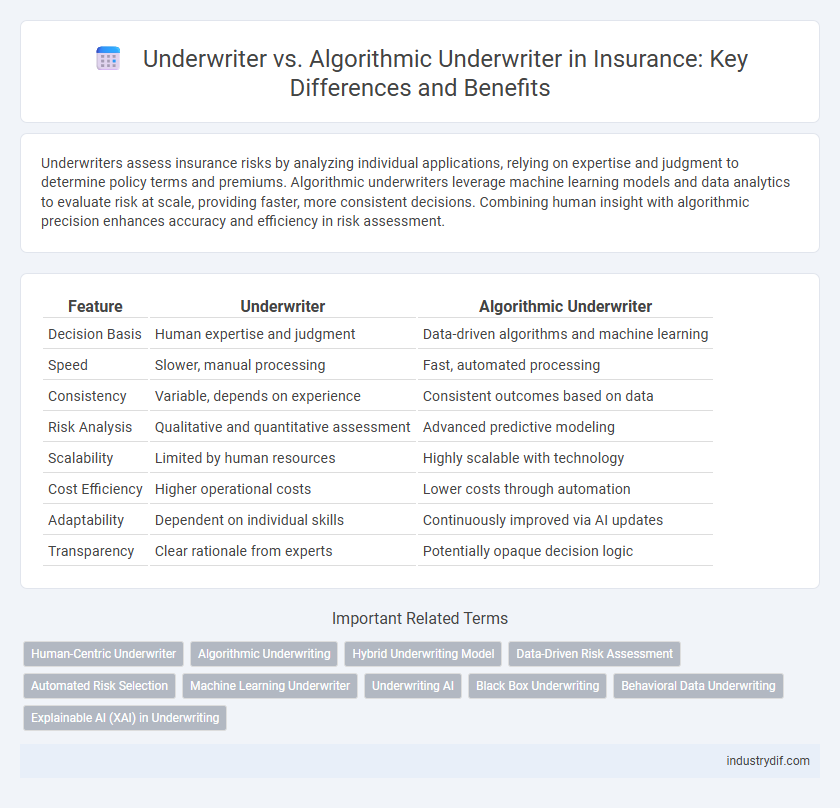

Underwriters assess insurance risks by analyzing individual applications, relying on expertise and judgment to determine policy terms and premiums. Algorithmic underwriters leverage machine learning models and data analytics to evaluate risk at scale, providing faster, more consistent decisions. Combining human insight with algorithmic precision enhances accuracy and efficiency in risk assessment.

Table of Comparison

| Feature | Underwriter | Algorithmic Underwriter |

|---|---|---|

| Decision Basis | Human expertise and judgment | Data-driven algorithms and machine learning |

| Speed | Slower, manual processing | Fast, automated processing |

| Consistency | Variable, depends on experience | Consistent outcomes based on data |

| Risk Analysis | Qualitative and quantitative assessment | Advanced predictive modeling |

| Scalability | Limited by human resources | Highly scalable with technology |

| Cost Efficiency | Higher operational costs | Lower costs through automation |

| Adaptability | Dependent on individual skills | Continuously improved via AI updates |

| Transparency | Clear rationale from experts | Potentially opaque decision logic |

Understanding Traditional Underwriting in Insurance

Traditional underwriting in insurance involves a skilled underwriter assessing risk by evaluating detailed client information, medical history, and financial data to determine policy terms and premiums. This manual process relies heavily on the underwriter's expertise, intuition, and experience to make nuanced decisions that factor in unique, often subjective risk elements. Unlike algorithmic underwriting, traditional methods can personalize risk assessment but may be slower and more prone to human error.

What is an Algorithmic Underwriter?

An algorithmic underwriter leverages advanced data analytics and machine learning models to assess risk and make underwriting decisions with greater speed and accuracy than traditional methods. By analyzing vast datasets, including historical claims, customer behavior, and external factors, algorithmic underwriters reduce human bias and improve risk assessment precision. This technology streamlines the insurance underwriting process, enabling real-time decision-making and personalized policy pricing.

Key Differences: Human vs Algorithmic Underwriting

Human underwriting relies on expert judgment and experience to assess risk by interpreting complex applications and unique circumstances, while algorithmic underwriting utilizes data-driven models and machine learning to process vast amounts of information quickly and consistently. Algorithmic underwriters excel in handling large datasets and identifying patterns for accurate risk prediction but may lack the nuanced understanding of atypical cases that human underwriters provide. The integration of algorithmic tools aims to enhance efficiency and reduce subjective bias, whereas human underwriters offer adaptability and personalized decision-making in complex insurance evaluations.

The Role of Expertise in Human Underwriting

Human underwriters leverage extensive industry knowledge and experience to assess risk factors that algorithms might overlook, ensuring nuanced decision-making in insurance policy approvals. Expertise allows underwriters to interpret complex scenarios, such as subtle fraud indicators or evolving market conditions, which enhance underwriting accuracy and policy customization. This human insight complements algorithmic data analysis, improving the overall risk evaluation and pricing strategies in insurance underwriting.

Efficiency and Speed: Algorithmic Underwriting Advantages

Algorithmic underwriting significantly enhances efficiency and speed by automatically analyzing vast datasets and delivering instant risk assessments compared to traditional underwriters who manually evaluate applications. This technology reduces processing time from days to minutes, enabling faster policy issuance and improved customer satisfaction. Data-driven algorithms also minimize human error, ensuring consistent and objective underwriting decisions.

Risk Assessment Methods: Manual vs Algorithmic Approaches

Traditional underwriters rely on manual risk assessment methods, analyzing applicant data through expert judgment and experience to determine insurance eligibility and premiums. Algorithmic underwriters employ machine learning models and data analytics to process large volumes of information quickly, identifying subtle risk patterns and enhancing accuracy in underwriting decisions. This shift towards algorithmic approaches enables insurers to streamline operations, reduce human bias, and improve predictive risk evaluation.

Data Usage and Technology in Algorithmic Underwriting

Algorithmic underwriters leverage advanced machine learning models and big data analytics to assess risk more accurately and efficiently than traditional underwriters. These systems integrate diverse data sources such as social media, IoT devices, and historical claim records to generate predictive risk scores in real-time. Enhanced by artificial intelligence, algorithmic underwriting reduces human bias and accelerates policy approval processes through automated decision-making frameworks.

Challenges Faced by Traditional and Algorithmic Underwriters

Traditional underwriters face challenges such as subjective risk assessment, high processing time, and limited scalability in handling large volumes of insurance applications. Algorithmic underwriters encounter difficulties including data quality issues, model bias, and lack of transparency in automated decision-making processes. Both approaches must address regulatory compliance and evolving fraud techniques to optimize underwriting accuracy and efficiency.

Impact on Claims and Customer Experience

Traditional underwriters leverage expertise to assess risk, potentially leading to longer claims processing times and variable customer experience. Algorithmic underwriters utilize advanced data analytics and machine learning models to expedite risk evaluation, resulting in faster claims settlements and more consistent customer interactions. This shift enhances operational efficiency and improves policyholder satisfaction by reducing manual errors and enabling real-time decision-making.

Future Trends: The Evolution of Underwriting in Insurance

Future trends in insurance underwriting demonstrate a shift from traditional underwriters to algorithmic underwriters powered by artificial intelligence and big data analytics. Algorithmic underwriters enhance risk assessment accuracy and expedite policy approval processes by leveraging machine learning models on vast datasets. This evolution drives more personalized insurance products, reduces human bias, and optimizes operational efficiency across underwriting functions.

Related Important Terms

Human-Centric Underwriter

Human-centric underwriters leverage expert judgment and nuanced risk assessment skills to evaluate insurance applications, offering personalized decisions that account for complex variables beyond algorithmic capabilities. Unlike algorithmic underwriters that rely solely on data patterns and automated rules, human underwriters ensure ethical considerations and context-specific insights drive underwriting accuracy and customer trust.

Algorithmic Underwriting

Algorithmic underwriting leverages advanced machine learning models and big data analytics to assess risk with greater accuracy and efficiency compared to traditional underwriters, enabling faster policy decisions and personalized premium pricing. By continuously improving through real-time data inputs and pattern recognition, algorithmic underwriters enhance risk prediction while reducing human bias and operational costs.

Hybrid Underwriting Model

The Hybrid Underwriting Model combines traditional underwriter expertise with algorithmic underwriters to enhance risk assessment accuracy and expedite policy approvals. This approach leverages data-driven algorithms alongside human judgment to optimize underwriting efficiency and improve decision-making quality in insurance risk evaluation.

Data-Driven Risk Assessment

Underwriters leverage expert judgment and historical data to evaluate insurance risks, while algorithmic underwriters use advanced machine learning models to analyze vast datasets for more precise risk assessment. The integration of algorithmic underwriting enhances predictive accuracy and accelerates decision-making by identifying patterns invisible to traditional methods.

Automated Risk Selection

Underwriters manually assess insurance applications to evaluate risk based on experience and judgment, while algorithmic underwriters use automated risk selection powered by machine learning models to analyze vast datasets for faster and more consistent decision-making. Automated risk selection enhances accuracy and efficiency by identifying patterns and predicting risk with minimal human intervention, leading to optimized underwriting processes and improved portfolio performance.

Machine Learning Underwriter

Machine learning underwriters leverage advanced algorithms to analyze vast datasets, enhancing accuracy and speed in risk assessment compared to traditional underwriters. These AI-driven models continuously learn from new information, enabling more precise policy pricing and fraud detection in insurance underwriting.

Underwriting AI

Underwriting AI leverages machine learning algorithms to analyze vast datasets, improving risk assessment accuracy and speeding the underwriting process compared to traditional human underwriters. Algorithmic underwriters enhance consistency and reduce human bias, enabling insurers to optimize pricing models and streamline policy approvals efficiently.

Black Box Underwriting

Black Box Underwriting relies on complex algorithms and machine learning models to assess insurance risk without transparent insight into decision-making processes, contrasting with traditional underwriters who evaluate risk through human judgment and explicit criteria. While Black Box algorithms can process vast amounts of data rapidly, their lack of explainability raises concerns about model bias, regulatory compliance, and accountability in underwriting decisions.

Behavioral Data Underwriting

Behavioral data underwriting enhances algorithmic underwriters by analyzing real-time consumer actions, enabling more precise risk assessment compared to traditional underwriters who rely on static historical data. Integrating behavioral insights allows algorithmic underwriters to identify nuanced patterns in policyholder behavior, improving prediction accuracy and personalized insurance pricing.

Explainable AI (XAI) in Underwriting

Explainable AI (XAI) in underwriting enhances transparency by allowing algorithmic underwriters to provide clear, interpretable reasons behind risk assessments and decisions, bridging the gap between traditional human underwriters and automated models. This integration improves trust, compliance, and accuracy in insurance risk evaluation while maintaining regulatory standards.

Underwriter vs Algorithmic Underwriter Infographic

industrydif.com

industrydif.com