Paper policies rely on manual processing and physical documentation, which can lead to delays and increased risk of errors or fraud. Smart contract insurance automates claims processing through blockchain technology, ensuring transparency, speed, and reduced administrative costs. This shift enhances policyholder trust by providing real-time verification and seamless execution of contract terms.

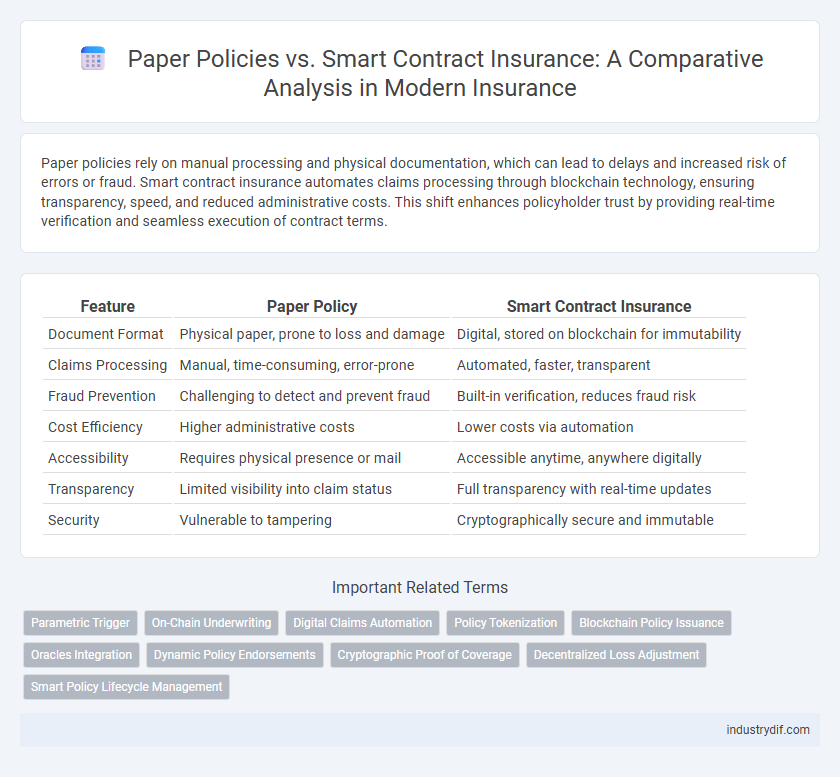

Table of Comparison

| Feature | Paper Policy | Smart Contract Insurance |

|---|---|---|

| Document Format | Physical paper, prone to loss and damage | Digital, stored on blockchain for immutability |

| Claims Processing | Manual, time-consuming, error-prone | Automated, faster, transparent |

| Fraud Prevention | Challenging to detect and prevent fraud | Built-in verification, reduces fraud risk |

| Cost Efficiency | Higher administrative costs | Lower costs via automation |

| Accessibility | Requires physical presence or mail | Accessible anytime, anywhere digitally |

| Transparency | Limited visibility into claim status | Full transparency with real-time updates |

| Security | Vulnerable to tampering | Cryptographically secure and immutable |

Introduction to Traditional Paper Policy Insurance

Traditional paper policy insurance involves physical documents that outline the terms, coverage, and conditions of an insurance agreement between the insurer and the insured. These paper-based contracts require manual processing, verification, and storage, which often leads to delays, increased administrative costs, and potential human errors. Despite being widely used, paper policy insurance lacks automation and real-time updates compared to innovative solutions like smart contract insurance.

Defining Smart Contract Insurance

Smart contract insurance utilizes blockchain technology to automate and streamline insurance policy management and claims processing through self-executing contracts with predefined terms. Unlike traditional paper policies, smart contracts offer increased transparency, reduced administrative costs, and faster claim settlements by eliminating manual intervention and minimizing fraud risks. This innovation transforms insurance workflows by enabling real-time verification and secure, decentralized record-keeping.

Key Differences Between Paper Policies and Smart Contracts

Paper policies rely on manual processing, physical documentation, and human intervention, which can lead to delays and errors in claims handling. Smart contract insurance utilizes blockchain technology to automate contract execution, enhance transparency, and reduce fraud by enforcing terms through code. The shift from paper policies to smart contracts results in faster settlements, lower administrative costs, and increased trust between insurers and policyholders.

Efficiency and Speed in Claims Processing

Smart contract insurance significantly enhances efficiency and speed in claims processing by automating verification and payout through blockchain technology, eliminating manual intervention common in paper policy claims. Traditional paper policies rely on extensive paperwork and human handling, causing delays and increasing the likelihood of errors or disputes. The transparency and immutability of smart contracts streamline claim adjudication, leading to faster settlements and improved customer satisfaction.

Transparency and Trust in Policy Management

Paper policies often suffer from limited transparency due to manual processing and the potential for errors or lost documents, which can undermine policyholder trust. Smart contract insurance leverages blockchain technology to ensure transparent, immutable records and automated execution, enhancing trust by providing real-time visibility into policy terms and claims status. This digital approach reduces ambiguities and dispute risks, fostering a more reliable and accountable insurance management environment.

Cost Implications of Paper vs Smart Contract Insurance

Paper policy insurance incurs higher administrative costs due to manual processing, physical storage, and increased risk of human error, leading to prolonged claim settlements and operational inefficiencies. Smart contract insurance leverages blockchain technology to automate claim verification and execution, significantly reducing transaction costs and enhancing transparency. The cost savings from reduced paperwork and faster processing result in lower premiums and improved customer satisfaction.

Security Considerations and Data Protection

Paper policies in insurance face significant risks due to physical loss, damage, and unauthorized access, making data protection challenging and often reliant on manual controls. Smart contract insurance leverages blockchain technology to enhance security, providing immutable, encrypted records and automated claim processing, which reduces fraud and human error. The decentralized nature of smart contracts ensures transparent data handling and stronger protection against cyber threats compared to traditional paper-based methods.

Scalability and Accessibility for Policyholders

Smart contract insurance offers superior scalability by automating claims processing and policy management through blockchain technology, reducing administrative overhead and enabling quick adaptation to growing policyholder demands. Unlike traditional paper policies, smart contracts enhance accessibility by providing real-time updates and seamless digital interactions accessible from any device, eliminating geographical and time constraints. This technological advancement empowers policyholders with transparent, efficient, and equitable insurance experiences at a large scale.

Regulatory Challenges and Compliance Issues

Paper policy insurance faces significant regulatory challenges due to manual processing errors, delays in claim verification, and difficulties ensuring consistent compliance with evolving legal standards. Smart contract insurance automates underwriting and claims through blockchain technology, enhancing transparency and auditability but encounters hurdles in legal recognition, jurisdictional variances, and integration with existing regulatory frameworks. Regulators must address these compliance issues by developing adaptable guidelines that validate the enforceability and security of smart contracts while maintaining consumer protection.

The Future Landscape of Insurance: Transition and Adoption

The future landscape of insurance is rapidly shifting from traditional paper policies to smart contract-based solutions powered by blockchain technology. Smart contracts enhance transparency, reduce claims processing time, and minimize fraud through automated, immutable transactions. Widespread adoption hinges on regulatory frameworks evolving to accommodate digital policies and industry stakeholders embracing decentralized technology for seamless risk management.

Related Important Terms

Parametric Trigger

Parametric trigger in smart contract insurance automates claim payouts based on predefined, verifiable data points such as weather conditions or event occurrences, eliminating the need for manual claim assessments typical of traditional paper policy insurance. This automation enhances transparency, reduces processing time, and minimizes disputes by ensuring payouts are executed instantly once parametric conditions are met.

On-Chain Underwriting

On-chain underwriting in smart contract insurance automates risk assessment and policy issuance through transparent blockchain protocols, significantly reducing processing time and human error compared to traditional paper policy methods. This innovation enhances real-time data integration, enabling dynamic pricing models and instant claim verification that paper policies cannot match.

Digital Claims Automation

Digital claims automation in smart contract insurance significantly reduces processing time by leveraging blockchain technology to execute claims automatically upon predefined conditions, unlike paper policy insurance that relies on manual verification and paperwork. This automation enhances transparency, decreases fraud risk, and improves customer satisfaction by enabling faster, more accurate claim settlements.

Policy Tokenization

Policy tokenization transforms traditional paper insurance policies into digital assets secured by blockchain, enhancing transparency and reducing fraud. This shift enables automated claims processing and real-time policy management, significantly improving efficiency compared to conventional documentation.

Blockchain Policy Issuance

Blockchain policy issuance enhances insurance by enabling immutable, transparent smart contract insurance that automates claims processing and reduces fraud, unlike traditional paper policy systems that rely on manual verification and are prone to errors and delays. Smart contracts streamline underwriting and policy management, significantly increasing efficiency and customer trust through decentralized, tamper-proof recordkeeping.

Oracles Integration

Smart contract insurance leverages oracles to provide real-time, tamper-proof data inputs that automate claim verification and processing. Unlike traditional paper policies, which require manual validation and are prone to delays, oracle integration ensures accuracy, transparency, and efficiency in executing insurance agreements.

Dynamic Policy Endorsements

Dynamic policy endorsements in smart contract insurance enable real-time updates and automated adjustments to coverage terms, reducing administrative delays and minimizing errors compared to traditional paper policies. This innovation enhances flexibility and accuracy by leveraging blockchain technology to securely record and execute endorsements instantly.

Cryptographic Proof of Coverage

Traditional paper policies rely on physical documents prone to loss or forgery, whereas smart contract insurance leverages cryptographic proof of coverage to ensure tamper-proof, automated claim validation. This technology enhances transparency and security by embedding coverage terms within blockchain protocols, reducing fraud and increasing trust in insurance transactions.

Decentralized Loss Adjustment

Decentralized loss adjustment in smart contract insurance leverages blockchain technology to automate claims processing, ensuring transparent, tamper-proof verification compared to traditional paper policy claims subject to manual errors and delays. Smart contracts facilitate real-time data validation and payout execution without intermediaries, significantly reducing fraud and operational costs in loss adjustment.

Smart Policy Lifecycle Management

Smart contract insurance revolutionizes policy lifecycle management by automating underwriting, claims processing, and renewals through blockchain technology, significantly reducing errors and fraud. This digital approach enhances transparency, speeds up settlements, and ensures real-time policy updates, surpassing traditional paper policy limitations.

Paper Policy vs Smart Contract Insurance Infographic

industrydif.com

industrydif.com