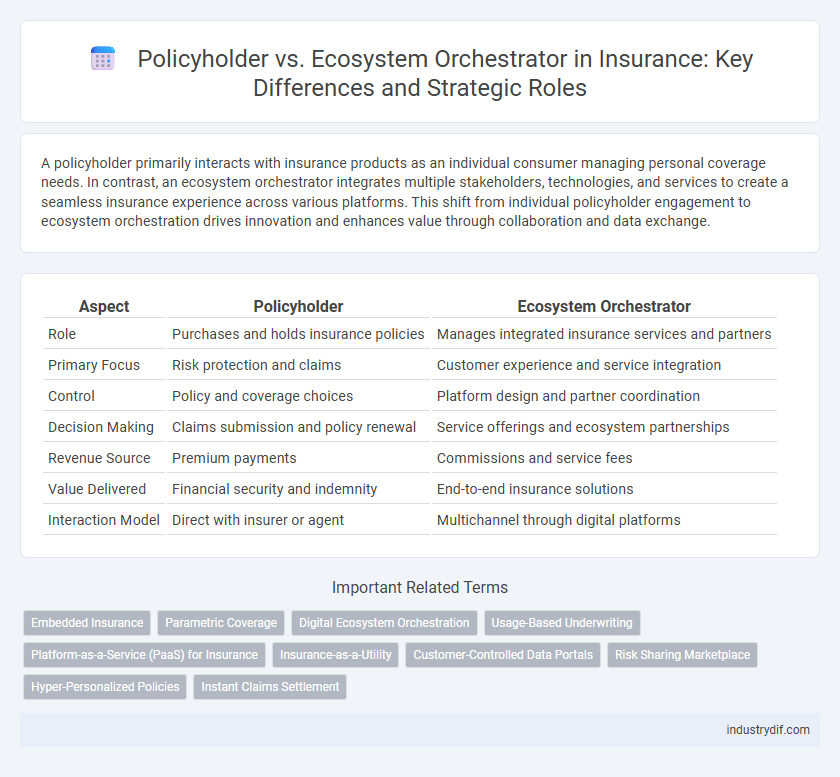

A policyholder primarily interacts with insurance products as an individual consumer managing personal coverage needs. In contrast, an ecosystem orchestrator integrates multiple stakeholders, technologies, and services to create a seamless insurance experience across various platforms. This shift from individual policyholder engagement to ecosystem orchestration drives innovation and enhances value through collaboration and data exchange.

Table of Comparison

| Aspect | Policyholder | Ecosystem Orchestrator |

|---|---|---|

| Role | Purchases and holds insurance policies | Manages integrated insurance services and partners |

| Primary Focus | Risk protection and claims | Customer experience and service integration |

| Control | Policy and coverage choices | Platform design and partner coordination |

| Decision Making | Claims submission and policy renewal | Service offerings and ecosystem partnerships |

| Revenue Source | Premium payments | Commissions and service fees |

| Value Delivered | Financial security and indemnity | End-to-end insurance solutions |

| Interaction Model | Direct with insurer or agent | Multichannel through digital platforms |

Defining the Policyholder in Insurance

The policyholder in insurance is the individual or entity that holds the insurance contract and is responsible for paying premiums while receiving coverage benefits. This role is distinct from the ecosystem orchestrator, who manages interactions among multiple stakeholders including insurers, agents, and service providers to optimize the insurance value chain. Clearly defining the policyholder ensures accurate risk assessment, personalized policy management, and efficient claims processing within the insurance ecosystem.

Understanding the Ecosystem Orchestrator Role

The Ecosystem Orchestrator in insurance acts as a central coordinator, integrating diverse service providers, technologies, and data sources to create seamless, value-added solutions for policyholders. This role enables real-time risk assessment, personalized coverage options, and efficient claims processing by leveraging advanced analytics and interconnected platforms. Unlike traditional policyholders who primarily interact with insurers for coverage and claims, the Ecosystem Orchestrator drives innovation and collaboration across the insurance value chain, enhancing customer experience and operational agility.

Key Differences Between Policyholder and Ecosystem Orchestrator

A policyholder is an individual or entity that owns an insurance policy and assumes the associated risks, rights, and responsibilities. In contrast, an ecosystem orchestrator manages a network of interconnected stakeholders, driving collaboration, innovation, and value creation across the insurance ecosystem. Key differences lie in the roles: policyholders seek protection and claims management, while ecosystem orchestrators focus on integrating services, optimizing processes, and enhancing customer experience through partnerships and technology platforms.

Responsibilities of Policyholders in Insurance Ecosystems

Policyholders in insurance ecosystems are primarily responsible for providing accurate and complete information during policy application and claims processes to ensure effective risk assessment and coverage. They must regularly update personal and asset data to maintain policy validity and facilitate seamless interactions within the ecosystem. Timely premium payments and adherence to policy terms are essential duties that enable the ecosystem orchestrator to optimize service delivery and risk management.

The Strategic Value of Ecosystem Orchestrators

Ecosystem orchestrators in insurance create strategic value by integrating diverse stakeholders, including policyholders, insurers, and third-party service providers, fostering collaboration and innovation. These orchestrators leverage data analytics and digital platforms to enhance customer engagement, risk assessment, and personalized policy offerings. By optimizing interconnected services, ecosystem orchestrators drive efficiency, reduce costs, and create adaptive insurance solutions that address evolving market demands.

Policyholder Experience in an Insurance Ecosystem

Policyholder experience in an insurance ecosystem crucially depends on seamless integration between the policyholder and the ecosystem orchestrator, who manages multiple service providers to ensure personalized, efficient coverage. The orchestrator leverages real-time data analytics and AI-driven insights to streamline claims processing, enhance communication, and offer tailored recommendations based on individual risk profiles. This results in faster resolutions, greater transparency, and improved overall satisfaction, highlighting the ecosystem's value beyond traditional insurance models.

How Ecosystem Orchestrators Transform Insurance Value Chains

Ecosystem orchestrators revolutionize insurance value chains by integrating diverse services such as underwriting, claims processing, and customer engagement into seamless digital platforms. They enable real-time data sharing and collaboration among insurers, brokers, service providers, and policyholders, enhancing risk assessment accuracy and improving claim efficiency. This transformation reduces operational costs, accelerates product innovation, and delivers personalized insurance solutions that meet evolving customer needs.

Policyholder Empowerment vs. Ecosystem Coordination

Policyholder empowerment centers on providing individuals with transparent access to personalized insurance products, streamlined claims processes, and real-time risk management tools that enhance decision-making autonomy. Ecosystem orchestrators prioritize seamless coordination between insurers, service providers, and technology platforms to create integrated insurance solutions that optimize data sharing and operational efficiency. Balancing policyholder empowerment with ecosystem coordination fosters a customer-centric environment that drives innovation and resilience within the insurance value chain.

Impact on Product Innovation: Policyholder vs. Orchestrator

The policyholder primarily drives product innovation through direct feedback and claims data, enabling insurers to tailor coverage and enhance risk assessment. In contrast, the ecosystem orchestrator leverages extensive data integration across multiple partners, fostering collaborative innovation and creating more comprehensive, customer-centric insurance products. This shift from individual to network-driven innovation accelerates the development of adaptive, scalable solutions that better address emerging risks and customer needs.

Future Trends: Evolution from Policyholder to Ecosystem Orchestrator

The future of insurance is shifting from a traditional policyholder model to an ecosystem orchestrator approach, where insurers leverage interconnected digital platforms to deliver integrated services beyond mere coverage. This evolution enables seamless collaboration among multiple stakeholders, including third-party service providers, enhancing customer experience and operational efficiency through real-time data sharing and predictive analytics. Advanced technologies such as AI, IoT, and blockchain drive this transformation, empowering insurers to manage risk proactively and foster personalized, comprehensive solutions in a dynamic ecosystem.

Related Important Terms

Embedded Insurance

Policyholders benefit from embedded insurance by seamlessly accessing tailored coverage integrated within everyday services and digital platforms, enhancing convenience and personalization. Ecosystem orchestrators facilitate this integration by leveraging APIs and data analytics to embed insurance products directly into their ecosystems, driving higher engagement and optimized risk management.

Parametric Coverage

Parametric coverage enables policyholders to receive predetermined payouts based on predefined triggers such as weather data or natural disaster measurements, reducing claims processing time and enhancing transparency. Ecosystem orchestrators leverage parametric insurance to integrate real-time data streams and automate claim settlements, optimizing risk management and customer experience across interconnected insurance platforms.

Digital Ecosystem Orchestration

Policyholders benefit from digital ecosystem orchestration by gaining seamless access to integrated insurance services, personalized risk management tools, and real-time claims processing within interconnected platforms. Ecosystem orchestrators leverage advanced analytics, API integrations, and strategic partnerships to create scalable, data-driven environments that enhance customer experience and operational efficiency.

Usage-Based Underwriting

Usage-Based Underwriting leverages real-time data collected from policyholders to tailor insurance premiums and coverage more accurately, enhancing risk assessment and pricing precision. Ecosystem Orchestrators integrate diverse data sources and third-party services, enabling seamless collaboration between insurers, policyholders, and ancillary providers to optimize underwriting processes and improve customer engagement.

Platform-as-a-Service (PaaS) for Insurance

Policyholders increasingly benefit from Platform-as-a-Service (PaaS) solutions that enable ecosystem orchestrators to seamlessly integrate diverse insurance products, data analytics, and customer service channels for personalized risk management. Ecosystem orchestrators leverage PaaS to streamline underwriting, claims processing, and cross-industry collaboration, boosting efficiency and enhancing policyholder experience through interconnected digital platforms.

Insurance-as-a-Utility

Policyholders benefit from seamless, on-demand access to insurance products through Ecosystem Orchestrators who integrate multiple service providers within an Insurance-as-a-Utility model, enhancing flexibility and personalization. This dynamic enables real-time risk management and automated policy adjustments, transforming traditional insurance into a scalable, user-centric utility service.

Customer-Controlled Data Portals

Customer-controlled data portals empower policyholders to directly manage and share their insurance information, enhancing transparency and personalized service. Ecosystem orchestrators leverage these portals to integrate diverse insurers, reinsurers, and service providers, creating seamless data exchanges that optimize risk assessment and claims processing.

Risk Sharing Marketplace

Policyholders benefit from increased flexibility and cost-efficiency in a Risk Sharing Marketplace, where the Ecosystem Orchestrator facilitates seamless collaboration among insurers, reinsurers, and service providers to optimize risk distribution. Leveraging data analytics and blockchain technology, the orchestrator enhances transparency and trust, enabling dynamic adjustments to coverage and premiums based on real-time risk assessment.

Hyper-Personalized Policies

Policyholders increasingly demand hyper-personalized insurance policies tailored to their unique risk profiles and lifestyles, leveraging data from connected devices and behavioral analytics. Ecosystem orchestrators integrate diverse data sources and partners to create customized coverage solutions, enhancing customer satisfaction and risk management precision.

Instant Claims Settlement

Policyholders benefit from instant claims settlement through streamlined digital platforms managed by ecosystem orchestrators, reducing processing times from days to minutes. Ecosystem orchestrators leverage integrated technologies and data analytics to enhance transparency, accuracy, and customer satisfaction in the claims process.

Policyholder vs Ecosystem Orchestrator Infographic

industrydif.com

industrydif.com