Reinsurance involves an insurance company transferring part of its risk portfolio to another insurer to reduce exposure and stabilize financial performance. Retrocession is the process where a reinsurer cedes risk to another reinsurer, further distributing potential losses within the reinsurance market. Both mechanisms are essential for managing large-scale risks and maintaining industry solvency.

Table of Comparison

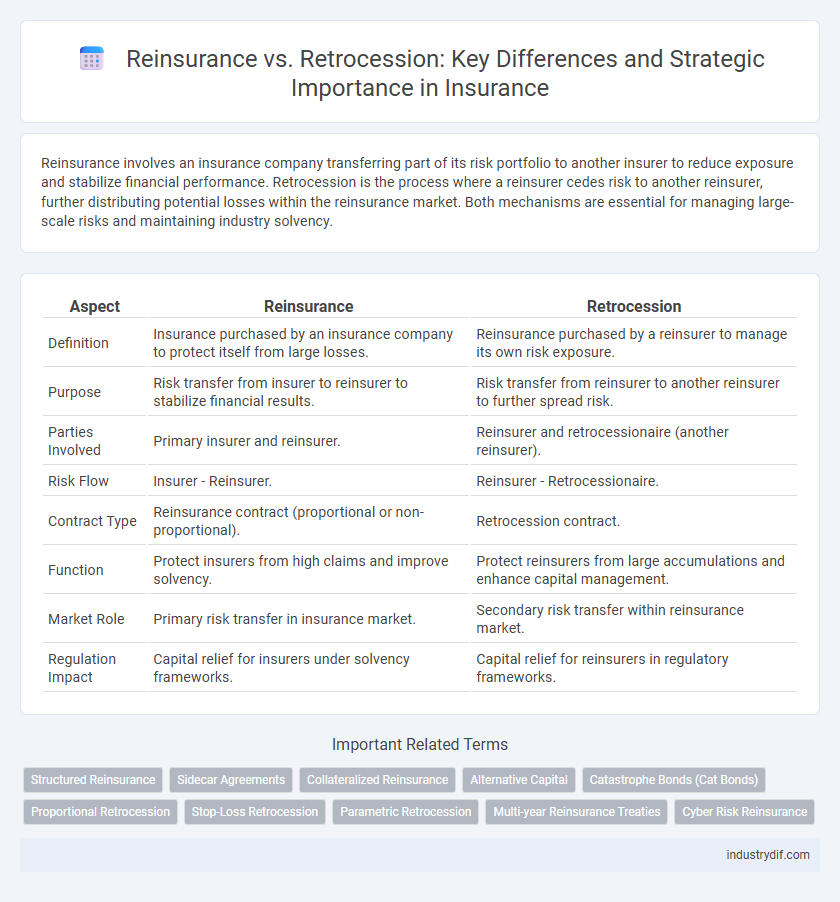

| Aspect | Reinsurance | Retrocession |

|---|---|---|

| Definition | Insurance purchased by an insurance company to protect itself from large losses. | Reinsurance purchased by a reinsurer to manage its own risk exposure. |

| Purpose | Risk transfer from insurer to reinsurer to stabilize financial results. | Risk transfer from reinsurer to another reinsurer to further spread risk. |

| Parties Involved | Primary insurer and reinsurer. | Reinsurer and retrocessionaire (another reinsurer). |

| Risk Flow | Insurer - Reinsurer. | Reinsurer - Retrocessionaire. |

| Contract Type | Reinsurance contract (proportional or non-proportional). | Retrocession contract. |

| Function | Protect insurers from high claims and improve solvency. | Protect reinsurers from large accumulations and enhance capital management. |

| Market Role | Primary risk transfer in insurance market. | Secondary risk transfer within reinsurance market. |

| Regulation Impact | Capital relief for insurers under solvency frameworks. | Capital relief for reinsurers in regulatory frameworks. |

Understanding Reinsurance: Key Concepts and Definitions

Reinsurance involves an insurance company transferring part of its risk portfolio to another insurer to reduce exposure to large losses, improve capital management, and stabilize financial performance. Retrocession refers to the practice where a reinsurer further cedes a portion of its assumed risks to additional reinsurers, creating a layered risk-sharing mechanism in the reinsurance market. Understanding these distinctions is essential for grasping how risk distribution and financial protection operate within the global insurance industry.

What is Retrocession? Breaking Down the Basics

Retrocession is the practice where a reinsurance company transfers portions of its risk portfolio to other reinsurance entities to mitigate exposure. This secondary layer of risk transfer helps reinsurance companies manage capital more effectively and diversify potential losses. By spreading risk through retrocession, the overall insurance ecosystem gains stability and enhanced capacity to underwrite large or complex policies.

Reinsurance vs Retrocession: Core Differences Explained

Reinsurance involves an insurance company transferring part of its risk portfolio to another insurer to reduce exposure, whereas retrocession occurs when a reinsurer passes risks to another reinsurer. The primary difference lies in the parties involved: reinsurance is between the original insurer and a reinsurer, while retrocession is between reinsurers themselves. Understanding these distinctions is crucial for risk management and capital optimization in the insurance industry.

Types of Reinsurance Agreements

Reinsurance agreements primarily include facultative, where coverage is negotiated per risk, and treaty reinsurance, which involves automatic acceptance of a portfolio. Retrocession occurs when a reinsurer cedes risk to another reinsurer, effectively creating a secondary layer of risk transfer to manage exposure. Understanding the distinctions between proportional agreements, such as quota share and surplus, versus non-proportional ones like excess of loss, is essential for optimizing risk distribution in both reinsurance and retrocession contracts.

Types of Retrocession Arrangements

Retrocession arrangements primarily include facultative retrocession, where specific risks are individually negotiated, and treaty retrocession, involving a portfolio of risks passed on under a pre-agreed contract. Proportional retrocession mandates sharing premiums and losses in agreed proportions, while non-proportional retrocession protects against losses exceeding a specified retention limit. These types ensure that reinsurers effectively manage their exposure by transferring portions of risk to retrocessionaires, enhancing overall capital efficiency and risk diversification.

Key Players in Reinsurance and Retrocession Markets

Key players in the reinsurance market include global giants such as Munich Re, Swiss Re, and Hannover Ruck, which dominate by offering risk transfer solutions to primary insurers. In the retrocession market, major reinsurers like Everest Re and Scor act as retrocessionaires, providing a second layer of risk protection by assuming portions of portfolios from primary reinsurers. The dynamic interplay between these top-tier companies ensures risk diversification and financial stability across the entire insurance value chain.

Benefits and Risks: Reinsurance Compared to Retrocession

Reinsurance provides insurers with risk diversification and capital relief by transferring portions of their risk portfolios to reinsurers, enhancing financial stability and underwriting capacity. Retrocession, involving the transfer of risk from reinsurers to retrocessionaires, offers an additional layer of risk management but introduces complexity and potential counterparty risk due to its indirect nature. Both mechanisms mitigate losses, yet reinsurance generally delivers more direct benefits with clearer regulatory oversight, while retrocession carries higher uncertainty and operational risks.

Regulatory Frameworks Impacting Reinsurance and Retrocession

Regulatory frameworks governing reinsurance and retrocession impose critical capital, reporting, and risk management requirements that shape underwriting and risk transfer practices. Solvency II in Europe mandates stringent capital adequacy and transparency for both reinsurers and retrocessionaires, enforcing proportional risk retention and comprehensive disclosure standards. Compliance with these regulations ensures financial stability and mitigates systemic risk in the global insurance market.

The Role of Reinsurance and Retrocession in Risk Management

Reinsurance transfers insurance risk from primary insurers to reinsurers to stabilize loss experience and protect against catastrophic events. Retrocession involves reinsurers ceding portions of their assumed risks to other reinsurers, further distributing potential liabilities and enhancing financial resilience. Both mechanisms are integral to risk management, providing layers of protection that help maintain solvency and optimize capital allocation within the insurance sector.

Emerging Trends in Reinsurance and Retrocession

Emerging trends in reinsurance and retrocession highlight increased adoption of parametric insurance solutions and advanced analytics powered by artificial intelligence to enhance risk assessment and pricing accuracy. The growth of catastrophe bonds and other insurance-linked securities reflects a shift towards diversifying capital sources and improving capital efficiency in the reinsurance market. Insurtech innovation facilitates seamless integration between primary insurers, reinsurers, and retrocessionaires, enabling real-time data exchange and improved portfolio management across global markets.

Related Important Terms

Structured Reinsurance

Structured reinsurance involves tailored risk transfer agreements between primary insurers and reinsurers, enhancing capital efficiency and risk management. Retrocession occurs when reinsurers cede portions of their assumed risks to other reinsurers, further distributing exposure and optimizing portfolio stability.

Sidecar Agreements

Sidecar agreements in reinsurance provide a structure where investors share underwriting risk alongside the insurer, enhancing capital efficiency without transferring risk to another reinsurer, unlike retrocession which involves reinsurers ceding risk to other entities. These agreements enable primary insurers to access additional capital and manage exposure more flexibly compared to traditional retrocession arrangements.

Collateralized Reinsurance

Collateralized reinsurance involves secure funds set aside to cover potential claims, offering enhanced credit protection compared to traditional reinsurance where the reinsurer's creditworthiness is the main backing. Unlike retrocession, which transfers risk from a reinsurer to another reinsurer, collateralized reinsurance provides direct, transparent collateral, reducing counterparty risk and improving liquidity management within insurance portfolios.

Alternative Capital

Alternative capital in reinsurance leverages non-traditional investors to provide risk transfer solutions, enhancing market capacity beyond conventional reinsurers. Retrocession, as a secondary layer of risk transfer, often incorporates alternative capital to diversify risk exposure and optimize capital efficiency within the broader reinsurance ecosystem.

Catastrophe Bonds (Cat Bonds)

Catastrophe bonds (Cat Bonds) serve as a risk transfer mechanism within reinsurance by allowing insurers to mitigate exposure to catastrophic events through capital markets, while retrocession involves reinsurance companies ceding portions of their risk portfolios to other reinsurers to further diversify and manage risk. Cat Bonds provide a direct way to finance catastrophe risk with investors absorbing losses if predefined disaster triggers occur, contrasting retrocession's traditional risk-sharing approach among reinsurers.

Proportional Retrocession

Proportional retrocession involves a reinsurer ceding a fixed share of premiums and losses to another reinsurer, maintaining proportional risk transfer that mirrors the original reinsurance agreement. This method optimizes capital management and risk diversification by allowing insurers to spread potential losses across multiple entities.

Stop-Loss Retrocession

Stop-loss retrocession is a risk management strategy within reinsurance where a reinsurer transfers excess losses above a predetermined threshold to another reinsurer, thereby limiting potential financial exposure. This mechanism enhances capital protection by capping aggregate losses that the primary reinsurer must retain, optimizing overall risk distribution in complex insurance portfolios.

Parametric Retrocession

Parametric retrocession involves transferring insurance risk based on predefined parameters, such as weather triggers or index values, offering insurers immediate financial relief without loss assessments. Unlike traditional reinsurance, parametric retrocession enables faster claims settlements by relying on objective data, enhancing risk management efficiency in catastrophic event coverage.

Multi-year Reinsurance Treaties

Multi-year reinsurance treaties provide long-term risk transfer agreements that enhance underwriting stability and capital management for insurers, while retrocession serves as reinsurance for reinsurers, redistributing risk exposure to further diversify portfolios. Both mechanisms optimize risk distribution but differ in contractual structure and participant roles within the insurance ecosystem.

Cyber Risk Reinsurance

Reinsurance in cyber risk involves insurers transferring portions of their cyber liability portfolios to mitigate large-scale cyber event losses, while retrocession further disperses these risks by reinsurers ceding parts of their assumed exposures to other reinsurance companies. Effective cyber risk reinsurance and retrocession strategies enhance capital efficiency and enable insurers to manage accumulating cyber threats from data breaches, ransomware, and system outages.

Reinsurance vs Retrocession Infographic

industrydif.com

industrydif.com