Traditional loss assessment relies on manual inspections that are time-consuming and prone to human error, often delaying claim settlements. Drone loss assessment leverages advanced aerial technology to capture high-resolution imagery, enabling faster and more accurate damage evaluations. This innovative approach enhances safety by reducing the need for on-site visits in hazardous conditions and streamlines the overall claims process.

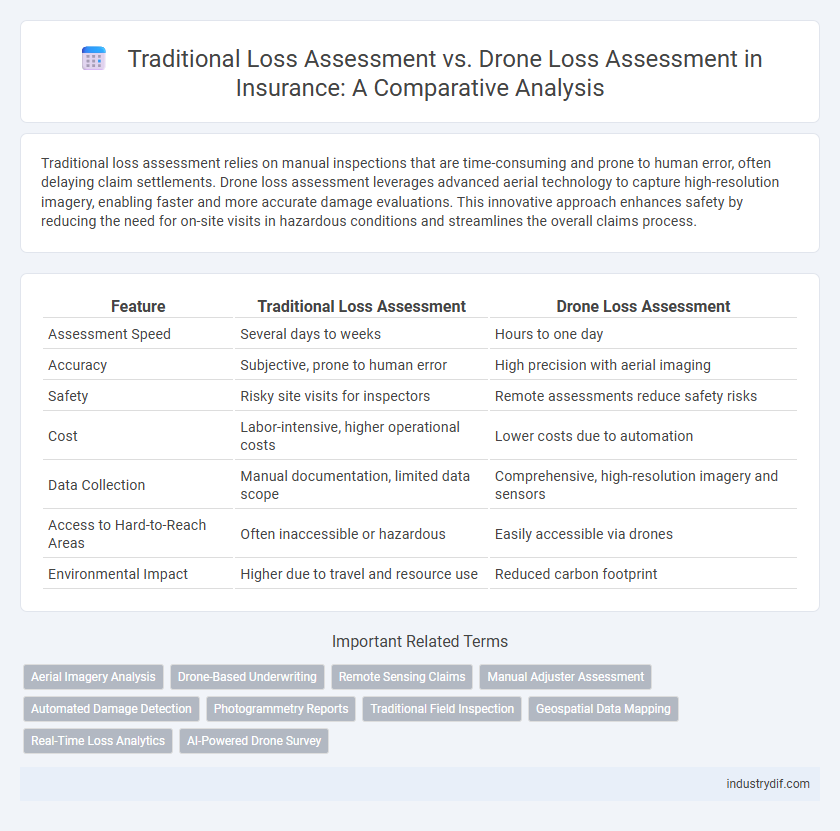

Table of Comparison

| Feature | Traditional Loss Assessment | Drone Loss Assessment |

|---|---|---|

| Assessment Speed | Several days to weeks | Hours to one day |

| Accuracy | Subjective, prone to human error | High precision with aerial imaging |

| Safety | Risky site visits for inspectors | Remote assessments reduce safety risks |

| Cost | Labor-intensive, higher operational costs | Lower costs due to automation |

| Data Collection | Manual documentation, limited data scope | Comprehensive, high-resolution imagery and sensors |

| Access to Hard-to-Reach Areas | Often inaccessible or hazardous | Easily accessible via drones |

| Environmental Impact | Higher due to travel and resource use | Reduced carbon footprint |

Introduction to Loss Assessment in Insurance

Traditional loss assessment in insurance relies heavily on manual inspections conducted by adjusters who evaluate physical damages to insured properties, often leading to longer claim processing times and subjective evaluations. Drone loss assessment introduces high-resolution aerial imaging and real-time data capture, enabling faster, more accurate damage evaluations, especially in hard-to-reach or large-scale disaster areas. Integrating drone technology enhances efficiency, improves risk assessment accuracy, and reduces operational costs in the insurance claims process.

Overview of Traditional Loss Assessment Methods

Traditional loss assessment methods in insurance typically involve on-site inspections by adjusters who manually evaluate property damage through visual examination and photographic documentation. This process is time-consuming, often subject to human error or bias, and may require multiple visits to accurately assess the extent of losses. Conventional approaches rely heavily on physical presence and direct observation, limiting efficiency and delaying claim settlements.

The Rise of Drone Technology in Insurance

Drone technology is revolutionizing insurance loss assessment by enabling rapid, precise, and comprehensive damage evaluation, which traditional methods often struggle to achieve due to time constraints and human error. High-resolution drone imagery and advanced sensors provide insurers with real-time data, enhancing claim accuracy and reducing settlement cycles. As drone adoption increases, insurers benefit from improved risk management and cost savings through automated aerial inspections.

Key Differences: Traditional vs Drone Loss Assessment

Traditional loss assessment relies heavily on manual inspections, requiring adjusters to visit sites, which can be time-consuming and sometimes hazardous. Drone loss assessment utilizes unmanned aerial vehicles equipped with high-resolution cameras and sensors, enabling rapid, precise data collection from difficult-to-access areas, enhancing accuracy and safety. The key differences lie in the efficiency, safety, and data quality, with drones significantly reducing assessment time and providing detailed visual evidence that improves claim evaluation.

Accuracy and Reliability in Loss Evaluation

Traditional loss assessment relies heavily on manual inspections, which can introduce human error and result in incomplete or inconsistent damage evaluation. Drone loss assessment enhances accuracy and reliability by capturing high-resolution aerial images and real-time data, providing comprehensive and precise damage documentation. Insurance companies benefit from faster claim resolutions and reduced disputes due to the objective and verifiable evidence collected via drone technology.

Efficiency and Turnaround Time Comparison

Traditional loss assessment involves manual inspections requiring days or weeks to complete, often delaying claim settlements. Drone loss assessment leverages aerial technology to capture detailed imagery quickly, reducing assessment time to hours or a few days. This efficiency improvement accelerates turnaround times, enabling faster claim processing and enhanced customer satisfaction.

Cost Implications for Insurers and Policyholders

Traditional loss assessment involves manual inspections that are time-consuming and labor-intensive, leading to higher operational costs for insurers and delayed claim settlements for policyholders. Drone loss assessment reduces inspection time by up to 70%, lowering labor expenses and enabling faster damage evaluation, which translates into cost savings for insurers and quicker reimbursements for policyholders. The integration of drone technology also decreases the risk of human error and safety hazards, further optimizing overall cost efficiency in the insurance claims process.

Safety Considerations in Loss Assessment Practices

Traditional loss assessment involves on-site inspections that expose adjusters to physical hazards such as unstable structures, hazardous materials, and adverse weather conditions, increasing the risk of injury. In contrast, drone loss assessment significantly enhances safety by remotely capturing detailed aerial imagery, minimizing the need for physical presence in dangerous environments. Incorporating drone technology reduces human exposure to risk while improving the accuracy and efficiency of damage evaluations in insurance claims.

Regulatory and Compliance Challenges

Traditional loss assessment in insurance often faces regulatory challenges due to manual documentation and potential human error, which can lead to inconsistencies in claim evaluations and compliance breaches. Drone loss assessment addresses these issues by providing precise, real-time aerial data that complies with evolving aviation and privacy regulations, enhancing transparency and accuracy in claims processing. Insurers must navigate complex regulatory environments including airspace restrictions and data protection laws to fully integrate drone technology without violating compliance standards.

The Future of Loss Assessment: Integrating Drones

Integrating drones into loss assessment revolutionizes insurance claims by offering rapid, accurate damage evaluation and minimizing human risk in hazardous environments. Traditional loss assessment relies heavily on manual inspections, which can be time-consuming and prone to errors, while drone technology leverages high-resolution imagery and real-time data analysis for precise estimations. The future of insurance loss assessment will increasingly adopt drones, enhancing efficiency, accuracy, and customer satisfaction through faster claims processing.

Related Important Terms

Aerial Imagery Analysis

Traditional loss assessment relies heavily on manual inspections and ground-level evaluations, which can be time-consuming and limited in scope, while drone loss assessment leverages advanced aerial imagery analysis to capture high-resolution, comprehensive views of damaged areas quickly and accurately. Utilizing drones equipped with multispectral and thermal imaging enhances damage detection and risk analysis, significantly improving claim processing efficiency and accuracy in insurance assessments.

Drone-Based Underwriting

Drone-based underwriting enhances traditional loss assessment by providing high-resolution aerial imagery and real-time data analytics, enabling precise risk evaluation and faster claim processing. This technology reduces human error and operational costs while improving the accuracy of property inspections for insurance providers.

Remote Sensing Claims

Traditional loss assessment relies on manual inspections that can be time-consuming, costly, and pose safety risks in remote or hazardous locations. Drone loss assessment leverages advanced remote sensing technology to capture high-resolution imagery and real-time data, enabling faster, more accurate, and safer claims evaluations for insurance providers.

Manual Adjuster Assessment

Manual adjuster assessment in traditional loss evaluation relies on physical inspections and subjective judgment, often leading to slower claim processing and higher error rates. In contrast, drone loss assessment offers precise aerial data capture, enhancing accuracy and efficiency in damage evaluation for insurance claims.

Automated Damage Detection

Automated damage detection through drone loss assessment enhances accuracy and speeds up claim processing by utilizing high-resolution imagery and AI-powered analysis to identify structural damages that traditional loss assessment methods may overlook. This technology minimizes human error, reduces assessment time from days to hours, and provides insurers with precise, data-driven insights for more efficient risk evaluation and cost estimation.

Photogrammetry Reports

Traditional loss assessment in insurance relies heavily on manual inspections, often leading to longer claim processing times and subjective evaluations. Drone loss assessment leverages photogrammetry reports to generate accurate, high-resolution 3D models that improve damage quantification, enhance precision in claims, and expedite settlement processes.

Traditional Field Inspection

Traditional field inspection in insurance claims involves manual on-site evaluation by adjusters to assess property damage, often resulting in longer claim processing times and potential human error. This method relies heavily on physical presence, detailed note-taking, and photographic documentation, which can delay settlement and increase operational costs compared to emerging drone loss assessment technologies.

Geospatial Data Mapping

Traditional loss assessment relies on manual site inspections and 2D photographs, often leading to incomplete or delayed data collection. Drone loss assessment leverages high-resolution geospatial data mapping, providing accurate, real-time 3D models that enhance damage evaluation and expedite claims processing.

Real-Time Loss Analytics

Traditional loss assessment relies on manual inspections and delayed reporting, limiting the speed and accuracy of damage evaluation. Drone loss assessment delivers real-time loss analytics through high-resolution aerial imagery and AI-driven data processing, enabling faster claim settlements and enhanced risk management.

AI-Powered Drone Survey

AI-powered drone surveys enhance traditional loss assessment by providing rapid, precise damage evaluation through high-resolution imagery and machine learning analytics. This technology reduces human error, accelerates claims processing, and offers safer access to hazardous or hard-to-reach areas, improving overall insurance loss assessment efficiency.

Traditional Loss Assessment vs Drone Loss Assessment Infographic

industrydif.com

industrydif.com