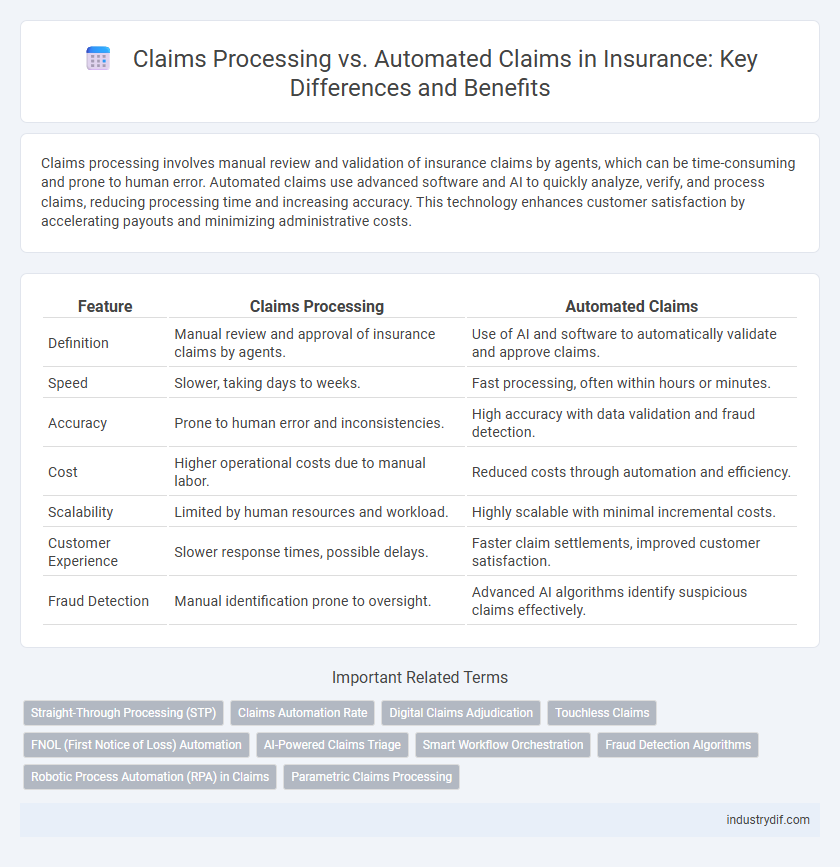

Claims processing involves manual review and validation of insurance claims by agents, which can be time-consuming and prone to human error. Automated claims use advanced software and AI to quickly analyze, verify, and process claims, reducing processing time and increasing accuracy. This technology enhances customer satisfaction by accelerating payouts and minimizing administrative costs.

Table of Comparison

| Feature | Claims Processing | Automated Claims |

|---|---|---|

| Definition | Manual review and approval of insurance claims by agents. | Use of AI and software to automatically validate and approve claims. |

| Speed | Slower, taking days to weeks. | Fast processing, often within hours or minutes. |

| Accuracy | Prone to human error and inconsistencies. | High accuracy with data validation and fraud detection. |

| Cost | Higher operational costs due to manual labor. | Reduced costs through automation and efficiency. |

| Scalability | Limited by human resources and workload. | Highly scalable with minimal incremental costs. |

| Customer Experience | Slower response times, possible delays. | Faster claim settlements, improved customer satisfaction. |

| Fraud Detection | Manual identification prone to oversight. | Advanced AI algorithms identify suspicious claims effectively. |

Overview of Claims Processing in Insurance

Claims processing in insurance involves verifying policyholder information, assessing damage or loss, and determining claim validity to ensure accurate and timely settlements. Traditional claims processing relies heavily on manual intervention, often causing delays and increased operational costs. Automation in claims processing leverages technologies like artificial intelligence and machine learning to streamline data extraction, fraud detection, and decision-making, enhancing efficiency and customer satisfaction.

Traditional Claims Processing: Key Steps

Traditional claims processing involves several key steps including claim submission, verification of policy details, and investigation of the incident. Claims adjusters manually assess damage, gather supporting documentation, and communicate with claimants for additional information. This process can be time-consuming and prone to human error, impacting the overall efficiency and accuracy of claim settlements.

What is Automated Claims Processing?

Automated claims processing leverages advanced technologies such as artificial intelligence and machine learning to streamline the evaluation and approval of insurance claims. This system reduces manual intervention, accelerates claim settlements, and minimizes errors by using data analytics to validate information against policy details and past claim history. By integrating automated workflows, insurers can enhance customer satisfaction while optimizing operational efficiency and cost-effectiveness.

Manual vs. Automated Claims: Core Differences

Manual claims processing relies heavily on human intervention to review, validate, and approve insurance claims, leading to longer turnaround times and increased risk of errors. Automated claims processing utilizes advanced algorithms and machine learning technology to streamline workflows, enhance accuracy, and expedite claim settlements. The core differences lie in efficiency, error reduction, and scalability, with automated systems significantly improving operational performance compared to manual methods.

Efficiency and Accuracy in Claims Handling

Automated claims processing leverages advanced technologies like AI and machine learning to significantly enhance efficiency by reducing manual intervention and expediting claim settlements. This automation minimizes human errors, improving accuracy in data entry and fraud detection, thus ensuring reliable claims handling. Traditional claims processing, reliant on manual workflows, often experiences delays and higher error rates, highlighting the operational advantages of automated systems in modern insurance practices.

Technology Driving Automated Claims

Technology driving automated claims leverages artificial intelligence, machine learning, and optical character recognition to streamline claims processing, reducing human error and accelerating claim resolution times. Automated claims systems utilize real-time data analytics and natural language processing to validate, assess, and approve claims more efficiently than traditional manual processing methods. Integration of cloud-based platforms and APIs further enhances scalability and accuracy, enabling insurers to improve customer satisfaction and reduce operational costs.

Cost Implications: Manual vs. Automated Claims

Manual claims processing incurs higher operational costs due to labor-intensive tasks, prolonged processing times, and increased error rates that require costly corrections. Automated claims systems leverage advanced algorithms and AI to streamline workflows, reducing overhead expenses by minimizing human intervention and accelerating claim settlements. Insurers adopting automated claims processing report up to 40% cost savings, improved accuracy, and enhanced customer satisfaction compared to traditional manual methods.

Customer Experience in Claims Processing

Automated claims processing leverages AI and machine learning to expedite verification, reduce errors, and provide real-time status updates, significantly enhancing the customer experience. Manual claims processing often results in longer wait times and inconsistent communication, leading to customer dissatisfaction and higher attrition rates. Integrating automated solutions streamlines workflows, improves transparency, and ensures faster settlements, fostering greater trust and loyalty among policyholders.

Compliance and Risk Management in Automation

Automated claims processing enhances compliance by integrating real-time regulatory updates and standardized data validation, reducing human errors and ensuring adherence to industry standards such as HIPAA and GDPR. Risk management improves through predictive analytics and AI-driven anomaly detection, identifying potential fraud and inconsistencies early in the claims lifecycle. These technologies streamline audit trails and maintain comprehensive documentation, facilitating transparent and efficient regulatory reporting.

Future Trends in Insurance Claims Processing

The future of insurance claims processing is increasingly driven by artificial intelligence and machine learning, which enhance automated claims accuracy and reduce processing time. Blockchain technology is poised to improve transparency and security, enabling faster fraud detection and claim verification. Integration of IoT devices further facilitates real-time data collection, streamlining claim assessments and enabling predictive analytics for more efficient risk management.

Related Important Terms

Straight-Through Processing (STP)

Straight-Through Processing (STP) in insurance claims processing enables fully automated claim adjudication without human intervention, significantly reducing cycle times and operational costs. Implementing STP improves accuracy by minimizing manual errors and accelerates claim settlements, enhancing customer satisfaction and operational efficiency.

Claims Automation Rate

Claims Automation Rate measures the percentage of insurance claims processed using automated systems, significantly reducing manual intervention and processing time. Higher claims automation rates enhance operational efficiency, accuracy, and customer satisfaction by expediting claim settlements and minimizing human errors.

Digital Claims Adjudication

Digital claims adjudication leverages advanced algorithms and artificial intelligence to streamline claims processing, significantly reducing manual errors and accelerating decision-making. Automated claims systems enhance accuracy, improve customer satisfaction, and lower operational costs by efficiently validating policy details and detecting fraudulent activities in real time.

Touchless Claims

Touchless claims processing leverages advanced AI and machine learning to automate claims adjudication without human intervention, significantly reducing processing time and minimizing errors compared to traditional manual claims processing. This automation enhances customer experience by enabling faster settlements and improving operational efficiency through real-time data integration and fraud detection.

FNOL (First Notice of Loss) Automation

FNOL (First Notice of Loss) automation accelerates claims processing by enabling real-time data capture and instant claim initiation through digital platforms, reducing manual errors and operational costs. Automated claims systems enhance accuracy and customer satisfaction by streamlining FNOL workflows, integrating AI-driven validation, and facilitating faster decision-making compared to traditional claims processing.

AI-Powered Claims Triage

AI-powered claims triage revolutionizes claims processing by swiftly categorizing and prioritizing claims based on severity and complexity, significantly reducing manual intervention and improving accuracy. This automation accelerates decision-making, enhances fraud detection, and optimizes resource allocation, resulting in faster claim settlements and improved customer satisfaction.

Smart Workflow Orchestration

Smart workflow orchestration revolutionizes claims processing by integrating automated claims systems that streamline data verification, reduce manual errors, and accelerate settlement times. Leveraging AI-driven decision-making optimizes resource allocation, enhances fraud detection, and ensures compliance throughout the insurance claims lifecycle.

Fraud Detection Algorithms

Claims processing systems incorporate fraud detection algorithms to analyze patterns and identify suspicious activities, reducing false claims and enhancing accuracy. Automated claims platforms leverage machine learning and real-time data analytics to improve fraud detection speed and precision, minimizing financial losses for insurers.

Robotic Process Automation (RPA) in Claims

Robotic Process Automation (RPA) in claims processing accelerates claim adjudication by automating repetitive tasks such as data entry, validation, and status updates, significantly reducing manual errors and operational costs. Automated claims systems integrated with RPA enhance efficiency, enabling real-time claims assessment and faster payouts, which improves customer satisfaction and streamlines insurance workflows.

Parametric Claims Processing

Parametric claims processing streamlines insurance payouts by triggering payments based on predefined event data, such as weather conditions or seismic activity, eliminating the need for traditional loss assessments. Automated claims systems leverage real-time data integration and AI to enhance accuracy and expedite settlements, significantly reducing processing time and operational costs in parametric insurance models.

Claims Processing vs Automated Claims Infographic

industrydif.com

industrydif.com