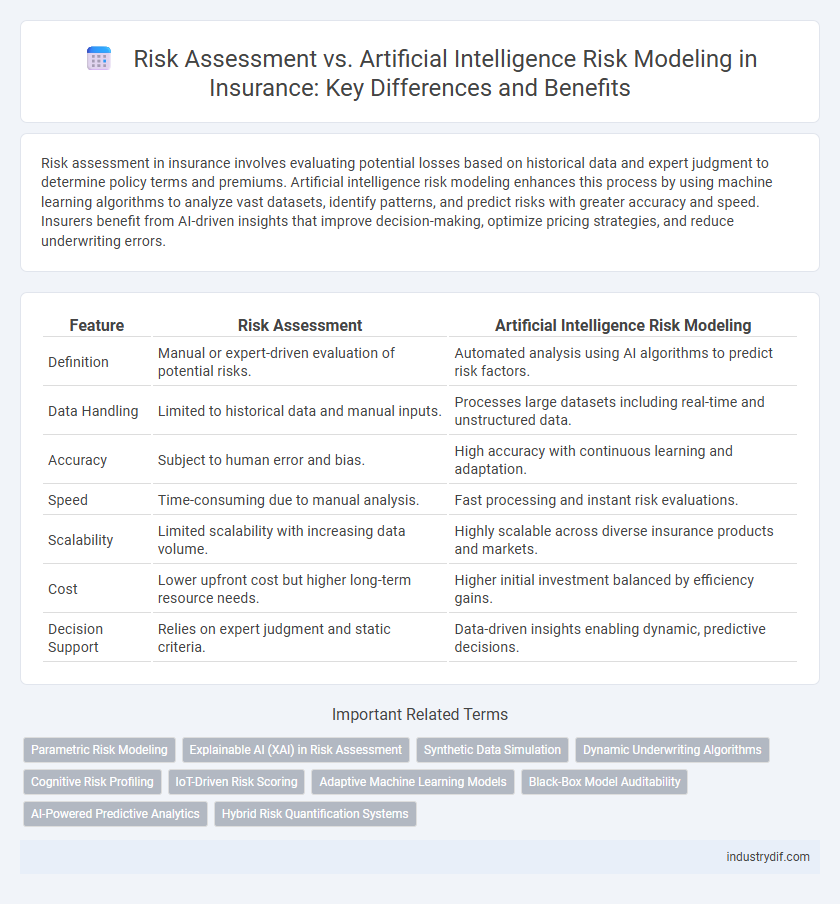

Risk assessment in insurance involves evaluating potential losses based on historical data and expert judgment to determine policy terms and premiums. Artificial intelligence risk modeling enhances this process by using machine learning algorithms to analyze vast datasets, identify patterns, and predict risks with greater accuracy and speed. Insurers benefit from AI-driven insights that improve decision-making, optimize pricing strategies, and reduce underwriting errors.

Table of Comparison

| Feature | Risk Assessment | Artificial Intelligence Risk Modeling |

|---|---|---|

| Definition | Manual or expert-driven evaluation of potential risks. | Automated analysis using AI algorithms to predict risk factors. |

| Data Handling | Limited to historical data and manual inputs. | Processes large datasets including real-time and unstructured data. |

| Accuracy | Subject to human error and bias. | High accuracy with continuous learning and adaptation. |

| Speed | Time-consuming due to manual analysis. | Fast processing and instant risk evaluations. |

| Scalability | Limited scalability with increasing data volume. | Highly scalable across diverse insurance products and markets. |

| Cost | Lower upfront cost but higher long-term resource needs. | Higher initial investment balanced by efficiency gains. |

| Decision Support | Relies on expert judgment and static criteria. | Data-driven insights enabling dynamic, predictive decisions. |

Understanding Risk Assessment in the Insurance Industry

Risk assessment in the insurance industry involves evaluating potential losses to determine policy terms and premiums, relying heavily on historical data, actuarial models, and expert judgment. Artificial intelligence risk modeling enhances this process by utilizing machine learning algorithms and big data analytics to identify complex patterns and predict risks more accurately. Integrating AI-driven models improves the precision of underwriting decisions, reduces fraud, and optimizes claims management, leading to more dynamic and efficient risk evaluation.

Introduction to Artificial Intelligence Risk Modeling

Artificial Intelligence Risk Modeling leverages machine learning algorithms and vast datasets to enhance the accuracy and efficiency of risk assessment in insurance. Unlike traditional methods that rely on historical data and expert judgment, AI models dynamically adapt to emerging patterns, improving predictive capabilities. This approach enables insurers to identify potential risks more precisely, optimize underwriting processes, and reduce exposure to unforeseen losses.

Key Differences Between Traditional Risk Assessment and AI-Driven Models

Traditional risk assessment relies on historical data, expert judgment, and standardized scoring systems to evaluate insurance risks, often resulting in slower and less adaptive analysis. AI-driven risk modeling utilizes machine learning algorithms and real-time data processing to identify complex patterns, enabling more accurate, dynamic, and scalable risk predictions. The key differences lie in AI's ability to process vast datasets, improve predictive accuracy, and continuously update models through automated learning, transforming risk evaluation in the insurance industry.

The Evolution of Risk Modeling: From Manual to Machine Learning

Risk assessment in insurance has evolved from manual, expert-driven processes to sophisticated artificial intelligence risk modeling that leverages machine learning algorithms for enhanced predictive accuracy. Traditional methods relied heavily on historical data interpretation and subjective judgment, whereas AI models analyze vast datasets in real-time, identifying complex patterns and emerging risks with greater precision. This transformation enables insurers to optimize underwriting, improve pricing strategies, and proactively manage risk portfolios through continuous learning and adaptive analytics.

Data Sources and Analytics in Insurance Risk Evaluation

Insurance risk evaluation increasingly relies on Artificial Intelligence risk modeling, which leverages diverse data sources such as telematics, social media, and IoT sensors, enhancing traditional risk assessment methods that primarily use historical claims and demographic data. Advanced analytics, including machine learning algorithms and predictive modeling, enable real-time risk identification and personalized underwriting, improving accuracy and efficiency compared to conventional actuarial techniques. Integrating big data and AI-driven analytics transforms insurance risk assessment by enabling dynamic, data-rich insights that optimize risk prediction and pricing strategies.

Benefits of AI-Powered Risk Modeling for Insurers

AI-powered risk modeling enhances insurers' ability to analyze vast datasets with precision, leading to more accurate risk predictions and underwriting decisions. This technology enables real-time risk assessment, reducing manual errors and operational costs while accelerating claim processing. By leveraging machine learning algorithms, insurers can identify emerging risks and personalize insurance products, improving customer satisfaction and competitive advantage.

Challenges and Limitations of Artificial Intelligence in Risk Assessment

Artificial intelligence risk modeling in insurance faces challenges such as data quality issues, transparency limitations, and algorithmic bias, which can undermine the accuracy and fairness of risk assessments. The complexity of AI models often leads to a lack of explainability, making it difficult for insurers to justify decisions to regulators and customers. Furthermore, AI systems require vast, diverse datasets to perform effectively, but data privacy concerns and incomplete information can restrict their usability in practical risk evaluation.

Regulatory Considerations for AI in Insurance Risk Modeling

Regulatory considerations for AI in insurance risk modeling emphasize transparency, data privacy, and fairness to comply with evolving legal frameworks such as the GDPR and the Insurance Distribution Directive (IDD). Insurers must ensure AI algorithms undergo rigorous validation and explainability assessments to mitigate biases that could lead to discriminatory practices. Continuous monitoring and audit trails are mandated to align AI-driven risk assessment models with regulatory requirements and maintain consumer trust.

Integrating Human Expertise with AI Risk Assessment Tools

Integrating human expertise with AI risk assessment tools enhances the accuracy and reliability of insurance risk evaluation by combining intuitive judgment with advanced data analytics. Human underwriters contribute contextual understanding and ethical considerations that AI models may overlook, ensuring comprehensive risk profiling. This synergy improves predictive outcomes and optimizes underwriting decisions in complex insurance environments.

The Future of Risk Assessment in the Age of Artificial Intelligence

The future of risk assessment in insurance hinges on the integration of artificial intelligence risk modeling, which offers enhanced predictive accuracy by analyzing vast datasets in real-time. AI-driven models leverage machine learning algorithms to identify emerging risks and automate complex underwriting processes, reducing human error and improving decision-making efficiency. This technological evolution is set to transform traditional risk evaluation, enabling insurers to offer more personalized policies and dynamic pricing structures.

Related Important Terms

Parametric Risk Modeling

Parametric risk modeling in insurance leverages predefined parameters such as weather conditions or natural disaster metrics to quantify risk exposure with greater objectivity and speed compared to traditional risk assessment methods. Artificial intelligence enhances parametric models by analyzing vast datasets and identifying complex patterns, improving predictive accuracy and enabling more dynamic, real-time risk pricing and mitigation strategies.

Explainable AI (XAI) in Risk Assessment

Explainable AI (XAI) enhances risk assessment by providing transparent and interpretable insights into AI-driven risk models, enabling insurers to understand decision-making processes and improve regulatory compliance. This transparency fosters trust and facilitates more accurate identification and mitigation of underwriting and claims risks.

Synthetic Data Simulation

Synthetic data simulation enhances traditional risk assessment by generating realistic yet artificial datasets, allowing AI risk modeling to identify patterns and predict outcomes without compromising sensitive information. This approach improves the accuracy of insurance risk evaluation while preserving privacy and enabling scalable testing of diverse risk scenarios.

Dynamic Underwriting Algorithms

Dynamic underwriting algorithms leverage artificial intelligence to enhance risk assessment by continuously analyzing real-time data, improving the accuracy and efficiency of insurance risk evaluations. These AI-driven models adapt to changing risk factors, enabling personalized policy pricing and proactive risk management compared to traditional static assessment methods.

Cognitive Risk Profiling

Cognitive Risk Profiling leverages Artificial Intelligence Risk Modeling to analyze behavioral patterns, psychological traits, and decision-making processes, providing a more nuanced and predictive approach than traditional Risk Assessment methods. This integration enhances insurers' ability to identify latent risks, tailor premiums accurately, and mitigate fraud by tapping into cognitive and emotional factors influencing policyholder behavior.

IoT-Driven Risk Scoring

IoT-driven risk scoring enhances traditional risk assessment by continuously collecting real-time data from connected devices, enabling more accurate and dynamic risk modeling through artificial intelligence algorithms. This integration allows insurers to predict potential hazards with greater precision, reduce underwriting uncertainty, and tailor premiums based on precise behavioral and environmental insights.

Adaptive Machine Learning Models

Adaptive machine learning models enhance risk assessment in insurance by continuously analyzing vast datasets to identify emerging patterns and adjust predictions in real time. These models outperform traditional static risk assessment methods by dynamically incorporating new information, improving accuracy in underwriting and fraud detection.

Black-Box Model Auditability

Risk assessment in insurance traditionally relies on transparent, rule-based methods allowing clear audit trails for regulatory compliance, whereas artificial intelligence risk modeling often utilizes complex black-box algorithms that challenge interpretability and auditability. Enhancing explainability frameworks within AI risk models is critical to ensure accountability and regulatory adherence in insurance underwriting and claims processing.

AI-Powered Predictive Analytics

AI-powered predictive analytics revolutionizes risk assessment by analyzing vast datasets to identify patterns and forecast potential insurance claims with higher accuracy. This advanced modeling enables insurers to optimize underwriting decisions, reduce loss ratios, and enhance customer segmentation by leveraging machine learning algorithms and real-time data integration.

Hybrid Risk Quantification Systems

Hybrid risk quantification systems integrate traditional risk assessment methodologies with artificial intelligence risk modeling to enhance predictive accuracy and enable dynamic risk evaluation in insurance underwriting. By combining actuarial data analysis with machine learning algorithms, these systems optimize risk stratification, improve fraud detection, and support real-time decision-making processes.

Risk Assessment vs Artificial Intelligence Risk Modeling Infographic

industrydif.com

industrydif.com