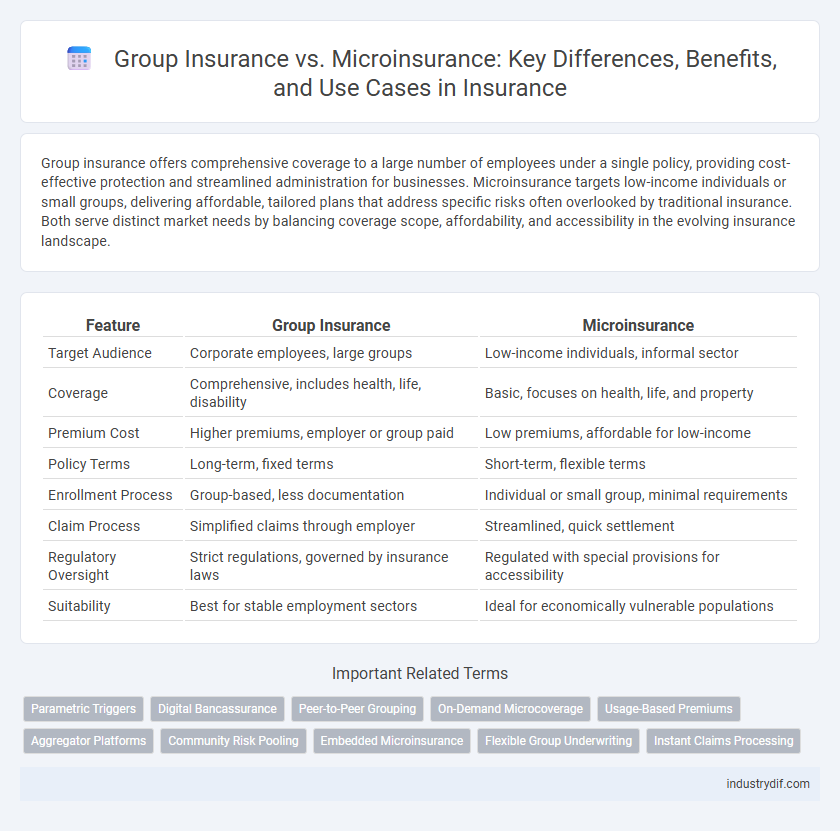

Group insurance offers comprehensive coverage to a large number of employees under a single policy, providing cost-effective protection and streamlined administration for businesses. Microinsurance targets low-income individuals or small groups, delivering affordable, tailored plans that address specific risks often overlooked by traditional insurance. Both serve distinct market needs by balancing coverage scope, affordability, and accessibility in the evolving insurance landscape.

Table of Comparison

| Feature | Group Insurance | Microinsurance |

|---|---|---|

| Target Audience | Corporate employees, large groups | Low-income individuals, informal sector |

| Coverage | Comprehensive, includes health, life, disability | Basic, focuses on health, life, and property |

| Premium Cost | Higher premiums, employer or group paid | Low premiums, affordable for low-income |

| Policy Terms | Long-term, fixed terms | Short-term, flexible terms |

| Enrollment Process | Group-based, less documentation | Individual or small group, minimal requirements |

| Claim Process | Simplified claims through employer | Streamlined, quick settlement |

| Regulatory Oversight | Strict regulations, governed by insurance laws | Regulated with special provisions for accessibility |

| Suitability | Best for stable employment sectors | Ideal for economically vulnerable populations |

Overview of Group Insurance

Group insurance offers coverage to a defined collective, such as employees of a company or members of an organization, providing benefits like life, health, or disability insurance under a single policy. This insurance type leverages risk pooling, resulting in lower premiums and comprehensive coverage compared to individual policies. Employers or organizations typically manage group insurance plans, streamlining administration and enhancing access to essential protection for all members.

Understanding Microinsurance

Microinsurance provides affordable insurance coverage tailored to low-income individuals and small businesses, filling gaps left by traditional group insurance plans. It offers simplified products with lower premiums and flexible terms, making financial protection accessible to underserved populations. Unlike group insurance, which often requires larger member pools and employer sponsorship, microinsurance emphasizes community-based enrollment and streamlined claims processes.

Coverage Scope: Group Insurance vs Microinsurance

Group insurance typically offers comprehensive coverage designed for large employee groups or organizations, encompassing health, life, and disability benefits with higher insured limits and broader risk protection. Microinsurance focuses on affordable, limited coverage tailored to low-income or underserved populations, often covering specific risks such as funeral expenses, crop failure, or basic health care with lower premiums and simplified claim processes. The coverage scope of group insurance is extensive and multifaceted, while microinsurance emphasizes accessibility and targeted protection for vulnerable communities.

Target Audience and Eligibility

Group insurance primarily targets organizations, businesses, and employee groups, offering coverage to members under a single policy, often requiring eligibility based on employment or membership status. Microinsurance is designed specifically for low-income individuals or informal sector workers who traditionally lack access to standard insurance, featuring simplified eligibility criteria and affordable premiums. The focus on group affiliation in group insurance contrasts with microinsurance's emphasis on financial inclusion and accessibility for underserved populations.

Premium Structure and Affordability

Group insurance offers a premium structure based on collective risk pooling, resulting in lower individual costs and enhanced affordability for members of large organizations. Microinsurance targets low-income individuals with tailored, smaller coverage plans featuring lower premiums that align with limited financial capacity. Both models strive to optimize affordability but differ in scale and premium calculation methods to meet diverse market needs.

Policy Administration Differences

Group insurance policy administration involves managing a single master policy covering multiple members, streamlining premium collection and claims processing through centralized systems. Microinsurance policy administration requires handling numerous individual policies with simpler terms, often using mobile platforms or agent networks to facilitate accessibility and quick renewals. The key administrative difference lies in volume management and technology use, where group insurance benefits from bulk processing, and microinsurance emphasizes ease of access and affordability for low-income clients.

Claims Process Comparison

Group insurance claims typically involve streamlined procedures where employers act as intermediaries, facilitating faster verification and approval due to bulk policy management. Microinsurance claims processes are designed to be accessible and simple, often leveraging mobile platforms to accommodate low-income clients with minimal documentation requirements. Efficiency in group insurance depends on organizational scale, while microinsurance prioritizes ease of access and quick disbursement to enhance financial inclusion.

Benefits and Limitations

Group insurance offers comprehensive coverage to a large number of employees under a single policy, providing cost-efficiency, risk pooling, and easier administration but may lack customization for individual needs. Microinsurance targets low-income populations with affordable premiums and simplified products, increasing accessibility but often offering limited coverage and benefit amounts. Both types serve distinct market segments, balancing affordability with coverage scope depending on policyholder demographics and financial capacity.

Regulatory Framework and Compliance

Group insurance operates under comprehensive regulatory frameworks designed for protecting larger risk pools and ensuring compliance with labor laws and employee welfare standards. Microinsurance regulations emphasize simplified compliance processes, affordability, and accessibility to accommodate low-income populations and underserved markets. Both frameworks mandate transparent underwriting practices and claims handling, but microinsurance policies prioritize flexibility and reduced capital requirements to foster inclusive financial protection.

Choosing the Right Insurance Solution

Group insurance offers broad coverage for organizations, providing cost-effective protection for employees with benefits like health, life, or disability insurance. Microinsurance targets low-income individuals or small groups, offering affordable, tailored policies that cover specific risks often excluded by traditional insurance. Selecting the right insurance solution depends on factors such as budget constraints, risk exposure, coverage needs, and beneficiary demographics.

Related Important Terms

Parametric Triggers

Parametric triggers in group insurance typically rely on predefined events like natural disasters or economic indicators to expedite claim payouts for large employee pools, enhancing efficiency and reducing administrative costs. Microinsurance leverages parametric triggers by using easily measurable indices such as rainfall levels or crop yields to provide affordable, timely coverage tailored to low-income individuals with limited access to traditional insurance products.

Digital Bancassurance

Group insurance offers comprehensive coverage for employees of organizations, often facilitated through digital bancassurance platforms that streamline policy management and claims processing. Microinsurance targets low-income individuals with affordable, tailored policies delivered via mobile banking and digital channels, enhancing accessibility and financial inclusion in underserved markets.

Peer-to-Peer Grouping

Peer-to-peer grouping in group insurance allows members to pool risks and share premiums, enhancing affordability and coverage scalability for larger collectives. Microinsurance leverages similar peer networks but targets low-income individuals with simplified policies and lower premiums tailored for financial inclusivity.

On-Demand Microcoverage

On-demand microcoverage offers flexible, affordable protection tailored for low-income groups or specific short-term needs, contrasting with traditional group insurance plans that provide broader, long-term coverage for larger employee groups. This microinsurance model leverages digital platforms to enable instant policy activation and payment, enhancing accessibility and convenience for underserved populations.

Usage-Based Premiums

Group insurance typically offers fixed premiums based on collective risk assessment, whereas microinsurance increasingly incorporates usage-based premiums that adjust costs according to individual behavior and real-time data, enhancing affordability and personalized coverage. Usage-based premiums optimize risk management by leveraging telematics and digital data analytics, making microinsurance more accessible for low-income populations with variable income and risk profiles.

Aggregator Platforms

Group insurance leverages aggregator platforms to streamline enrollment and claims management for large collectives, enhancing cost-efficiency and risk pooling. Microinsurance uses these platforms to reach underserved, low-income segments by offering customized, affordable coverage with simplified underwriting processes.

Community Risk Pooling

Group insurance leverages community risk pooling by aggregating premiums from a large member base, enhancing risk diversification and reducing individual costs. Microinsurance targets low-income populations with smaller, affordable coverage units while still relying on collective risk pooling to stabilize claims and premiums within communities.

Embedded Microinsurance

Embedded microinsurance integrates affordable, low-coverage policies directly into products or services, targeting low-income populations frequently excluded from traditional group insurance schemes that offer broader but costlier coverage. This model enhances accessibility and convenience by bundling insurance with everyday purchases, improving financial inclusion and risk protection for vulnerable groups.

Flexible Group Underwriting

Flexible group underwriting in group insurance allows tailored risk assessments based on collective member profiles, enabling businesses to offer customized coverage with streamlined enrollment processes. Microinsurance, by contrast, targets low-income populations with simplified underwriting criteria to ensure affordability and accessibility, typically covering smaller risk pools with limited flexibility.

Instant Claims Processing

Group insurance typically offers streamlined instant claims processing through centralized digital platforms that handle multiple policyholders efficiently, reducing administrative delays. Microinsurance leverages mobile technology for rapid, real-time claims settlement, making instant claims processing accessible for low-income or remote populations with minimal paperwork.

Group Insurance vs Microinsurance Infographic

industrydif.com

industrydif.com