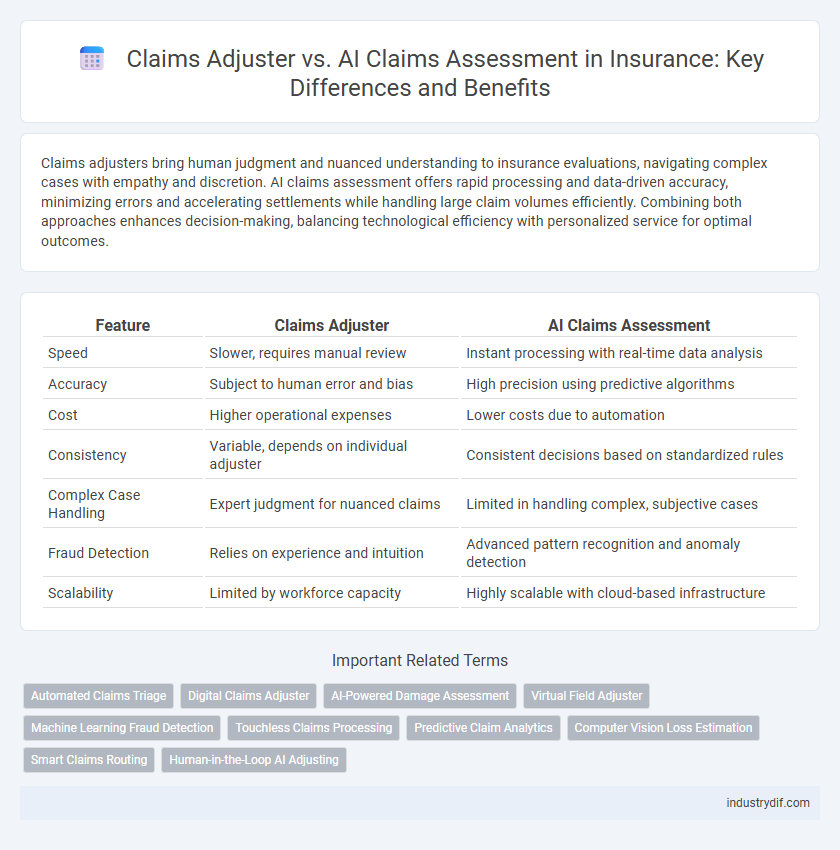

Claims adjusters bring human judgment and nuanced understanding to insurance evaluations, navigating complex cases with empathy and discretion. AI claims assessment offers rapid processing and data-driven accuracy, minimizing errors and accelerating settlements while handling large claim volumes efficiently. Combining both approaches enhances decision-making, balancing technological efficiency with personalized service for optimal outcomes.

Table of Comparison

| Feature | Claims Adjuster | AI Claims Assessment |

|---|---|---|

| Speed | Slower, requires manual review | Instant processing with real-time data analysis |

| Accuracy | Subject to human error and bias | High precision using predictive algorithms |

| Cost | Higher operational expenses | Lower costs due to automation |

| Consistency | Variable, depends on individual adjuster | Consistent decisions based on standardized rules |

| Complex Case Handling | Expert judgment for nuanced claims | Limited in handling complex, subjective cases |

| Fraud Detection | Relies on experience and intuition | Advanced pattern recognition and anomaly detection |

| Scalability | Limited by workforce capacity | Highly scalable with cloud-based infrastructure |

Introduction to Claims Assessment in Insurance

Claims assessment in insurance involves evaluating the validity and extent of a policyholder's claim to determine appropriate compensation. Claims adjusters traditionally conduct detailed investigations, analyzing evidence, documenting damages, and negotiating settlements to ensure fair outcomes. AI claims assessment leverages machine learning algorithms and data analytics to automate damage evaluation, fraud detection, and risk estimation, enhancing efficiency and accuracy in the claims process.

Defining the Role of a Claims Adjuster

A Claims Adjuster investigates insurance claims by evaluating damage, interviewing witnesses, and reviewing policy terms to determine settlement amounts accurately. Unlike AI Claims Assessment, which uses algorithms to analyze data quickly, a Claims Adjuster applies human judgment to handle complex cases and assess nuances in claim validity. This role is critical for maintaining fairness and accuracy in the insurance claims process.

How AI is Transforming Claims Assessment

AI is revolutionizing claims assessment by enabling faster and more accurate evaluation of insurance claims through machine learning algorithms that analyze vast datasets and detect patterns beyond human capability. Automated AI systems reduce human error, lower operational costs, and improve customer satisfaction by delivering real-time claim decisions. This transformation enhances fraud detection, streamlines workflows, and accelerates settlement processes in the insurance industry.

Human Expertise vs. AI Automation in Claims Processing

Claims adjusters leverage deep industry knowledge and empathy to evaluate damage, assess liability, and negotiate settlements, ensuring personalized and context-sensitive decisions. AI claims assessment automates data analysis and pattern recognition at high speed, improving efficiency and consistency while reducing human bias and errors in large-scale claims processing. Combining human expertise with AI-driven automation optimizes claim accuracy, accelerates resolution times, and enhances overall customer satisfaction in the insurance industry.

Speed and Efficiency: Manual vs. AI-driven Claims

AI-driven claims assessment significantly accelerates the processing time by instantly analyzing vast datasets and identifying patterns that manual claims adjusters might overlook. Manual claims adjusters, while thorough, often require days or weeks to complete investigations and verify information, slowing down settlements. The efficiency of AI systems reduces human error and operational costs, enabling faster claim resolutions and improving customer satisfaction.

Accuracy and Consistency in Claims Evaluation

Claims adjusters bring expert judgment and contextual understanding to evaluating insurance claims, ensuring nuanced accuracy based on individual case factors. AI claims assessment leverages machine learning algorithms to deliver high consistency by minimizing human error and processing large datasets efficiently. Combining human expertise with AI technology enhances overall claims evaluation accuracy and uniformity across diverse claim scenarios.

Customer Experience: Personal Touch vs. Digital Solutions

Claims adjusters offer personalized customer interactions by evaluating individual cases with empathy and nuanced judgment, enhancing trust and satisfaction. AI claims assessment streamlines the process through rapid data analysis and automation, providing convenience and faster resolution times for policyholders. Balancing human insight and digital efficiency can significantly improve overall customer experience in insurance claims handling.

Cost Implications: Traditional Adjusters vs. AI Systems

Traditional claims adjusters incur higher operational costs due to salaries, training, and time-intensive investigations, impacting overall insurance claim expenses. AI claims assessment systems significantly reduce costs by automating data analysis, minimizing human error, and accelerating claim resolutions. Insurers adopting AI technology benefit from lower overhead and improved scalability, optimizing cost-efficiency in claims management.

Data Security and Privacy Considerations

Claims adjusters handle sensitive personal and financial information, requiring strict adherence to data security protocols and privacy regulations such as GDPR and HIPAA to protect client data. AI claims assessment tools utilize advanced encryption and anonymization techniques to secure data, but pose risks related to potential algorithmic biases and unauthorized access if not properly managed. Both approaches must implement comprehensive data governance frameworks to maintain confidentiality and comply with evolving cybersecurity standards.

The Future of Claims Assessment: Collaboration or Replacement?

Claims adjusters bring critical expertise in nuanced decision-making and personalized customer interactions that AI claims assessment tools currently cannot fully replicate. AI enhances efficiency by rapidly analyzing large datasets, detecting fraud, and streamlining routine claim processing, creating opportunities for collaboration rather than outright replacement. The future of claims assessment lies in integrating AI-driven insights with human judgment to achieve accuracy, speed, and empathetic service in insurance claims handling.

Related Important Terms

Automated Claims Triage

Automated claims triage powered by AI enhances efficiency by rapidly categorizing and prioritizing insurance claims based on severity and complexity, reducing manual workload for claims adjusters. This technology leverages machine learning algorithms to analyze claim data, enabling faster decision-making and improved resource allocation compared to traditional claims adjuster methods.

Digital Claims Adjuster

Digital claims adjusters leverage artificial intelligence algorithms to analyze policy details, damage reports, and historical data, significantly reducing processing time and enhancing accuracy compared to traditional claims adjusters. AI-driven assessments enable real-time fraud detection and predictive analytics, optimizing claim settlement efficiency and customer satisfaction in the insurance industry.

AI-Powered Damage Assessment

AI-powered damage assessment leverages advanced machine learning algorithms and computer vision to rapidly analyze claim images and data, delivering highly accurate damage evaluations with minimal human intervention. This technology enhances efficiency by reducing processing time and improving consistency, surpassing traditional claims adjuster methods in scalability and precision.

Virtual Field Adjuster

Virtual Field Adjusters leverage AI-driven tools to enhance the accuracy and efficiency of claims assessments by remotely collecting and analyzing real-time data from claim sites. This technology reduces the need for physical inspections, speeds up claim resolutions, and optimizes resource allocation while maintaining precise damage evaluations.

Machine Learning Fraud Detection

Machine learning fraud detection revolutionizes claims adjustment by analyzing vast datasets to identify unusual patterns and flag potentially fraudulent claims more accurately than traditional methods. AI-driven claims assessment enhances efficiency, reduces human error, and accelerates the verification process while continuously improving through advanced algorithms and data training.

Touchless Claims Processing

Touchless claims processing leverages AI claims assessment to automate damage evaluation, accelerating claim resolution and reducing human error compared to traditional claims adjusters. This technology enables insurance companies to enhance operational efficiency and improve customer satisfaction by minimizing manual intervention.

Predictive Claim Analytics

Claims adjusters rely on experience and manual evaluation to assess insurance claims, while AI claims assessment leverages predictive claim analytics to analyze large datasets and identify patterns, enabling faster and more accurate damage estimation. Predictive claim analytics improves fraud detection, optimizes settlement processes, and enhances customer satisfaction by reducing claim processing times through machine learning algorithms.

Computer Vision Loss Estimation

Claims adjusters evaluate insurance losses by inspecting physical damages and verifying policy coverage, often requiring site visits and manual documentation. AI claims assessment leverages computer vision technology to quickly analyze images, accurately estimate losses, and streamline the claims process by reducing human error and accelerating decision-making.

Smart Claims Routing

Smart claims routing uses AI claims assessment to analyze and direct insurance claims to the most appropriate claims adjuster based on complexity, risk, and specialization, enhancing processing efficiency. This integration reduces human error and accelerates claim resolution while optimizing resource allocation in claims management.

Human-in-the-Loop AI Adjusting

Human-in-the-Loop AI adjusting combines advanced machine learning algorithms with expert claims adjusters to enhance accuracy and efficiency in insurance claims processing. This hybrid approach leverages AI for rapid data analysis while allowing human adjusters to evaluate complex cases, ensuring precise fraud detection and fair settlement decisions.

Claims Adjuster vs AI Claims Assessment Infographic

industrydif.com

industrydif.com