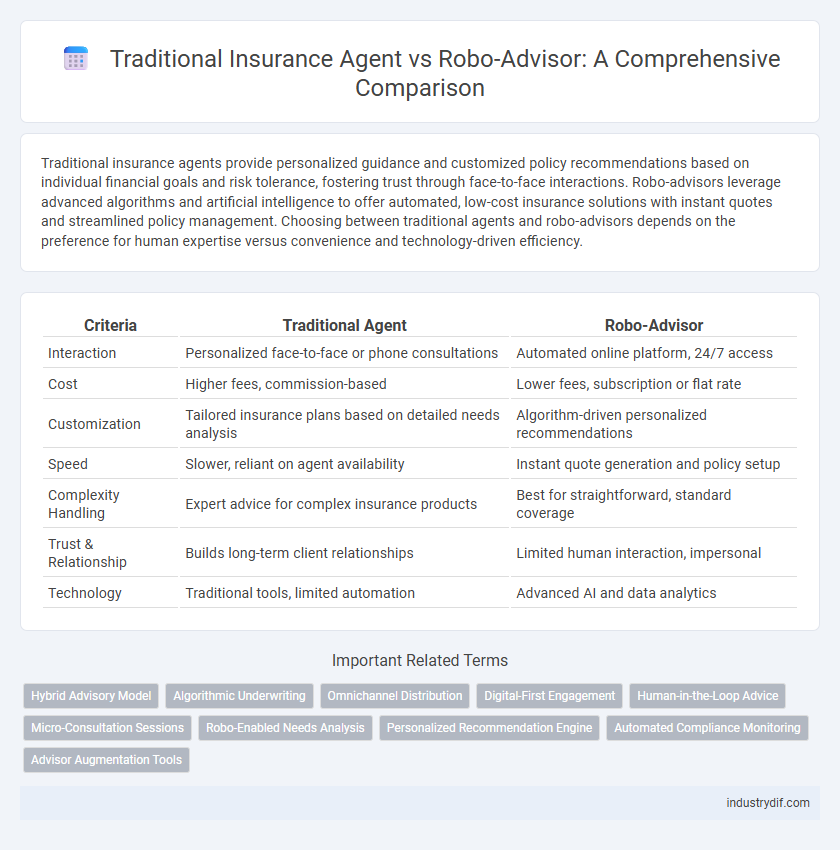

Traditional insurance agents provide personalized guidance and customized policy recommendations based on individual financial goals and risk tolerance, fostering trust through face-to-face interactions. Robo-advisors leverage advanced algorithms and artificial intelligence to offer automated, low-cost insurance solutions with instant quotes and streamlined policy management. Choosing between traditional agents and robo-advisors depends on the preference for human expertise versus convenience and technology-driven efficiency.

Table of Comparison

| Criteria | Traditional Agent | Robo-Advisor |

|---|---|---|

| Interaction | Personalized face-to-face or phone consultations | Automated online platform, 24/7 access |

| Cost | Higher fees, commission-based | Lower fees, subscription or flat rate |

| Customization | Tailored insurance plans based on detailed needs analysis | Algorithm-driven personalized recommendations |

| Speed | Slower, reliant on agent availability | Instant quote generation and policy setup |

| Complexity Handling | Expert advice for complex insurance products | Best for straightforward, standard coverage |

| Trust & Relationship | Builds long-term client relationships | Limited human interaction, impersonal |

| Technology | Traditional tools, limited automation | Advanced AI and data analytics |

Understanding Traditional Insurance Agents

Traditional insurance agents offer personalized service by assessing clients' unique needs and providing tailored coverage options. They build relationships through face-to-face interactions, leveraging their industry expertise to explain complex policy details and assist in claims processing. This hands-on approach contrasts with robo-advisors, which rely on algorithms for automated insurance recommendations.

What Is a Robo-Advisor in Insurance?

A robo-advisor in insurance is an automated digital platform that uses algorithms and data analysis to recommend and manage insurance policies without human intervention. It streamlines the insurance purchasing process by providing personalized quotes, coverage suggestions, and policy management based on individual risk profiles and preferences. Robo-advisors enhance accessibility and efficiency, offering 24/7 service with reduced operational costs compared to traditional insurance agents.

Key Differences Between Agents and Robo-Advisors

Traditional insurance agents provide personalized guidance through face-to-face interactions, leveraging extensive product knowledge to tailor policies to individual client needs. Robo-advisors use advanced algorithms and machine learning to offer automated, cost-efficient insurance recommendations based on real-time data analysis. While agents excel in building trust and handling complex cases, robo-advisors deliver speed, transparency, and 24/7 accessibility for streamlined policy selection.

Personalized Service: Human Touch vs Automation

Traditional insurance agents provide personalized service by understanding clients' unique financial situations, risk tolerance, and long-term goals through direct human interaction. Robo-advisors leverage algorithms and data analytics to deliver automated, scalable recommendations, offering quick and cost-effective solutions but lacking the empathy and nuanced judgment a human agent can provide. The choice between traditional agents and robo-advisors depends on preferences for personalized human guidance versus efficient, technology-driven convenience.

Cost Comparison: Fees and Commissions

Traditional insurance agents typically charge higher fees and commissions, ranging from 5% to 10% of the premium, which can significantly increase the overall cost of coverage. Robo-advisors offer a cost-efficient alternative with fees usually between 0.25% and 0.50%, leveraging automation to reduce operational expenses. Clients opting for robo-advisors benefit from transparent pricing and lower commissions, making insurance more affordable compared to traditional agent models.

Accessibility and Convenience of Platforms

Traditional insurance agents offer personalized, face-to-face consultations but often require scheduled appointments and office visits, limiting accessibility for busy clients. Robo-advisors provide 24/7 access through mobile apps and websites, enabling users to compare quotes, customize policies, and purchase coverage instantly from any location. Digital platforms use algorithms to streamline processes, enhancing convenience by reducing paperwork and accelerating approval times compared to conventional methods.

Technology Integration in Policy Management

Traditional insurance agents rely on manual processes and face-to-face interactions for policy management, which often results in slower service and limited real-time updates. Robo-advisors leverage advanced algorithms, artificial intelligence, and cloud-based platforms to automate policy management, providing instant quotes, digital document handling, and continuous policy monitoring. The integration of technology in robo-advisors enhances accuracy, efficiency, and customer accessibility compared to the analog methods used by traditional agents.

Trust, Transparency, and Regulatory Considerations

Traditional insurance agents build trust through personalized interactions and established industry experience, while robo-advisors leverage algorithmic transparency and data-driven decisions to enhance clarity. Regulatory frameworks for traditional agents emphasize licensing and fiduciary responsibilities, whereas robo-advisors face evolving compliance standards centered on digital security and automated advice accountability. Trust in robo-advisors depends on transparent algorithms and regulatory adherence, contrasting with the agent's reliance on personal credibility and regulatory oversight.

Target Markets: Who Benefits Most?

Traditional insurance agents excel in serving clients who prefer personalized guidance, complex policy customization, and face-to-face interactions, making them ideal for high-net-worth individuals and those with unique coverage needs. Robo-advisors benefit tech-savvy millennials and budget-conscious consumers seeking quick, low-cost insurance quotes and streamlined digital experiences. Understanding these distinct target markets helps insurers tailor their distribution strategies to maximize engagement and customer satisfaction.

Future Trends in Insurance Distribution

Traditional insurance agents provide personalized client interactions and trust-building, but robo-advisors leverage AI and big data to offer faster, cost-effective policy recommendations and streamlined claims processing. Future trends in insurance distribution indicate a hybrid model, where human expertise integrates with advanced algorithms to enhance customer experience and operational efficiency. Insurers investing in digital transformation and machine learning platforms gain competitive advantages by delivering tailored solutions and predictive analytics.

Related Important Terms

Hybrid Advisory Model

The hybrid advisory model in insurance combines the personalized expertise of traditional agents with the efficiency of robo-advisors, enhancing customer experience and decision-making accuracy. This approach leverages AI-driven analytics alongside human insight to provide tailored policy recommendations and real-time support.

Algorithmic Underwriting

Algorithmic underwriting leverages advanced machine learning models and big data analytics to rapidly assess insurance risk, enhancing accuracy and reducing human bias compared to traditional agents' manual evaluations. This technology enables personalized policy recommendations and dynamic pricing, streamlining the underwriting process and improving customer experience through faster decision-making.

Omnichannel Distribution

Traditional insurance agents provide personalized service through face-to-face interactions and phone support, leveraging deep product knowledge and customer relationships across multiple channels. Robo-advisors enhance omnichannel distribution by offering automated, data-driven policy recommendations and 24/7 digital access, streamlining customer acquisition and service with AI-powered platforms.

Digital-First Engagement

Traditional insurance agents provide personalized, face-to-face consultations that build trust through direct human interaction, while robo-advisors offer automated, algorithm-driven recommendations accessible 24/7 via digital platforms, emphasizing convenience and speed. Digital-first engagement in insurance increasingly favors robo-advisors for straightforward policy comparisons and quick quoting, although complex or customized coverage often still requires human agent expertise.

Human-in-the-Loop Advice

Traditional insurance agents leverage human expertise to provide personalized risk assessments and tailored policy recommendations, ensuring nuanced understanding of customer needs. Robo-advisors incorporate algorithms with human-in-the-loop systems to enhance decision accuracy, combining automated data analysis with expert intervention for optimized insurance advice.

Micro-Consultation Sessions

Micro-consultation sessions with traditional insurance agents provide personalized advice tailored to individual client needs, leveraging human expertise to clarify complex policy details. Robo-advisors offer automated, data-driven recommendations through quick, convenient online micro-consultations, optimizing efficiency and accessibility for diverse insurance planning.

Robo-Enabled Needs Analysis

Robo-enabled needs analysis leverages advanced algorithms and big data to provide personalized insurance recommendations with increased accuracy and efficiency compared to traditional agents. By automating risk assessment and policy customization, robo-advisors reduce human bias and enable scalable, cost-effective insurance solutions tailored to individual client profiles.

Personalized Recommendation Engine

Traditional insurance agents rely on human expertise and client interactions to deliver personalized recommendation engines tailored to individual risk profiles and coverage needs. Robo-advisors utilize advanced algorithms and machine learning to analyze vast datasets instantly, offering scalable, data-driven personalized insurance solutions with real-time updates and optimization.

Automated Compliance Monitoring

Traditional insurance agents rely on manual processes to ensure regulatory compliance, which can be time-consuming and prone to errors. In contrast, robo-advisors utilize automated compliance monitoring systems that continuously track regulatory changes and client data, enhancing accuracy and reducing risk of non-compliance.

Advisor Augmentation Tools

Advisor augmentation tools enhance traditional insurance agents' capabilities by integrating AI-driven analytics, real-time customer insights, and automated policy recommendations. These technologies empower agents to deliver personalized, efficient service while maintaining human trust and relationship-building essential in insurance advisory roles.

Traditional Agent vs Robo-Advisor Infographic

industrydif.com

industrydif.com