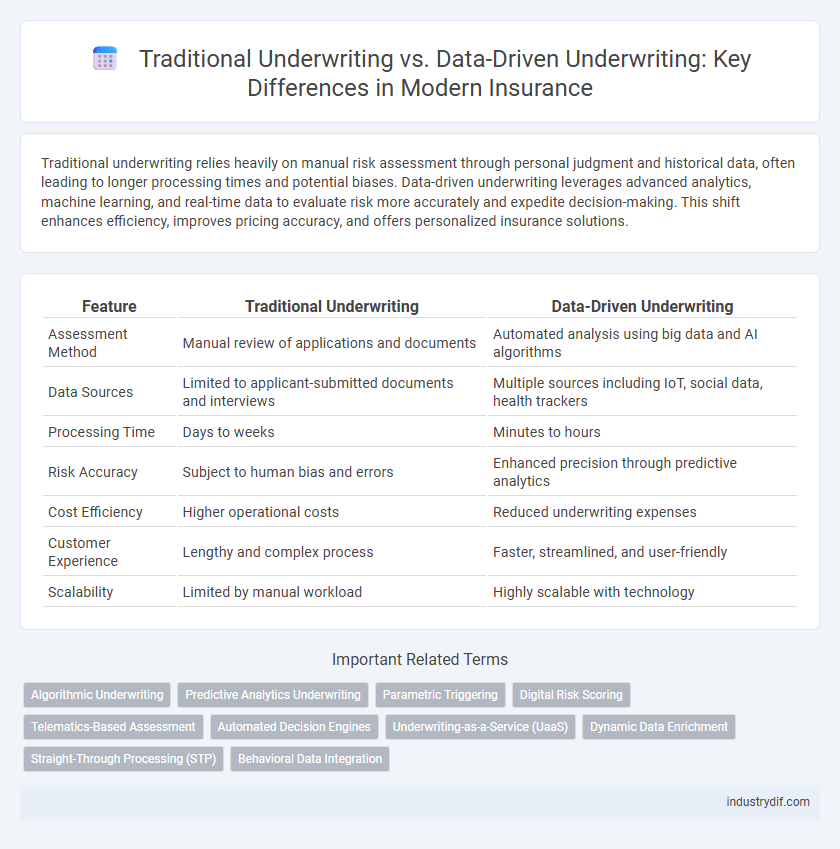

Traditional underwriting relies heavily on manual risk assessment through personal judgment and historical data, often leading to longer processing times and potential biases. Data-driven underwriting leverages advanced analytics, machine learning, and real-time data to evaluate risk more accurately and expedite decision-making. This shift enhances efficiency, improves pricing accuracy, and offers personalized insurance solutions.

Table of Comparison

| Feature | Traditional Underwriting | Data-Driven Underwriting |

|---|---|---|

| Assessment Method | Manual review of applications and documents | Automated analysis using big data and AI algorithms |

| Data Sources | Limited to applicant-submitted documents and interviews | Multiple sources including IoT, social data, health trackers |

| Processing Time | Days to weeks | Minutes to hours |

| Risk Accuracy | Subject to human bias and errors | Enhanced precision through predictive analytics |

| Cost Efficiency | Higher operational costs | Reduced underwriting expenses |

| Customer Experience | Lengthy and complex process | Faster, streamlined, and user-friendly |

| Scalability | Limited by manual workload | Highly scalable with technology |

Introduction to Underwriting in Insurance

Underwriting in insurance involves assessing risk to determine policy terms and premiums, traditionally relying on manual evaluation of applicant information and historical data. Data-driven underwriting utilizes advanced analytics, machine learning, and real-time data sources to enhance risk assessment accuracy and efficiency. This shift enables insurers to reduce processing time, improve pricing strategies, and tailor coverage to individual risk profiles.

Defining Traditional Underwriting

Traditional underwriting relies on manual evaluation of applicant information, including medical history, financial records, and personal interviews, to assess risk and determine premiums. This process depends heavily on underwriter expertise and historical data patterns to make subjective judgments. Although thorough, traditional underwriting is often time-consuming and may lack the predictive accuracy of data-driven models.

What is Data-Driven Underwriting?

Data-driven underwriting leverages advanced analytics, machine learning algorithms, and vast datasets to assess risk more accurately and efficiently in the insurance industry. Unlike traditional underwriting, which relies heavily on manual evaluation of applications and historical data, data-driven underwriting integrates real-time data sources such as IoT devices, social media, and predictive models. This approach enhances risk assessment precision, speeds up policy issuance, and enables personalized insurance pricing based on individual risk profiles.

Key Differences Between Traditional and Data-Driven Underwriting

Traditional underwriting relies heavily on manual evaluation of applicant information, using standard criteria such as medical exams and credit history, which can be time-consuming and subjective. Data-driven underwriting integrates advanced analytics, machine learning algorithms, and vast datasets to assess risk more accurately and efficiently, enabling faster decision-making. This approach allows insurers to personalize policies, reduce fraud, and improve risk prediction by leveraging real-time data sources and predictive modeling.

Role of Actuarial Science in Underwriting

Actuarial science plays a critical role in both traditional and data-driven underwriting by applying statistical models to assess risk and determine premiums. In traditional underwriting, actuaries rely on historical data and expert judgment to evaluate policyholder risk, while data-driven underwriting leverages machine learning algorithms and big data analytics for more precise risk predictions. This evolution enhances accuracy and efficiency, enabling insurers to tailor policies and optimize financial outcomes.

Impact of Technology on Risk Assessment

Traditional underwriting relies heavily on manual processes, expert judgment, and limited historical data, which can result in slower risk assessment and potential biases. Data-driven underwriting incorporates advanced algorithms, machine learning, and real-time data sources, significantly enhancing accuracy and efficiency in evaluating risk profiles. Technology enables insurers to analyze vast datasets, detect patterns, and automate decision-making, leading to more precise pricing and reduced underwriting cycle times.

Data Sources and Analytics in Modern Underwriting

Data-driven underwriting leverages extensive data sources such as telematics, social media analytics, and IoT sensor data to generate comprehensive risk profiles. Advanced machine learning algorithms analyze real-time and historical data, enhancing predictive accuracy and enabling personalized insurance pricing. This approach surpasses traditional underwriting's reliance on static, limited information, accelerating decision-making and reducing human bias.

Benefits of Data-Driven Underwriting for Insurers

Data-driven underwriting enhances risk assessment accuracy by leveraging advanced analytics and big data, reducing reliance on subjective judgments. Insurers benefit from faster decision-making processes, resulting in improved operational efficiency and customer satisfaction. Enhanced predictive models enable more precise pricing, minimizing loss ratios and maximizing profitability.

Challenges Faced in Adopting Data-Driven Methods

Data-driven underwriting faces challenges such as integrating vast and diverse data sources while ensuring data quality and accuracy. Regulatory compliance and privacy concerns complicate the use of advanced analytics and machine learning models in insurance risk assessment. Insurers must also address resistance to change within organizations and the need for skilled personnel to interpret complex data outputs effectively.

The Future of Underwriting in the Insurance Industry

The future of underwriting in the insurance industry hinges on the integration of data-driven underwriting models that leverage big data, predictive analytics, and artificial intelligence to enhance risk assessment accuracy and streamline policy issuance. Traditional underwriting, which relies heavily on manual risk evaluation and historical data, faces limitations in scalability and speed compared to automated algorithms that analyze vast datasets in real time. Embracing data-driven underwriting results in personalized risk profiles, improved customer experience, and optimized pricing strategies, driving innovation and competitiveness across the insurance sector.

Related Important Terms

Algorithmic Underwriting

Algorithmic underwriting leverages machine learning models and big data analytics to assess risk with greater accuracy and speed compared to traditional underwriting methods, enabling insurers to process applications efficiently while reducing human biases and errors. This data-driven approach uses real-time data integration from diverse sources such as social media, IoT devices, and medical records, optimizing risk evaluation and pricing strategies for improved policyholder outcomes.

Predictive Analytics Underwriting

Predictive analytics underwriting leverages advanced data modeling and machine learning algorithms to assess risk more accurately than traditional underwriting, which relies on historical data and manual evaluation. This data-driven approach enhances risk prediction, reduces underwriting time, and improves policy pricing precision in the insurance industry.

Parametric Triggering

Traditional underwriting relies on manual assessment of individual risk factors and historical data, often leading to slower claim processing and subjective decision-making. Data-driven underwriting with parametric triggering utilizes predefined parameters and real-time data, enabling faster, more accurate claim settlements by automatically activating payouts when specific conditions are met.

Digital Risk Scoring

Digital risk scoring in data-driven underwriting leverages machine learning algorithms to analyze vast datasets, enabling more accurate and efficient assessment of policyholder risk compared to traditional underwriting methods that rely heavily on manual evaluation and historical data. This approach enhances predictive precision, reduces processing time, and allows insurers to customize premiums dynamically based on real-time behavioral and biometric data.

Telematics-Based Assessment

Telematics-based assessment in insurance underwriting leverages real-time driving behavior data to offer personalized risk profiles, enhancing accuracy beyond traditional methods reliant on static questionnaires and historical records. This data-driven approach reduces underwriting turnaround time and enables dynamic premium adjustments, improving risk management and customer satisfaction.

Automated Decision Engines

Automated decision engines in data-driven underwriting leverage machine learning algorithms and real-time data analytics to evaluate risk more accurately and swiftly than traditional underwriting methods, which rely heavily on manual assessments and historical data. These engines enhance precision, reduce human error, and enable scalable policy issuance by continuously integrating diverse data sources such as social media, IoT devices, and credit scores.

Underwriting-as-a-Service (UaaS)

Underwriting-as-a-Service (UaaS) integrates traditional underwriting methods with advanced data-driven analytics to enhance risk assessment accuracy and operational efficiency in insurance. Leveraging real-time data feeds and machine learning algorithms, UaaS platforms enable insurers to streamline underwriting workflows, reduce manual errors, and offer faster policy issuance.

Dynamic Data Enrichment

Data-driven underwriting revolutionizes risk assessment by leveraging dynamic data enrichment, integrating real-time information from diverse sources such as IoT devices, social media, and credit scores to create a comprehensive and continuously updated risk profile. Traditional underwriting relies heavily on static data and historical records, resulting in slower decision-making and less accurate risk predictions compared to the adaptive, data-rich models that improve pricing accuracy and customer personalization.

Straight-Through Processing (STP)

Traditional underwriting relies on manual risk assessment and document verification, which slows the Straight-Through Processing (STP) rate and increases operational costs. Data-driven underwriting leverages automated analytics and real-time data integration, significantly enhancing STP efficiency, reducing processing time, and improving accuracy in insurance policy issuance.

Behavioral Data Integration

Traditional underwriting primarily relies on historical medical records and credit scores, limiting risk assessment to static data points. Data-driven underwriting enhances precision by integrating behavioral data such as lifestyle choices, online activity, and real-time health metrics, enabling insurers to tailor policies and pricing more accurately.

Traditional Underwriting vs Data-Driven Underwriting Infographic

industrydif.com

industrydif.com