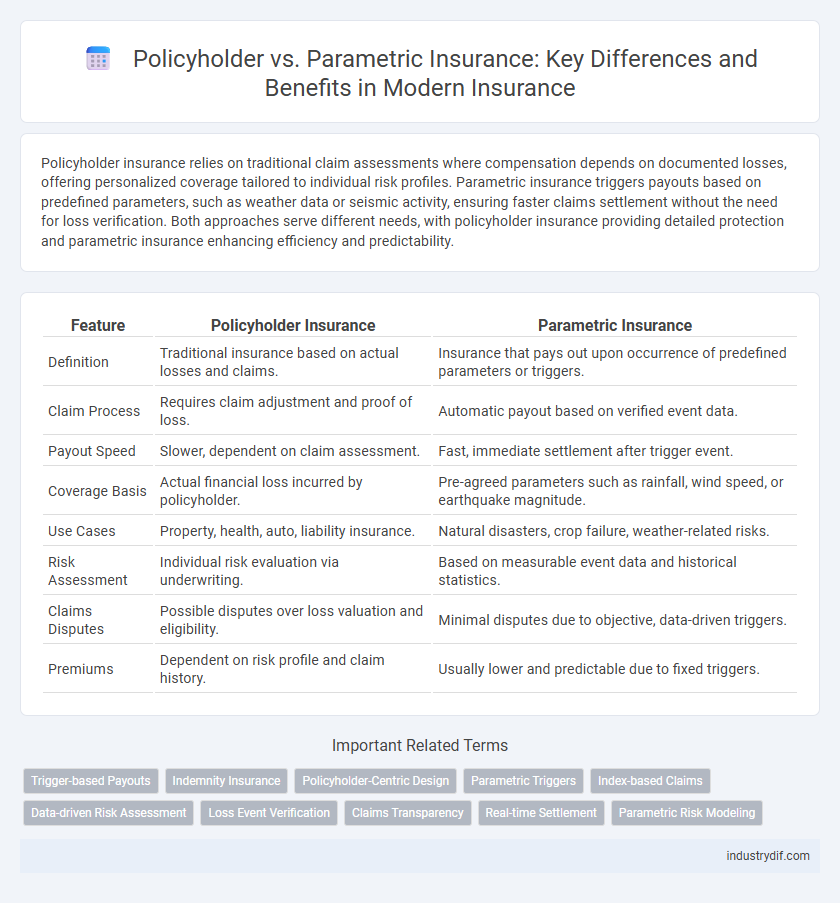

Policyholder insurance relies on traditional claim assessments where compensation depends on documented losses, offering personalized coverage tailored to individual risk profiles. Parametric insurance triggers payouts based on predefined parameters, such as weather data or seismic activity, ensuring faster claims settlement without the need for loss verification. Both approaches serve different needs, with policyholder insurance providing detailed protection and parametric insurance enhancing efficiency and predictability.

Table of Comparison

| Feature | Policyholder Insurance | Parametric Insurance |

|---|---|---|

| Definition | Traditional insurance based on actual losses and claims. | Insurance that pays out upon occurrence of predefined parameters or triggers. |

| Claim Process | Requires claim adjustment and proof of loss. | Automatic payout based on verified event data. |

| Payout Speed | Slower, dependent on claim assessment. | Fast, immediate settlement after trigger event. |

| Coverage Basis | Actual financial loss incurred by policyholder. | Pre-agreed parameters such as rainfall, wind speed, or earthquake magnitude. |

| Use Cases | Property, health, auto, liability insurance. | Natural disasters, crop failure, weather-related risks. |

| Risk Assessment | Individual risk evaluation via underwriting. | Based on measurable event data and historical statistics. |

| Claims Disputes | Possible disputes over loss valuation and eligibility. | Minimal disputes due to objective, data-driven triggers. |

| Premiums | Dependent on risk profile and claim history. | Usually lower and predictable due to fixed triggers. |

Understanding Policyholder Insurance

Policyholder insurance involves a contract between the insured individual and the insurer, providing financial protection against specified risks such as property damage, health issues, or liability claims. It requires a detailed claims assessment to determine the extent of loss or damage before compensation is awarded, ensuring coverage aligns with the policy terms. Understanding policyholder insurance is essential for evaluating traditional insurance benefits compared to emerging models like parametric insurance, which offer predefined payouts based on triggering events rather than loss verification.

Introduction to Parametric Insurance

Parametric insurance offers a streamlined alternative to traditional policyholder claims by triggering payouts based on pre-agreed parameters such as weather data or seismic activity, eliminating the need for lengthy loss assessments. This innovative approach enhances efficiency and transparency, providing rapid financial relief to insured parties when specific event thresholds are met. Insurers leverage real-time data and smart contracts to automate claims, reducing administrative costs and improving customer satisfaction in disaster-prone sectors.

Key Differences Between Policyholder and Parametric Insurance

Policyholder insurance involves traditional claims processes where compensation depends on proven losses and policy terms, requiring extensive documentation and assessment. Parametric insurance triggers payout based on predefined parameters or indices, such as rainfall levels or earthquake magnitude, ensuring faster, simplified claim settlements without the need for loss adjustment. The key difference lies in payout methodology: policyholder insurance is indemnity-based, while parametric insurance is index-based, enhancing transparency and efficiency in risk management.

How Policyholder Insurance Works

Policyholder insurance involves a contractual agreement where the insured pays premiums to transfer specific risks to the insurer, who then indemnifies the policyholder for covered losses after verifying a claim. The process typically requires loss assessment and proof of damage to receive financial compensation based on actual incurred costs. This traditional model contrasts with parametric insurance, which relies on predefined triggers and payouts without loss verification.

How Parametric Insurance Works

Parametric insurance operates by triggering a predetermined payout based on the occurrence of a specific event measured by an objective parameter, such as rainfall levels or earthquake magnitude, rather than assessing actual loss incurred by the policyholder. This model reduces claim processing time and administrative costs, providing faster financial relief when predefined thresholds are met. Data from trusted sources like weather stations or seismic sensors are used to verify parameters, enabling transparent and efficient policy execution.

Claims Process: Policyholder vs Parametric Insurance

The claims process for policyholder insurance typically involves a thorough evaluation of documented losses, requiring detailed assessments and potentially lengthy approval times. Parametric insurance accelerates claims settlement by triggering payments based on predefined parameters, such as weather data or seismic activity, eliminating the need for traditional damage verification. This rapid, data-driven approach reduces administrative burdens and enhances payout transparency for insured parties.

Benefits of Policyholder Insurance

Policyholder insurance provides comprehensive coverage tailored to the insured's specific risks, offering financial protection through traditional claim assessments and indemnity payments. This model ensures personalized service, legal certainty, and the ability to cover wide-ranging losses beyond predefined parameters. Policyholder insurance also fosters trust by enabling policy customization and dispute resolution based on documented damages.

Advantages of Parametric Insurance

Parametric insurance offers swift payout triggers based on measurable events, reducing claim processing time and administrative costs for policyholders. It provides transparency and predictability by relying on predefined parameters such as wind speed or earthquake magnitude, ensuring immediate financial relief. The model mitigates disputes over damage assessment, enhancing efficiency and satisfaction compared to traditional indemnity policies.

Suitability: Which Insurance Type Fits Your Needs?

Policyholder insurance suits individuals seeking traditional coverage with claim assessments based on actual loss evaluation, providing tailored financial protection. Parametric insurance fits those needing rapid payouts triggered by predetermined events or parameters, ideal for disaster-prone regions requiring quick liquidity. Evaluating risk tolerance, claim process preferences, and event predictability ensures selecting the most appropriate insurance type aligning with personal or business needs.

Future Trends in Policyholder and Parametric Insurance

Future trends in insurance highlight increased adoption of parametric insurance due to its rapid payout mechanisms and transparency, benefiting policyholders seeking quicker claims settlements. Emerging technologies like blockchain and IoT sensors are expected to enhance parametric insurance accuracy, improving risk assessment and reducing fraud. Policyholders will experience more personalized insurance solutions, driven by data analytics and AI, shifting the industry towards flexible, usage-based coverage models.

Related Important Terms

Trigger-based Payouts

Parametric insurance provides policyholders with trigger-based payouts that are automatically activated when predefined event parameters, such as wind speed or earthquake magnitude, are met or exceeded, ensuring faster claim settlement without the need for loss assessment. Unlike traditional indemnity insurance, policyholders benefit from transparent and objective triggers, reducing claims disputes and administrative delays.

Indemnity Insurance

Policyholder indemnity insurance relies on actual loss assessments to compensate damages, while parametric insurance provides predetermined payouts based on specific trigger events, such as weather thresholds, without adjusting for the actual loss incurred. Indemnity insurance covers direct financial losses, requiring detailed claims processes, whereas parametric insurance offers faster payments by bypassing loss verification, ideal for quick disaster relief response.

Policyholder-Centric Design

Policyholder-centric design in insurance emphasizes personalized coverage and transparency, ensuring policyholders have clear understanding and control over their policies compared to parametric insurance, which relies on predefined triggers and payouts. This approach enhances customer satisfaction by tailoring solutions to individual risk profiles and offering proactive claims management.

Parametric Triggers

Parametric insurance relies on pre-defined, measurable triggers such as earthquake magnitude or rainfall levels to automatically initiate payouts, eliminating the need for traditional loss assessments. These objective parametric triggers provide faster claims processing and increased transparency compared to conventional policyholder claims that require detailed damage evaluations.

Index-based Claims

Policyholder insurance relies on traditional claim assessments based on documented losses, whereas parametric insurance triggers payouts automatically when predefined index thresholds, such as rainfall or wind speed, are met. Index-based claims reduce settlement time and disputes by using objective data, offering faster financial relief without the need for individual loss verification.

Data-driven Risk Assessment

Policyholder insurance relies on traditional claims processes and historical data to assess risk, often leading to longer claim settlements. Parametric insurance uses real-time, data-driven risk assessment based on predefined triggers such as weather data or seismic activity, enabling faster, automated payouts and improved transparency.

Loss Event Verification

Policyholder insurance relies on traditional claims processes requiring detailed loss event verification through adjusters and documentation, often leading to longer settlement times. Parametric insurance eliminates subjective verification by triggering payouts automatically when predefined parameters, such as weather data or seismic readings, meet set thresholds, ensuring faster compensation.

Claims Transparency

Policyholder insurance relies on traditional claims processes that often involve detailed assessments and subjective evaluations, potentially leading to delays and disputes over claim settlements. Parametric insurance enhances claims transparency through predefined trigger events and automated payouts, allowing policyholders to receive prompt compensation based on clear, measurable parameters.

Real-time Settlement

Parametric insurance offers policyholders real-time settlement by triggering automatic payouts when predefined parameters, such as weather data or seismic measurements, are met, eliminating the need for lengthy claims assessments. This contrasts with traditional insurance policies, where policyholders face delays due to claim verification and damage evaluation processes.

Parametric Risk Modeling

Parametric risk modeling in insurance utilizes predefined triggers based on measurable parameters, such as weather data or seismic activity, to automate claim payouts, reducing the ambiguity and delays typical in traditional policyholder claim assessments. This model enhances transparency and efficiency by linking indemnity directly to quantifiable risk events, facilitating quicker financial relief compared to conventional insurance policies.

Policyholder vs Parametric Insurance Infographic

industrydif.com

industrydif.com