing efficiency and reducing wait times. Combining both methods ensures comprehensive support, balancing human expertise with technological convenience.

Table of Comparison

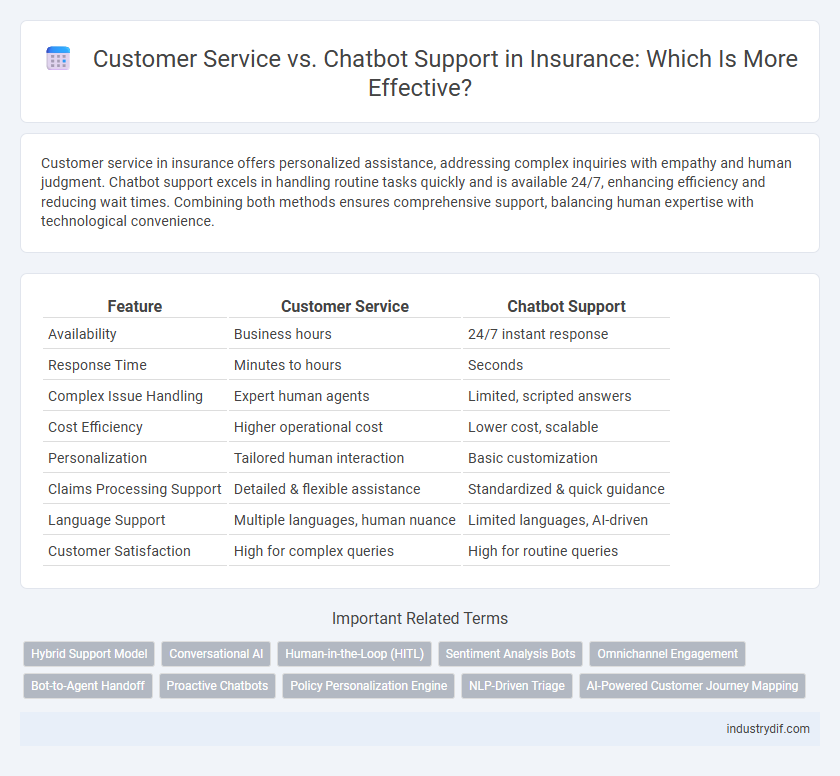

| Feature | Customer Service | Chatbot Support |

|---|---|---|

| Availability | Business hours | 24/7 instant response |

| Response Time | Minutes to hours | Seconds |

| Complex Issue Handling | Expert human agents | Limited, scripted answers |

| Cost Efficiency | Higher operational cost | Lower cost, scalable |

| Personalization | Tailored human interaction | Basic customization |

| Claims Processing Support | Detailed & flexible assistance | Standardized & quick guidance |

| Language Support | Multiple languages, human nuance | Limited languages, AI-driven |

| Customer Satisfaction | High for complex queries | High for routine queries |

Understanding Customer Service in Insurance

Customer service in insurance involves personalized interactions where agents assess individual policyholder needs, clarify complex terms, and provide tailored advice on claims and coverage options. This human-centric approach ensures empathy, nuanced understanding, and resolution of unique customer issues that automated chatbot support may overlook. High-quality insurance customer service improves client satisfaction, trust, and long-term retention, which are critical in a competitive insurance market.

The Rise of Chatbot Support in Insurance

Chatbot support in insurance has surged due to advancements in AI and natural language processing, enabling 24/7 customer interaction and instant claim assistance. Automated chatbots handle routine inquiries, policy updates, and premium calculations efficiently, reducing wait times and operational costs. This shift allows human customer service agents to focus on complex cases, improving overall customer satisfaction and streamlining insurance processes.

Comparing Human Agents and AI Chatbots

Human agents in insurance customer service offer personalized, empathetic interactions and can handle complex claims and policy questions with nuanced understanding. AI chatbots provide 24/7 immediate responses, streamline routine inquiries, and reduce wait times but may struggle with intricate or emotion-sensitive cases. Combining human expertise with chatbot efficiency enhances overall customer satisfaction and operational productivity.

Speed and Efficiency: Chatbots vs. Human Representatives

Chatbot support in insurance significantly enhances speed by instantly processing claims inquiries and policy details, reducing customer wait times compared to human representatives. Human customer service excels in handling complex or nuanced issues requiring empathy and judgment but often involves longer response durations. Combining chatbots for routine tasks with human agents for personalized service optimizes overall efficiency and customer satisfaction.

Personalization and Empathy: Human Touch or Machine Logic?

Customer service in insurance leverages personalization and empathy through human agents who understand nuanced client needs and convey emotional support, fostering trust and satisfaction. Chatbot support relies on machine logic, using AI algorithms to provide quick, consistent responses but often lacks the depth of emotional connection found in human interactions. Balancing these approaches enhances customer experience by integrating chatbot efficiency with human empathy for complex or sensitive insurance inquiries.

Cost Implications for Insurance Providers

Insurance providers face significant cost differences between customer service representatives and chatbot support, with chatbots reducing operational expenses by automating routine queries and lowering call center staffing needs. Implementing AI-driven chatbot systems can decrease average handling costs by up to 50%, enhancing scalability during peak claim periods without proportional cost increases. However, complex policy issues still require human intervention, meaning a hybrid approach optimizes cost-efficiency while maintaining customer satisfaction.

Data Security and Compliance in Automated Support

Customer service in insurance prioritizes data security by adhering to strict compliance standards such as GDPR and HIPAA, ensuring that sensitive client information is protected during every interaction. Chatbot support, when integrated with advanced encryption protocols and real-time monitoring, enhances automated assistance while maintaining regulatory compliance. Leveraging secure AI platforms reduces the risk of data breaches and supports seamless, confidential communication between insurers and customers.

Policy Inquiries: Human Versus Bot Accuracy

Human customer service agents demonstrate higher accuracy in handling complex insurance policy inquiries, as they can interpret nuances and provide tailored advice based on individual circumstances. Chatbot support excels in managing straightforward, frequently asked questions quickly, offering 24/7 availability but with limited understanding of intricate policy details. Combining human expertise with chatbot efficiency enhances overall customer satisfaction and operational effectiveness in insurance policy management.

Customer Satisfaction: Feedback and Outcomes

Customer satisfaction in insurance is significantly influenced by the quality of customer service, with personalized human interactions often leading to higher positive feedback scores compared to chatbot support. While chatbots provide immediate responses and 24/7 availability, customers frequently report greater trust and resolution satisfaction when engaging with human agents. Data indicates that integrating chatbot support with human follow-up improves overall outcomes by addressing complex inquiries effectively and enhancing customer experience.

Future Trends: Integrating Human and AI Support

The future of insurance customer service lies in seamlessly integrating human agents with AI chatbots to enhance efficiency and personalization. Advanced machine learning algorithms enable chatbots to handle routine inquiries, while human representatives focus on complex claims, creating a hybrid support model that improves customer satisfaction. This synergy leverages natural language processing and predictive analytics to deliver faster resolutions and proactive service interventions.

Related Important Terms

Hybrid Support Model

The hybrid support model in insurance combines customer service agents with AI-powered chatbots to enhance response efficiency and personalize client interactions. This integrated approach leverages real-time data analytics and machine learning to resolve complex claims swiftly while maintaining human empathy and accuracy in sensitive situations.

Conversational AI

Conversational AI in insurance enhances customer service by providing instant, 24/7 support through chatbots that handle common inquiries, policy details, and claim status updates efficiently. This technology reduces wait times, improves policyholder satisfaction, and allows human agents to focus on complex cases requiring personalized assistance.

Human-in-the-Loop (HITL)

Customer service in insurance leverages Human-in-the-Loop (HITL) integration to combine the empathy and nuanced understanding of human agents with the efficiency and scalability of chatbot support, enhancing claim processing and policy inquiries. HITL frameworks ensure complex cases are seamlessly escalated to human experts, reducing errors and improving customer satisfaction through personalized assistance.

Sentiment Analysis Bots

Sentiment analysis bots in insurance customer service enhance user experience by accurately identifying and responding to customer emotions in real-time, improving satisfaction and retention rates. These AI-driven tools enable personalized interactions by detecting frustration or urgency, allowing insurers to tailor support or escalate issues promptly for effective resolutions.

Omnichannel Engagement

Omnichannel engagement in insurance leverages seamless integration of customer service representatives and AI-powered chatbot support to enhance policyholder experiences across web, mobile, and call centers. Combining human empathy with chatbot efficiency accelerates claim processing, tailored advice, and 24/7 assistance, driving customer satisfaction and retention.

Bot-to-Agent Handoff

Bot-to-agent handoff in insurance customer service enhances support efficiency by seamlessly transferring complex inquiries from chatbots to human agents, ensuring personalized assistance for policyholders. This integration reduces resolution time and improves customer satisfaction by combining AI-driven automation with expert human intervention.

Proactive Chatbots

Proactive chatbots in insurance customer service enhance client engagement by anticipating needs and offering real-time policy updates, claim assistance, and personalized advice. This technology reduces wait times and operational costs while improving satisfaction through 24/7 availability and instant, accurate responses.

Policy Personalization Engine

Policy personalization engines enhance customer service by leveraging advanced algorithms to tailor insurance plans to individual needs, offering higher accuracy and customer satisfaction. Chatbot support integrates these engines by providing instant, automated responses while enabling dynamic policy adjustments based on real-time customer data and preferences.

NLP-Driven Triage

NLP-driven triage in insurance customer service enhances efficiency by automatically categorizing and prioritizing claims, reducing response times and improving accuracy in addressing policyholder needs. Integrating AI-powered chatbots streamlines initial interactions, enabling human agents to concentrate on complex issues, which leads to higher customer satisfaction and operational cost savings.

AI-Powered Customer Journey Mapping

AI-powered customer journey mapping enhances insurance customer service by analyzing interactions and predicting needs to deliver personalized support across multiple channels. Chatbot support leverages this data to provide instant, accurate responses, streamline claim processes, and improve overall customer satisfaction through continuous learning and adaptation.

Customer Service vs Chatbot Support Infographic

industrydif.com

industrydif.com