Indemnity insurance provides financial reimbursement to policyholders after a verified loss, ensuring coverage based on the actual value of the damage or liability. Smart contract claims automate the claims process using blockchain technology, enabling faster, transparent settlements without the need for manual verification. This innovative approach reduces processing time and administrative costs while maintaining accuracy and trust.

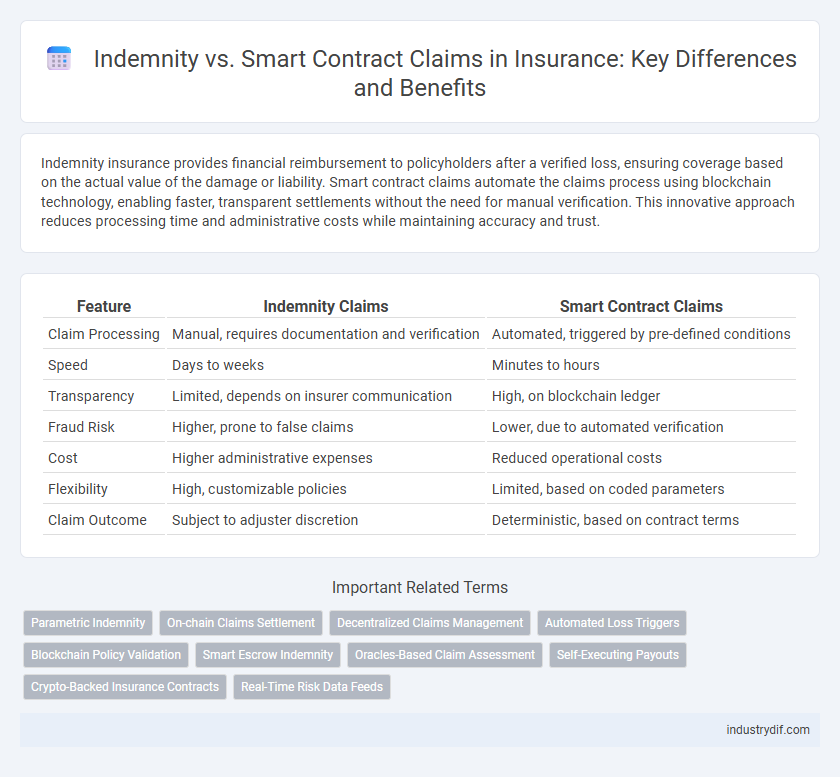

Table of Comparison

| Feature | Indemnity Claims | Smart Contract Claims |

|---|---|---|

| Claim Processing | Manual, requires documentation and verification | Automated, triggered by pre-defined conditions |

| Speed | Days to weeks | Minutes to hours |

| Transparency | Limited, depends on insurer communication | High, on blockchain ledger |

| Fraud Risk | Higher, prone to false claims | Lower, due to automated verification |

| Cost | Higher administrative expenses | Reduced operational costs |

| Flexibility | High, customizable policies | Limited, based on coded parameters |

| Claim Outcome | Subject to adjuster discretion | Deterministic, based on contract terms |

Understanding Indemnity in Insurance

Indemnity in insurance refers to the principle of compensating the insured for losses incurred, restoring them to their financial position before the event. Traditional indemnity claims involve a detailed loss assessment and require proof of damages to process reimbursement. Unlike smart contract claims that execute automatically based on predefined conditions, indemnity ensures personalized evaluation, safeguarding policyholders against overpayment or fraud.

Introduction to Smart Contract Claims

Smart contract claims leverage blockchain technology to automate the verification and settlement of insurance claims, reducing the need for manual intervention. These digital contracts execute predefined conditions instantly when triggered, enhancing transparency and efficiency in the claims process. Unlike traditional indemnity claims, smart contract claims minimize fraud risk by securely recording transactions on an immutable ledger.

Key Differences: Indemnity vs Smart Contract Claims

Indemnity claims rely on traditional insurance policies where losses are compensated based on proof of damage and policy terms, emphasizing risk transfer and assessment by human adjusters. Smart contract claims operate through self-executing blockchain protocols that automatically verify and settle claims based on predefined conditions without manual intervention. Key differences include the speed and transparency of smart contracts, automation versus manual underwriting, and the reliance on trusted intermediaries in indemnity claims compared to decentralized verification in smart contract processes.

Advantages of Traditional Indemnity

Traditional indemnity insurance offers broad coverage flexibility, allowing policyholders to file claims for a wide range of losses with tailored settlements based on actual damages incurred. It provides legal protection and the ability to negotiate claim terms, ensuring comprehensive risk management beyond predefined contract parameters. This approach supports complex claims processes where human judgment and customized assessment are critical, enhancing overall claim fairness and accuracy.

Benefits of Smart Contract Claims

Smart contract claims automate the insurance payout process by leveraging blockchain technology, ensuring faster, transparent, and error-free settlements compared to traditional indemnity claims. These claims eliminate manual verification, reducing fraud risk and operational costs for insurers. Policyholders benefit from immediate claim processing and enhanced trust through immutable, real-time transaction records.

Challenges Facing Indemnity Models

Indemnity insurance models often face challenges such as slow claim processing, lack of transparency, and increased fraud risk due to manual verification and adjudication processes. These limitations result in higher administrative costs and delayed payouts, undermining customer satisfaction and trust. Emerging smart contract claims aim to address these inefficiencies by automating verification and leveraging blockchain for secure, transparent transactions.

Smart Contracts: Risks and Limitations

Smart contract claims in insurance streamline claims processing by automating verification and payment based on predefined conditions but expose insurers to risks such as coding errors, lack of regulatory clarity, and potential security vulnerabilities. These limitations can lead to incorrect claim settlements or disputes, highlighting the importance of rigorous smart contract auditing and regulatory compliance. Despite efficiency gains, reliance on immutable blockchain code restricts flexibility in handling complex or ambiguous claims scenarios.

Impact on Claims Processing Efficiency

Indemnity claims rely on traditional manual verification and documentation, often leading to longer processing times and increased administrative costs. Smart contract claims utilize blockchain technology to automate verification and payment triggers, significantly enhancing processing speed and reducing human error. This automation streamlines claims settlement, improving overall efficiency and customer satisfaction in insurance workflows.

Regulatory Considerations for Both Approaches

Insurance indemnity claims are governed by established regulatory frameworks ensuring consumer protection, claims validation, and fraud prevention, while smart contract claims face evolving regulatory scrutiny focused on blockchain transparency, automated enforcement, and jurisdictional challenges. Regulatory bodies emphasize compliance with data privacy laws, anti-money laundering (AML) standards, and dispute resolution mechanisms, making smart contract claims subject to complex legal interpretations. Insurers adopting smart contracts must navigate cybersecurity regulations and adapt to emerging legal standards to ensure operational legitimacy and customer trust in decentralized claim processing.

Future Outlook: Insurance Claims Transformation

The future outlook of insurance claims highlights a transformative shift from traditional indemnity models to smart contract claims, leveraging blockchain technology for enhanced transparency and efficiency. Smart contracts automate claim verification and settlement processes, reducing fraud and administrative costs while accelerating payouts. This evolution is expected to drive a more customer-centric insurance ecosystem with real-time claim processing and predictive risk management capabilities.

Related Important Terms

Parametric Indemnity

Parametric indemnity in insurance offers a predefined payout based on triggering events like weather conditions, eliminating lengthy claims assessments associated with traditional indemnity models. Smart contract claims automate this process using blockchain technology, enabling transparent, instant settlements upon parameter validation, which enhances efficiency and reduces disputes.

On-chain Claims Settlement

On-chain claims settlement leverages smart contracts to automate indemnity payment processes, reducing processing time and minimizing human error in insurance claims. Smart contracts ensure transparent, tamper-proof execution of claim conditions, enhancing efficiency compared to traditional indemnity settlements that rely heavily on manual assessments.

Decentralized Claims Management

Decentralized claims management leverages smart contracts to automate indemnity payments, reducing processing time and minimizing fraud through transparent, blockchain-based verification. Traditional indemnity claims rely on manual assessment and centralized adjudication, which are prone to delays and subjective interpretation of policy terms.

Automated Loss Triggers

Automated loss triggers in smart contract claims enable real-time, objective assessment of insurance events, eliminating delays and reducing human error compared to traditional indemnity claims that rely on manual verification and subjective evaluation. This technology streamlines payouts by using predefined conditions coded into the contract, enhancing transparency and efficiency in claim processing.

Blockchain Policy Validation

Blockchain policy validation in insurance enhances claim processing by enabling real-time verification of coverage through immutable smart contracts, reducing fraud and administrative costs. Unlike traditional indemnity claims, smart contract claims automate payouts based on predefined criteria, ensuring faster settlements and increased transparency.

Smart Escrow Indemnity

Smart Escrow Indemnity leverages blockchain technology to automate claim settlements by securely holding funds in a decentralized escrow until contract conditions are fulfilled, ensuring transparent and tamper-proof indemnity processes. This system reduces fraud risks and accelerates payout times compared to traditional indemnity by enforcing predefined smart contract terms without manual intervention.

Oracles-Based Claim Assessment

Oracles-based claim assessment in insurance leverages real-time, external data sources to automatically verify claims against predefined smart contract conditions, reducing fraud and processing time. This method contrasts with traditional indemnity claims, which rely on manual evaluation and often involve subjective judgment and delayed settlements.

Self-Executing Payouts

Smart contract claims enable self-executing payouts by automatically verifying policy conditions and triggering payments without manual intervention, reducing processing time and errors compared to traditional indemnity claims that rely on manual assessments and approvals. This innovation enhances transparency, efficiency, and trust in insurance transactions through blockchain technology.

Crypto-Backed Insurance Contracts

Crypto-backed insurance contracts use smart contracts to automate claims processing, reducing the need for traditional indemnity agreements and manual claim verifications. These decentralized protocols enhance transparency, speed, and trust by executing payouts based on pre-defined conditions recorded on the blockchain.

Real-Time Risk Data Feeds

Real-time risk data feeds enhance indemnity insurance by enabling accurate, dynamic loss assessments and timely claim settlements based on actual events, reducing fraud and administrative costs. Smart contract claims automate payouts through blockchain technology, using these data feeds to trigger predefined conditions instantly, ensuring transparency and efficiency in insurance processes.

Indemnity vs Smart Contract Claims Infographic

industrydif.com

industrydif.com