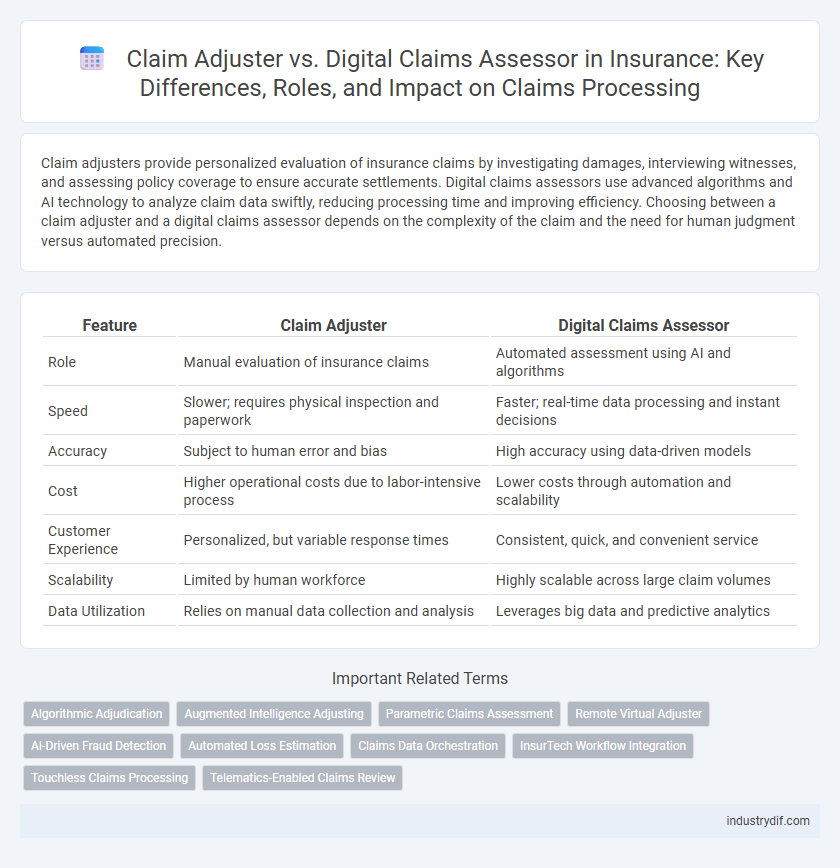

Claim adjusters provide personalized evaluation of insurance claims by investigating damages, interviewing witnesses, and assessing policy coverage to ensure accurate settlements. Digital claims assessors use advanced algorithms and AI technology to analyze claim data swiftly, reducing processing time and improving efficiency. Choosing between a claim adjuster and a digital claims assessor depends on the complexity of the claim and the need for human judgment versus automated precision.

Table of Comparison

| Feature | Claim Adjuster | Digital Claims Assessor |

|---|---|---|

| Role | Manual evaluation of insurance claims | Automated assessment using AI and algorithms |

| Speed | Slower; requires physical inspection and paperwork | Faster; real-time data processing and instant decisions |

| Accuracy | Subject to human error and bias | High accuracy using data-driven models |

| Cost | Higher operational costs due to labor-intensive process | Lower costs through automation and scalability |

| Customer Experience | Personalized, but variable response times | Consistent, quick, and convenient service |

| Scalability | Limited by human workforce | Highly scalable across large claim volumes |

| Data Utilization | Relies on manual data collection and analysis | Leverages big data and predictive analytics |

Introduction to Claims Handling in Insurance

Claim adjusters play a crucial role in insurance by investigating, evaluating, and settling claims based on policy terms, ensuring accurate and fair resolution. Digital claims assessors leverage advanced technology, including AI and data analytics, to automate claim evaluations, enhancing efficiency and reducing processing time. Combining traditional adjuster expertise with digital assessment tools improves claims accuracy and customer satisfaction in insurance handling.

Defining the Role of a Claim Adjuster

A claim adjuster evaluates insurance claims by investigating details, assessing damages, and determining the validity of claims to ensure fair settlements. They conduct interviews, inspect property damage, and review police reports to establish accurate claim payouts. This role requires strong analytical skills, negotiation expertise, and knowledge of insurance policies and regulations.

What Is a Digital Claims Assessor?

A Digital Claims Assessor is an AI-powered tool that automates the evaluation of insurance claims by analyzing data, images, and documentation to determine claim validity and settlement amounts quickly and accurately. Unlike traditional Claim Adjusters who manually investigate claims and interact with policyholders, Digital Claims Assessors streamline the claims process, reducing human error and accelerating decision-making. This technology integrates machine learning algorithms and predictive analytics to improve efficiency and consistency in claims handling.

Key Responsibilities: Claim Adjuster vs Digital Claims Assessor

Claim adjusters conduct in-person investigations, evaluate damages, interview claimants, and negotiate settlements to determine claim validity and payout amounts. Digital claims assessors leverage artificial intelligence and data analytics to automate damage assessments, process claims rapidly, and reduce human error, focusing on efficiency and cost reduction. Both roles prioritize claim accuracy, but adjusters emphasize personalized evaluation while digital assessors drive scalability through technology.

Technological Integration in Claims Assessment

Claim adjusters rely on personal inspections and manual evaluations to determine the validity and extent of insurance claims, whereas digital claims assessors use advanced technologies such as AI algorithms, machine learning, and automated data analysis to streamline and enhance accuracy in claims processing. The integration of technological tools enables real-time data collection, predictive analytics, and fraud detection, significantly reducing settlement times and operational costs. Insurers adopting digital claims assessment benefit from improved efficiency, customer satisfaction, and scalability of claims handling operations.

Skills Required for Each Role

A Claim Adjuster requires strong negotiation skills, in-depth knowledge of insurance policies, and expertise in investigating claims to assess damages accurately. A Digital Claims Assessor must possess proficiency in data analysis, familiarity with AI-driven tools, and the ability to interpret digital evidence for swift and precise claim evaluations. Both roles demand attention to detail and effective communication but differ significantly in technical competencies and reliance on digital technologies.

Speed and Accuracy: Manual vs Digital Assessment

Claim adjusters rely on manual assessment methods that often require extensive document review and on-site inspections, resulting in longer processing times and increased risk of human error. Digital claims assessors utilize AI-powered algorithms and automation to analyze claims rapidly, achieving higher accuracy in detecting fraud and inconsistencies. This digital approach significantly accelerates claim settlements while improving precision and reducing operational costs for insurance companies.

Customer Experience and Communication

Claim adjusters provide personalized, human interaction that can enhance customer trust and empathy during the insurance claims process. Digital claims assessors use AI-driven automation to deliver faster claim evaluations, improving efficiency and reducing wait times for customers. Combining both methods can optimize customer experience by balancing human judgment with technological speed and accuracy.

Industry Trends: Automation and Human Oversight

Automation in insurance claims processing accelerates settlement times and reduces operational costs by utilizing digital claims assessors powered by AI and machine learning algorithms. Despite the efficiency gains, human oversight from claim adjusters remains critical to handle complex cases, ensure accuracy, and address nuanced customer needs. Industry trends emphasize a hybrid approach combining advanced automation technologies with expert claim adjuster intervention to optimize claim outcomes and maintain regulatory compliance.

Future Outlook: Evolving Roles in Insurance Claims

The evolving roles of Claim Adjusters and Digital Claims Assessors reflect the insurance industry's shift towards automation and data-driven decision-making. Advanced AI algorithms and machine learning enhance Digital Claims Assessors' accuracy and efficiency, reducing human error and accelerating claim settlements. Future insurance claims processes will increasingly integrate hybrid models combining expert human judgment with sophisticated digital tools to optimize risk assessment and customer experience.

Related Important Terms

Algorithmic Adjudication

Algorithmic adjudication in digital claims assessment leverages advanced machine learning models to analyze and process insurance claims with greater speed and accuracy compared to traditional claim adjusters. This technology reduces human error, enhances fraud detection, and streamlines decision-making by automatically validating data against policy rules and historical claim patterns.

Augmented Intelligence Adjusting

Claim adjusters leverage augmented intelligence adjusting by combining human expertise with advanced AI algorithms to enhance accuracy and speed in damage assessment. Digital claims assessors utilize machine learning models to analyze claim data efficiently, reducing processing time and improving fraud detection in insurance claims.

Parametric Claims Assessment

Claim adjusters perform traditional loss evaluations through on-site inspections and detailed interviews, while digital claims assessors leverage parametric claims assessment using data triggers and predefined parameters to automate and expedite payouts based on verified event metrics. Parametric claims assessment reduces processing time and enhances accuracy by utilizing real-time sensor data, satellite imagery, and historical event databases to determine claim eligibility without extensive manual investigation.

Remote Virtual Adjuster

Remote virtual adjusters leverage advanced digital tools and AI-driven data analytics to expedite insurance claim assessments with greater accuracy and efficiency compared to traditional claim adjusters. By utilizing remote inspections, real-time video evaluations, and cloud-based documentation, digital claims assessors reduce processing times and enhance customer experience while maintaining compliance and risk mitigation standards.

AI-Driven Fraud Detection

AI-driven fraud detection in digital claims assessment leverages machine learning algorithms to analyze vast datasets, identifying suspicious patterns and anomalies more efficiently than traditional claim adjusters. This technology reduces human error, accelerates claim processing, and enhances accuracy in detecting fraudulent insurance claims.

Automated Loss Estimation

Claim adjusters conduct manual investigations and damage assessments to determine insurance payouts, relying heavily on physical inspections and human judgment. Digital claims assessors utilize automated loss estimation technologies, leveraging AI and machine learning algorithms to analyze images and data rapidly, improving accuracy and accelerating claim settlements.

Claims Data Orchestration

Claim adjusters manually evaluate insurance claims, relying on fragmented data sources that can lead to delays and inconsistencies, whereas digital claims assessors leverage automated claims data orchestration platforms to aggregate and analyze extensive datasets swiftly, improving accuracy and decision-making efficiency. Advanced claims data orchestration integrates real-time data from multiple channels, enabling digital claims assessors to streamline workflows, reduce processing times, and enhance fraud detection in insurance claims management.

InsurTech Workflow Integration

Claim adjusters manually evaluate insurance claims through on-site inspections and detailed reports, whereas digital claims assessors leverage AI-driven algorithms and automated data analysis to expedite claim validation. Integrating digital claims assessors into InsurTech workflows enhances operational efficiency, reduces processing time, and improves accuracy in fraud detection and risk assessment.

Touchless Claims Processing

Touchless claims processing leverages digital claims assessors to automate damage evaluation using AI and machine learning, reducing the need for traditional claim adjusters' physical inspections. This technology accelerates claim settlements, enhances accuracy, and improves customer satisfaction by minimizing manual intervention and streamlining workflows.

Telematics-Enabled Claims Review

Telematics-enabled claims review revolutionizes the role of traditional claim adjusters by integrating real-time data from connected vehicles to enhance accuracy in damage assessment and fraud detection. Digital claims assessors leverage telematics inputs such as GPS and sensor data to streamline claim processing, reduce settlement times, and improve customer experience through data-driven decisions.

Claim Adjuster vs Digital Claims Assessor Infographic

industrydif.com

industrydif.com