A deductible is the amount a policyholder must pay out-of-pocket before an insurance company covers the remaining costs, serving as a cost-sharing mechanism to reduce premiums and prevent small claims. Microinsurance, on the other hand, provides affordable coverage tailored to low-income individuals, often with lower premiums and reduced or no deductibles to increase accessibility and financial protection. Understanding the balance between deductibles and microinsurance options helps consumers select policies that optimize risk management and affordability based on their financial situation and coverage needs.

Table of Comparison

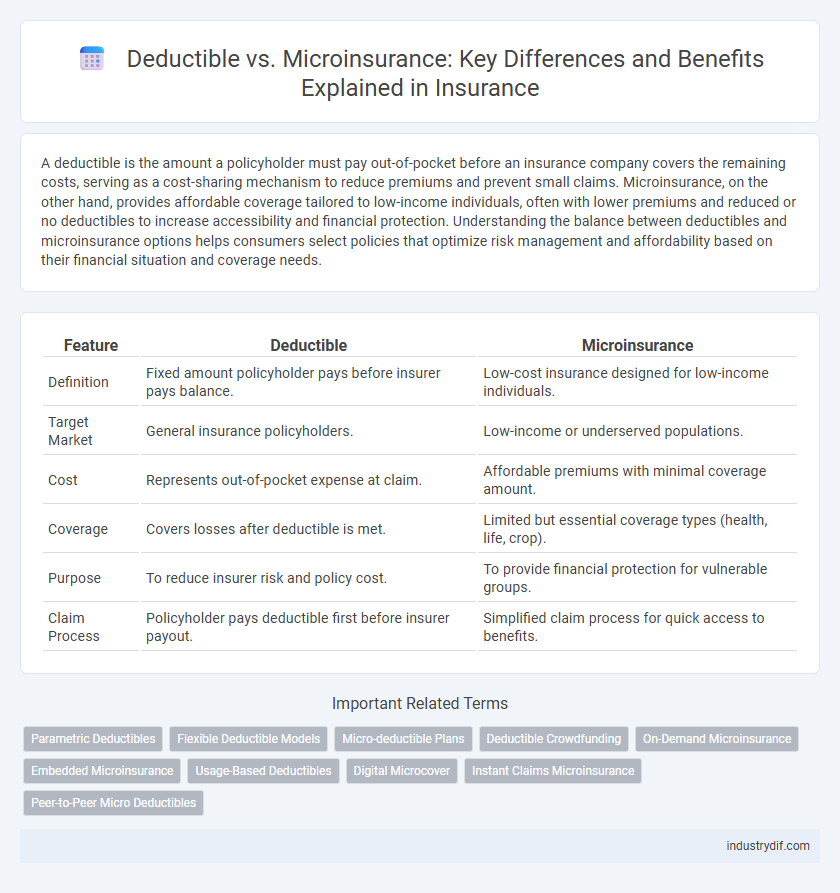

| Feature | Deductible | Microinsurance |

|---|---|---|

| Definition | Fixed amount policyholder pays before insurer pays balance. | Low-cost insurance designed for low-income individuals. |

| Target Market | General insurance policyholders. | Low-income or underserved populations. |

| Cost | Represents out-of-pocket expense at claim. | Affordable premiums with minimal coverage amount. |

| Coverage | Covers losses after deductible is met. | Limited but essential coverage types (health, life, crop). |

| Purpose | To reduce insurer risk and policy cost. | To provide financial protection for vulnerable groups. |

| Claim Process | Policyholder pays deductible first before insurer payout. | Simplified claim process for quick access to benefits. |

Understanding Deductibles in Insurance

Deductibles in insurance represent the fixed amount policyholders must pay out-of-pocket before the insurer covers any expenses, directly impacting premium costs and claim processes. A higher deductible usually results in lower premium payments, making it a critical factor in managing insurance affordability and risk exposure. Microinsurance offers low-cost, small-coverage options primarily for low-income individuals, differing significantly from traditional policies where deductible terms influence overall financial responsibility.

What is Microinsurance?

Microinsurance is a type of insurance designed to provide affordable coverage to low-income individuals or communities who are typically underserved by traditional insurance markets. It offers protection against specific risks such as health issues, accidents, natural disasters, or property damage, with lower premiums and simplified policies compared to standard insurance plans. By minimizing coverage amounts and premium costs, microinsurance enhances financial inclusion and helps vulnerable populations manage risk effectively.

Key Differences: Deductible and Microinsurance

Deductible refers to the amount a policyholder must pay out-of-pocket before insurance coverage begins, typically used in traditional insurance plans to share risk between insurer and insured. Microinsurance targets low-income individuals, providing affordable, low-premium coverage with smaller benefits designed to protect against specific risks such as health, agriculture, or property loss. Key differences include deductible's role in risk-sharing and cost control versus microinsurance's focus on accessibility and financial inclusion for underserved populations.

How Deductibles Impact Policyholders

Deductibles require policyholders to pay a specified amount out of pocket before insurance coverage begins, influencing their financial responsibility during claims. Higher deductibles typically lower premium costs but increase upfront expenses, potentially deterring small or frequent claims. Microinsurance often offers low or no deductibles, making it accessible for low-income individuals by minimizing initial payment barriers while providing essential coverage.

Target Markets for Microinsurance

Microinsurance targets low-income populations typically excluded from traditional insurance due to high deductibles and premiums. It offers affordable coverage tailored to the financial capacity and risk profiles of underserved communities in developing regions. This insurance model mitigates vulnerabilities by addressing specific needs such as health, agriculture, or property protection with minimal out-of-pocket expenses.

Cost Implications: Deductible vs Microinsurance

Deductibles typically lower premium costs by requiring policyholders to pay a set amount out-of-pocket before coverage begins, which can lead to significant savings on regular payments but higher expenses during claims. Microinsurance offers affordable premiums with minimal coverage limits designed for low-income individuals, reducing upfront costs and providing essential protection without the financial burden of large deductibles. Comparing cost implications, deductibles shift more immediate financial responsibility to policyholders during claims, while microinsurance emphasizes accessible, low-cost premiums with limited risk exposure.

Claims Process: Comparing Deductible and Microinsurance

The claims process for deductible insurance requires policyholders to pay a specified amount out-of-pocket before the insurer covers remaining costs, which can delay immediate financial relief. In contrast, microinsurance often features streamlined claims procedures tailored to low-income clients, enabling faster payouts with minimal documentation. Understanding these differences helps consumers select policies that best balance cost-sharing with ease of claims access.

Accessibility and Affordability in Insurance Options

Microinsurance offers significantly greater accessibility and affordability compared to traditional insurance with high deductibles, making it an ideal option for low-income individuals and underserved communities. While deductibles require policyholders to pay a substantial out-of-pocket amount before coverage begins, microinsurance provides lower premiums and minimal or no deductibles, enabling broader population segments to obtain financial protection. This affordability and ease of access enhance financial inclusion by reducing the barriers to essential insurance coverage.

Advantages and Disadvantages: Deductible vs Microinsurance

Deductibles reduce insurance premiums by requiring policyholders to pay a set amount before coverage begins, which can lower costs but may result in higher out-of-pocket expenses during claims. Microinsurance offers low-cost, targeted coverage designed for low-income populations, enhancing accessibility but often with limited benefits and lower coverage limits. Comparing both, deductibles provide cost control for standard policies, whereas microinsurance expands protection to underserved markets but may sacrifice comprehensiveness and claims flexibility.

Choosing the Right Option: Deductible or Microinsurance?

Choosing between a deductible and microinsurance depends on individual risk tolerance and financial capacity. Deductibles require policyholders to pay a fixed amount before coverage begins, often lowering premium costs but increasing out-of-pocket expenses. Microinsurance offers affordable, low-coverage plans designed for low-income individuals, providing essential protection with minimal upfront payments.

Related Important Terms

Parametric Deductibles

Parametric deductibles in microinsurance offer predefined payout triggers based on measurable events, reducing claim processing time and enhancing transparency compared to traditional deductibles. This approach optimizes risk management by linking payouts directly to specific parameters like rainfall levels or wind speeds, providing efficient financial protection for low-income clients.

Flexible Deductible Models

Flexible deductible models in insurance allow policyholders to adjust their out-of-pocket costs based on risk tolerance and premium affordability, enhancing personalized coverage compared to fixed deductibles. Microinsurance, often designed for low-income clients, typically features lower premiums and smaller coverage limits but lacks the customizable deductible flexibility found in advanced flexible deductible schemes.

Micro-deductible Plans

Micro-deductible plans combine the affordability of microinsurance with manageable deductible amounts, offering policyholders lower out-of-pocket expenses before coverage kicks in. These plans enhance financial protection for low-income individuals by minimizing upfront costs while maintaining essential insurance benefits.

Deductible Crowdfunding

Deductible crowdfunding enables policyholders to collectively fund their insurance deductibles, reducing individual out-of-pocket expenses during claims. This approach contrasts with microinsurance, which offers low-premium, limited-coverage policies designed for high-risk, low-income individuals, emphasizing accessibility over shared cost mitigation.

On-Demand Microinsurance

On-demand microinsurance provides affordable, flexible coverage with low premiums tailored to specific risks, making it an accessible alternative for individuals wary of high deductibles. This model reduces financial barriers by offering pay-as-you-go policies that activate only when needed, contrasting with traditional insurance plans where deductibles can delay claim payouts and increase out-of-pocket expenses.

Embedded Microinsurance

Embedded microinsurance integrates coverage seamlessly into everyday products or services, offering affordable, low-deductible protection tailored for low-income populations. This approach contrasts with traditional deductibles by minimizing out-of-pocket expenses, enhancing accessibility, and fostering financial inclusion through automated premium collection and claim processes.

Usage-Based Deductibles

Usage-based deductibles adjust the amount policyholders pay out-of-pocket based on real-time behavioral data like driving habits or health metrics, offering a personalized risk assessment that can lower premiums. Microinsurance provides affordable, limited coverage designed for low-income individuals but lacks the dynamic pricing and customized risk evaluation found in usage-based deductible models.

Digital Microcover

Digital microcover offers affordable insurance options with low premiums and minimal coverage limits, designed to cater to underserved populations who seek protection without high deductibles. Unlike traditional insurance with substantial deductibles that can delay claims payouts, digital microinsurance provides fast, accessible coverage through mobile platforms, enhancing financial inclusion and risk management.

Instant Claims Microinsurance

Instant claims microinsurance offers rapid, low-cost coverage with minimal deductibles, designed to provide immediate financial relief for small, everyday risks. Unlike traditional insurance with higher deductibles that delay payouts, microinsurance ensures swift claim processing through digital platforms, enhancing accessibility and affordability for underserved populations.

Peer-to-Peer Micro Deductibles

Peer-to-peer micro deductibles revolutionize insurance by enabling small, collective contributions to cover initial out-of-pocket costs, minimizing financial burdens on individual policyholders while enhancing claim efficiency. This model contrasts with traditional deductibles by pooling resources within communities, offering affordable, accessible risk-sharing tailored for microinsurance markets.

Deductible vs Microinsurance Infographic

industrydif.com

industrydif.com