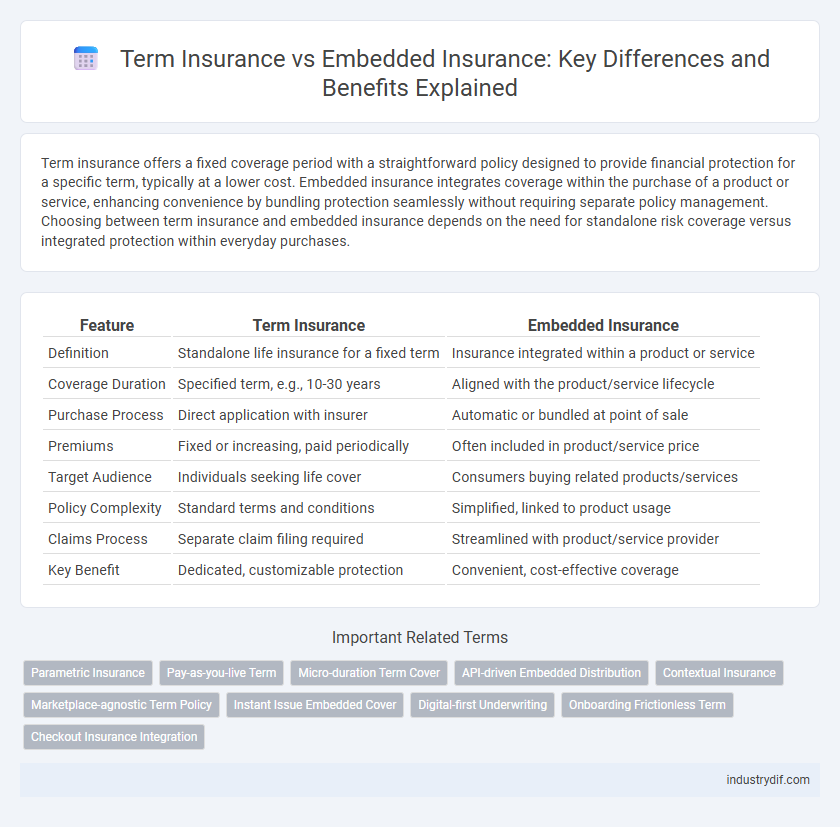

Term insurance offers a fixed coverage period with a straightforward policy designed to provide financial protection for a specific term, typically at a lower cost. Embedded insurance integrates coverage within the purchase of a product or service, enhancing convenience by bundling protection seamlessly without requiring separate policy management. Choosing between term insurance and embedded insurance depends on the need for standalone risk coverage versus integrated protection within everyday purchases.

Table of Comparison

| Feature | Term Insurance | Embedded Insurance |

|---|---|---|

| Definition | Standalone life insurance for a fixed term | Insurance integrated within a product or service |

| Coverage Duration | Specified term, e.g., 10-30 years | Aligned with the product/service lifecycle |

| Purchase Process | Direct application with insurer | Automatic or bundled at point of sale |

| Premiums | Fixed or increasing, paid periodically | Often included in product/service price |

| Target Audience | Individuals seeking life cover | Consumers buying related products/services |

| Policy Complexity | Standard terms and conditions | Simplified, linked to product usage |

| Claims Process | Separate claim filing required | Streamlined with product/service provider |

| Key Benefit | Dedicated, customizable protection | Convenient, cost-effective coverage |

Definition of Term Insurance

Term insurance is a life insurance policy that provides coverage for a specified period, offering a death benefit if the insured passes away during the term. It does not accumulate cash value, making it a cost-effective choice for pure protection needs. This type of insurance is ideal for individuals seeking straightforward financial security for a set duration, such as mortgage protection or income replacement.

Definition of Embedded Insurance

Embedded insurance refers to insurance coverage integrated directly into the purchase of a product or service, eliminating the need for separate policies or claims processes. Unlike traditional term insurance that offers standalone life coverage for a fixed period, embedded insurance seamlessly bundles protection with transactions such as travel bookings or electronics purchases. This integration enhances customer convenience and often results in more personalized risk management tailored to specific activities or goods.

Key Features of Term Insurance

Term insurance offers affordable, fixed-coverage protection for a specified period, providing a death benefit only if the insured passes away within the term. Key features include low premiums, straightforward policy structure, and the ability to customize coverage duration to match financial obligations like mortgages or education expenses. Unlike embedded insurance, which integrates coverage with products or services, term insurance separates pure risk protection without investment components or cash value accumulation.

Key Features of Embedded Insurance

Embedded insurance integrates coverage seamlessly within the purchase of products or services, offering convenience and immediate protection without separate policy applications. Key features include automatic enrollment, tailored coverage aligned with the primary product, and simplified claims processes that enhance customer experience. This approach leverages digital platforms to provide cost-effective, accessible insurance solutions, promoting higher adoption rates compared to standalone term insurance policies.

Benefits of Term Insurance

Term insurance offers affordable premium rates and straightforward coverage for a specified period, making it ideal for long-term financial protection. It provides a guaranteed death benefit to beneficiaries, ensuring financial security in case of untimely demise. Unlike embedded insurance, term insurance allows policyholders to customize coverage amounts and durations to suit individual needs.

Benefits of Embedded Insurance

Embedded insurance integrates coverage seamlessly into products or services, enhancing customer convenience and simplifying the purchasing process. This approach increases accessibility by offering tailored insurance options at the point of sale, leading to higher conversion rates and improved customer satisfaction. Businesses benefit from embedded insurance through increased revenue streams and stronger customer loyalty due to the value-added service integration.

Term Insurance vs Embedded Insurance: Coverage Comparison

Term insurance offers fixed coverage for a specified period, providing a predetermined death benefit that ensures financial security if the insured passes away during the term. Embedded insurance integrates coverage within the purchase of goods or services, offering limited protection tied to the primary product with less flexibility in benefit amounts and durations. Comparing the two, term insurance provides more customizable and comprehensive coverage, while embedded insurance delivers convenience but often with lower coverage limits and shorter protection periods.

Cost Differences Between Term and Embedded Insurance

Term insurance typically involves a standalone premium that offers coverage for a specified period, often resulting in lower upfront costs compared to embedded insurance. Embedded insurance is integrated into a product or service, which can lead to higher overall costs driven by bundled pricing and administrative fees. Consumers may find term insurance more cost-effective due to its transparency and flexibility in choosing coverage amounts and durations.

Choosing the Right Insurance: Factors to Consider

Choosing the right insurance requires evaluating factors such as coverage duration, premium flexibility, and risk exposure. Term insurance offers fixed coverage for a specific period, making it ideal for temporary financial protection, while embedded insurance integrates coverage within a product or service, enhancing convenience and cost-effectiveness. Assessing personal financial goals, affordability, and the nature of the insured asset ensures an informed decision between term and embedded insurance options.

Future Trends in Term and Embedded Insurance

Future trends in term insurance reveal increasing integration with digital platforms, leveraging AI to personalize policies and streamline claims processing for enhanced customer experience. Embedded insurance is expected to grow through strategic partnerships within ecosystems like travel, e-commerce, and automotive, offering seamless coverage at the point of sale. Both models emphasize data-driven underwriting and real-time risk assessment, positioning insurers to meet evolving consumer demands and regulatory requirements.

Related Important Terms

Parametric Insurance

Parametric insurance, a type of embedded insurance, offers automatic payouts triggered by predefined events or parameters, enhancing transparency and speed compared to traditional term insurance that requires claim assessments. This innovative approach reduces claim disputes and accelerates coverage for specific risks like weather events, making it ideal for sectors needing quick, data-driven compensation.

Pay-as-you-live Term

Pay-as-you-live term insurance adapts coverage based on real-time lifestyle and health data, reducing premiums for lower-risk behavior compared to traditional fixed-term policies. Embedded insurance integrates term coverage directly into products or services, offering seamless protection without separate policy management while pay-as-you-live optimizes cost through usage-based risk assessment.

Micro-duration Term Cover

Micro-duration term cover in term insurance offers flexible, short-term protection at affordable premiums, catering to specific, time-bound risks. Embedded insurance integrates micro-duration term cover within products or services, enhancing customer convenience by providing instant, tailored coverage without requiring separate policies.

API-driven Embedded Distribution

API-driven embedded distribution transforms term insurance by seamlessly integrating coverage options into third-party platforms, enhancing user convenience and expanding market reach. This approach leverages real-time data exchange and automated underwriting to reduce friction and enable personalized, on-demand term insurance solutions within everyday digital experiences.

Contextual Insurance

Contextual insurance integrates term insurance coverage directly into related products or services, enhancing customer experience by providing seamless protection aligned with specific events or purchases. This embedded approach offers tailored term insurance solutions that activate precisely when needed, optimizing risk management and cost-efficiency.

Marketplace-agnostic Term Policy

Marketplace-agnostic term insurance policies offer flexible, standalone coverage without being tied to specific platforms or products, enabling consumers to select protection independently of their purchasing environment. Unlike embedded insurance integrated directly into product offerings, term insurance provides customizable term lengths and coverage amounts, optimizing risk management and premium efficiency across various marketplaces.

Instant Issue Embedded Cover

Instant issue embedded cover in term insurance provides seamless protection by integrating insurance benefits directly within product purchases, eliminating delays and extensive underwriting processes. This approach enhances customer experience by offering immediate coverage, reducing administrative costs, and improving policy uptake rates compared to traditional standalone term insurance plans.

Digital-first Underwriting

Term insurance offers straightforward coverage for a fixed period with digital-first underwriting streamlining the application process through automated risk assessment and instant policy issuance. Embedded insurance integrates coverage within products or services, leveraging real-time data and AI-driven underwriting to provide personalized protection seamlessly during the customer journey.

Onboarding Frictionless Term

Onboarding frictionless term insurance streamlines the application process by integrating seamless digital solutions that reduce paperwork and approval delays, enhancing customer experience and boosting conversion rates. Embedded insurance further simplifies access by offering coverage directly within the purchase journey of products or services, promoting convenience and higher adoption through contextual relevance.

Checkout Insurance Integration

Term insurance provides standalone coverage for a fixed period, offering cost-effective protection against risks like death or disability. Embedded insurance integrates coverage options directly into the checkout process, enhancing customer experience by offering seamless, contextual protection tailored to the purchased product.

Term Insurance vs Embedded Insurance Infographic

industrydif.com

industrydif.com