Claims adjusters bring expert judgment and personalized assessment to resolve insurance claims, ensuring accurate evaluations and fair settlements. Claims automation streamlines the process by using advanced algorithms and machine learning to quickly analyze data and expedite claim approvals. Combining human expertise with automated efficiency optimizes claims management, reducing errors and enhancing customer satisfaction.

Table of Comparison

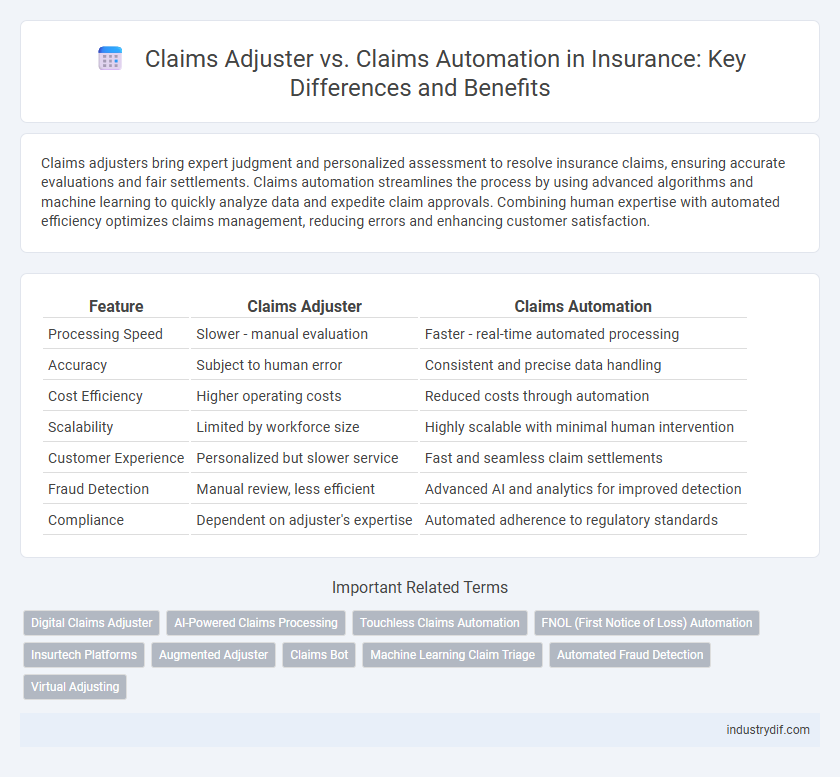

| Feature | Claims Adjuster | Claims Automation |

|---|---|---|

| Processing Speed | Slower - manual evaluation | Faster - real-time automated processing |

| Accuracy | Subject to human error | Consistent and precise data handling |

| Cost Efficiency | Higher operating costs | Reduced costs through automation |

| Scalability | Limited by workforce size | Highly scalable with minimal human intervention |

| Customer Experience | Personalized but slower service | Fast and seamless claim settlements |

| Fraud Detection | Manual review, less efficient | Advanced AI and analytics for improved detection |

| Compliance | Dependent on adjuster's expertise | Automated adherence to regulatory standards |

Claims Adjuster vs Claims Automation: Key Differences

Claims adjusters manually investigate and evaluate insurance claims to determine validity and settlement amounts, leveraging expertise in risk assessment and customer interaction. Claims automation utilizes AI and machine learning algorithms to process claims at scale, reducing processing time and minimizing human error. Key differences include human judgment and personalized assessment by adjusters versus the efficiency and consistency provided by automated systems.

Roles and Responsibilities: Human Adjusters vs Automated Systems

Claims adjusters manually investigate, evaluate, and negotiate insurance claims by gathering evidence, interviewing involved parties, and applying policy knowledge to determine settlement amounts. Automated claims systems use artificial intelligence and machine learning algorithms to quickly analyze claim data, detect fraud, and process approvals based on predefined rules, reducing processing time and operational costs. Human adjusters provide personalized judgment and handle complex cases requiring empathy, while automated systems excel in high-volume routine claims with consistent, data-driven decision-making.

Impact on Claims Processing Efficiency

Claims adjusters provide personalized evaluations of insurance claims, ensuring accurate assessments through human expertise and nuanced judgment. Claims automation employs AI-driven tools and algorithms to streamline claim intake, validation, and settlement, significantly reducing processing time and operational costs. Combining human adjusters with automated systems enhances claims processing efficiency by balancing accuracy and speed, leading to faster claim resolutions and improved customer satisfaction.

Accuracy and Consistency in Claims Assessment

Claims adjusters bring expert judgment to complex cases but can be prone to human error and inconsistencies in evaluations. Claims automation uses advanced algorithms and data analytics to ensure high accuracy and consistent application of policy rules across all claims. Integrating automation with human oversight significantly reduces errors and standardizes claims assessments, enhancing overall reliability and customer satisfaction.

Customer Experience: Personalized Service vs Speed

Claims adjusters provide personalized service by evaluating unique circumstances and tailoring solutions to individual customers, enhancing satisfaction through empathetic communication. Claims automation significantly accelerates the process by using AI and data analytics to quickly assess claims, reducing waiting times and improving efficiency. Balancing human touch with technological speed optimizes customer experience by combining accuracy with rapid response.

Cost Implications of Manual vs Automated Claims Handling

Manual claims adjusters typically incur higher operational costs due to labor-intensive processes, prolonged claim resolution times, and increased potential for human error. Automated claims handling leverages advanced algorithms and AI technologies to streamline workflows, significantly reducing administrative expenses and accelerating claim processing. Insurance companies adopting automation experience cost savings through enhanced efficiency, lower overhead, and improved scalability compared to manual claims adjustment methods.

Fraud Detection: Human Judgment vs AI Algorithms

Claims adjusters rely on human judgment to detect subtle signs of fraud through experience and intuition, enabling the identification of complex cases that may evade standard checks. AI algorithms in claims automation analyze vast datasets in real-time, using machine learning to detect patterns and anomalies indicative of fraudulent activity with high efficiency. Combining human insight with AI-driven fraud detection enhances accuracy and reduces false positives in insurance claims processing.

Integration of Automation in Traditional Adjusting

Claims adjusters traditionally assess insurance claims by investigating, evaluating damages, and negotiating settlements, relying heavily on manual processes and subjective judgment. Claims automation integrates artificial intelligence, machine learning, and data analytics to streamline claim intake, fraud detection, and damage evaluation, significantly reducing processing time and errors. Combining automation with traditional adjusting enhances accuracy, accelerates claim resolutions, and allows adjusters to focus on complex cases requiring human expertise.

Training and Skill Evolution in the Insurance Workforce

Claims adjusters require ongoing training to adapt to evolving regulations, complex policies, and customer service demands, while claims automation systems rely on AI and machine learning to enhance accuracy and speed. The integration of automation shifts the workforce skillset towards technical proficiency, data analysis, and oversight of AI-driven processes. Continuous skill evolution in the insurance sector ensures claims professionals can effectively manage automated tools and maintain quality claim assessments.

Future Trends: The Evolving Role of Claims Adjusters in the Age of Automation

Claims adjusters are increasingly collaborating with advanced claims automation technologies that utilize AI and machine learning to streamline data analysis and fraud detection. The future role of claims adjusters will emphasize complex decision-making, personalized customer service, and oversight of automated processes to ensure accuracy and compliance. Integration of automation tools enhances efficiency while maintaining the essential human judgment required in nuanced claims evaluation and resolution.

Related Important Terms

Digital Claims Adjuster

Digital claims adjusters leverage artificial intelligence and machine learning to evaluate insurance claims rapidly and with greater accuracy, reducing human error and processing time. Integration of automated workflows enhances customer satisfaction by providing real-time updates and seamless communication throughout the claims lifecycle.

AI-Powered Claims Processing

Claims adjusters manually assess policyholder claims, analyzing damages and validating coverage, while AI-powered claims automation streamlines this process by rapidly processing large volumes of data using machine learning algorithms for accurate fraud detection and damage evaluation. Integration of AI-driven claims processing enhances efficiency, reduces human error, and accelerates claim settlements in the insurance industry.

Touchless Claims Automation

Claims adjusters handle complex evaluations and customer interactions, while touchless claims automation leverages AI and machine learning to process simple claims swiftly without human intervention, significantly reducing operational costs and accelerating settlement times. This automation enhances accuracy and customer satisfaction by minimizing manual errors and enabling real-time claim status updates.

FNOL (First Notice of Loss) Automation

Claims adjusters traditionally handle FNOL by manually assessing damages and verifying claims, which can delay processing time and increase operational costs. FNOL automation streamlines this initial loss reporting through AI-driven data capture and validation, accelerating claim settlements while reducing human errors and enhancing customer satisfaction.

Insurtech Platforms

Claims adjusters provide personalized assessment and negotiation services to ensure accurate compensation, while claims automation leverages insurtech platforms to streamline workflows, reduce processing times, and enhance data accuracy through AI and machine learning algorithms. Insurtech platforms integrate advanced analytics and real-time data to optimize claims handling efficiency, minimize fraud, and improve customer satisfaction in the insurance industry.

Augmented Adjuster

Augmented adjusters leverage AI-powered claims automation to enhance accuracy and expedite settlement processes, combining human expertise with machine efficiency for optimized claim evaluations. This hybrid approach reduces processing time and operational costs while improving customer satisfaction through real-time data analysis and decision support.

Claims Bot

Claims adjusters manually evaluate insurance claims to determine coverage and settlement amounts, often leading to longer processing times and increased costs. Claims automation, particularly through Claims Bot technology, streamlines claim assessments by using AI to rapidly analyze data, reduce human error, and accelerate approval workflows for enhanced operational efficiency.

Machine Learning Claim Triage

Machine learning claim triage revolutionizes the claims process by automating initial assessments, enabling faster and more accurate claims categorization compared to traditional claims adjusters. This technology enhances efficiency by reducing manual efforts, minimizing human error, and prioritizing complex cases for adjuster review.

Automated Fraud Detection

Claims adjusters rely on manual investigation techniques to evaluate insurance claims, often leading to slower fraud detection and increased operational costs. Automated fraud detection systems leverage machine learning algorithms and big data analytics to identify suspicious patterns in real-time, significantly enhancing accuracy and efficiency in claims processing.

Virtual Adjusting

Virtual adjusting leverages AI-driven claims automation to streamline the assessment process, reducing the need for traditional claims adjusters to conduct on-site inspections. This technology enhances accuracy and accelerates claim resolution by using digital tools such as video inspections, machine learning algorithms, and real-time data analysis.

Claims adjuster vs Claims automation Infographic

industrydif.com

industrydif.com