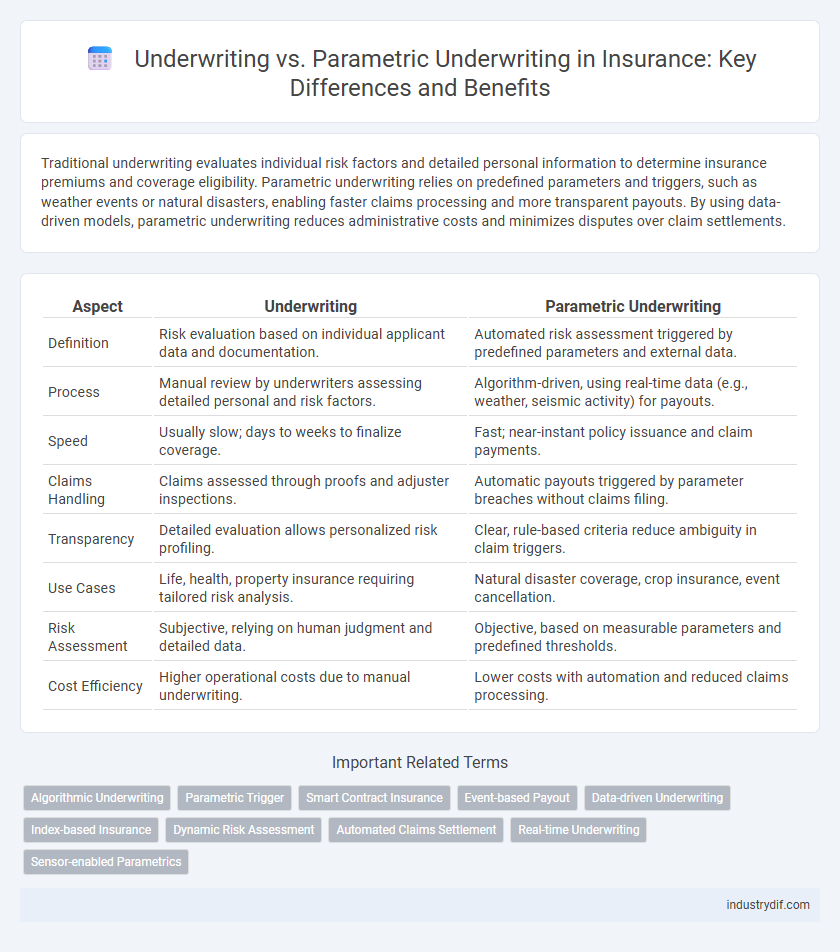

Traditional underwriting evaluates individual risk factors and detailed personal information to determine insurance premiums and coverage eligibility. Parametric underwriting relies on predefined parameters and triggers, such as weather events or natural disasters, enabling faster claims processing and more transparent payouts. By using data-driven models, parametric underwriting reduces administrative costs and minimizes disputes over claim settlements.

Table of Comparison

| Aspect | Underwriting | Parametric Underwriting |

|---|---|---|

| Definition | Risk evaluation based on individual applicant data and documentation. | Automated risk assessment triggered by predefined parameters and external data. |

| Process | Manual review by underwriters assessing detailed personal and risk factors. | Algorithm-driven, using real-time data (e.g., weather, seismic activity) for payouts. |

| Speed | Usually slow; days to weeks to finalize coverage. | Fast; near-instant policy issuance and claim payments. |

| Claims Handling | Claims assessed through proofs and adjuster inspections. | Automatic payouts triggered by parameter breaches without claims filing. |

| Transparency | Detailed evaluation allows personalized risk profiling. | Clear, rule-based criteria reduce ambiguity in claim triggers. |

| Use Cases | Life, health, property insurance requiring tailored risk analysis. | Natural disaster coverage, crop insurance, event cancellation. |

| Risk Assessment | Subjective, relying on human judgment and detailed data. | Objective, based on measurable parameters and predefined thresholds. |

| Cost Efficiency | Higher operational costs due to manual underwriting. | Lower costs with automation and reduced claims processing. |

Introduction to Traditional vs Parametric Underwriting

Traditional underwriting evaluates individual risk factors such as medical history, credit scores, and claims records to determine policy eligibility and premiums. Parametric underwriting relies on predefined triggers like weather events or natural disasters, enabling faster claim settlements based on objective data without extensive individual assessments. Insurers increasingly adopt parametric underwriting for its efficiency and transparency in managing catastrophe-related risks.

What is Traditional Underwriting?

Traditional underwriting involves evaluating an applicant's risk based on detailed individual information such as medical history, credit score, and lifestyle factors to determine policy eligibility and premium pricing. This process requires thorough documentation and often involves manual assessment by underwriters. Traditional underwriting provides customized risk assessment but can be time-consuming and may delay policy issuance.

Exploring Parametric Underwriting

Parametric underwriting leverages predefined parameters and data triggers to automate claim payouts quickly, reducing the need for traditional risk assessments. This approach enhances transparency and efficiency by using real-time data such as weather events or sensor metrics to validate claims instantly. Parametric underwriting minimizes disputes and administrative costs, offering a streamlined alternative to conventional underwriting methods in the insurance industry.

Key Differences Between Underwriting Models

Traditional underwriting assesses risk through detailed individual evaluations and historical data analysis, involving in-depth scrutiny of the policyholder's personal or business information. Parametric underwriting leverages predefined parameters and triggers, such as weather events or natural disasters, to automatically determine claims without evaluating individual losses. Key differences include the speed of claim processing, transparency in risk assessment, and the reliance on objective, measurable event data versus subjective risk criteria.

Data Sources: Traditional vs Parametric Underwriting

Traditional underwriting relies on historical data, credit scores, and medical records to assess risk, often resulting in lengthy evaluation periods. Parametric underwriting utilizes real-time data from IoT sensors, satellite imagery, and weather databases to trigger automatic payouts based on predefined parameters. This data-driven approach enhances accuracy, speed, and transparency in risk assessment and claims processing.

Speed and Efficiency Comparison

Parametric underwriting dramatically enhances speed by using pre-defined, parameter-based criteria to trigger claims, bypassing traditional risk assessment processes that often require extensive documentation and manual evaluation. Traditional underwriting, while thorough, involves detailed risk analysis and individual policy customization, resulting in longer processing times and increased administrative costs. This efficiency difference makes parametric underwriting highly suitable for insurance products needing rapid payout and streamlined operations, such as disaster or crop insurance.

Claims Settlement: Indemnity vs Parametrics

Traditional underwriting in insurance involves indemnity-based claims settlement, where losses are assessed and verified before compensation is paid, ensuring coverage matches actual financial damage. Parametric underwriting uses predefined triggers such as weather data or event parameters to automatically release payouts, enabling faster claims processing without detailed loss verification. This approach reduces administrative costs and accelerates liquidity for policyholders, particularly in catastrophe insurance.

Suitability for Different Insurance Products

Underwriting traditionally evaluates individual risk factors to determine insurance terms, making it suitable for complex products like life or health insurance with varied personal health data. Parametric underwriting uses predefined parameters and triggers for quicker claims processing, ideal for products such as travel or crop insurance where specific events like flight delays or weather conditions can be objectively measured. The choice between traditional and parametric underwriting depends on the insurance product's complexity, data availability, and the need for rapid claim settlements.

Risk Assessment Methodologies

Underwriting traditionally evaluates risk through detailed individual analysis of policyholder data, medical histories, and actuarial tables to determine premiums and coverage eligibility. Parametric underwriting employs predefined parameters and triggers, such as weather events or seismic activity, enabling rapid payout decisions without extensive individual assessments. This shift towards parametric risk assessment streamlines claims processing and reduces moral hazard by relying on objective, quantifiable metrics rather than subjective evaluations.

Future Trends in Insurance Underwriting

Future trends in insurance underwriting emphasize the integration of parametric underwriting, leveraging real-time data and advanced analytics to enable faster, more accurate risk assessment and automated claim processing. Traditional underwriting evolves through the use of artificial intelligence and machine learning, enhancing predictive models and personalized policy offerings while reducing human bias. The shift towards parametric solutions supports greater transparency and efficiency, catering to emerging risks like climate change and cyber threats, shaping the insurance industry's future landscape.

Related Important Terms

Algorithmic Underwriting

Algorithmic underwriting leverages advanced data analytics and machine learning models to assess risk more accurately and efficiently compared to traditional underwriting, which relies heavily on manual evaluation and historical data. Parametric underwriting uses predefined triggers based on measurable events to expedite claim settlements, while algorithmic underwriting dynamically integrates diverse data sources for real-time risk assessment and personalized policy pricing.

Parametric Trigger

Parametric underwriting uses predefined triggers based on measurable parameters such as weather data, seismic activity, or other quantifiable events to automatically initiate claim payments, minimizing the need for lengthy loss assessments typical in traditional underwriting. This approach enhances efficiency and transparency in insurance processes by relying on objective data points instead of subjective loss evaluations.

Smart Contract Insurance

Smart contract insurance leverages parametric underwriting by automating claim payouts based on predefined triggers encoded in blockchain, reducing reliance on traditional risk assessment and manual claims processing inherent in conventional underwriting. This enables faster, transparent settlements and minimizes underwriting costs through objective, data-driven parameters such as weather events or IoT sensor outputs.

Event-based Payout

Underwriting involves assessing individual risk factors to determine insurance coverage and premiums, whereas parametric underwriting uses predefined event triggers, such as natural disasters or weather events, to automatically release payouts without claim adjustments. Event-based payout in parametric underwriting enables faster claims processing and minimizes disputes by relying on objective data like earthquake magnitude or rainfall levels.

Data-driven Underwriting

Data-driven underwriting leverages extensive datasets and predictive analytics to assess risk more accurately compared to traditional underwriting, which relies heavily on manual evaluation and historical records. Parametric underwriting automates claims by triggering payouts based on predefined event parameters, enhancing efficiency and transparency in risk management.

Index-based Insurance

Underwriting in traditional insurance relies on individual risk assessment through detailed information collection, whereas parametric underwriting uses predefined indices, such as weather data or seismic activity, to trigger payouts automatically without loss adjustment. Index-based insurance leverages parametric underwriting to enhance efficiency and transparency by providing faster claims settlement based on measurable events like rainfall levels or earthquake magnitude.

Dynamic Risk Assessment

Underwriting traditionally involves evaluating individual risks based on historical data and manual assessments, whereas parametric underwriting leverages real-time data and predefined parameters for dynamic risk assessment, enabling faster and more accurate policy issuance. This dynamic approach enhances risk prediction and pricing by incorporating continuous environmental and individual risk factors, reducing exposure to unexpected losses.

Automated Claims Settlement

Automated claims settlement in parametric underwriting leverages pre-defined triggers based on measurable parameters, enabling faster and more transparent payouts compared to traditional underwriting, which relies on manual risk assessment and claims evaluation. Parametric models reduce processing time and operational costs by eliminating the need for claim investigations, enhancing efficiency and customer satisfaction in insurance operations.

Real-time Underwriting

Real-time underwriting leverages advanced algorithms and data analytics to assess risk instantly, contrasting traditional underwriting's manual, time-consuming evaluations. Parametric underwriting enhances this process by triggering automatic payouts based on predefined parameters like weather data, enabling faster claim resolutions and improved customer experience.

Sensor-enabled Parametrics

Sensor-enabled parametric underwriting leverages real-time data from IoT devices to automate risk assessment, improving speed and accuracy compared to traditional underwriting methods that rely heavily on historical and subjective information. This approach enhances transparency and reduces loss adjustment expenses by triggering payouts based on predefined parameters detected by sensors, streamlining claims processing in insurance.

Underwriting vs Parametric Underwriting Infographic

industrydif.com

industrydif.com