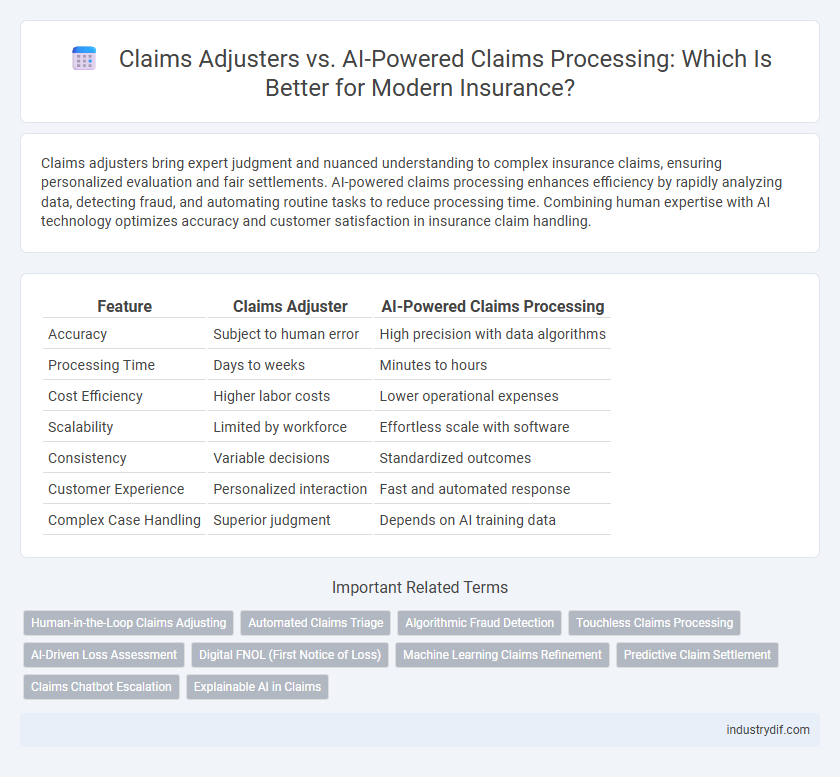

Claims adjusters bring expert judgment and nuanced understanding to complex insurance claims, ensuring personalized evaluation and fair settlements. AI-powered claims processing enhances efficiency by rapidly analyzing data, detecting fraud, and automating routine tasks to reduce processing time. Combining human expertise with AI technology optimizes accuracy and customer satisfaction in insurance claim handling.

Table of Comparison

| Feature | Claims Adjuster | AI-Powered Claims Processing |

|---|---|---|

| Accuracy | Subject to human error | High precision with data algorithms |

| Processing Time | Days to weeks | Minutes to hours |

| Cost Efficiency | Higher labor costs | Lower operational expenses |

| Scalability | Limited by workforce | Effortless scale with software |

| Consistency | Variable decisions | Standardized outcomes |

| Customer Experience | Personalized interaction | Fast and automated response |

| Complex Case Handling | Superior judgment | Depends on AI training data |

Introduction to Claims Adjusters and AI in Insurance

Claims adjusters play a crucial role in the insurance industry by investigating, evaluating, and settling insurance claims to ensure fair and accurate compensation. AI-powered claims processing leverages machine learning algorithms and data analytics to automate claim assessments, reduce processing times, and enhance decision accuracy. Combining human expertise with AI technology optimizes claim outcomes, improves customer experience, and lowers operational costs for insurers.

Key Responsibilities of Human Claims Adjusters

Human claims adjusters are responsible for investigating insurance claims by interviewing claimants and witnesses, examining evidence, and assessing damages to determine the extent of the insurer's liability. They apply critical thinking and expert judgment to evaluate complex or ambiguous cases that require interpretation beyond automated data analysis. These professionals also negotiate settlements and communicate directly with policyholders to ensure claims are resolved fairly and efficiently.

How AI-Powered Claims Processing Works

AI-powered claims processing leverages machine learning algorithms and natural language processing to analyze and validate insurance claims rapidly. By automating data extraction from claim documents, images, and customer inputs, the system reduces human error and speeds up decision-making. Advanced AI models cross-reference claim details with policy terms and historical data to accurately assess claim legitimacy and calculate payouts.

Speed and Efficiency: Human Adjusters vs AI Systems

AI-powered claims processing significantly accelerates claim assessments by rapidly analyzing vast datasets and automating routine tasks, reducing average processing times from days to mere minutes. Human claims adjusters apply critical thinking and nuanced judgment to complex cases but typically require longer periods to finalize determinations, especially with intricate or disputed claims. Combining AI's speed and efficiency with human expertise optimizes claims resolution, enhances accuracy, and improves customer satisfaction in the insurance industry.

Accuracy and Consistency in Claim Assessments

Claims adjusters rely on professional judgment and experience to evaluate insurance claims, which can introduce variability and human error into the assessment process. AI-powered claims processing uses machine learning algorithms and data analytics to analyze claims with higher accuracy, ensuring consistent application of policy rules across vast datasets. Enhanced accuracy and consistency reduce claim processing time, minimize disputes, and improve customer satisfaction in the insurance industry.

Customer Experience in Human vs AI-Driven Claims

Claims adjusters provide personalized support by analyzing policy details, conducting investigations, and addressing complex customer concerns, which enhances trust and satisfaction through empathetic communication. AI-powered claims processing accelerates claim settlements with automated data analysis, reducing wait times and minimizing human error, resulting in a more efficient experience for routine claims. Combining human expertise with AI technology optimizes customer experience by balancing thoroughness and speed in claims handling.

Role of Data Security and Privacy in Claims Processing

Claims adjusters manage sensitive policyholder information requiring strict adherence to data security protocols to protect privacy during claims investigation. AI-powered claims processing employs advanced encryption and compliance frameworks to safeguard personal data while enabling faster, automated evaluations. Maintaining robust cybersecurity measures is critical in both approaches to prevent breaches and ensure regulatory compliance in insurance claims handling.

Cost Implications: Traditional vs AI Claims Handling

Traditional claims adjusters incur higher operational costs due to labor-intensive processes, manual assessments, and longer claim resolution times. AI-powered claims processing significantly reduces expenses by automating document analysis, fraud detection, and customer communication, leading to faster claim settlements and lower administrative overhead. Insurers adopting AI technology benefit from improved cost efficiency and enhanced scalability compared to conventional claims handling methods.

Future Trends: The Evolving Role of Claims Professionals

Claims adjusters will increasingly collaborate with AI-powered claims processing systems, leveraging machine learning algorithms to enhance accuracy and speed in damage assessments and fraud detection. The integration of AI tools enables claims professionals to focus on complex cases and personalized customer service, driving operational efficiency and improved client satisfaction. Future trends indicate a hybrid model where human expertise and AI technology combine to transform the insurance claims landscape.

Choosing the Right Approach for Modern Insurance Firms

Claims adjusters provide personalized assessment and negotiation expertise, ensuring accurate damage evaluation and fair settlements in complex insurance claims. AI-powered claims processing enhances efficiency by automating data analysis, fraud detection, and rapid decision-making, reducing operational costs and turnaround times. Modern insurance firms must balance human judgment with AI technology to optimize claims management, improve customer satisfaction, and maintain regulatory compliance.

Related Important Terms

Human-in-the-Loop Claims Adjusting

Human-in-the-loop claims adjusting enhances insurance claims processing by combining the analytical precision of AI-powered systems with the critical judgment and empathy of experienced claims adjusters. This hybrid approach improves accuracy in damage assessment and fraudulent claim detection while maintaining personalized customer service and complex decision-making abilities.

Automated Claims Triage

Automated claims triage leverages AI-powered algorithms to efficiently categorize and prioritize insurance claims based on severity, complexity, and fraud risk, enabling faster response times and optimized resource allocation. Claims adjusters focus on complex cases requiring human judgment, while AI handles routine claims, reducing processing costs and minimizing errors in initial claim assessments.

Algorithmic Fraud Detection

Claims adjusters rely on expertise and investigation skills to evaluate insurance claims, while AI-powered claims processing leverages advanced algorithms for algorithmic fraud detection, analyzing patterns and anomalies in large datasets to identify suspicious activities with higher accuracy and speed. Integrating AI-driven fraud detection reduces human error, accelerates claim settlements, and enhances overall efficiency in the insurance claims workflow.

Touchless Claims Processing

Touchless claims processing leverages AI-powered algorithms to automate data extraction, damage assessment, and fraud detection, significantly reducing human intervention and accelerating settlement times. Claims adjusters, while essential for complex cases requiring nuanced judgement, are increasingly supported by AI to enhance accuracy and efficiency in routine claims workflows.

AI-Driven Loss Assessment

AI-driven loss assessment enhances claims processing by rapidly analyzing vast data sets, improving accuracy in damage evaluation and reducing human error. Claims adjusters benefit from AI tools that provide real-time insights, enabling faster settlements and more precise risk assessments.

Digital FNOL (First Notice of Loss)

Digital FNOL streamlines the initial reporting of insurance claims by enabling real-time data capture and immediate documentation through AI-powered claims processing systems, enhancing accuracy and reducing settlement times. Claims adjusters benefit from AI-driven insights that prioritize cases and automate routine assessments, allowing them to focus on complex claim evaluations and improve overall operational efficiency.

Machine Learning Claims Refinement

Machine learning claims refinement leverages AI algorithms to analyze vast datasets, identify patterns, and detect anomalies, enhancing the accuracy and efficiency of claims processing compared to traditional claims adjusters. This technology reduces human error and accelerates claim settlements by continuously learning from new data, optimizing fraud detection, and improving risk assessment in insurance claims management.

Predictive Claim Settlement

Claims adjusters analyze policy details and investigate damages to determine fair settlements, while AI-powered claims processing leverages predictive analytics to expedite claim resolution and enhance accuracy by forecasting settlement outcomes based on historical data. Predictive claim settlement models reduce processing times and minimize human errors, improving overall efficiency and customer satisfaction in insurance claims management.

Claims Chatbot Escalation

Claims adjusters collaborate with AI-powered claims processing systems to enhance efficiency, where claims chatbot escalation directs complex cases to human experts for accurate evaluation. Leveraging natural language processing and machine learning, chatbots handle routine inquiries while ensuring seamless handoff to claims adjusters for nuanced decision-making.

Explainable AI in Claims

Explainable AI in claims processing enhances transparency by providing clear, interpretable decision-making processes that enable claims adjusters to validate and trust automated outcomes. This integration improves accuracy and efficiency while maintaining regulatory compliance and customer satisfaction in the insurance claims lifecycle.

Claims Adjuster vs AI-Powered Claims Processing Infographic

industrydif.com

industrydif.com