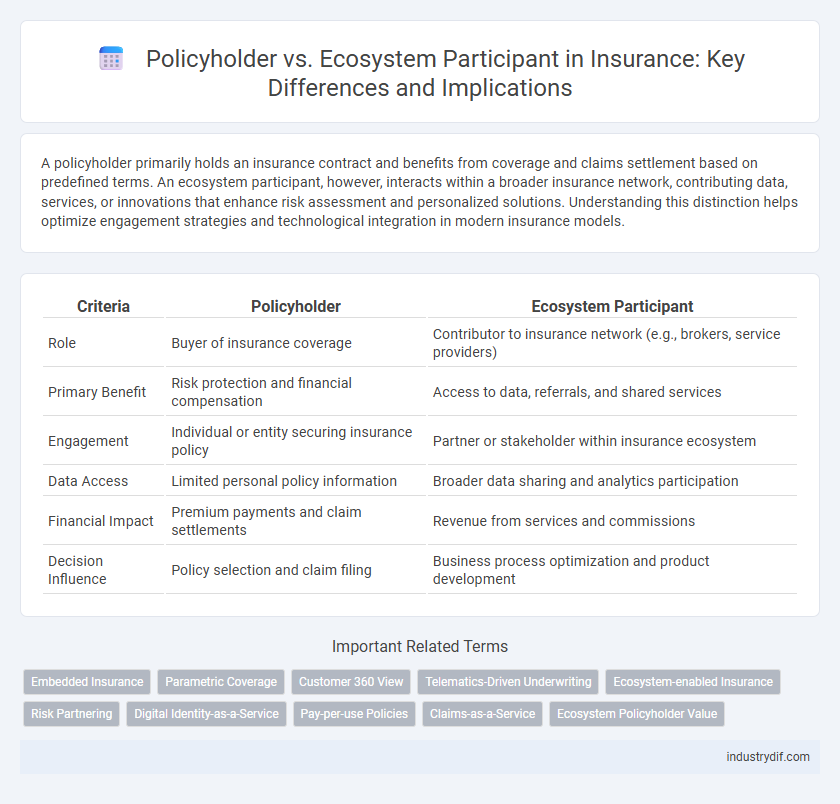

A policyholder primarily holds an insurance contract and benefits from coverage and claims settlement based on predefined terms. An ecosystem participant, however, interacts within a broader insurance network, contributing data, services, or innovations that enhance risk assessment and personalized solutions. Understanding this distinction helps optimize engagement strategies and technological integration in modern insurance models.

Table of Comparison

| Criteria | Policyholder | Ecosystem Participant |

|---|---|---|

| Role | Buyer of insurance coverage | Contributor to insurance network (e.g., brokers, service providers) |

| Primary Benefit | Risk protection and financial compensation | Access to data, referrals, and shared services |

| Engagement | Individual or entity securing insurance policy | Partner or stakeholder within insurance ecosystem |

| Data Access | Limited personal policy information | Broader data sharing and analytics participation |

| Financial Impact | Premium payments and claim settlements | Revenue from services and commissions |

| Decision Influence | Policy selection and claim filing | Business process optimization and product development |

Defining the Policyholder in Insurance

The policyholder in insurance is the individual or entity who owns the insurance contract and holds the rights to its benefits, responsibilities, and obligations. This role is distinct from ecosystem participants such as insurers, brokers, or service providers who facilitate various functions within the insurance value chain. Defining the policyholder precisely is crucial for legal clarity, claims processing, and ensuring accountability within the insurance ecosystem.

Who is an Ecosystem Participant?

An ecosystem participant in insurance refers to entities such as brokers, service providers, reinsurers, and technology partners who interact within the insurance value chain but do not hold the insurance policy directly. Unlike a policyholder, who is the individual or organization purchasing and owning an insurance contract, ecosystem participants contribute to risk assessment, underwriting, claims processing, or customer engagement. These participants play a pivotal role in enhancing the efficiency, innovation, and collaboration across the insurance ecosystem.

Core Roles: Policyholder vs Ecosystem Participant

Policyholders are the primary insured individuals or entities who purchase insurance policies and bear the financial responsibility for premiums and claims. Ecosystem participants encompass a broader network including insurers, brokers, agents, reinsurers, and service providers collaborating to deliver comprehensive insurance solutions. The core roles differ as policyholders are end customers holding coverage rights, while ecosystem participants enable risk management, distribution, and claims processing within the insurance value chain.

Policyholder Rights and Responsibilities

Policyholders hold specific rights including access to clear policy information, claims filing, and dispute resolution, ensuring transparency and protection under insurance contracts. Their responsibilities encompass providing accurate information during application, timely premium payments, and notifying the insurer of relevant changes to maintain coverage validity. Ecosystem participants, such as brokers and service providers, support these functions but do not share the core policyholder obligations tied to contract enforcement and claims entitlement.

Ecosystem Participant Functions in Insurance

Ecosystem participants in insurance include brokers, underwriters, reinsurers, and service providers who collaboratively enhance risk assessment, claims processing, and customer engagement. Their functions involve data sharing, risk pooling, and innovation in product offerings to improve efficiency and customer experience. Leveraging technology platforms, these participants enable seamless integration and real-time communication across the insurance value chain.

Value Creation: Individuals vs Ecosystem

Policyholders contribute value primarily through premium payments, securing personal financial protection and risk mitigation. Ecosystem participants enhance value by fostering collaboration, data sharing, and innovative service offerings that improve risk assessment and customer experience across the insurance network. This collective engagement drives greater efficiency, personalized coverage, and long-term sustainability for the entire insurance ecosystem.

Data Ownership and Privacy Concerns

Policyholders maintain primary ownership and control over their personal data, ensuring compliance with data privacy regulations such as GDPR and CCPA. Ecosystem participants, including insurers, brokers, and third-party service providers, access data through consent-based frameworks designed to protect sensitive information while enabling seamless service delivery. Transparent data governance models prioritize privacy protection, minimizing risks associated with data sharing across insurance ecosystems.

Claims Process: Policyholder Perspective

Policyholders play a central role in the insurance claims process by initiating claims, providing necessary documentation, and communicating directly with insurers to expedite resolution. Their experience is shaped by clear policy terms, timely updates, and transparent claim assessment procedures, which influence satisfaction and trust. Efficient claims handling systems integrating digital tools enhance policyholder engagement, reduce processing times, and minimize disputes during claim settlements.

Collaboration within the Insurance Ecosystem

Policyholders and ecosystem participants collaborate through integrated digital platforms that streamline risk assessment, claims processing, and personalized product offerings. Leveraging shared data analytics, both parties enhance transparency and trust, fostering a proactive approach to insurance coverage and risk management. This synergy drives innovation in underwriting models and customer experience across the insurance value chain.

The Future: Evolving from Policyholder to Ecosystem Participant

The future of insurance emphasizes the transformation from traditional policyholders to active ecosystem participants, leveraging interconnected digital platforms for personalized risk management and value creation. Ecosystem participants engage in real-time data sharing, enabling insurers to offer dynamic policies that adapt to lifestyle changes and emerging risks. This evolution fosters greater collaboration, enhances customer experience, and drives innovation across the entire insurance value chain.

Related Important Terms

Embedded Insurance

Policyholders traditionally purchase insurance policies directly from providers, while ecosystem participants engage with embedded insurance integrated seamlessly within products and services they already use. Embedded insurance enhances customer experience by offering tailored coverage options at the point of need, increasing accessibility and driving higher adoption rates within diverse digital ecosystems.

Parametric Coverage

Parametric coverage in insurance automates payouts for policyholders based on predefined triggers such as weather events, reducing claims processing time and increasing transparency. Ecosystem participants, including insurers, reinsurers, and data providers, collaborate to integrate real-time data, enabling seamless parametric policy execution and risk transfer.

Customer 360 View

A comprehensive Customer 360 View integrates data from both Policyholders and Ecosystem Participants, enabling insurers to deliver personalized experiences and optimize risk assessment. Leveraging unified profiles that combine insurance policies, claims history, and third-party interactions enhances decision-making and drives customer-centric strategies.

Telematics-Driven Underwriting

Telematics-driven underwriting leverages real-time data from ecosystem participants, such as drivers and connected vehicles, to create personalized insurance policies that enhance risk assessment accuracy compared to traditional policyholder metrics. This approach enables insurers to move beyond static information, dynamically adjusting premiums and coverage based on actual behavior within the telematics ecosystem.

Ecosystem-enabled Insurance

Ecosystem-enabled insurance transforms traditional policyholder roles by integrating participants such as service providers, technology platforms, and data aggregators into a connected network that enhances risk assessment and personalized coverage. This collaborative model leverages real-time data and seamless interactions to optimize underwriting, claims processing, and customer engagement beyond individual policyholder boundaries.

Risk Partnering

Policyholders actively manage insurance coverage while ecosystem participants engage collaboratively to share risks and enhance overall risk mitigation strategies. Risk partnering within insurance ecosystems drives innovation by pooling data and resources, resulting in tailored policies and improved loss prevention.

Digital Identity-as-a-Service

Policyholders benefit from Digital Identity-as-a-Service by experiencing streamlined access to insurance products through secure, verifiable digital credentials, enhancing trust and reducing fraud. Ecosystem participants, including insurers, brokers, and service providers, leverage this technology to enable seamless identity management, improve customer onboarding, and facilitate interoperability across diverse platforms within the insurance ecosystem.

Pay-per-use Policies

Pay-per-use policies enable policyholders to pay premiums based on actual usage or risk exposure, offering personalized and cost-effective insurance solutions. Ecosystem participants contribute data and services that enhance risk assessment accuracy and facilitate seamless claims processing within these usage-based insurance models.

Claims-as-a-Service

Policyholders utilize Claims-as-a-Service platforms to streamline and expedite insurance claim processes, improving transparency and customer satisfaction. Ecosystem participants, including insurers, third-party service providers, and technology partners, collaborate within these digital frameworks to enhance data sharing, risk assessment, and operational efficiency.

Ecosystem Policyholder Value

Ecosystem policyholder value in insurance is enhanced by integrating diverse services and data sources, enabling personalized risk assessments and tailored coverage options. This approach transforms traditional policyholders into active ecosystem participants, driving improved customer engagement and optimized claims management through collaborative digital platforms.

Policyholder vs Ecosystem Participant Infographic

industrydif.com

industrydif.com