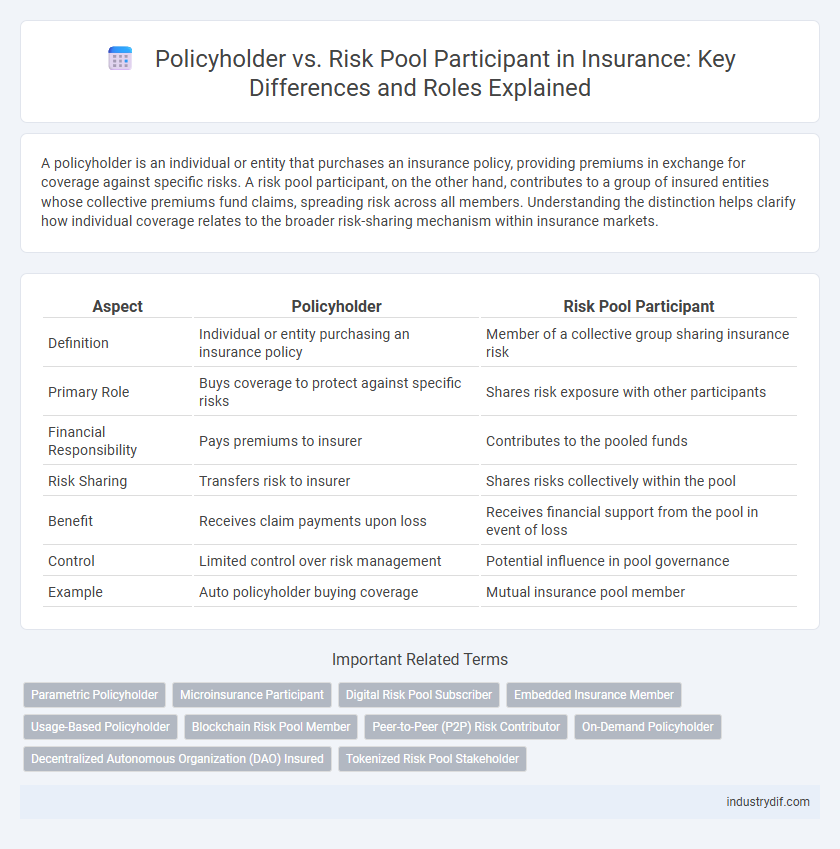

A policyholder is an individual or entity that purchases an insurance policy, providing premiums in exchange for coverage against specific risks. A risk pool participant, on the other hand, contributes to a group of insured entities whose collective premiums fund claims, spreading risk across all members. Understanding the distinction helps clarify how individual coverage relates to the broader risk-sharing mechanism within insurance markets.

Table of Comparison

| Aspect | Policyholder | Risk Pool Participant |

|---|---|---|

| Definition | Individual or entity purchasing an insurance policy | Member of a collective group sharing insurance risk |

| Primary Role | Buys coverage to protect against specific risks | Shares risk exposure with other participants |

| Financial Responsibility | Pays premiums to insurer | Contributes to the pooled funds |

| Risk Sharing | Transfers risk to insurer | Shares risks collectively within the pool |

| Benefit | Receives claim payments upon loss | Receives financial support from the pool in event of loss |

| Control | Limited control over risk management | Potential influence in pool governance |

| Example | Auto policyholder buying coverage | Mutual insurance pool member |

Definition of Policyholder

A policyholder is an individual or entity that owns an insurance policy and holds the contractual right to receive coverage as specified in the contract. Unlike a risk pool participant, who collectively shares risk with others, the policyholder actively manages their own policy terms and benefits. The policyholder's obligations include paying premiums and adhering to policy conditions to maintain coverage.

Understanding Risk Pool Participant

A risk pool participant is an individual or entity included in a collective group that shares insurance risks, allowing for the distribution of potential losses across all members. Unlike a policyholder who holds a specific insurance contract, risk pool participants contribute to and benefit from the aggregated risk management strategy, enhancing overall coverage stability. Understanding the role of risk pool participants is essential for assessing how premiums are calculated and how claims are funded within the insurance ecosystem.

Key Differences Between Policyholder and Risk Pool Participant

A policyholder holds an individual insurance contract with specific coverage, premiums, and terms tailored to their needs, while a risk pool participant belongs to a collective group sharing the financial risk of losses. Policyholders have defined policy benefits and claims rights, whereas risk pool participants contribute to and benefit from the aggregated risk management of the pool. The primary difference lies in the policyholder's direct contractual relationship with the insurer versus the risk pool participant's involvement in a shared risk mechanism without a personalized policy.

Rights and Responsibilities of a Policyholder

A policyholder holds contractual rights including claim filing, policy renewal, and premium payment, while being responsible for providing accurate information and timely payments to maintain coverage. Unlike risk pool participants who collectively share risks, policyholders have individualized obligations to uphold policy terms and comply with insurer requirements. Their responsibilities directly influence the insurer's risk assessment and the legitimacy of benefits received.

Role of a Risk Pool Participant in Insurance

A risk pool participant in insurance shares exposure to potential losses alongside other members, distributing individual risk across the entire group to stabilize premiums and promote financial predictability. This collective risk-sharing mechanism allows insurers to assess and price policies more accurately, reducing the impact of high claims on individual policyholders. By contributing to the risk pool, participants enable insurers to maintain solvency and provide coverage that might otherwise be unaffordable or unavailable to single individuals.

Impact on Premiums: Policyholder vs Risk Pool Participant

Policyholders pay premiums based on their individual risk profiles, which directly influence the cost and coverage of their insurance policies. In contrast, risk pool participants benefit from shared risk, where premiums are adjusted collectively to balance out high and low-risk members, potentially lowering costs for some. Understanding the distinction between these roles is essential for evaluating how premiums are determined and managed within insurance markets.

Claims Process Differences

Policyholders submit claims directly to their insurer, who evaluates the individual risk profile and policy terms to determine claim eligibility and payout amount. Risk pool participants share claims costs collectively, with payouts typically based on the overall pool performance rather than individual risk assessments. This collective approach in risk pools leads to more standardized claims processing compared to the personalized evaluation for policyholders.

Benefits of Being a Policyholder

Policyholders receive personalized coverage tailored to their specific needs, ensuring financial protection against potential losses. As direct contract holders, they benefit from claims processing priority and access to exclusive policy endorsements or riders. This targeted risk management enhances financial security compared to general risk pool participants who share broader risk without individualized guarantees.

Importance of Risk Pooling in Insurance

Risk pooling is essential in insurance as it allows policyholders to share the financial risks associated with uncertain events, reducing individual exposure and stabilizing premiums. Policyholders collectively contribute to the risk pool, enabling insurers to pay claims efficiently and maintain solvency. This shared risk mechanism ensures affordable coverage and promotes long-term stability in the insurance market.

Choosing the Right Role in Insurance Policies

Choosing the right role in insurance policies depends on understanding the differences between a policyholder and a risk pool participant. A policyholder is the individual or entity that owns the insurance contract and is responsible for premium payments, while a risk pool participant shares the collective risks with others in the insurance pool, helping to spread potential losses. Selecting the appropriate role influences coverage options, financial responsibilities, and the extent of risk exposure in insurance agreements.

Related Important Terms

Parametric Policyholder

A parametric policyholder benefits from predefined triggers that activate payouts based on specific data metrics, unlike traditional risk pool participants who share losses collectively within the insurance pool. This model enhances transparency and speed in claims processing by relying on objective, verifiable parameters such as weather indices or seismic activity levels.

Microinsurance Participant

Microinsurance participants often serve dual roles as both policyholders and active members of risk pools, enabling the collective sharing of financial risks in low-income communities. Their participation enhances risk diversification and affordability while ensuring access to essential insurance protection tailored to vulnerable populations.

Digital Risk Pool Subscriber

A Digital Risk Pool subscriber acts as a policyholder by sharing insurance risks within a decentralized network, enhancing transparency and reducing costs compared to traditional insurance models. This innovative participation transforms risk management through blockchain technology, enabling real-time claim processing and personalized coverage adjustments.

Embedded Insurance Member

An embedded insurance member acts as a risk pool participant within a larger ecosystem, benefiting from shared risk coverage without directly holding the insurance policy. Policyholders have contractual obligations and rights tied to their individual policies, whereas embedded members gain protection through integrated services, optimizing risk distribution and cost efficiency.

Usage-Based Policyholder

Usage-based policyholders leverage telematics data to tailor insurance premiums based on actual driving behavior, enhancing personalized risk assessment within the risk pool. Unlike traditional risk pool participants whose premiums are determined by demographic averages, these policyholders contribute precise usage data that refines underwriting models and promotes fairer pricing strategies.

Blockchain Risk Pool Member

Blockchain risk pool members contribute premiums into a decentralized ledger that enhances transparency and security for all policyholders involved. This distributed approach aligns incentives by directly linking each participant's data and claims history within the immutable blockchain, optimizing risk assessment and claim validation processes.

Peer-to-Peer (P2P) Risk Contributor

A Policyholder typically purchases insurance coverage individually, while a Risk Pool Participant in a Peer-to-Peer (P2P) insurance model actively contributes to a shared risk pool, sharing both premiums and potential claims among members. P2P Risk Contributors benefit from reduced costs and increased transparency by collectively managing risk and mitigating adverse selection through mutual accountability.

On-Demand Policyholder

An On-Demand Policyholder actively purchases insurance coverage only when needed, distinguishing them from traditional Risk Pool Participants who contribute continuously to a collective fund. This flexible approach optimizes cost-efficiency and aligns coverage precisely with temporal risk exposure, enhancing personalized insurance solutions.

Decentralized Autonomous Organization (DAO) Insured

Policyholders in a Decentralized Autonomous Organization (DAO) insured model actively participate as risk pool participants, sharing premiums and claims transparently through blockchain technology. This decentralized framework enhances trust and efficiency by automating policy enforcement and claim settlements without traditional intermediaries.

Tokenized Risk Pool Stakeholder

Tokenized risk pool stakeholders represent policyholders through blockchain-enabled digital assets, allowing fractional ownership and transparent participation in underwriting and claims processes. This innovation enhances liquidity and incentivizes risk-sharing, distinguishing tokenized stakeholders from traditional policyholders by enabling real-time governance and financial returns within decentralized insurance ecosystems.

Policyholder vs Risk Pool Participant Infographic

industrydif.com

industrydif.com