Commercial insurance provides broad protection for businesses against risks such as property damage, liability, and employee-related incidents, safeguarding physical and operational assets. Cyber insurance specifically addresses risks associated with digital threats like data breaches, ransomware attacks, and network failures, offering coverage for financial losses and recovery costs related to cyber incidents. Both types of insurance are essential for comprehensive risk management, with commercial insurance covering tangible assets and cyber insurance protecting against intangible digital vulnerabilities.

Table of Comparison

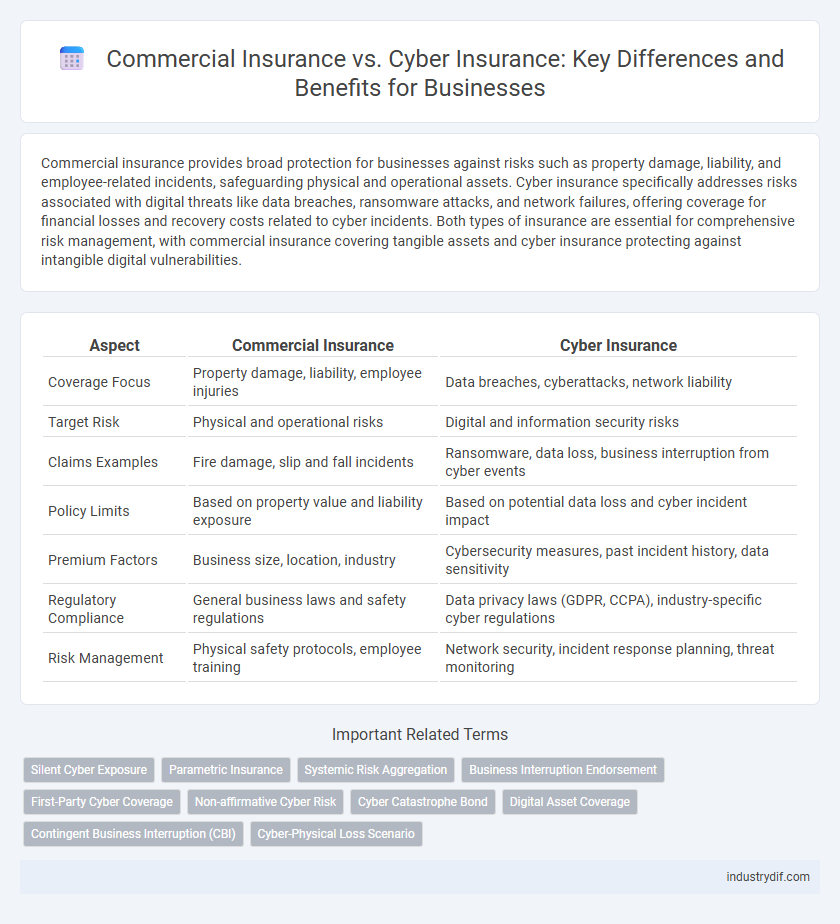

| Aspect | Commercial Insurance | Cyber Insurance |

|---|---|---|

| Coverage Focus | Property damage, liability, employee injuries | Data breaches, cyberattacks, network liability |

| Target Risk | Physical and operational risks | Digital and information security risks |

| Claims Examples | Fire damage, slip and fall incidents | Ransomware, data loss, business interruption from cyber events |

| Policy Limits | Based on property value and liability exposure | Based on potential data loss and cyber incident impact |

| Premium Factors | Business size, location, industry | Cybersecurity measures, past incident history, data sensitivity |

| Regulatory Compliance | General business laws and safety regulations | Data privacy laws (GDPR, CCPA), industry-specific cyber regulations |

| Risk Management | Physical safety protocols, employee training | Network security, incident response planning, threat monitoring |

Understanding Commercial Insurance

Commercial insurance provides broad coverage designed to protect businesses from various risks such as property damage, liability claims, and employee-related risks. It typically includes policies like general liability, property insurance, and workers' compensation, safeguarding physical assets and legal responsibilities. Understanding commercial insurance is crucial for businesses to mitigate potential financial losses from unforeseen events and maintain operational stability.

What is Cyber Insurance?

Cyber insurance is a specialized policy designed to protect businesses from financial losses resulting from cyberattacks, data breaches, and other digital threats. It covers costs related to data recovery, legal fees, notification expenses, and liability claims due to privacy violations or network damages. Unlike commercial insurance, which broadly safeguards physical assets and liabilities, cyber insurance specifically addresses risks associated with information technology and cybersecurity incidents.

Key Differences Between Commercial and Cyber Insurance

Commercial insurance primarily covers physical assets and general business liabilities such as property damage, employee injuries, and legal claims, while cyber insurance specifically addresses risks related to data breaches, cyberattacks, and digital security incidents. Cyber insurance policies often include coverage for incident response, data recovery, ransomware payments, and notification costs, which are not typically covered under standard commercial insurance. Understanding these distinctions ensures businesses select appropriate policies to mitigate both tangible and digital risks effectively.

Coverage Scope: Property vs. Data Protection

Commercial insurance primarily covers physical assets and property damage, including buildings, equipment, and inventory. Cyber insurance focuses on protecting digital assets, offering coverage for data breaches, cyberattacks, and associated liabilities. This distinction highlights the property-centric scope of commercial insurance versus the data protection emphasis inherent in cyber insurance policies.

Common Risks Covered by Commercial Insurance

Commercial insurance typically covers common risks such as property damage, liability claims, business interruption, and employee-related risks like workers' compensation. It protects against physical assets loss, legal liabilities from third-party injuries or property damage, and income loss due to unforeseen disruptions. Cyber insurance, by contrast, specifically addresses risks related to data breaches, cyberattacks, and digital privacy violations, which are generally not covered under standard commercial insurance policies.

Unique Cyber Threats and Their Impact

Commercial insurance primarily covers traditional business risks such as property damage, liability, and employee-related incidents, while cyber insurance specifically addresses unique cyber threats including data breaches, ransomware attacks, and network intrusions. These cyber risks can result in significant financial losses due to regulatory fines, business interruption, and reputational damage that are not typically covered under standard commercial policies. Understanding the specialized coverage of cyber insurance is crucial for businesses facing escalating cyber threats in today's digital landscape.

Premium Costs: Commercial vs. Cyber Policies

Premium costs for commercial insurance typically vary based on factors like business size, industry, and coverage limits, often resulting in moderate to high rates depending on risk exposure. Cyber insurance premiums are generally influenced by the organization's cybersecurity posture, data volume, and incident history, often presenting higher costs due to increasing cyber threats and specialized coverage needs. Comparing commercial and cyber insurance premiums reveals cyber policies often command higher rates owing to the evolving nature of cyber risks and the complexity of mitigating data breach liabilities.

Claims Process and Response Times

Commercial insurance claims typically involve longer response times due to the complexity of evaluating property damages, liability, and business interruption impacts. Cyber insurance claims require expedited handling and specialized expertise to quickly assess data breaches, ransomware attacks, and IT system restorations. The efficiency of cyber insurance claims processes is critical to minimizing operational downtime and financial losses in digital risk events.

Industry Trends in Commercial and Cyber Insurance

Commercial insurance market shows steady growth driven by increasing business risks and regulatory compliance demands, while cyber insurance experiences rapid expansion due to escalating cyber threats and data breaches. Industry trends highlight a shift toward integrated policies combining traditional commercial coverage with cyber risk protection, reflecting heightened awareness of digital vulnerabilities. Emerging technologies such as AI and blockchain are being leveraged to enhance risk assessment and streamline claims processing across both insurance lines.

Choosing the Right Policy for Your Business

Choosing the right policy for your business involves understanding the distinct coverage of commercial insurance, which protects physical assets and liability, versus cyber insurance, designed to mitigate digital risks like data breaches and cyberattacks. Businesses with significant online operations or sensitive customer data benefit from cyber insurance to address evolving cyber threats, while commercial insurance remains essential for general property and liability protection. Assessing industry-specific risks and consulting with insurance experts ensures comprehensive coverage tailored to your business's unique exposure.

Related Important Terms

Silent Cyber Exposure

Commercial insurance policies often exclude coverage for cyber-related incidents, creating silent cyber exposure risk that leaves businesses unprotected against data breaches and cyberattacks. Cyber insurance specifically addresses these gaps by covering liabilities, data loss, and business interruption directly linked to cyber incidents, mitigating potential financial losses from silent cyber exposures.

Parametric Insurance

Parametric insurance in commercial insurance offers predefined payouts based on specific trigger events, streamlining claims processes and enhancing financial predictability for businesses. Cyber insurance with parametric features provides rapid compensation for cyber incidents, such as data breaches or ransomware attacks, by relying on measurable parameters instead of traditional loss assessments.

Systemic Risk Aggregation

Commercial insurance covers broad risks such as property damage, liability, and business interruption, but often underestimates systemic risk aggregation inherent in interconnected business operations. Cyber insurance specifically targets systemic risk aggregation from widespread cyberattacks, addressing vulnerabilities in digital infrastructure and supply chains that can trigger cascading losses across multiple organizations.

Business Interruption Endorsement

Commercial insurance typically covers business interruption caused by physical property damage, while cyber insurance focuses on interruptions from cyberattacks like data breaches or ransomware. Business interruption endorsements in cyber insurance specifically address financial losses due to network downtime, highlighting the importance of tailored coverage for digital risks.

First-Party Cyber Coverage

Commercial insurance primarily covers physical assets, liability, and business interruption risks, while first-party cyber insurance specifically protects against direct losses from cyber incidents such as data breaches, ransomware attacks, and business downtime caused by system failures. First-party cyber coverage includes costs related to data restoration, forensic investigations, notification expenses, and crisis management, addressing vulnerabilities that traditional commercial policies often exclude.

Non-affirmative Cyber Risk

Commercial insurance typically covers property, liability, and business interruption risks but often excludes non-affirmative cyber risks, which are scenarios where cyber incidents are not explicitly listed or intentionally excluded in policy language. Cyber insurance specifically addresses these non-affirmative cyber exposures by providing tailored protection against data breaches, ransomware attacks, and other digital threats not covered under traditional commercial insurance policies.

Cyber Catastrophe Bond

Cyber catastrophe bonds provide an innovative risk transfer solution for cyber insurance losses by enabling insurers to transfer significant cyber event risks to capital markets, offering financial protection beyond traditional commercial insurance limits. These bonds enhance coverage for large-scale cyber incidents, addressing gaps in commercial insurance policies that often exclude or limit catastrophic cyber event payouts.

Digital Asset Coverage

Commercial insurance typically covers physical assets, liability, and property damage, whereas cyber insurance specifically addresses risks related to digital assets such as data breaches, ransomware attacks, and cyber extortion. Cyber insurance provides specialized coverage for losses due to unauthorized access, data restoration, and business interruption caused by cyber incidents, which traditional commercial insurance often excludes.

Contingent Business Interruption (CBI)

Commercial insurance typically covers Contingent Business Interruption (CBI) losses arising from direct physical damage to suppliers or customers, while cyber insurance specifically addresses CBI risks stemming from cyberattacks disrupting digital supply chains. Effective risk management requires combining commercial insurance with cyber insurance to fully protect against both physical and cyber-related business interruptions.

Cyber-Physical Loss Scenario

Commercial insurance traditionally covers property damage, liability, and business interruption losses affecting physical assets, while cyber insurance specifically addresses risks stemming from digital threats such as data breaches and cyberattacks. In a cyber-physical loss scenario, where a cyber incident causes direct physical damage to equipment or disrupts operational technology, cyber insurance policies often include coverage for first-party losses and third-party liabilities linked to these intertwined cyber-physical risks.

Commercial Insurance vs Cyber Insurance Infographic

industrydif.com

industrydif.com