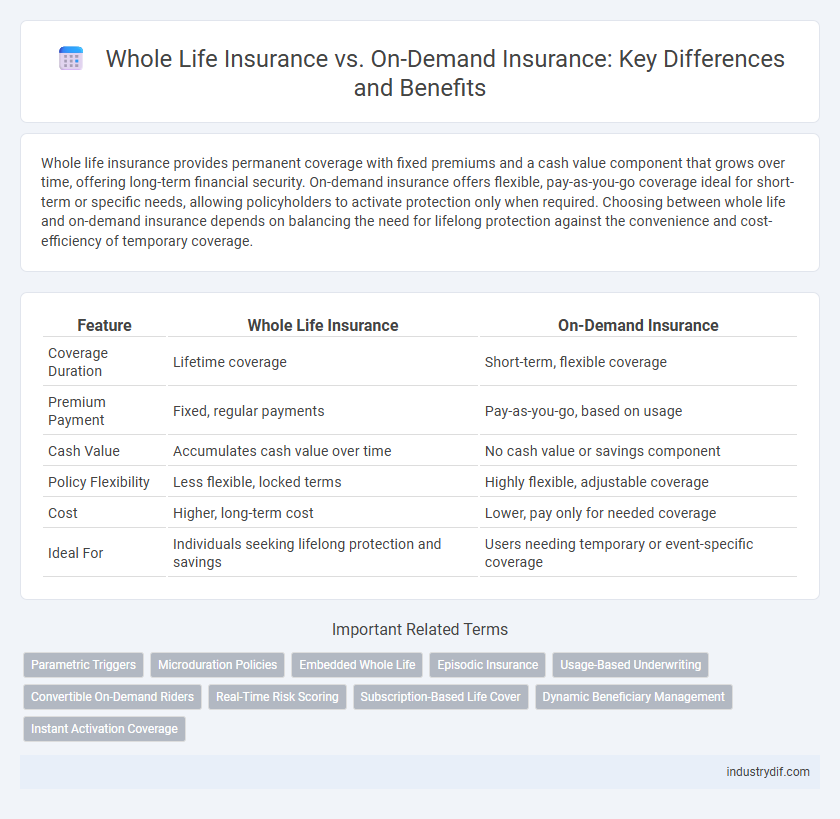

Whole life insurance provides permanent coverage with fixed premiums and a cash value component that grows over time, offering long-term financial security. On-demand insurance offers flexible, pay-as-you-go coverage ideal for short-term or specific needs, allowing policyholders to activate protection only when required. Choosing between whole life and on-demand insurance depends on balancing the need for lifelong protection against the convenience and cost-efficiency of temporary coverage.

Table of Comparison

| Feature | Whole Life Insurance | On-Demand Insurance |

|---|---|---|

| Coverage Duration | Lifetime coverage | Short-term, flexible coverage |

| Premium Payment | Fixed, regular payments | Pay-as-you-go, based on usage |

| Cash Value | Accumulates cash value over time | No cash value or savings component |

| Policy Flexibility | Less flexible, locked terms | Highly flexible, adjustable coverage |

| Cost | Higher, long-term cost | Lower, pay only for needed coverage |

| Ideal For | Individuals seeking lifelong protection and savings | Users needing temporary or event-specific coverage |

Understanding Whole Life Insurance

Whole life insurance offers lifelong coverage with fixed premiums and a cash value component that grows tax-deferred, providing both protection and a savings element. This policy guarantees a death benefit regardless of when the insured passes away, as long as premiums are paid. Understanding the stability and long-term financial benefits of whole life insurance is crucial when comparing it to the flexible, pay-as-you-go nature of on-demand insurance.

What Is On-Demand Insurance?

On-demand insurance offers flexible, pay-as-you-go coverage activated only when needed, contrasting with traditional whole life insurance's continuous, lifelong protection. This model leverages mobile technology to provide instant, short-term policies tailored for specific activities or time periods, optimizing cost efficiency for users. On-demand insurance is ideal for customers seeking control over coverage without the long-term financial commitment of whole life policies.

Key Features of Whole Life Policies

Whole Life insurance offers lifelong coverage with fixed premiums and a guaranteed death benefit, ensuring long-term financial security for policyholders and their beneficiaries. It includes a cash value component that grows tax-deferred over time, providing opportunities for loans or withdrawals to support emergencies or investments. These policies emphasize stability and predictability, making them ideal for estate planning and wealth transfer.

Benefits of On-Demand Insurance

On-demand insurance offers flexibility by allowing policyholders to activate coverage only when needed, reducing unnecessary premiums and providing cost-effective protection for short-term risks. It leverages real-time technology to deliver instant claims processing, enhancing convenience and customer satisfaction. This model is ideal for users seeking personalized coverage without long-term commitments or large upfront costs.

Cost Comparison: Whole Life vs On-Demand

Whole Life Insurance typically involves higher premiums due to its lifelong coverage and cash value accumulation, whereas On-Demand Insurance offers flexible, pay-as-you-go pricing suited for short-term needs. The consistent, fixed premiums of Whole Life provide long-term financial security but come at a significant upfront and ongoing cost compared to the variable, usage-based fees of On-Demand Insurance. For individuals prioritizing lower initial costs and adaptability, On-Demand Insurance presents a more cost-efficient option, while Whole Life remains ideal for those seeking permanent policy benefits and investment growth.

Flexibility and Customization Options

Whole life insurance offers less flexibility due to fixed premiums and guaranteed coverage for life, while on-demand insurance provides highly customizable policies with adjustable coverage and payments tailored to immediate needs. On-demand insurance's flexibility allows policyholders to activate or suspend coverage quickly, adapting to lifestyle changes and reducing unnecessary costs. Whole life insurance benefits include cash value accumulation and long-term financial planning but lacks the dynamic customization available in on-demand models.

Policy Duration and Coverage Limits

Whole Life insurance provides lifelong coverage with fixed premiums and guaranteed cash value accumulation, ensuring permanent protection regardless of changes in health. On-Demand insurance offers flexible, short-term coverage tailored to specific needs, with limits defined by the policy duration, typically ranging from hours to months. Policy duration in Whole Life is continuous, while On-Demand insurance duration is limited and renewal-dependent, affecting overall coverage stability and benefits.

Suitability for Different Lifestyles

Whole Life Insurance offers lifelong coverage with fixed premiums and cash value accumulation, making it suitable for individuals seeking long-term financial security and estate planning. On-Demand Insurance provides flexible, pay-as-you-go coverage ideal for people with fluctuating needs, such as gig workers or those with temporary assets. Choosing between these options depends on lifestyle stability, financial goals, and the desire for permanent versus flexible protection.

Claims Process Differences

Whole Life insurance claims involve a structured, often lengthy process requiring extensive documentation due to its long-term nature and guaranteed death benefits. On-Demand insurance offers a streamlined, faster claims process with minimal paperwork, leveraging digital platforms for instant verification and approval. Policyholders benefit from Whole Life's reliability in financial planning, while On-Demand policies prioritize agility and convenience in claims settlement.

Choosing the Right Insurance for You

Whole life insurance offers lifelong coverage with fixed premiums and a cash value component, making it a reliable option for long-term financial security. On-demand insurance provides flexible, short-term protection tailored to specific needs, ideal for those seeking cost-effective, temporary coverage. Evaluating your financial goals, coverage needs, and budget ensures the right insurance choice aligns with your personal and family's risk management strategy.

Related Important Terms

Parametric Triggers

Whole Life Insurance provides lifelong coverage with fixed premiums and cash value accumulation, while On-Demand Insurance uses parametric triggers such as predefined weather events or loss indices to automatically release payments without traditional claims processing. Parametric insurance enhances speed and transparency by relying on measurable data triggers, offering a streamlined alternative to conventional whole life policies.

Microduration Policies

Whole Life insurance offers lifelong coverage with fixed premiums and cash value accumulation, while On-Demand Insurance, including Microduration Policies, provides flexible, short-term protection tailored to specific needs or time frames. Microduration Policies, typically lasting from hours to days, optimize cost-efficiency and convenience for consumers seeking temporary coverage without long-term commitments.

Embedded Whole Life

Embedded Whole Life insurance offers permanent coverage with a cash value component that grows over time, providing policyholders with long-term financial security and potential dividends. Unlike On-Demand Insurance, which provides flexible, short-term coverage primarily for specific needs, Embedded Whole Life integrates lifelong protection within broader financial plans, ensuring consistent benefit accumulation and stability.

Episodic Insurance

Episodic insurance, also known as on-demand insurance, provides flexible, short-term coverage tailored to specific events or time periods, unlike whole life insurance which offers continuous, lifelong protection with cash value accumulation. This model benefits policyholders seeking affordable, situational risk management without long-term commitments or expensive premiums.

Usage-Based Underwriting

Usage-based underwriting in whole life insurance leverages continuous data from policyholders' behavior and health metrics to adjust premiums and coverage dynamically, providing long-term financial security with personalized risk assessment. On-demand insurance uses real-time usage data to offer flexible, short-term coverage options, optimizing cost efficiency and convenience for consumers who prefer pay-as-you-go protection models.

Convertible On-Demand Riders

Convertible on-demand riders in insurance provide policyholders with the flexibility to switch from temporary on-demand coverage to permanent whole life insurance without undergoing a new medical examination. This feature enhances long-term financial security by allowing gradual coverage buildup while maintaining the option for lifetime protection.

Real-Time Risk Scoring

Whole Life insurance offers fixed premiums and guaranteed cash value, while On-Demand insurance utilizes real-time risk scoring to dynamically adjust coverage and pricing based on up-to-the-minute data. Real-time risk scoring enhances underwriting accuracy by analyzing behavior patterns, location, and environmental factors instantly, providing personalized and cost-efficient insurance solutions.

Subscription-Based Life Cover

Subscription-based life cover offers flexible premium payments and customizable coverage compared to traditional whole life insurance, which requires fixed premiums and builds cash value over time. On-demand insurance provides short-term, usage-based protection ideal for fluctuating needs, while whole life policies ensure lifelong coverage with guaranteed death benefits and potential dividends.

Dynamic Beneficiary Management

Whole Life insurance offers stable, long-term beneficiary designations with less frequent changes, ensuring consistent asset protection and estate planning benefits. On-Demand insurance provides dynamic beneficiary management, enabling real-time updates to recipient information that align with evolving personal circumstances and financial goals.

Instant Activation Coverage

Whole Life insurance offers permanent, lifelong coverage with fixed premiums and cash value accumulation, while On-Demand insurance provides instant activation coverage tailored for temporary needs without long-term commitment. Instant activation in On-Demand insurance enables policyholders to secure immediate protection, ideal for short-term activities or sudden coverage requirements.

Whole Life vs On-Demand Insurance Infographic

industrydif.com

industrydif.com