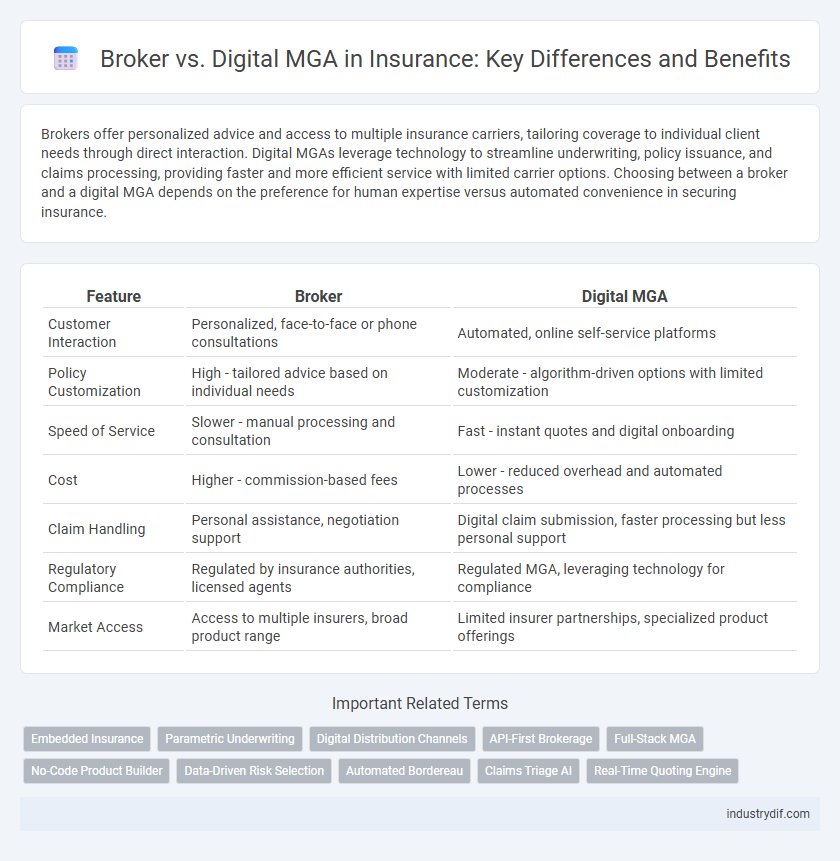

Brokers offer personalized advice and access to multiple insurance carriers, tailoring coverage to individual client needs through direct interaction. Digital MGAs leverage technology to streamline underwriting, policy issuance, and claims processing, providing faster and more efficient service with limited carrier options. Choosing between a broker and a digital MGA depends on the preference for human expertise versus automated convenience in securing insurance.

Table of Comparison

| Feature | Broker | Digital MGA |

|---|---|---|

| Customer Interaction | Personalized, face-to-face or phone consultations | Automated, online self-service platforms |

| Policy Customization | High - tailored advice based on individual needs | Moderate - algorithm-driven options with limited customization |

| Speed of Service | Slower - manual processing and consultation | Fast - instant quotes and digital onboarding |

| Cost | Higher - commission-based fees | Lower - reduced overhead and automated processes |

| Claim Handling | Personal assistance, negotiation support | Digital claim submission, faster processing but less personal support |

| Regulatory Compliance | Regulated by insurance authorities, licensed agents | Regulated MGA, leveraging technology for compliance |

| Market Access | Access to multiple insurers, broad product range | Limited insurer partnerships, specialized product offerings |

Introduction to Insurance Intermediaries

Insurance intermediaries play a crucial role in connecting policyholders with insurers, with brokers offering personalized advice and tailored coverage options by representing multiple insurance carriers. Digital Managing General Agents (MGAs) leverage technology to streamline underwriting, policy issuance, and claims processing, enhancing efficiency and customer experience. Both brokers and digital MGAs serve as essential channels in the insurance distribution ecosystem, adapting to evolving market demands and digital transformation.

Defining Brokers in the Insurance Ecosystem

Brokers in the insurance ecosystem act as intermediaries connecting clients with a diverse range of insurance carriers to find tailored coverage solutions. They provide personalized advice by assessing individual or business risk profiles, ensuring policies match specific needs and compliance standards. Unlike Digital MGAs, brokers emphasize human expertise and relationship-building, navigating complex insurance markets to secure optimal terms for their clients.

What is a Digital MGA?

A Digital Managing General Agent (Digital MGA) leverages advanced technology platforms to underwrite, price, and distribute insurance products directly or through brokers, streamlining traditional insurance processes. Unlike traditional brokers who primarily act as intermediaries between insurers and clients, Digital MGAs have delegated underwriting authority from insurers, enabling faster policy issuance and claims handling. This tech-driven approach enhances efficiency, improves customer experience, and allows for more customized insurance solutions based on real-time data analytics.

Core Functions: Broker vs Digital MGA

Brokers act as intermediaries between clients and multiple insurance carriers, providing personalized advice and tailored coverage options based on individual risk assessments. Digital MGAs (Managing General Agents) leverage technology platforms to underwrite, price, and bind insurance policies directly, streamlining processes and offering faster turnaround times. While brokers emphasize client-centric relationship management and product diversity, digital MGAs prioritize efficiency, automation, and data-driven underwriting to enhance scalability and operational agility.

Technology Adoption and Digital Transformation

Digital MGAs leverage advanced technology platforms and data analytics to streamline underwriting and claims processing, enabling faster decision-making and enhanced customer experiences. Traditional brokers, while increasingly adopting digital tools, often face challenges integrating legacy systems with new technologies, limiting their agility in digital transformation efforts. The shift towards fully automated workflows and AI-driven insights positions Digital MGAs as leaders in innovation within the insurance distribution landscape.

Customer Experience and Engagement Models

Brokers offer personalized, relational customer experiences through direct interactions, fostering trust and tailored insurance solutions based on individual needs. Digital MGAs leverage technology-driven platforms to provide seamless, on-demand engagement with automated underwriting and instant policy issuance, emphasizing convenience and speed. Customer engagement models differ as brokers excel in complex risk advisory, while digital MGAs prioritize streamlined user interfaces and data-driven decision-making for efficiency.

Regulatory and Compliance Differences

Brokers operate under strict regulatory frameworks requiring licenses in each jurisdiction they serve, ensuring compliance with consumer protection laws and maintaining fiduciary responsibilities. Digital Managing General Agents (MGAs) hold underwriting authority granted by insurers, subject to both MGA-specific regulations and insurer oversight, often facing stringent cybersecurity and data privacy requirements due to their technology-driven platforms. Regulatory differences impact compliance protocols, with brokers emphasizing transparency and client disclosures, while digital MGAs prioritize contractual obligations with insurers and adherence to platform-based compliance controls.

Revenue Streams and Compensation Structures

Brokers typically earn revenue through commissions based on premiums sold, which incentivizes personalized client service and product selection across multiple insurers. Digital Managing General Agents (MGAs) generate income from underwriting fees, profit-sharing arrangements, and technology-driven service charges, allowing scalable revenue from streamlined operations and risk assessment. Compensation structures for brokers rely heavily on commission percentages, while digital MGAs leverage a combination of fixed fees and performance-based incentives linked to underwriting profitability and operational efficiency.

Market Position and Competitive Advantage

Digital MGAs leverage advanced data analytics and automation to streamline underwriting and claims processing, positioning themselves as agile and cost-efficient market players. Traditional brokers maintain strong client relationships and personalized service, offering tailored insurance solutions that foster trust and long-term loyalty. Market competitiveness hinges on digital MGAs' scalability and innovation versus brokers' expertise and consultative approach.

Choosing Between Brokers and Digital MGAs

Choosing between brokers and digital Managing General Agents (MGAs) hinges on factors such as personalized service, speed, and technology integration. Brokers offer tailored advice and customer-centric solutions, ideal for complex or unique insurance needs, while digital MGAs prioritize streamlined online processes, rapid policy issuance, and competitive pricing through advanced algorithms. Evaluating risk profiles, coverage customization, and digital accessibility is essential for selecting the optimal insurance intermediary.

Related Important Terms

Embedded Insurance

Embedded insurance integrates coverage seamlessly within digital platforms, offering consumers instant access without traditional broker intermediaries. Digital MGAs leverage advanced data analytics and streamlined underwriting to provide personalized policies efficiently, outperforming conventional brokerage models in speed and customer experience.

Parametric Underwriting

Parametric underwriting leverages predefined triggers such as weather data or flight delays to automate claims, offering Digital MGAs a streamlined, technology-driven approach compared to traditional brokers who rely on manual risk assessment and subjective criteria. Digital MGAs enhance efficiency and customer experience by integrating real-time data and automated policy management, whereas brokers provide personalized advice and complex risk evaluation in conventional underwriting processes.

Digital Distribution Channels

Digital MGAs leverage advanced digital distribution channels such as APIs, mobile apps, and online platforms to streamline underwriting and policy issuance, enhancing customer experience with faster, more transparent service. In contrast, traditional brokers rely heavily on personal relationships and manual processes, which can limit scalability and real-time data integration in the increasingly digital insurance market.

API-First Brokerage

API-first brokerages leverage seamless integration to enhance insurer and customer connectivity, enabling real-time data exchange and personalized insurance solutions. Digital MGAs prioritize automation but often depend on APIs from third-party providers, whereas API-first brokers build proprietary platforms that streamline underwriting, claims processing, and policy management.

Full-Stack MGA

Full-Stack MGAs leverage advanced technology to streamline underwriting, policy administration, and claims processing, offering a unified platform that enhances efficiency compared to traditional brokers who rely heavily on manual processes. Digital MGAs provide greater agility in product development and real-time data analytics, enabling faster risk assessment and personalized insurance solutions tailored to specific customer segments.

No-Code Product Builder

Digital MGAs leverage no-code product builders to rapidly design and deploy tailored insurance products, enhancing agility and reducing time-to-market compared to traditional brokers. Brokers often rely on legacy systems and manual processes, limiting customization speed and operational efficiency.

Data-Driven Risk Selection

Digital MGAs leverage advanced data analytics and machine learning algorithms to enhance risk selection accuracy, enabling more precise underwriting compared to traditional brokers who often rely on experience and historical data. This data-driven approach allows Digital MGAs to optimize pricing models, reduce fraud, and tailor coverage to individual risk profiles, driving greater efficiency and profitability in the insurance value chain.

Automated Bordereau

Automated Bordereau processing streamlines data submission and reconciliation, significantly enhancing efficiency for both brokers and digital Managing General Agents (MGAs). Digital MGAs leverage automated Bordereaux to reduce manual errors and accelerate underwriting decisions, while brokers benefit from faster premium reporting and improved transparency.

Claims Triage AI

Claims triage AI in digital Managing General Agencies (MGAs) streamlines the assessment process by rapidly analyzing and categorizing claims, enhancing efficiency compared to traditional brokers who rely on manual evaluation. By integrating advanced machine learning algorithms, digital MGAs can reduce claim processing time and improve accuracy, resulting in faster settlements and improved customer satisfaction.

Real-Time Quoting Engine

Real-time quoting engines enable digital MGAs to instantly generate tailored insurance quotes by integrating multiple data sources and automated underwriting rules, enhancing speed and accuracy. Traditional brokers often rely on manual processes, which can delay quote delivery and limit the ability to offer dynamic pricing based on real-time risk assessment.

Broker vs Digital MGA Infographic

industrydif.com

industrydif.com