Underwriting involves a detailed risk assessment by insurance experts to evaluate policy applications and determine coverage terms. Automated underwriting uses advanced algorithms and data analysis to quickly assess risk and streamline decision-making processes. This technology enhances efficiency, reduces human error, and improves the overall accuracy of risk evaluation in insurance.

Table of Comparison

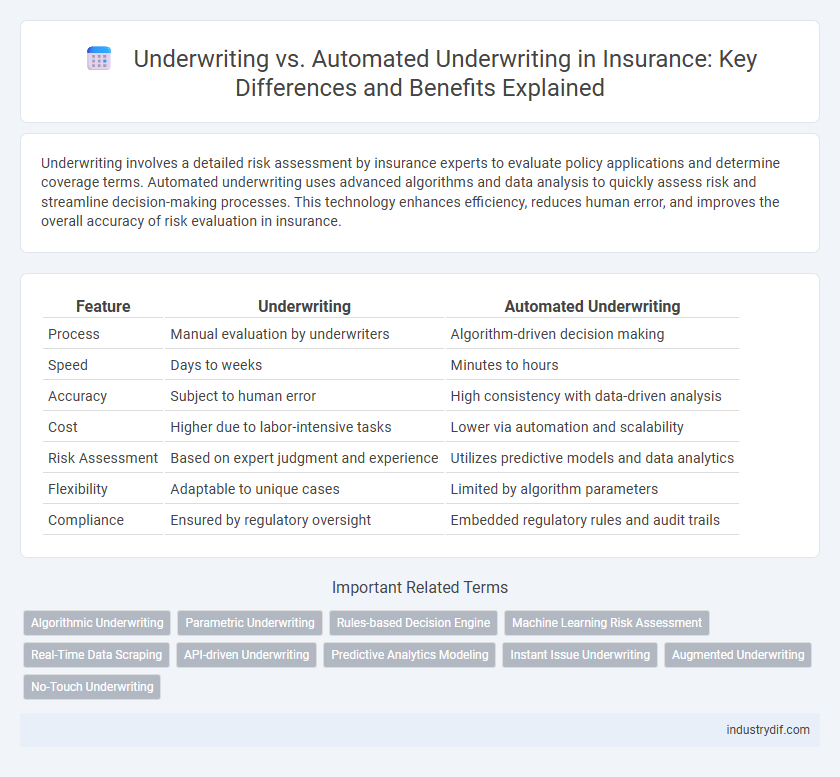

| Feature | Underwriting | Automated Underwriting |

|---|---|---|

| Process | Manual evaluation by underwriters | Algorithm-driven decision making |

| Speed | Days to weeks | Minutes to hours |

| Accuracy | Subject to human error | High consistency with data-driven analysis |

| Cost | Higher due to labor-intensive tasks | Lower via automation and scalability |

| Risk Assessment | Based on expert judgment and experience | Utilizes predictive models and data analytics |

| Flexibility | Adaptable to unique cases | Limited by algorithm parameters |

| Compliance | Ensured by regulatory oversight | Embedded regulatory rules and audit trails |

Understanding Underwriting in Insurance

Underwriting in insurance involves assessing risks and determining appropriate premiums based on detailed analysis of policyholders' information, medical history, and financial background. Automated underwriting utilizes advanced algorithms and machine learning models to rapidly evaluate large volumes of data, improving accuracy and efficiency compared to traditional manual processes. Understanding these differences ensures insurers optimize risk management while providing competitive pricing and faster policy approvals.

What Is Automated Underwriting?

Automated underwriting uses advanced algorithms and data analytics to evaluate insurance applications rapidly, minimizing human intervention in risk assessment. It leverages machine learning models and extensive datasets to enhance accuracy, consistency, and efficiency in policy approvals. This technology streamlines the underwriting process, reduces operational costs, and accelerates decision-making compared to traditional manual underwriting methods.

Key Differences Between Manual and Automated Underwriting

Manual underwriting involves human underwriters evaluating risk by reviewing detailed applicant information, medical records, and financial documents to make subjective decisions. Automated underwriting utilizes algorithms and data analytics to quickly assess risk, often increasing speed and consistency while reducing human error. Key differences include the speed of processing, the reliance on data-driven models versus expert judgment, and the level of customization in risk assessment.

Advantages of Traditional Underwriting

Traditional underwriting allows for personalized evaluation of insurance applications, leveraging human expertise to assess complex risk factors and unique circumstances that automated systems might overlook. This method enhances accuracy in risk assessment by incorporating qualitative data and nuanced judgment beyond algorithmic capabilities. Insurers benefit from reduced errors and improved fraud detection, leading to more tailored policy pricing and coverage decisions.

Benefits of Automated Underwriting Systems

Automated underwriting systems enhance efficiency by rapidly evaluating large volumes of insurance applications using advanced algorithms and data analytics. They reduce human error and bias, enabling more consistent and accurate risk assessments compared to traditional underwriting methods. These systems also lower operational costs and improve customer experience by accelerating approval processes and providing real-time decision-making.

Risks and Challenges in Automated Underwriting

Automated underwriting in insurance leverages algorithms and data analytics to assess risk, yet it faces challenges such as data quality issues and algorithmic biases that can lead to inaccurate risk evaluations. The reliance on predetermined rules limits adaptability to unique or complex cases, potentially resulting in overlooked risks or improper policy pricing. Ensuring transparency and continuous model validation is critical to mitigate risks like discrimination and regulatory non-compliance in automated underwriting systems.

Impact on Customer Experience

Underwriting traditionally involves manual review by underwriters, which can result in longer processing times and increased chances of subjective bias, affecting customer satisfaction. Automated underwriting leverages algorithms and AI to analyze risk factors swiftly, providing faster decisions and enhanced accuracy that improve customer convenience and trust. This technological shift reduces wait times and streamlines policy issuance, directly boosting the overall customer experience in insurance.

Data and Technology in Insurance Underwriting

Insurance underwriting leverages vast datasets and advanced algorithms to assess risk and determine policy terms, while automated underwriting integrates machine learning and big data analytics to streamline this process, enhancing accuracy and speed. Traditional underwriting relies heavily on human expertise to interpret data, whereas automated underwriting utilizes technology platforms that analyze real-time information from multiple sources such as credit scores, medical records, and claims history. The integration of AI and predictive modeling in automated underwriting reduces manual errors, accelerates decision-making, and supports scalable risk evaluation in the insurance industry.

Regulatory Considerations for Underwriting Methods

Underwriting methods in insurance undergo strict regulatory scrutiny to ensure compliance with fairness, transparency, and anti-discrimination laws. Automated underwriting systems must be designed to meet regulatory standards by providing explainable algorithms and maintaining data privacy protections to prevent bias. Traditional underwriting adheres to regulatory guidelines through human judgment, but automated methods face increasing oversight to balance efficiency with compliance requirements.

Future Trends in Insurance Underwriting

Future trends in insurance underwriting highlight an increasing shift towards automated underwriting systems powered by artificial intelligence and machine learning algorithms, enhancing risk assessment accuracy and processing speed. Traditional underwriting methods rely heavily on human judgment and manual data evaluation, which can be time-consuming and prone to inconsistencies. The integration of predictive analytics and big data enables insurers to customize policies with greater precision, improve fraud detection, and streamline the overall underwriting workflow.

Related Important Terms

Algorithmic Underwriting

Algorithmic underwriting leverages advanced machine learning models to analyze vast datasets, enhancing accuracy and efficiency compared to traditional manual underwriting processes. This technology enables insurers to assess risk dynamically, reduce operational costs, and expedite policy issuance while maintaining regulatory compliance.

Parametric Underwriting

Parametric underwriting leverages predefined parameters and real-time data to streamline risk assessment, reducing reliance on traditional manual evaluations inherent in conventional underwriting processes. This approach enhances accuracy and efficiency by automating decisions based on measurable variables such as weather conditions or sensor data, contrasting with automated underwriting that primarily uses historical data and algorithms without parametric triggers.

Rules-based Decision Engine

Underwriting involves manual risk assessment by insurance professionals, while automated underwriting uses a rules-based decision engine to evaluate applications quickly by applying predefined criteria and algorithms. This rules-based system enhances accuracy, consistency, and efficiency in risk evaluation, reducing human error and accelerating policy approval times.

Machine Learning Risk Assessment

Machine learning risk assessment in automated underwriting enhances accuracy by analyzing vast datasets to predict policyholder risk more efficiently than traditional manual underwriting. This technology enables real-time decision-making, reducing processing time and improving consistency in insurance risk evaluations.

Real-Time Data Scraping

Automated underwriting leverages real-time data scraping from multiple sources, enabling faster risk assessment and decision-making compared to traditional underwriting methods that rely on manual data collection and analysis. This integration of real-time data enhances accuracy, reduces underwriting cycle times, and improves overall efficiency in insurance policy approvals.

API-driven Underwriting

API-driven underwriting leverages advanced algorithms and real-time data integration to streamline risk assessment and policy issuance compared to traditional manual underwriting processes. This automation enhances accuracy, reduces processing time, and improves scalability for insurance providers, enabling more dynamic and precise decision-making.

Predictive Analytics Modeling

Predictive analytics modeling enhances both traditional underwriting and automated underwriting by analyzing historical data and risk factors to forecast potential claims and policyholder behavior with greater accuracy. Automated underwriting leverages these predictive models to speed up decision-making processes, reduce human error, and improve risk assessment efficiency compared to manual underwriting methods.

Instant Issue Underwriting

Instant Issue Underwriting leverages advanced algorithms and real-time data analysis to streamline the approval process, significantly reducing the time from application to policy issuance. Traditional underwriting relies on manual risk assessment and extensive documentation, whereas automated systems enable faster, more accurate decisions with minimal human intervention.

Augmented Underwriting

Augmented underwriting integrates artificial intelligence and machine learning with traditional underwriting processes to enhance risk assessment accuracy and efficiency in insurance. This hybrid approach leverages big data analytics and automated tools while retaining human expertise to improve decision-making and reduce processing time.

No-Touch Underwriting

No-touch underwriting leverages advanced algorithms and artificial intelligence to assess risk and approve insurance policies without human intervention, significantly increasing processing speed and accuracy. This automated underwriting process reduces operational costs while maintaining compliance and enhancing customer experience through instant decision-making.

Underwriting vs Automated Underwriting Infographic

industrydif.com

industrydif.com