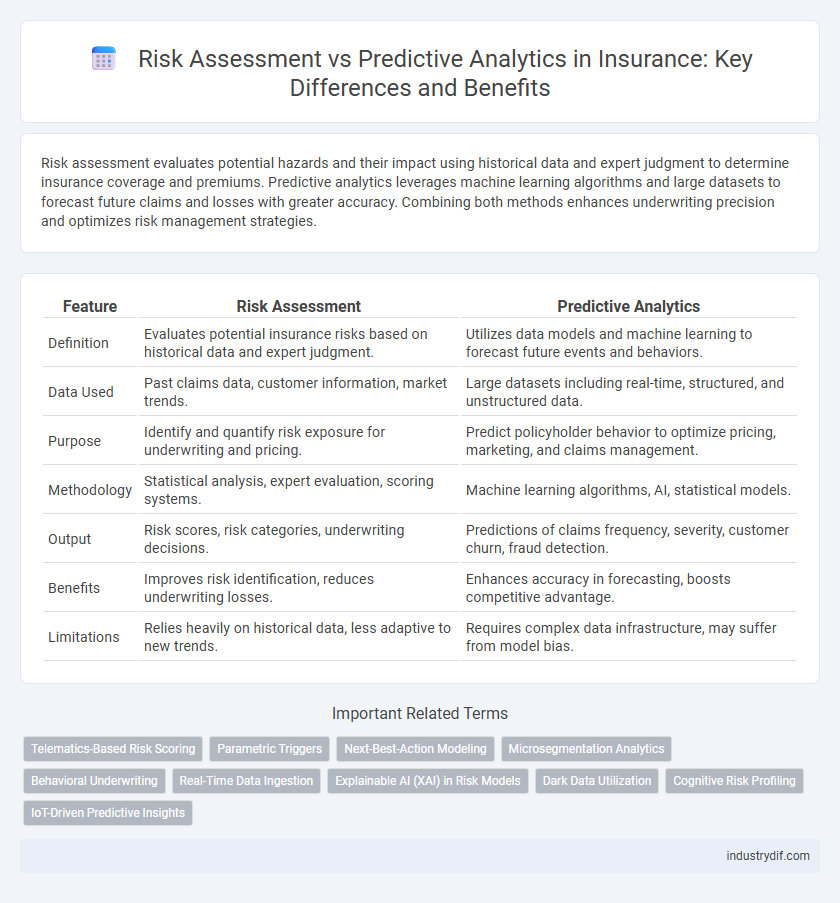

Risk assessment evaluates potential hazards and their impact using historical data and expert judgment to determine insurance coverage and premiums. Predictive analytics leverages machine learning algorithms and large datasets to forecast future claims and losses with greater accuracy. Combining both methods enhances underwriting precision and optimizes risk management strategies.

Table of Comparison

| Feature | Risk Assessment | Predictive Analytics |

|---|---|---|

| Definition | Evaluates potential insurance risks based on historical data and expert judgment. | Utilizes data models and machine learning to forecast future events and behaviors. |

| Data Used | Past claims data, customer information, market trends. | Large datasets including real-time, structured, and unstructured data. |

| Purpose | Identify and quantify risk exposure for underwriting and pricing. | Predict policyholder behavior to optimize pricing, marketing, and claims management. |

| Methodology | Statistical analysis, expert evaluation, scoring systems. | Machine learning algorithms, AI, statistical models. |

| Output | Risk scores, risk categories, underwriting decisions. | Predictions of claims frequency, severity, customer churn, fraud detection. |

| Benefits | Improves risk identification, reduces underwriting losses. | Enhances accuracy in forecasting, boosts competitive advantage. |

| Limitations | Relies heavily on historical data, less adaptive to new trends. | Requires complex data infrastructure, may suffer from model bias. |

Understanding Risk Assessment in Insurance

Risk assessment in insurance involves evaluating the potential risks associated with insuring an individual or entity by analyzing historical data, claim history, and environmental factors to determine policy terms and premiums. This process prioritizes identifying the likelihood and impact of specific risks, ensuring adequate coverage while minimizing losses for insurers. Data-driven risk assessment models improve accuracy in underwriting decisions by quantifying exposure and potential financial liabilities.

What Is Predictive Analytics in Insurance?

Predictive analytics in insurance involves using historical data, machine learning algorithms, and statistical models to forecast future risks and claim probabilities. This approach enables insurers to identify high-risk customers, optimize pricing strategies, and reduce fraud by analyzing patterns and trends within large datasets. Predictive analytics improves decision-making accuracy by providing actionable insights that enhance underwriting efficiency and policy management.

Key Differences: Risk Assessment vs Predictive Analytics

Risk assessment in insurance involves evaluating the likelihood and potential impact of insured events using historical data and expert judgment. Predictive analytics uses advanced algorithms and machine learning techniques to analyze large datasets, identifying patterns and forecasting future risks with greater precision. Unlike traditional risk assessment, predictive analytics enhances underwriting accuracy and claims management by providing dynamic, data-driven insights.

Traditional Risk Assessment Methods

Traditional risk assessment methods in insurance rely heavily on historical data, manual underwriting, and actuarial tables to evaluate potential loss exposures. These techniques emphasize qualitative judgments and standardized criteria to determine risk classifications and premium pricing. While effective for basic risk evaluation, traditional methods often lack the dynamic data integration and real-time predictive capabilities found in modern predictive analytics.

How Predictive Analytics Transforms Insurance

Predictive analytics revolutionizes risk assessment in insurance by utilizing vast datasets and machine learning algorithms to identify patterns and forecast potential claims with higher accuracy. This transformation enables insurers to price policies more precisely, reduce fraud, and tailor products to individual risk profiles. Enhanced predictive capabilities lead to improved underwriting decisions, efficient claims management, and optimized capital allocation across insurance portfolios.

Data Sources Used in Insurance Risk Evaluation

Insurance risk evaluation relies heavily on a diverse range of data sources to perform accurate risk assessment and predictive analytics. Traditional risk assessment incorporates historical claims data, customer demographics, and policy details, while predictive analytics expands this scope by integrating real-time data from IoT devices, social media activity, and telematics. Leveraging these varied datasets enhances insurers' capabilities to forecast potential risks, set premiums more precisely, and tailor coverage options effectively.

Benefits of Predictive Analytics Over Standard Risk Assessment

Predictive analytics enhances insurance risk assessment by leveraging advanced algorithms and machine learning to analyze vast datasets, identifying patterns traditional methods often miss. This approach enables more accurate risk profiling and personalized premium pricing, reducing underwriting errors and improving loss prediction. Implementing predictive analytics leads to optimized claims management and better fraud detection, ultimately driving higher profitability and customer satisfaction.

Challenges in Integrating Predictive Analytics

Integrating predictive analytics into risk assessment faces challenges such as data quality issues, including incomplete or inconsistent data sets that hinder accurate modeling. The complexity of combining traditional actuarial methods with advanced machine learning algorithms creates difficulties in aligning risk metrics and ensuring regulatory compliance. Additionally, the need for skilled personnel to interpret predictive outputs and the high costs of technology implementation limit widespread adoption in insurance firms.

The Future of Risk Management in Insurance

Risk assessment in insurance evaluates historical data and current variables to determine policyholder risk, while predictive analytics leverages machine learning algorithms and big data to forecast future claims and trends. The future of risk management in insurance hinges on integrating advanced predictive models, real-time data processing, and AI-driven insights to enhance underwriting accuracy and minimize losses. Insurers adopting these technologies gain a competitive edge through proactive risk mitigation and personalized policy offerings.

Real-World Examples: Insurance Risk Assessment and Predictive Analytics

Insurance companies use risk assessment models to evaluate policyholders' likelihood of filing claims based on historical data such as age, driving records, and health status. Predictive analytics enhances this process by analyzing vast datasets, including telematics and social media behavior, to forecast future risks with higher accuracy. For example, Progressive uses telematics data to adjust auto insurance premiums in real-time, while health insurers like UnitedHealthcare leverage predictive analytics to identify patients at risk of chronic diseases for proactive care management.

Related Important Terms

Telematics-Based Risk Scoring

Telematics-based risk scoring leverages real-time driving data such as speed, acceleration, and braking patterns to provide more accurate risk assessment in insurance underwriting. Predictive analytics uses this granular data to forecast future claims probability, enabling insurers to tailor policies and premiums with greater precision.

Parametric Triggers

Parametric triggers enable precise risk assessment by automatically activating insurance payouts when predefined thresholds, such as natural disaster intensity or weather metrics, are met, eliminating the need for traditional claim verification. Predictive analytics further enhance these triggers by analyzing historical data and patterns to forecast potential risk events, improving underwriting accuracy and enabling proactive risk management in insurance.

Next-Best-Action Modeling

Next-Best-Action (NBA) modeling in insurance leverages predictive analytics to enhance risk assessment by identifying personalized customer interactions that optimize retention and profitability. Integrating machine learning algorithms with historical claims and behavioral data allows insurers to proactively address individual risks and tailor policy recommendations.

Microsegmentation Analytics

Microsegmentation analytics enhances risk assessment in insurance by dividing policyholders into highly specific groups based on granular data such as behavior, demographics, and past claims, enabling tailored underwriting and pricing strategies. Predictive analytics leverages these microsegments to forecast future risk and loss probabilities more accurately, improving portfolio management and customer targeting efficiency.

Behavioral Underwriting

Behavioral underwriting enhances traditional risk assessment by integrating predictive analytics to analyze policyholders' behavioral data, enabling more precise risk profiling and pricing strategies. This approach leverages real-time data such as driving habits, lifestyle activities, and digital interactions to forecast potential claims and reduce underwriting uncertainty.

Real-Time Data Ingestion

Risk assessment leverages real-time data ingestion to continuously evaluate emerging threats and adjust insurance policies dynamically, enhancing accuracy and responsiveness. Predictive analytics utilizes this streaming data to forecast future claims and customer behavior, enabling insurers to proactively mitigate risks and optimize underwriting decisions.

Explainable AI (XAI) in Risk Models

Explainable AI (XAI) enhances risk assessment in insurance by making predictive analytics models transparent and interpretable, allowing underwriters to understand the rationale behind risk scores and decisions. Integrating XAI improves regulatory compliance, fosters trust, and enables more accurate identification of high-risk policies through clear visualization of data patterns and feature importance.

Dark Data Utilization

Risk assessment in insurance leverages dark data--unstructured and untapped information from sources like social media, customer interactions, and sensor data--to enhance accuracy in identifying potential risks. Predictive analytics integrates this dark data with historical records, machine learning algorithms, and real-time inputs to forecast claim probabilities and optimize underwriting decisions.

Cognitive Risk Profiling

Cognitive Risk Profiling leverages advanced predictive analytics to assess behavioral patterns and psychological factors, enhancing the precision of risk assessment in insurance underwriting. This approach enables insurers to tailor policies and pricing models by integrating cognitive data with traditional risk metrics, improving risk prediction and customer segmentation.

IoT-Driven Predictive Insights

IoT-driven predictive analytics enhance risk assessment in insurance by leveraging real-time data from connected devices to identify patterns and predict potential losses more accurately. This approach enables insurers to develop personalized policies and proactive risk management strategies, improving underwriting precision and claims handling efficiency.

Risk Assessment vs Predictive Analytics Infographic

industrydif.com

industrydif.com