Manual rating in insurance relies on underwriters' expertise to assess risk using predefined rules and historical data, whereas predictive analytics rating employs advanced algorithms and machine learning to analyze vast datasets for more accurate risk estimation. Predictive analytics enhances pricing precision by identifying patterns and trends unnoticed in manual processes, resulting in optimized premiums and reduced loss ratios. Insurance companies leveraging predictive models gain competitive advantages through improved customer segmentation, faster decision-making, and dynamic pricing strategies.

Table of Comparison

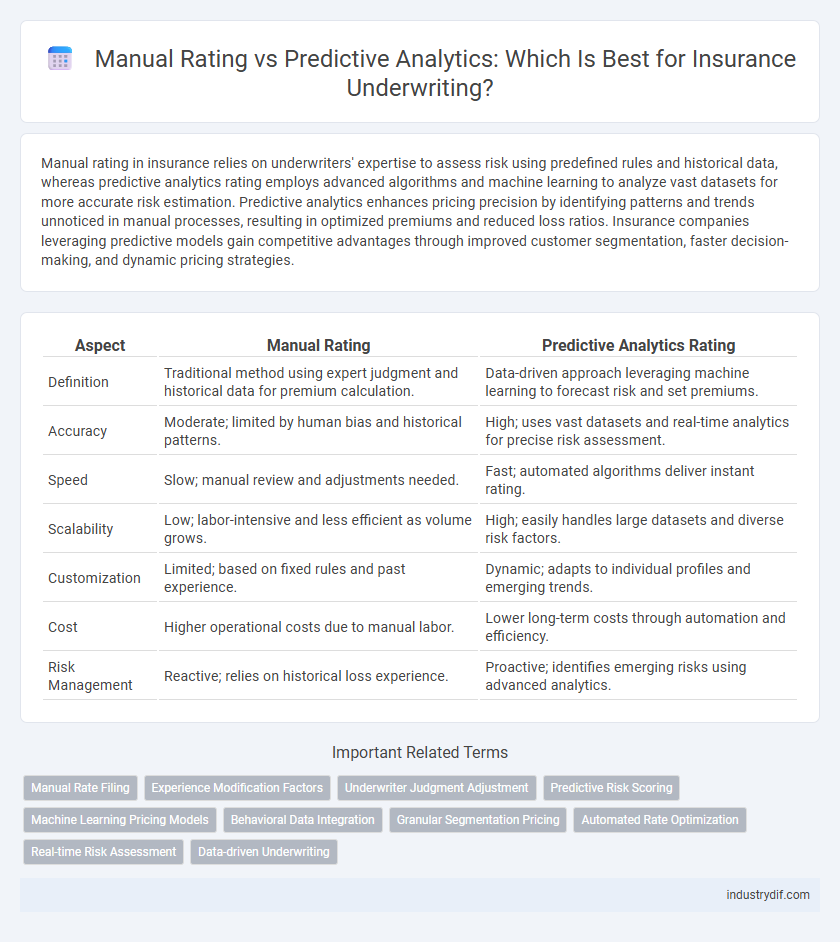

| Aspect | Manual Rating | Predictive Analytics Rating |

|---|---|---|

| Definition | Traditional method using expert judgment and historical data for premium calculation. | Data-driven approach leveraging machine learning to forecast risk and set premiums. |

| Accuracy | Moderate; limited by human bias and historical patterns. | High; uses vast datasets and real-time analytics for precise risk assessment. |

| Speed | Slow; manual review and adjustments needed. | Fast; automated algorithms deliver instant rating. |

| Scalability | Low; labor-intensive and less efficient as volume grows. | High; easily handles large datasets and diverse risk factors. |

| Customization | Limited; based on fixed rules and past experience. | Dynamic; adapts to individual profiles and emerging trends. |

| Cost | Higher operational costs due to manual labor. | Lower long-term costs through automation and efficiency. |

| Risk Management | Reactive; relies on historical loss experience. | Proactive; identifies emerging risks using advanced analytics. |

Understanding Manual Rating in Insurance

Manual rating in insurance involves assigning premiums based on established tables and rules derived from historical loss data and subject matter expertise, ensuring consistency and regulatory compliance. It requires underwriters to evaluate risk factors such as age, location, and coverage limits without automated assistance, promoting transparency and control over pricing decisions. While labor-intensive, manual rating remains essential for unique or complex risks where available data for predictive models is insufficient.

What is Predictive Analytics Rating?

Predictive Analytics Rating utilizes advanced statistical models and machine learning algorithms to analyze historical data and identify risk patterns, enabling more accurate insurance premium calculations. Unlike Manual Rating, which relies on expert judgment and fixed criteria, Predictive Analytics continuously refines risk assessments by processing large datasets including policyholder behavior, claims history, and external market factors. This data-driven approach enhances underwriting precision and helps insurers optimize pricing strategies while reducing loss ratios.

Key Differences Between Manual and Predictive Analytics Rating

Manual rating relies on traditional underwriting expertise and fixed rules, often causing slower and less precise premium calculations. Predictive analytics rating uses machine learning algorithms to analyze vast datasets, enhancing accuracy and enabling dynamic risk assessment. This data-driven approach improves efficiency, reduces underwriting bias, and allows insurers to tailor premiums more effectively based on real-time insights.

Historical Background of Insurance Rating Methods

Traditional insurance rating methods relied heavily on manual rating systems, where underwriters assessed risk based on historical loss data and individual judgment. Over time, the accumulation of vast amounts of policyholder data enabled the emergence of predictive analytics, utilizing statistical models and machine learning algorithms to forecast risk more accurately. This shift from manual to data-driven approaches has transformed underwriting precision, pricing strategies, and claims management in the insurance industry.

Advantages of Manual Rating

Manual rating in insurance offers the advantage of expert judgment, allowing underwriters to incorporate nuanced factors and unique circumstances that automated predictive models might overlook. This approach enables customized policy pricing tailored to specific risk profiles, enhancing accuracy for complex or uncommon cases. Manual rating also provides greater transparency and control over decision-making processes, fostering trust between insurers and clients.

Benefits of Predictive Analytics in Insurance

Predictive analytics in insurance enhances underwriting accuracy by leveraging vast datasets and advanced machine learning algorithms, reducing human error inherent in manual rating. It improves risk assessment and pricing precision, enabling insurers to offer personalized premiums and detect fraud more effectively. These benefits lead to increased operational efficiency, reduced claims costs, and improved customer satisfaction.

Challenges of Transitioning to Predictive Analytics

Transitioning from manual rating to predictive analytics in insurance presents significant challenges, including the need for extensive data integration and the development of advanced statistical models to accurately assess risk. Insurers must overcome data quality issues, legacy system constraints, and the necessity for skilled data scientists to interpret complex algorithms. Ensuring regulatory compliance and gaining internal stakeholder trust also complicate the shift towards data-driven rating methodologies.

Impact on Premium Pricing Accuracy

Manual rating relies on expert judgment and fixed criteria, often resulting in less precise premium pricing due to limited data scope and human bias. Predictive analytics rating utilizes advanced algorithms and extensive datasets, enhancing accuracy by identifying complex risk patterns and individual policyholder characteristics. Insurers adopting predictive models typically achieve more competitive and fair premiums through refined risk segmentation and dynamic pricing adjustments.

Regulatory Considerations for Rating Methods

Regulatory considerations for rating methods in insurance demand transparency, fairness, and compliance with state-specific guidelines, which often challenge the adoption of predictive analytics due to model complexity and explainability issues. Manual rating processes, grounded in historical data and actuarial judgment, typically align more easily with regulatory requirements for auditability and justification of premiums. Insurers must balance innovative predictive analytics with regulatory mandates by ensuring models are interpretable, validated, and incorporate protections against discrimination and bias.

Future Trends in Insurance Rating Systems

Future trends in insurance rating systems emphasize the transition from traditional manual rating methods to advanced predictive analytics, leveraging big data and machine learning algorithms for more accurate risk assessment. Predictive models enable insurers to personalize premiums dynamically, enhance fraud detection, and improve underwriting efficiency. The integration of AI-driven analytics is expected to revolutionize pricing strategies, offering real-time insights and fostering more competitive, customer-centric insurance products.

Related Important Terms

Manual Rate Filing

Manual rate filing involves underwriters setting insurance premiums based on historical loss data, expert judgment, and regulatory guidelines without automated algorithms. This process offers precision in complex cases but lacks the scalability and real-time adaptability provided by predictive analytics rating models.

Experience Modification Factors

Experience Modification Factors (EMFs) in manual rating rely on historical loss data and subjective adjustments by underwriters to determine risk, often leading to less precise premium calculations. Predictive analytics rating utilizes advanced algorithms and extensive datasets to analyze patterns and forecast risks more accurately, enhancing the precision of EMFs and resulting in fairer, data-driven insurance premiums.

Underwriter Judgment Adjustment

Underwriter judgment adjustments play a critical role in manual rating by allowing personalized risk assessments based on qualitative factors such as unique client circumstances and market conditions, which predictive analytics models might overlook. While predictive analytics leverage vast datasets and algorithms for consistent risk scoring, underwriters use judgment adjustments to refine rates and address nuances beyond quantitative data.

Predictive Risk Scoring

Predictive risk scoring leverages advanced algorithms and historical data to accurately assess an individual's insurance risk profile, enabling insurers to offer tailored premiums and minimize losses. Unlike manual rating, predictive analytics automates risk evaluation with greater precision, improving underwriting efficiency and enhancing portfolio profitability.

Machine Learning Pricing Models

Machine learning pricing models enhance insurance rating accuracy by analyzing vast datasets to identify nuanced risk patterns beyond traditional manual rating methods, enabling personalized premium calculations. These predictive analytics frameworks adapt continuously, improving risk segmentation and underwriting efficiency while reducing the reliance on fixed rating plans and subjective judgment.

Behavioral Data Integration

Manual rating relies on fixed guidelines and historical data, limiting its responsiveness to individual policyholder behavior, while predictive analytics rating integrates behavioral data such as driving patterns and lifestyle habits to deliver more personalized and accurate risk assessments. Incorporating real-time behavioral data enhances predictive models, enabling insurers to optimize pricing strategies and improve risk management effectively.

Granular Segmentation Pricing

Granular segmentation pricing in insurance using manual rating relies on expert judgment and predefined risk categories, often leading to broad, less personalized risk assessments. Predictive analytics rating enhances granular segmentation by leveraging vast datasets and machine learning algorithms to identify subtle risk patterns, enabling more precise premium pricing tailored to individual policyholders.

Automated Rate Optimization

Manual rating in insurance relies on historical data and expert judgment to set premiums, often resulting in slower adjustments and less precision. Predictive analytics rating leverages machine learning algorithms and vast datasets to enable automated rate optimization, enhancing accuracy, efficiency, and real-time responsiveness in pricing strategies.

Real-time Risk Assessment

Manual rating relies on predefined rules and historical data inputs to estimate risk but often lacks agility for instant updates, whereas predictive analytics rating leverages machine learning algorithms and real-time data streams to dynamically assess risk, enhancing accuracy and responsiveness. Real-time risk assessment through predictive analytics enables insurers to quickly adapt to emerging threats and market changes, improving underwriting decisions and pricing precision.

Data-driven Underwriting

Manual rating relies on underwriters' expertise and historical rules to assess risk, often resulting in slower decision-making and less precise pricing. Predictive analytics rating uses advanced data models and machine learning algorithms to analyze vast datasets, enabling more accurate risk assessments and personalized underwriting decisions in real time.

Manual Rating vs Predictive Analytics Rating Infographic

industrydif.com

industrydif.com