Actuarial analysis relies on historical data and statistical methods to assess risk and determine insurance premiums, emphasizing long-term trends and regulatory compliance. Predictive analytics leverages machine learning algorithms and real-time data to forecast future outcomes, enabling more dynamic risk management and personalized insurance products. Combining both approaches enhances accuracy in risk evaluation and improves decision-making in underwriting and claims management.

Table of Comparison

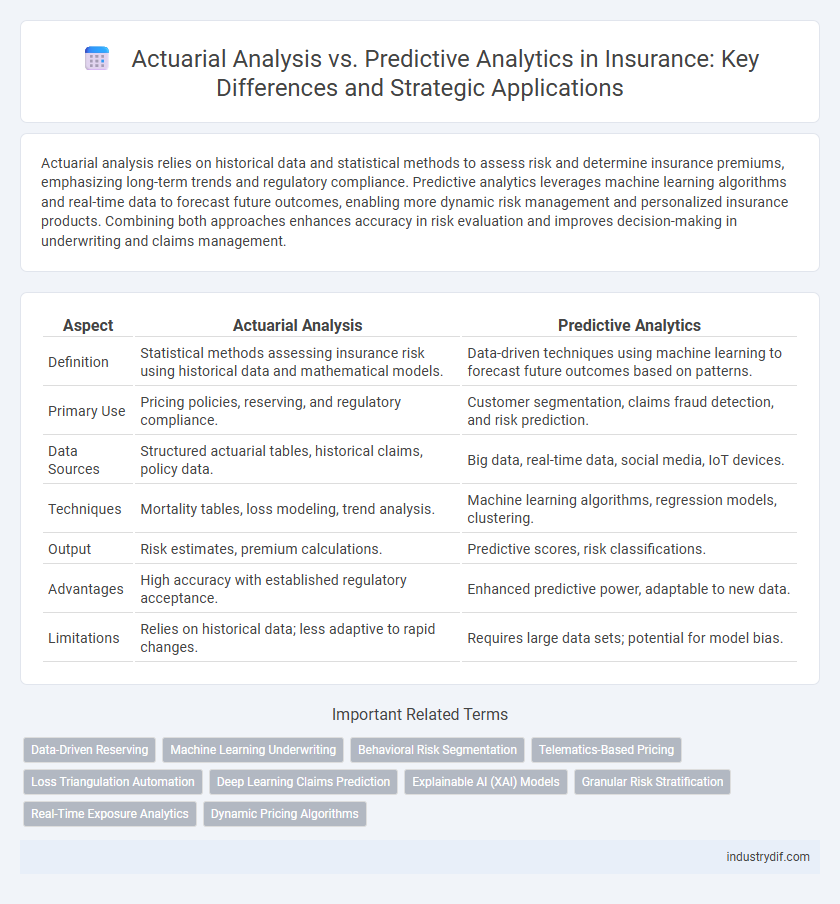

| Aspect | Actuarial Analysis | Predictive Analytics |

|---|---|---|

| Definition | Statistical methods assessing insurance risk using historical data and mathematical models. | Data-driven techniques using machine learning to forecast future outcomes based on patterns. |

| Primary Use | Pricing policies, reserving, and regulatory compliance. | Customer segmentation, claims fraud detection, and risk prediction. |

| Data Sources | Structured actuarial tables, historical claims, policy data. | Big data, real-time data, social media, IoT devices. |

| Techniques | Mortality tables, loss modeling, trend analysis. | Machine learning algorithms, regression models, clustering. |

| Output | Risk estimates, premium calculations. | Predictive scores, risk classifications. |

| Advantages | High accuracy with established regulatory acceptance. | Enhanced predictive power, adaptable to new data. |

| Limitations | Relies on historical data; less adaptive to rapid changes. | Requires large data sets; potential for model bias. |

Defining Actuarial Analysis in Insurance

Actuarial Analysis in insurance involves using mathematical and statistical methods to evaluate risk, calculate premiums, and ensure financial stability. It relies on historical data, mortality tables, and loss distributions to model future claims and liabilities accurately. Actuaries apply this discipline to design insurance policies, set pricing strategies, and maintain regulatory compliance.

Understanding Predictive Analytics in Insurance

Predictive analytics in insurance leverages historical data, machine learning algorithms, and statistical models to forecast future risk events and customer behaviors, enabling more accurate premium pricing and claims management. This technique improves underwriting efficiency by identifying high-risk policyholders and detecting fraudulent claims through pattern recognition and anomaly detection. By contrast, actuarial analysis primarily relies on traditional statistical methods and historical loss data to estimate liabilities and reserve requirements, focusing on long-term financial stability.

Historical Roots of Actuarial Science

Actuarial analysis in insurance has deep historical roots dating back to the 17th century when mathematicians began applying probability theory to life insurance and pensions. This foundation established rigorous statistical methods to assess risk and determine premium rates based on mortality tables and long-term data. Predictive analytics, by contrast, leverages modern machine learning algorithms and big data to enhance risk modeling but builds on the traditional actuarial principles of analyzing historical trends.

Emergence of Predictive Analytics Technologies

Predictive analytics technologies have revolutionized insurance by enhancing risk assessment beyond traditional actuarial analysis methods. Utilizing machine learning algorithms and big data, predictive analytics enables more precise forecasting of policyholder behavior, claims probability, and fraud detection. This technological advancement drives improved underwriting efficiency and personalized insurance products, reshaping the industry's approach to risk management.

Key Differences Between Actuarial and Predictive Approaches

Actuarial analysis relies on historical data and statistical methods to assess risk and determine insurance premiums, focusing on long-term financial stability and regulatory compliance. Predictive analytics utilizes machine learning algorithms and real-time data to forecast future events and customer behaviors, enhancing underwriting accuracy and personalized marketing strategies. Key differences lie in actuarial models' emphasis on traditional risk assessment versus predictive analytics' dynamic, data-driven insights for proactive decision-making.

Data Sources and Methodologies Compared

Actuarial analysis in insurance primarily relies on historical claims data, policyholder demographics, and mortality tables to assess risk and determine premiums through statistical models such as life tables and loss distributions. Predictive analytics leverages a broader range of data sources, including telematics, social media, and real-time sensor data, utilizing machine learning algorithms and big data techniques to forecast future events and customer behavior. While actuarial methods emphasize traditionally structured datasets and probabilistic theories, predictive analytics integrates unstructured and high-velocity data streams to enhance accuracy and insight in risk assessment.

Applications of Actuarial Analysis in Insurance

Actuarial analysis in insurance primarily involves using statistical models and financial theory to assess risk, calculate premiums, and ensure the financial stability of insurance products. It applies probability theory, mortality rates, and loss distribution data to predict future claims and reserve requirements accurately. This method supports underwriting decisions, pricing strategies, and regulatory compliance by quantifying long-term risk exposure and optimizing capital allocation.

Predictive Analytics Use Cases in the Insurance Sector

Predictive analytics in the insurance sector enables insurers to identify high-risk policyholders, optimize pricing strategies, and detect fraudulent claims by leveraging historical data and machine learning algorithms. Insurers use predictive models to forecast customer lifetime value, improve underwriting accuracy, and enhance customer retention through personalized offers. This data-driven approach enhances risk management and operational efficiency compared to traditional actuarial analysis, which primarily relies on historical statistical methods.

Integrating Actuarial and Predictive Models

Integrating actuarial analysis with predictive analytics enhances insurance risk assessment by combining traditional statistical methods with machine learning algorithms. This integration enables more accurate pricing models and improved loss forecasting by leveraging vast datasets and advanced predictive capabilities. Insurers benefit from synergizing these approaches to optimize underwriting, claims management, and customer segmentation.

Future Trends: Analytics in Insurance Transformation

Actuarial analysis continues to provide foundational risk assessment through statistical methods and historical data evaluation in insurance underwriting. Predictive analytics advances this by leveraging machine learning algorithms and big data to forecast customer behavior, claims, and loss trends with greater precision. Future trends indicate a convergence where insurers integrate real-time data streams and AI-driven models to enhance pricing accuracy, fraud detection, and personalized policy offerings.

Related Important Terms

Data-Driven Reserving

Actuarial analysis in insurance relies on historical loss data and statistical methods to estimate reserve requirements, ensuring sufficient funds for future claims. Predictive analytics enhances data-driven reserving by integrating machine learning algorithms and real-time data, improving accuracy in forecasting claim liabilities and optimizing capital allocation.

Machine Learning Underwriting

Actuarial analysis relies on historical data and statistical methods to assess risk and set premiums, whereas predictive analytics leverages machine learning algorithms to enhance underwriting accuracy by identifying complex patterns in vast datasets. Machine learning underwriting improves risk selection and pricing precision, driving competitive advantages in insurance through dynamic and data-driven decision-making.

Behavioral Risk Segmentation

Behavioral risk segmentation in insurance leverages actuarial analysis by quantifying risk factors based on historical claims and policyholder data, enabling precise premium setting and reserve calculation. Predictive analytics enhances this process by using machine learning algorithms to identify patterns in customer behavior, improving risk segmentation accuracy and enabling targeted interventions for risk mitigation.

Telematics-Based Pricing

Actuarial analysis in insurance relies on historical data and statistical models to assess risk and set prices, while predictive analytics leverages telematics data such as driving behavior, location, and vehicle usage to create personalized pricing models. Telematics-based pricing enhances risk segmentation and accuracy by integrating real-time, individual driver data into predictive algorithms, transforming traditional underwriting processes.

Loss Triangulation Automation

Loss triangulation automation leverages actuarial analysis by systematically organizing historical claims data into development triangles to estimate reserves more accurately. Predictive analytics enhances this process by applying machine learning algorithms to detect hidden patterns and forecast future losses, improving reserve precision and operational efficiency.

Deep Learning Claims Prediction

Deep learning claims prediction leverages complex neural networks to identify patterns and trends in vast insurance datasets, enhancing the accuracy beyond traditional actuarial analysis that primarily relies on historical statistical models. By integrating deep learning, insurers can improve risk assessment and pricing strategies through dynamic and granular insights into future claim probabilities.

Explainable AI (XAI) Models

Actuarial analysis relies on traditional statistical methods and historical data to assess risk and develop pricing models, while predictive analytics employs machine learning techniques, including Explainable AI (XAI) models, to enhance transparency and interpretability in insurance decision-making. Explainable AI models enable insurers to understand and communicate the reasoning behind predictions, improving regulatory compliance and stakeholder trust in risk assessment and claims processing.

Granular Risk Stratification

Granular risk stratification in insurance leverages actuarial analysis to evaluate historical loss data and establish precise risk probabilities, enhancing policy pricing accuracy. Predictive analytics employs machine learning algorithms on diverse data sources to identify subtle risk patterns and forecast future claims, enabling more personalized underwriting decisions.

Real-Time Exposure Analytics

Actuarial analysis relies on historical data and statistical models to estimate long-term insurance risks, while predictive analytics leverages real-time exposure analytics to provide immediate insights and dynamic risk assessment. Real-time exposure analytics enhances underwriting precision by continuously monitoring variables such as policyholder behavior and environmental changes, enabling insurers to optimize pricing and prevent losses more effectively.

Dynamic Pricing Algorithms

Dynamic pricing algorithms in insurance leverage predictive analytics to evaluate real-time data, optimizing premiums based on individual risk factors and market conditions. Actuarial analysis traditionally relies on historical data and statistical models to assess risk, but dynamic pricing integrates machine learning techniques for more adaptive and precise premium adjustments.

Actuarial Analysis vs Predictive Analytics Infographic

industrydif.com

industrydif.com