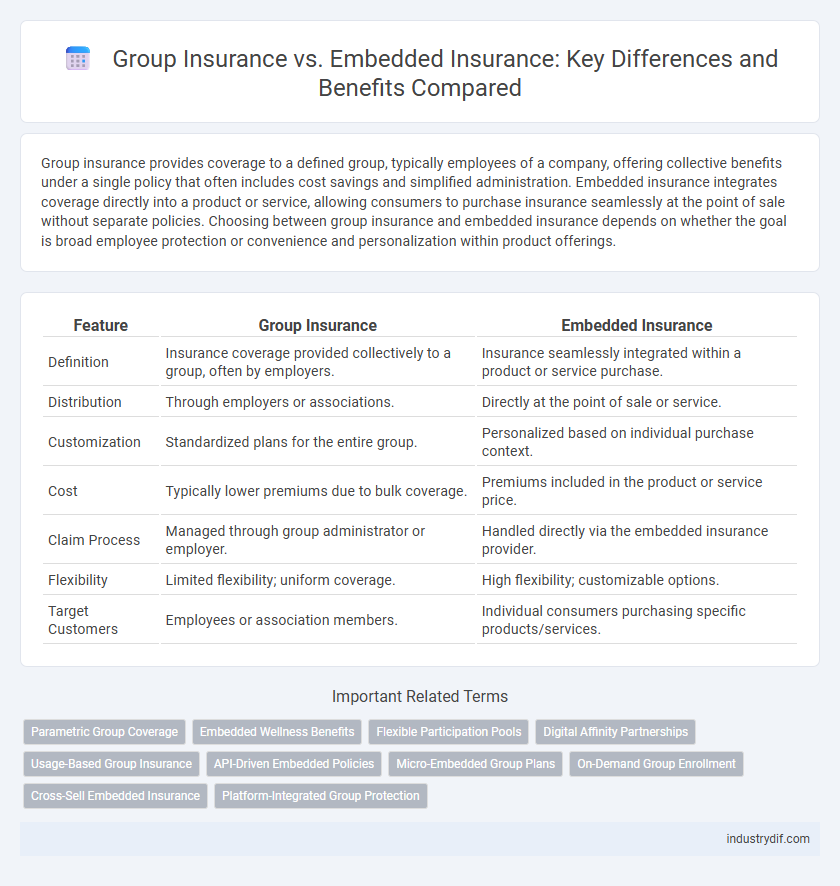

Group insurance provides coverage to a defined group, typically employees of a company, offering collective benefits under a single policy that often includes cost savings and simplified administration. Embedded insurance integrates coverage directly into a product or service, allowing consumers to purchase insurance seamlessly at the point of sale without separate policies. Choosing between group insurance and embedded insurance depends on whether the goal is broad employee protection or convenience and personalization within product offerings.

Table of Comparison

| Feature | Group Insurance | Embedded Insurance |

|---|---|---|

| Definition | Insurance coverage provided collectively to a group, often by employers. | Insurance seamlessly integrated within a product or service purchase. |

| Distribution | Through employers or associations. | Directly at the point of sale or service. |

| Customization | Standardized plans for the entire group. | Personalized based on individual purchase context. |

| Cost | Typically lower premiums due to bulk coverage. | Premiums included in the product or service price. |

| Claim Process | Managed through group administrator or employer. | Handled directly via the embedded insurance provider. |

| Flexibility | Limited flexibility; uniform coverage. | High flexibility; customizable options. |

| Target Customers | Employees or association members. | Individual consumers purchasing specific products/services. |

Definition of Group Insurance

Group insurance is a type of coverage offered to a defined group of people, typically employees of a company or members of an organization, providing collective benefits under a single policy. This insurance model often includes health, life, or disability coverage, offering cost savings and streamlined administration compared to individual policies. Employers or organizations usually negotiate and pay for the premiums, while members gain access to coverage based on group eligibility criteria.

Definition of Embedded Insurance

Embedded insurance integrates coverage directly into the purchase of goods or services, providing seamless protection without requiring separate policies. Unlike traditional group insurance, which offers a collective plan to members of an organization, embedded insurance is activated automatically during a transaction. This approach enhances customer convenience and streamlines the insurance process by bundling protection within the user experience.

Key Differences Between Group and Embedded Insurance

Group insurance offers coverage to a defined group, such as employees of a company, providing uniform benefits and collective risk pooling. Embedded insurance integrates coverage directly into a product or service, allowing individuals to purchase insurance seamlessly at the point of sale or use. Key differences include the distribution channel, customization level, and policy administration, with group insurance managed by an employer or organization while embedded insurance relies on digital platforms and partners for real-time integration.

Coverage Scope: Group vs Embedded Insurance

Group insurance typically offers broad coverage tailored to all members within an organization, ensuring standardized protection across employees or members. Embedded insurance provides customized coverage linked directly to a specific product or service, integrating seamlessly with the purchase experience. Coverage scope in group insurance focuses on collective risk pooling, while embedded insurance targets individual needs with contextual relevance.

Eligibility Criteria for Each Model

Group insurance eligibility typically requires membership in a defined group such as employees of a company or members of an association, with coverage dependent on group enrollment policies. Embedded insurance eligibility is tied directly to the purchase of a primary product or service, automatically including customers as policyholders without separate application processes. Both models streamline risk assessment differently, with group insurance relying on collective underwriting and embedded insurance focusing on individual transactional triggers.

Customization and Flexibility of Policies

Group insurance offers limited customization as policies are designed to cover a broad audience under uniform terms, often restricting individual flexibility for specific needs. Embedded insurance integrates seamlessly with products or services, allowing for highly customizable coverage options tailored to individual usage and preferences within a digital ecosystem. This flexibility enables policyholders to adjust benefits, coverage limits, and premiums more dynamically compared to traditional group insurance plans.

Premium Pricing Structures

Group insurance typically offers lower premium pricing structures due to risk pooling among members, resulting in economies of scale and reduced administrative costs. Embedded insurance integrates coverage costs directly into the price of a product or service, often reflecting a more personalized risk assessment and potentially higher premiums for individual users. Understanding these distinct pricing mechanisms helps organizations optimize cost efficiency while balancing coverage adequacy for policyholders.

Claims Process Comparison

Group insurance claims are processed through a centralized system managed by the employer or organization, often resulting in faster approvals and streamlined communication. Embedded insurance integrates claims processing directly within the purchase of a product or service, enabling immediate claim initiation and automated settlements via digital platforms. Both models aim to enhance efficiency, but embedded insurance leverages technology for near-instantaneous claim handling, reducing administrative burdens and improving customer experience.

Industry Applications and Use Cases

Group insurance is commonly utilized in employee benefits programs across industries such as manufacturing, healthcare, and technology, offering cost-effective coverage to large workforces and enhancing employee retention. Embedded insurance integrates insurance products directly into purchasing journeys within sectors like automotive, travel, and e-commerce, providing seamless protection options at the point of sale. Both models drive industry-specific value by tailoring risk management solutions: group insurance emphasizes collective risk pooling, while embedded insurance focuses on enhancing customer experience through instant coverage.

Future Trends in Group and Embedded Insurance

Group insurance is evolving with increased integration of AI-driven analytics to personalize coverage and reduce costs for large employee pools, while embedded insurance is rapidly expanding through API-based platforms that streamline policy inclusion within everyday transactions. Future trends highlight a convergence where group insurance leverages embedded insurance technology to offer seamless, on-demand coverage tied directly to specific employee activities and benefits. This fusion enhances user experience, drives higher engagement, and supports real-time risk assessment across corporate ecosystems.

Related Important Terms

Parametric Group Coverage

Parametric Group Coverage in insurance provides predetermined payouts based on specific event triggers such as natural disasters, offering faster claims processing compared to traditional Group Insurance that relies on loss assessments. Embedded Insurance integrates parametric group benefits directly into products or services, enhancing customer experience by simplifying access and reducing administrative burdens.

Embedded Wellness Benefits

Embedded insurance integrates wellness benefits directly into group insurance plans, enhancing member engagement through seamless access to health programs and preventive care. This approach drives better health outcomes and reduces overall claims costs by promoting proactive wellness within the insured population.

Flexible Participation Pools

Group insurance typically offers flexible participation pools where members can join or leave without individual underwriting, enabling broader coverage and cost distribution. Embedded insurance integrates coverage within a product or service, often featuring dynamic participation pools that adjust based on usage or membership levels, enhancing customer convenience and operational efficiency.

Digital Affinity Partnerships

Group insurance leverages digital affinity partnerships by offering tailored coverage to specific member groups, enhancing customer engagement through seamless integration with partner platforms. Embedded insurance integrates policies directly into digital products, streamlining the purchase process and driving higher conversion rates by delivering contextually relevant insurance solutions at the point of need.

Usage-Based Group Insurance

Usage-based group insurance leverages telematics and data analytics to tailor premiums and coverage based on collective member behaviors, enhancing risk assessment accuracy and cost efficiency. Embedded insurance integrates coverage directly into products or services but lacks the dynamic, data-driven customization that usage-based group insurance offers for improving group-specific risk management.

API-Driven Embedded Policies

API-driven embedded insurance seamlessly integrates group insurance policies within digital platforms, enabling real-time policy management and personalized coverage options. This approach enhances customer experience by automating underwriting, claims processing, and premium adjustments directly through interconnected systems.

Micro-Embedded Group Plans

Micro-embedded group plans integrate tailored insurance coverage within employee benefits, offering seamless protection without the complexity of traditional group insurance administration. These plans leverage digital platforms to provide scalable, cost-effective solutions that enhance member engagement and streamline risk management for small and medium-sized enterprises.

On-Demand Group Enrollment

On-demand group enrollment offers businesses flexible access to group insurance, allowing employees to opt in as needed without rigid annual open enrollment periods. Embedded insurance integrates coverage directly into products or services, providing seamless protection but less customization compared to the dynamic enrollment benefits of on-demand group insurance models.

Cross-Sell Embedded Insurance

Cross-sell embedded insurance integrates tailored coverage options directly into existing group insurance plans, enhancing protection while increasing customer retention and lifetime value. This strategic embedding leverages data analytics to offer personalized policies at the point of sale, driving adoption rates higher than traditional group insurance models alone.

Platform-Integrated Group Protection

Platform-integrated group protection combines the scalability of group insurance with seamless embedded insurance features, offering companies a streamlined way to provide comprehensive coverage to their employees. This integration enhances user experience by automating policy management and claims processing within the platform, increasing engagement and reducing administrative costs.

Group Insurance vs Embedded Insurance Infographic

industrydif.com

industrydif.com