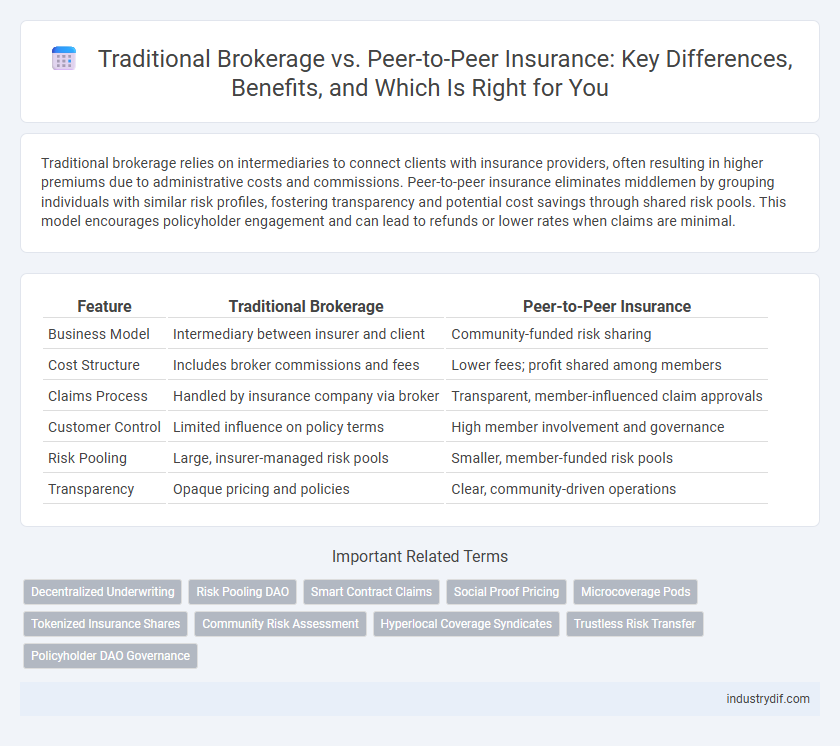

Traditional brokerage relies on intermediaries to connect clients with insurance providers, often resulting in higher premiums due to administrative costs and commissions. Peer-to-peer insurance eliminates middlemen by grouping individuals with similar risk profiles, fostering transparency and potential cost savings through shared risk pools. This model encourages policyholder engagement and can lead to refunds or lower rates when claims are minimal.

Table of Comparison

| Feature | Traditional Brokerage | Peer-to-Peer Insurance |

|---|---|---|

| Business Model | Intermediary between insurer and client | Community-funded risk sharing |

| Cost Structure | Includes broker commissions and fees | Lower fees; profit shared among members |

| Claims Process | Handled by insurance company via broker | Transparent, member-influenced claim approvals |

| Customer Control | Limited influence on policy terms | High member involvement and governance |

| Risk Pooling | Large, insurer-managed risk pools | Smaller, member-funded risk pools |

| Transparency | Opaque pricing and policies | Clear, community-driven operations |

Introduction to Insurance Models

Traditional insurance brokerage relies on intermediaries to connect policyholders with insurers, offering personalized advice and tailored coverage options. Peer-to-peer insurance models leverage social networks and community pooling of risk, promoting transparency and often lower premiums by reducing administrative costs. Both models aim to manage risk effectively but differ significantly in structure, customer engagement, and cost dynamics.

Defining Traditional Brokerage Insurance

Traditional brokerage insurance involves licensed agents or brokers who act as intermediaries between policyholders and insurance companies, helping clients select suitable coverage based on their individual needs. These brokers access multiple insurance providers, negotiate terms, and offer personalized advice, ensuring compliance with regulatory standards. This model emphasizes trust, professional expertise, and tailored risk assessment to optimize insurance solutions for customers.

Understanding Peer-to-Peer (P2P) Insurance

Peer-to-Peer (P2P) insurance leverages group pooling to reduce premiums and increase transparency by connecting policyholders directly, bypassing traditional brokers. This innovative model utilizes social networks and digital platforms to facilitate risk sharing among members with similar profiles, enhancing trust and collaboration. P2P insurance often results in lower costs and improved claims processes by minimizing administrative overhead and aligning the interests of insured parties.

Operational Structures Compared

Traditional brokerage relies on intermediaries to connect clients with insurance providers, involving multiple layers of administration and commission fees that increase operational complexity and costs. Peer-to-peer insurance operates on a decentralized model where groups of individuals pool their premiums directly to share risk, minimizing administrative overhead and promoting transparency. This streamlined operational structure reduces expenses and aligns incentives among members, fostering greater trust and efficiency in claims handling.

Risk Pooling and Distribution Methods

Traditional brokerage relies on centralized risk pooling where insurers aggregate premiums from policyholders to cover claims, distributing risk across a broad customer base. Peer-to-peer insurance utilizes decentralized risk pools formed by groups of individuals who share risks among themselves, often leveraging technology platforms for transparency and direct claim handling. This method enhances trust and potentially reduces administrative costs by minimizing the role of intermediaries in risk distribution.

Claims Handling Processes

Traditional brokerage relies on agents to navigate complex claims handling processes, often leading to slower response times and higher administrative costs. Peer-to-peer insurance platforms streamline claims management through decentralized, transparent systems that enable faster verification and payout using smart contracts. This approach reduces fraud risk and enhances customer satisfaction by aligning incentives among policyholders within the same peer group.

Cost and Premium Differences

Traditional brokerage insurance often involves higher premiums due to agent commissions and administrative fees, increasing overall policy costs for consumers. Peer-to-peer (P2P) insurance leverages group pooling and minimizes intermediaries, resulting in lower premiums and potential refunds when claims are fewer than expected. The cost efficiency of P2P insurance appeals to budget-conscious policyholders seeking transparent pricing and reduced overhead expenses.

Regulatory and Compliance Aspects

Traditional brokerage operates within established regulatory frameworks, ensuring compliance with licensing, consumer protection laws, and financial solvency requirements enforced by authorities like state insurance departments. Peer-to-peer insurance models face emerging regulatory challenges due to their decentralized risk-sharing structures, with regulators scrutinizing transparency, risk pooling, and consumer safeguards. Both models must adhere to anti-money laundering (AML) and data privacy regulations, but peer-to-peer insurance requires innovative compliance solutions to meet evolving legal standards in digital insurance ecosystems.

Customer Experience and Transparency

Traditional brokerage often involves multiple intermediaries, which can lead to less transparency and slower claim processing, affecting overall customer experience. Peer-to-peer insurance enhances transparency by grouping similar risk profiles and enabling direct interactions among members, fostering trust and quicker resolutions. Customer experience improves significantly in peer-to-peer models due to reduced costs, personalized services, and more straightforward communication channels.

Future Trends in Insurance Models

The future of insurance models is shifting towards decentralized peer-to-peer (P2P) insurance platforms leveraging blockchain technology for enhanced transparency and reduced operational costs. Traditional brokerage will continue to play a role but is increasingly integrating digital tools and AI-driven risk assessment to remain competitive. Emerging trends indicate a hybrid approach combining P2P's community-driven claims management with brokers' personalized advisory services for optimized customer experience.

Related Important Terms

Decentralized Underwriting

Traditional brokerage relies on centralized underwriting processes where insurance agents assess risk and set premiums based on historical data and personal expertise. Peer-to-peer insurance leverages decentralized underwriting, enabling members within a network to collectively evaluate risks and share claims, increasing transparency and reducing administrative costs.

Risk Pooling DAO

Traditional brokerage relies on centralized risk pooling where insurers aggregate premiums to underwrite policies, whereas Peer-to-Peer Insurance leverages Risk Pooling DAOs that utilize blockchain technology to create decentralized, transparent pools managed by smart contracts. This decentralized approach enables policyholders to share risk directly, reducing overhead costs and enhancing trust through automated claims processing and community-driven governance.

Smart Contract Claims

Traditional brokerage relies on intermediaries for claim processing, often resulting in delays and increased administrative costs, whereas peer-to-peer insurance leverages smart contract claims to automate verification and payouts, enhancing transparency and reducing fraud. Smart contracts execute claim settlements based on pre-defined conditions encoded on a blockchain, minimizing human error and accelerating the claims lifecycle for policyholders.

Social Proof Pricing

Traditional brokerage relies heavily on established market rates and expert agents to set insurance premiums, often resulting in standardized pricing with limited transparency. Peer-to-peer insurance leverages social proof pricing by grouping policyholders to share risk and costs, creating more personalized premiums and fostering trust through collective accountability.

Microcoverage Pods

Traditional brokerage relies on agents to connect clients with insurers, often involving higher premiums and limited customization, whereas peer-to-peer insurance organizes microcoverage pods that pool resources among members for specific, small-scale risks, promoting transparency and cost efficiency. Microcoverage pods enable tailored, flexible insurance solutions by distributing risk within tight-knit groups, reducing administrative overhead and fostering community trust.

Tokenized Insurance Shares

Tokenized insurance shares in peer-to-peer insurance enable transparent, fractional ownership, enhancing liquidity and empowering policyholders with governance rights, unlike traditional brokerage models where intermediaries control policy distribution and profit margins. This decentralized approach reduces costs and aligns incentives by directly connecting insured individuals, thereby disrupting conventional insurance frameworks dependent on centralized brokers.

Community Risk Assessment

Traditional brokerage relies on actuarial data and individual risk profiles to assess premiums, often resulting in standardized pricing models. Peer-to-peer insurance emphasizes community risk assessment by pooling similar risk groups, enabling more personalized premiums and fostering collective accountability.

Hyperlocal Coverage Syndicates

Traditional brokerage relies on established insurance companies and agents to provide coverage through standardized policies, while Peer-to-Peer Insurance leverages hyperlocal coverage syndicates that pool premiums within tight-knit communities for tailored risk-sharing and reduced costs. Hyperlocal syndicates foster greater transparency and trust by directly involving members in claims assessments, optimizing risk management at a neighborhood or regional level.

Trustless Risk Transfer

Traditional brokerage relies on centralized intermediaries to manage risk transfer, often leading to higher costs and slower claims processing due to reliance on trust in third parties. Peer-to-peer insurance employs blockchain technology and smart contracts to enable trustless risk transfer, reducing fraud and enhancing transparency by automating claims settlement without intermediaries.

Policyholder DAO Governance

Traditional brokerage relies on centralized agents to manage insurance policies, whereas Peer-to-Peer Insurance employs Policyholder DAO Governance, enabling members to collectively make decisions on claims, premiums, and risk management through blockchain-based smart contracts. This decentralized approach enhances transparency, reduces administrative costs, and aligns incentives by giving policyholders direct control over their insurance ecosystem.

Traditional Brokerage vs Peer-to-Peer Insurance Infographic

industrydif.com

industrydif.com