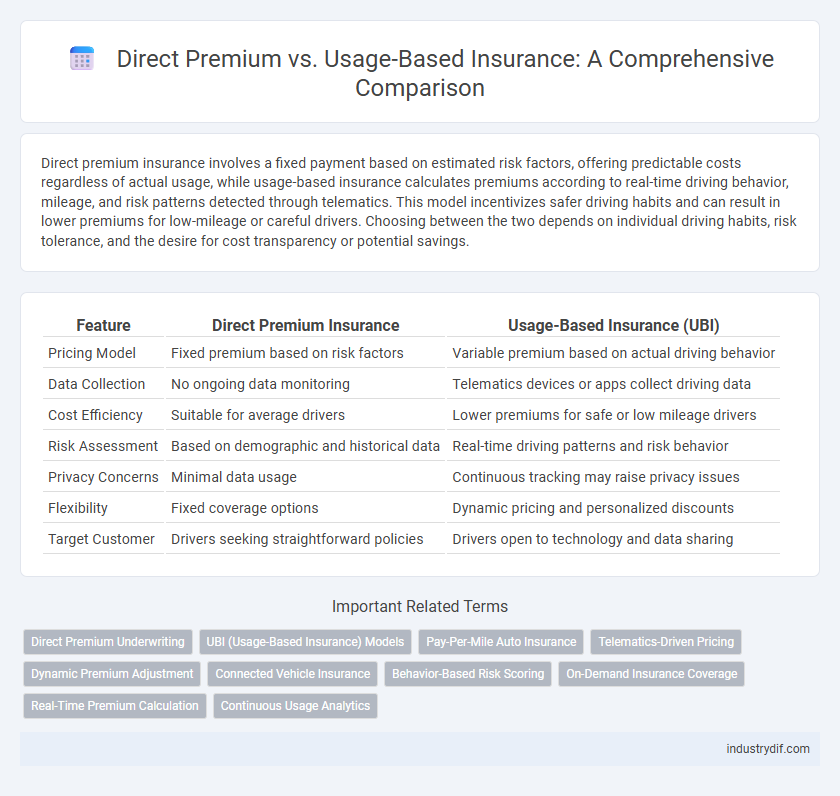

Direct premium insurance involves a fixed payment based on estimated risk factors, offering predictable costs regardless of actual usage, while usage-based insurance calculates premiums according to real-time driving behavior, mileage, and risk patterns detected through telematics. This model incentivizes safer driving habits and can result in lower premiums for low-mileage or careful drivers. Choosing between the two depends on individual driving habits, risk tolerance, and the desire for cost transparency or potential savings.

Table of Comparison

| Feature | Direct Premium Insurance | Usage-Based Insurance (UBI) |

|---|---|---|

| Pricing Model | Fixed premium based on risk factors | Variable premium based on actual driving behavior |

| Data Collection | No ongoing data monitoring | Telematics devices or apps collect driving data |

| Cost Efficiency | Suitable for average drivers | Lower premiums for safe or low mileage drivers |

| Risk Assessment | Based on demographic and historical data | Real-time driving patterns and risk behavior |

| Privacy Concerns | Minimal data usage | Continuous tracking may raise privacy issues |

| Flexibility | Fixed coverage options | Dynamic pricing and personalized discounts |

| Target Customer | Drivers seeking straightforward policies | Drivers open to technology and data sharing |

Definition of Direct Premium Insurance

Direct Premium Insurance refers to a traditional insurance model where policyholders pay a fixed premium amount upfront based on standard risk assessments such as age, location, and coverage limits. This premium is calculated using historical data and actuarial tables without factoring in real-time behavior or usage patterns. Unlike Usage-Based Insurance, Direct Premium Insurance does not adjust costs dynamically based on an individual's actual driving habits or risk exposure.

Overview of Usage-Based Insurance (UBI)

Usage-Based Insurance (UBI) leverages telematics technology to monitor drivers' real-time behavior, such as speed, braking patterns, and mileage, enabling personalized premium calculations. Unlike traditional direct premiums that rely on demographic and historical data, UBI offers dynamic pricing reflective of actual driving habits, promoting fairer risk assessment. This model incentivizes safer driving and can lead to significant cost savings for low-risk policyholders.

Key Differences Between Direct Premium and UBI

Direct premium insurance charges a fixed rate based on broad risk factors such as age, location, and vehicle type, while usage-based insurance (UBI) calculates premiums dynamically using real-time driving data including mileage, speed, and braking behavior. Direct premium plans offer predictable costs without the need for monitoring devices, whereas UBI leverages telematics to reward safer driving habits with potentially lower premiums. Insurers utilize direct premium models for straightforward underwriting, whereas UBI enhances risk assessment precision by integrating personalized usage patterns and driver behavior metrics.

How Direct Premium Insurance is Calculated

Direct Premium Insurance is calculated based on fixed factors such as the insured item's value, coverage limits, risk classification, and standard rate tables provided by insurance companies. Pricing models incorporate statistical data including claims history, geographic location, and demographic risk profiles to determine a consistent premium amount. Unlike Usage-Based Insurance, which adjusts rates dynamically based on driving behavior and mileage, Direct Premium Insurance relies on predetermined criteria established at policy inception.

Usage-Based Insurance: Data Collection Methods

Usage-based insurance (UBI) relies on telematics devices, smartphone apps, and OBD-II ports to collect real-time data on driving behavior, including speed, acceleration, braking patterns, and trip duration. GPS tracking and sensor technologies enable insurers to monitor mileage and driving conditions, allowing for more personalized premium calculations. This data-driven approach supports risk assessment by providing accurate, behavior-based insights rather than relying solely on traditional factors used in direct premium insurance models.

Advantages of Direct Premium Insurance

Direct Premium Insurance offers policyholders predictable, fixed premiums that simplify budgeting and financial planning. It provides immediate coverage benefits without the need for telematics devices or continuous monitoring, ensuring straightforward claim processing. Insurers managing direct premiums often deliver faster customer service and clearer policy terms, enhancing overall transparency and trust.

Benefits of Usage-Based Insurance for Policyholders

Usage-Based Insurance (UBI) offers policyholders personalized premiums by analyzing real-time driving behavior through telematics, leading to potentially lower costs compared to traditional Direct Premium models. This approach incentivizes safer driving habits and provides increased transparency, as premiums directly reflect individual risk profiles. Enhanced risk assessment in UBI results in fairer pricing, rewarding low-risk drivers with significant savings and fostering greater customer satisfaction.

Challenges and Limitations of Each Model

Direct premium insurance often faces challenges related to accurately assessing risk due to reliance on broad demographic data, which can lead to higher or unfair premiums for some customers. Usage-based insurance models encounter limitations in privacy concerns, data security, and potential inaccuracies in telematics data that can affect premium calculations. Both models also struggle with regulatory compliance and customer acceptance, impacting their widespread adoption.

Impact on Customer Experience and Engagement

Direct Premium insurance offers customers straightforward pricing with fixed premiums, enhancing predictability and simplifying the purchase process to boost satisfaction. Usage-Based Insurance (UBI) leverages telematics data to tailor premiums based on actual driving behavior, fostering greater engagement through personalized rates and real-time feedback. This dynamic pricing model encourages safer driving habits, improving customer loyalty and delivering a more interactive insurance experience.

Future Trends in Insurance Premium Models

Direct premium insurance relies on fixed rates based on traditional risk factors, while usage-based insurance (UBI) leverages telematics data, such as mileage and driving behavior, to personalize premiums. Future trends indicate a significant shift towards UBI models driven by advancements in IoT, AI, and big data analytics, enhancing risk assessment accuracy and customer engagement. Insurers adopting dynamic pricing strategies incorporating real-time data are expected to gain competitive advantages and improve loss ratios.

Related Important Terms

Direct Premium Underwriting

Direct Premium Underwriting evaluates risk and calculates premiums based on standardized criteria, ensuring predictable pricing for policyholders. This approach contrasts with Usage-Based Insurance by relying on historical data and fixed factors rather than real-time driving behavior.

UBI (Usage-Based Insurance) Models

Usage-Based Insurance (UBI) models leverage telematics data such as mileage, driving behavior, and time of use to tailor premiums more accurately than traditional direct premium approaches, promoting fairer pricing and risk assessment. UBI models often utilize smartphone apps or in-vehicle devices to continuously monitor drivers, enabling insurers to reward safe driving habits and reduce overall claims costs.

Pay-Per-Mile Auto Insurance

Pay-Per-Mile auto insurance offers a flexible alternative to traditional direct premium policies by charging drivers based on the exact number of miles they drive, resulting in potentially lower costs for low-mileage drivers. This usage-based insurance model leverages telematics technology to monitor real-time driving data, optimizing premiums to reflect individual driving habits and reducing unnecessary expenses inherent in flat-rate direct premium plans.

Telematics-Driven Pricing

Telematics-driven pricing in usage-based insurance (UBI) leverages real-time data on driving behavior, mileage, and location to tailor premiums more accurately compared to traditional direct premium models that rely on static factors like age and vehicle type. This data-driven approach enables insurers to incentivize safer driving habits, reduce risk exposure, and offer personalized, cost-efficient coverage options.

Dynamic Premium Adjustment

Direct Premium insurance offers a fixed rate based on traditional risk factors, while Usage-Based Insurance (UBI) dynamically adjusts premiums by analyzing real-time driving behavior and mileage data through telematics. This dynamic premium adjustment allows UBI to provide personalized rates that reflect actual risk exposure, promoting safer driving habits and potentially lowering costs for low-risk drivers.

Connected Vehicle Insurance

Direct premium insurance charges customers a fixed rate based on traditional risk assessments, while usage-based insurance (UBI) leverages connected vehicle data, such as real-time driving behavior and mileage, to tailor premiums more accurately. Connected vehicle insurance enhances risk prediction models by integrating telematics, GPS, and sensor data, enabling insurers to offer dynamic pricing that rewards safer driving and reduces overall claim costs.

Behavior-Based Risk Scoring

Direct premium insurance calculates costs based on aggregated risk pools and fixed factors, while usage-based insurance leverages telematics and behavior-based risk scoring to tailor premiums according to real-time driving habits and individual risk profiles, enhancing pricing accuracy and incentivizing safer behavior. Behavior-based risk scoring utilizes data points such as speed, braking patterns, and mileage to assess risk dynamically, offering policyholders more personalized and potentially cost-effective insurance options.

On-Demand Insurance Coverage

Direct premium insurance requires upfront payment based on estimated risk, while usage-based insurance adjusts premiums dynamically according to real-time driver behavior and mileage. On-demand insurance coverage offers flexible, pay-as-you-go policies ideal for occasional drivers, reducing costs by activating coverage only when the vehicle is in use.

Real-Time Premium Calculation

Direct premium insurance offers fixed rates determined at policy inception using historical data and risk profiles, whereas usage-based insurance calculates premiums in real time by analyzing telematics data such as mileage, driving behavior, and time of use. Real-time premium calculation enables more personalized and dynamic pricing, encouraging safer driving habits and providing cost savings based on actual risk exposure.

Continuous Usage Analytics

Direct Premium insurance charges a fixed rate based on aggregated risk factors, while Usage-Based Insurance (UBI) leverages continuous usage analytics to adjust premiums in real-time according to actual driving behavior and patterns. Continuous data collection through telematics devices enables insurers to assess risk more precisely, resulting in personalized pricing and incentivizing safer driving habits.

Direct Premium vs Usage-Based Insurance Infographic

industrydif.com

industrydif.com