Actuaries specialize in evaluating financial risks using statistical models and historical data to design insurance policies and ensure company solvency. Insurtech data scientists leverage advanced machine learning algorithms and big data analytics to create innovative solutions that enhance underwriting, pricing, and customer experience. Combining actuarial expertise with insurtech insights drives more accurate risk assessment and operational efficiency in the insurance industry.

Table of Comparison

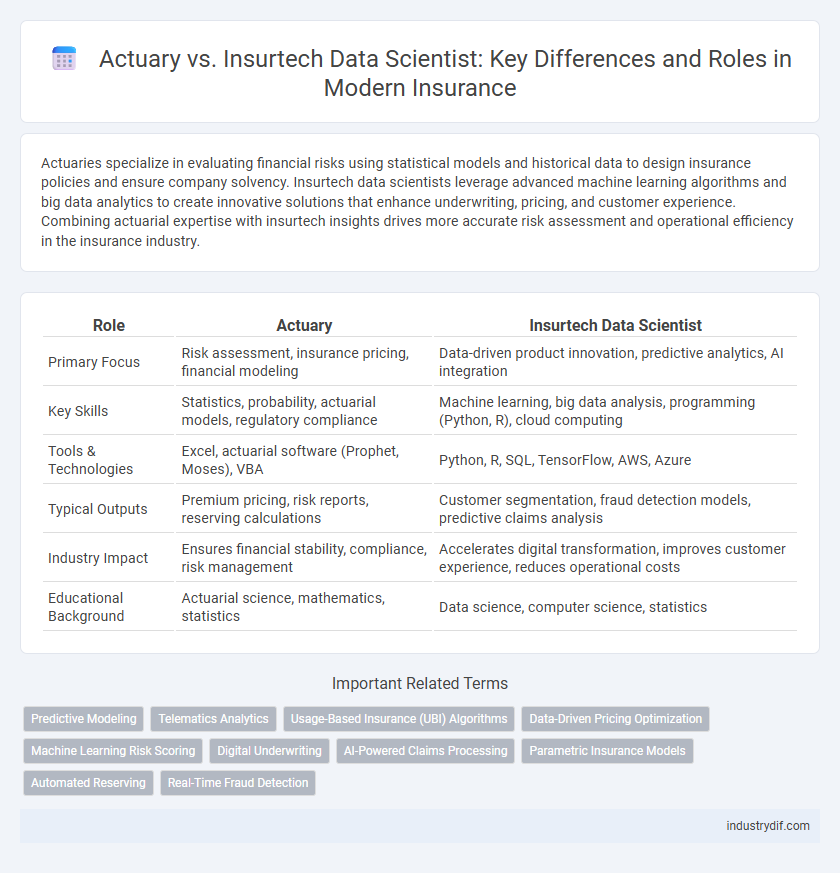

| Role | Actuary | Insurtech Data Scientist |

|---|---|---|

| Primary Focus | Risk assessment, insurance pricing, financial modeling | Data-driven product innovation, predictive analytics, AI integration |

| Key Skills | Statistics, probability, actuarial models, regulatory compliance | Machine learning, big data analysis, programming (Python, R), cloud computing |

| Tools & Technologies | Excel, actuarial software (Prophet, Moses), VBA | Python, R, SQL, TensorFlow, AWS, Azure |

| Typical Outputs | Premium pricing, risk reports, reserving calculations | Customer segmentation, fraud detection models, predictive claims analysis |

| Industry Impact | Ensures financial stability, compliance, risk management | Accelerates digital transformation, improves customer experience, reduces operational costs |

| Educational Background | Actuarial science, mathematics, statistics | Data science, computer science, statistics |

Defining the Actuary Role in Insurance

The actuary in insurance specializes in evaluating financial risks using mathematics, statistics, and financial theory to predict future events and ensure company solvency. This role involves pricing insurance policies, calculating reserves, and conducting risk assessments to maintain profitability and regulatory compliance. Unlike insurtech data scientists who focus on leveraging big data and machine learning for innovative solutions, actuaries rely on traditional risk models and actuarial methods to quantify uncertainty and guide strategic decision-making.

What is an Insurtech Data Scientist?

An Insurtech Data Scientist leverages advanced analytics, machine learning, and big data to optimize insurance products, pricing, and risk assessment beyond traditional actuarial methods. Unlike actuaries who focus primarily on statistical models for loss prediction and reserving, insurtech data scientists integrate diverse datasets from Internet of Things (IoT), telematics, and customer behavior to innovate insurance solutions. Their expertise drives automation, personalized underwriting, fraud detection, and claims management improvements within the digital insurance ecosystem.

Core Responsibilities: Actuaries vs Data Scientists

Actuaries specialize in risk assessment by applying mathematical models, statistics, and financial theory to analyze insurance data and forecast future claims, pricing policies accurately. Insurtech data scientists focus on leveraging big data, machine learning algorithms, and advanced analytics to extract insights, optimize underwriting processes, and enhance customer experience using technology-driven solutions. Both roles contribute to risk management but actuaries emphasize traditional actuarial methods while insurtech data scientists innovate through data science and artificial intelligence techniques.

Key Skills and Qualifications

Actuaries possess strong expertise in probability, statistics, and financial mathematics to assess risk and design insurance policies, requiring professional certifications like CFA or ASA. Insurtech data scientists excel in advanced machine learning, big data analytics, and programming languages such as Python or R, leveraging technology to innovate underwriting and claims processing. Both roles demand deep knowledge of insurance products, regulatory environments, and data interpretation but differ in technical emphasis and industry application.

Tools and Technologies Used

Actuaries primarily use statistical software such as SAS, R, and Excel for risk assessment, pricing models, and financial forecasting within insurance. Insurtech data scientists leverage advanced tools like Python, SQL, machine learning frameworks (TensorFlow, Scikit-Learn), and big data platforms (Hadoop, Spark) to analyze large datasets and develop predictive models. Both roles require proficiency in data analysis but differ significantly in technological ecosystems and application focus.

The Role of Data in Decision Making

Actuaries utilize statistical models and historical insurance data to assess risk, calculate premiums, and ensure financial stability within traditional insurance frameworks. Insurtech data scientists leverage advanced machine learning algorithms and real-time data analytics to optimize underwriting, detect fraud, and enhance customer personalization in digital insurance platforms. Both roles rely heavily on data-driven decision making, but actuaries focus on long-term risk management while insurtech data scientists emphasize innovation through scalable, technology-driven insights.

Traditional Actuarial Models vs Machine Learning Approaches

Traditional actuarial models rely on statistical methods such as generalized linear models (GLMs) and life tables to assess risk and determine insurance premiums based on historical data and mortality rates. Insurtech data scientists employ machine learning techniques like random forests, gradient boosting, and neural networks to analyze large, complex datasets, uncover patterns, and improve predictive accuracy beyond conventional actuarial methods. Machine learning enhances risk assessment by automating feature selection and adapting quickly to new data, enabling more dynamic pricing and personalized insurance products.

Collaboration and Team Dynamics

Actuaries and insurtech data scientists collaborate by combining actuarial models with advanced data analytics to enhance risk assessment and pricing strategies. Their teamwork leverages statistical expertise and machine learning techniques to improve predictive accuracy and operational efficiency within insurance companies. Effective communication and a shared understanding of both traditional actuarial principles and modern data-driven approaches drive innovation and competitive advantage in the insurance sector.

Evolving Career Paths in Insurance Analytics

Actuaries traditionally leverage statistical models and risk theory to evaluate insurance liabilities, while Insurtech data scientists utilize machine learning algorithms and big data analytics to optimize underwriting and claims processes. Emerging technologies enable data scientists to harness unstructured data and real-time analytics, driving innovative product development and personalized pricing strategies. The convergence of actuarial expertise and data science skills is reshaping insurance analytics, creating hybrid roles focused on predictive modeling and risk management automation.

Future Trends: The Convergence of Actuary and Insurtech Data Science

The convergence of actuaries and insurtech data scientists is reshaping insurance through advanced predictive analytics and machine learning models that enhance risk assessment and pricing accuracy. Integrating actuarial expertise with insurtech innovation accelerates the development of real-time data-driven underwriting and claims processing, improving operational efficiency and customer experience. Future trends emphasize hybrid skill sets combining statistical rigor with cutting-edge technology to drive personalized insurance products and dynamic risk management strategies.

Related Important Terms

Predictive Modeling

Actuaries use statistical models and historical insurance data to assess risk and calculate premiums, ensuring financial stability and regulatory compliance. Insurtech data scientists leverage advanced machine learning algorithms and real-time big data to enhance predictive modeling accuracy, driving innovation in personalized insurance products and dynamic pricing.

Telematics Analytics

Actuaries leverage telematics analytics to assess risk and price insurance policies using statistical models based on large datasets of driver behavior and claims history. Insurtech data scientists apply advanced machine learning algorithms and real-time telematics data streams to enhance predictive accuracy and develop personalized insurance products.

Usage-Based Insurance (UBI) Algorithms

Actuaries develop Usage-Based Insurance (UBI) algorithms by applying statistical models and risk assessment techniques to predict driver behavior and optimize premiums based on historical data. Insurtech data scientists enhance UBI algorithms using machine learning and real-time telematics data, enabling dynamic risk scoring and personalized insurance offerings through advanced analytics and sensor integration.

Data-Driven Pricing Optimization

Actuaries apply statistical models and historical risk data to establish premium rates, ensuring financial stability and regulatory compliance in insurance pricing. Insurtech data scientists leverage advanced machine learning algorithms and real-time data analytics to optimize pricing strategies dynamically, enhancing accuracy and personalization in risk assessment.

Machine Learning Risk Scoring

Actuaries use traditional statistical models and actuarial science principles to assess risk and price insurance products, relying on historical data and regulatory frameworks. Insurtech data scientists leverage machine learning algorithms and big data analytics to develop dynamic risk scoring models that enhance predictive accuracy and enable real-time underwriting decisions.

Digital Underwriting

Actuaries apply statistical models and risk theory to evaluate insurance liabilities and pricing, ensuring financial stability through traditional underwriting processes. Insurtech data scientists leverage machine learning algorithms and big data analytics to enhance digital underwriting efficiency, improving risk assessment accuracy and customer experience in real-time.

AI-Powered Claims Processing

AI-powered claims processing transforms actuarial tasks by enabling real-time risk assessment and fraud detection through advanced algorithms, enhancing accuracy and efficiency beyond traditional methods. Insurtech data scientists leverage machine learning models to automate claims evaluation and predict claim outcomes, driving innovation and reducing processing time in insurance operations.

Parametric Insurance Models

Parametric insurance models rely on predefined triggers and data points to automate claims processing, where actuaries use statistical methods to assess risks and calculate premiums based on historical loss data. Insurtech data scientists enhance these models by integrating real-time data analytics, machine learning, and sensor inputs to improve accuracy and streamline claim settlements, fostering innovation in risk quantification and parametric product design.

Automated Reserving

Actuaries specialize in traditional reserving methods using historical data and actuarial models to estimate liabilities, while insurtech data scientists leverage automated reserving techniques powered by machine learning algorithms and real-time data analytics to enhance accuracy and efficiency. Automated reserving integrates predictive modeling and big data to dynamically adjust reserves, reducing manual errors and accelerating financial reporting cycles in the insurance industry.

Real-Time Fraud Detection

Actuaries leverage statistical models and historical data to assess risk and set premiums, while insurtech data scientists utilize machine learning algorithms and real-time analytics to detect fraud patterns instantly during claims processing. Real-time fraud detection enhances underwriting accuracy and reduces financial losses by identifying suspicious activities as they occur, enabling faster decision-making and more efficient insurance operations.

Actuary vs Insurtech Data Scientist Infographic

industrydif.com

industrydif.com