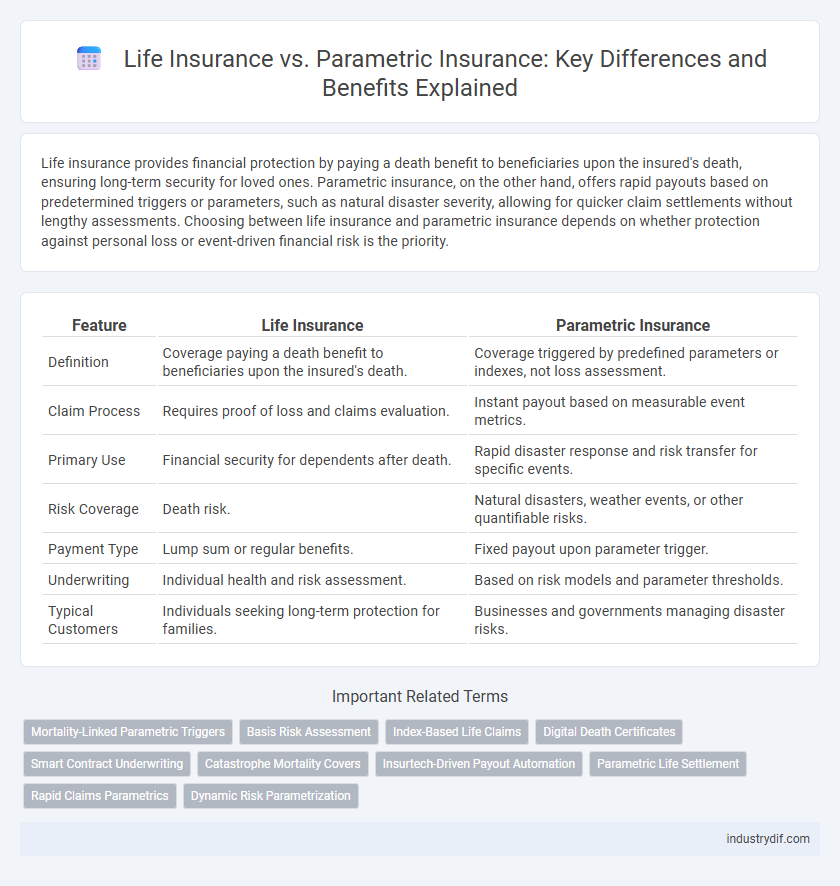

Life insurance provides financial protection by paying a death benefit to beneficiaries upon the insured's death, ensuring long-term security for loved ones. Parametric insurance, on the other hand, offers rapid payouts based on predetermined triggers or parameters, such as natural disaster severity, allowing for quicker claim settlements without lengthy assessments. Choosing between life insurance and parametric insurance depends on whether protection against personal loss or event-driven financial risk is the priority.

Table of Comparison

| Feature | Life Insurance | Parametric Insurance |

|---|---|---|

| Definition | Coverage paying a death benefit to beneficiaries upon the insured's death. | Coverage triggered by predefined parameters or indexes, not loss assessment. |

| Claim Process | Requires proof of loss and claims evaluation. | Instant payout based on measurable event metrics. |

| Primary Use | Financial security for dependents after death. | Rapid disaster response and risk transfer for specific events. |

| Risk Coverage | Death risk. | Natural disasters, weather events, or other quantifiable risks. |

| Payment Type | Lump sum or regular benefits. | Fixed payout upon parameter trigger. |

| Underwriting | Individual health and risk assessment. | Based on risk models and parameter thresholds. |

| Typical Customers | Individuals seeking long-term protection for families. | Businesses and governments managing disaster risks. |

Understanding Life Insurance: Definition and Scope

Life insurance provides financial protection by paying a death benefit to beneficiaries upon the policyholder's death, covering risks related to income loss, debt repayment, and estate planning. It typically involves underwriting based on medical history and lifestyle, with policy types including term, whole, and universal life insurance. The scope of life insurance extends beyond death payouts to include riders for critical illness, disability, and long-term care, enhancing coverage flexibility.

What is Parametric Insurance? Key Features

Parametric insurance provides predetermined payouts based on the occurrence of specific events or parameters, such as earthquake magnitude or rainfall levels, rather than actual loss assessment. Key features include rapid claims settlement, transparency through objective triggers, and reduced administrative costs compared to traditional indemnity insurance. This model enhances risk management by offering predictable compensation linked directly to quantifiable event thresholds.

Core Differences Between Life Insurance and Parametric Insurance

Life insurance provides a payout based on the insured individual's death or specific life events, requiring claims assessment and proof of loss, whereas parametric insurance triggers payouts automatically when predefined parameters, such as natural disaster intensity or weather thresholds, are met. Life insurance typically covers risks related to human life and financial dependents, while parametric insurance focuses on quantifiable events with rapid claims settlement and reduced administrative costs. The core difference lies in the claim process: indemnity-based coverage in life insurance versus parameter-triggered, data-driven payouts in parametric insurance.

How Life Insurance Policies Work

Life insurance policies provide a financial payout to beneficiaries upon the insured's death, based on the policy's face value and terms, offering long-term financial security and estate planning benefits. Premiums are typically paid regularly, and coverage duration can be term-based or whole life, with some policies accumulating cash value over time. Unlike parametric insurance, which pays out based on predefined triggers, life insurance requires a claim process verifying death before benefits are disbursed.

Mechanisms of Parametric Insurance Claims

Parametric insurance claims are triggered by predefined parameters or indices, such as earthquake magnitude or rainfall levels, rather than actual loss assessments. This mechanism enables rapid payouts by using objective data from third-party sources, bypassing lengthy traditional claims adjustments. Life insurance relies on verifying death or disability events, whereas parametric insurance focuses on event occurrence and severity to expedite compensation.

Comparing Payout Triggers: Life Insurance vs Parametric Insurance

Life insurance payout triggers are based on an insured event, such as death or terminal illness, verified through documentation and claims processes. Parametric insurance triggers payouts when a predefined parameter, like an earthquake magnitude or rainfall level, is met or exceeded, allowing for faster and more transparent claims settlement. This key difference makes parametric insurance particularly suitable for rapid response scenarios, while life insurance provides tailored financial protection based on verified personal events.

Policyholder Benefits and Limitations

Life insurance provides financial security to beneficiaries through a predetermined payout upon the policyholder's death, ensuring long-term family protection but often involves complex underwriting and delayed claim settlements. Parametric insurance offers rapid, transparent payouts triggered by specific predefined events such as natural disasters, minimizing claim processing time but may not cover actual loss amounts fully. Policyholders must weigh the comprehensive coverage and death benefit of life insurance against the speed and event-specific nature of parametric insurance when selecting appropriate protection.

Use Cases: When to Choose Each Insurance Type

Life insurance is ideal for individuals seeking financial protection for their beneficiaries in the event of death, providing a payout to cover living expenses, debts, or education costs. Parametric insurance suits businesses or individuals exposed to specific, quantifiable risks like natural disasters, offering rapid payouts based on predefined event parameters such as earthquake magnitude or hurricane wind speed. Choose life insurance for long-term family security and parametric insurance for streamlined coverage against high-impact, measurable events where speed and clarity of payout are crucial.

Premium Structures and Cost Considerations

Life insurance premiums are typically based on factors such as age, health status, and coverage amount, resulting in fixed or variable payments spread over time. Parametric insurance premiums are generally calculated using predefined parameters like geographic risk data and event frequency, often leading to lower costs due to reduced claims processing expenses. Cost considerations for parametric insurance include potential basis risk, whereas life insurance premiums account for mortality risk and administrative overhead.

Future Trends: The Evolution of Life and Parametric Insurance

Future trends in life insurance emphasize the integration of parametric insurance models, leveraging real-time data and advanced analytics to offer faster, more transparent claims processing. Parametric insurance is poised to enhance personalized coverage through AI-driven risk assessment, enabling tailored policies that respond instantly to predetermined triggers. The evolution of both life and parametric insurance will increasingly rely on blockchain technology to ensure secure, efficient transactions and foster greater consumer trust.

Related Important Terms

Mortality-Linked Parametric Triggers

Mortality-linked parametric triggers in life insurance enable rapid claim settlements by activating payments based on predefined mortality indices rather than traditional loss assessments, enhancing transparency and speed. These triggers reduce administrative costs and minimize disputes by relying on objective data, offering a viable alternative to conventional indemnity-based life insurance policies in managing death-related financial risks.

Basis Risk Assessment

Life insurance primarily depends on individual health and mortality data for risk assessment, leading to personalized premium calculations and coverage terms; parametric insurance, however, bases payouts on predefined trigger events such as natural disasters, minimizing claim processing time but introducing basis risk, which arises when the event trigger does not perfectly correlate with the actual loss. Effective basis risk assessment in parametric insurance involves analyzing historical event data and spatial-temporal correlations to optimize trigger thresholds and reduce discrepancies between payouts and actual damages.

Index-Based Life Claims

Index-based life claims in parametric insurance provide rapid, transparent payouts triggered by predefined indices like mortality rates, contrasting traditional life insurance which relies on individual claim assessments. This approach reduces claim settlement times and administrative costs, offering policyholders a more efficient risk transfer mechanism tied directly to quantifiable life event data.

Digital Death Certificates

Digital death certificates streamline claims processing in life insurance by providing instant, verifiable proof of death, reducing fraud and accelerating payouts. Parametric insurance leverages predefined trigger events rather than traditional documentation, making digital death certificates less critical but enhancing transparency and efficiency in policy execution.

Smart Contract Underwriting

Smart contract underwriting in life insurance automates risk assessment and policy issuance using predefined algorithms and data inputs, enhancing accuracy and efficiency. In contrast, parametric insurance leverages smart contracts to trigger automatic payouts based on specific, measurable event parameters, reducing claim processing time and operational costs.

Catastrophe Mortality Covers

Life insurance provides traditional financial protection by paying beneficiaries upon the policyholder's death, while parametric insurance offers predefined payouts triggered by specific catastrophe parameters, such as earthquake magnitude or hurricane wind speeds, enabling faster claims processing in catastrophe mortality cases. Catastrophe mortality covers in parametric insurance reduce claim disputes by utilizing objective data indices, enhancing responsiveness compared to the indemnity-based life insurance model.

Insurtech-Driven Payout Automation

Insurtech-driven payout automation in life insurance streamlines claims processing through advanced data analytics and AI, ensuring fast and accurate settlements based on verified events such as death or disability. In contrast, parametric insurance leverages real-time data triggers like weather sensors or seismic activity, enabling immediate automated payouts without traditional claims assessments, significantly reducing administrative costs and enhancing customer experience.

Parametric Life Settlement

Parametric life settlement combines traditional life insurance benefits with parametric triggers, enabling faster, transparent claims based on predefined biometric or actuarial data thresholds rather than waiting for death events. This innovative approach reduces underwriting complexity, accelerates payout processes, and offers policyholders and investors more efficient risk transfer and liquidity options in the life insurance market.

Rapid Claims Parametrics

Rapid claims parametric insurance offers immediate payout based on predefined triggers like weather events or natural disasters, providing faster financial relief compared to traditional life insurance, which relies on claim processing after insured events. This parametric model minimizes claim disputes and accelerates settlement, enhancing coverage efficiency in scenarios requiring urgent liquidity.

Dynamic Risk Parametrization

Life insurance provides financial protection based on actuarial risk assessments and fixed premium schedules, while parametric insurance utilizes dynamic risk parametrization through real-time data triggers such as weather patterns or seismic activity to facilitate faster, more flexible claims payouts. This innovative approach reduces claim processing times and improves accuracy by relying on objective, quantifiable parameters rather than traditional loss assessments.

Life Insurance vs Parametric Insurance Infographic

industrydif.com

industrydif.com