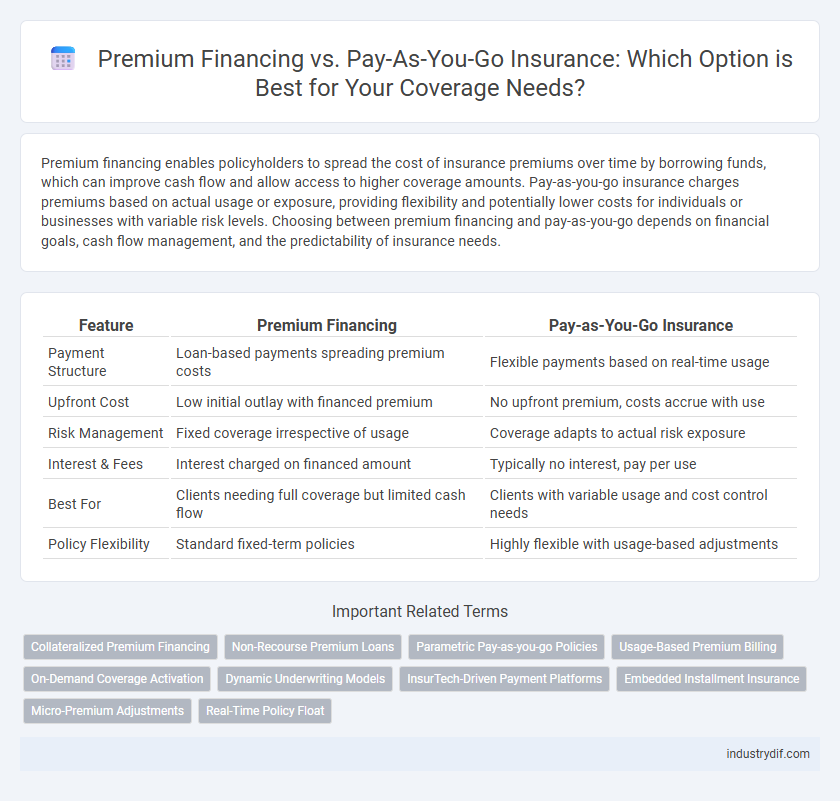

Premium financing enables policyholders to spread the cost of insurance premiums over time by borrowing funds, which can improve cash flow and allow access to higher coverage amounts. Pay-as-you-go insurance charges premiums based on actual usage or exposure, providing flexibility and potentially lower costs for individuals or businesses with variable risk levels. Choosing between premium financing and pay-as-you-go depends on financial goals, cash flow management, and the predictability of insurance needs.

Table of Comparison

| Feature | Premium Financing | Pay-as-You-Go Insurance |

|---|---|---|

| Payment Structure | Loan-based payments spreading premium costs | Flexible payments based on real-time usage |

| Upfront Cost | Low initial outlay with financed premium | No upfront premium, costs accrue with use |

| Risk Management | Fixed coverage irrespective of usage | Coverage adapts to actual risk exposure |

| Interest & Fees | Interest charged on financed amount | Typically no interest, pay per use |

| Best For | Clients needing full coverage but limited cash flow | Clients with variable usage and cost control needs |

| Policy Flexibility | Standard fixed-term policies | Highly flexible with usage-based adjustments |

Understanding Premium Financing: Definition and Key Features

Premium financing is a structured loan arrangement that enables policyholders to pay insurance premiums over time instead of upfront. Key features include leveraging third-party funds to cover large premium costs, maintaining cash flow, and typically involving interest and collateral requirements. This option contrasts with pay-as-you-go insurance, which charges premiums based solely on actual usage, emphasizing flexibility over credit reliance.

Pay-as-you-go Insurance Explained: How It Works

Pay-as-you-go insurance allows policyholders to pay premiums based on actual usage or risk exposure, often tracked through telematics or meter readings, offering flexible and cost-efficient coverage. This model adjusts premiums dynamically, reflecting real-time behavior, which can lead to significant savings compared to traditional fixed-premium plans. By aligning insurance costs with actual usage patterns, pay-as-you-go insurance enhances affordability and encourages safer habits among insured individuals.

Comparing Cost Structures: Premium Financing vs Pay-as-you-go

Premium financing involves borrowing funds to pay insurance premiums upfront, typically incurring interest charges and fees that increase overall costs compared to traditional payment methods. Pay-as-you-go insurance charges policyholders based on actual usage or risk exposure, often resulting in more flexible, potentially lower payments without financing fees. Comparing cost structures, premium financing offers predictable fixed payments with added interest, while pay-as-you-go adjusts costs dynamically, which may better align expenses with real-time risk but can be less predictable.

Cash Flow Management in Premium Financing

Premium financing offers strategic cash flow management by allowing policyholders to spread out large insurance premium payments over time, preserving capital for other business needs. Unlike pay-as-you-go insurance, which requires premiums to be paid based on real-time usage or payroll, premium financing reduces the immediate financial burden and enhances liquidity. This approach is particularly beneficial for businesses seeking to maintain steady cash flow while securing comprehensive insurance coverage.

Flexibility and Adaptability of Pay-as-you-go Insurance

Pay-as-you-go insurance offers unmatched flexibility by allowing policyholders to adjust coverage and payments based on real-time needs and usage, making it ideal for fluctuating circumstances. Premium financing typically requires fixed payments and long-term commitments, limiting adaptability in changing financial situations. This pay-as-you-go model empowers consumers to optimize coverage costs dynamically while maintaining essential insurance protection.

Risk Assessment: Which Model Offers Better Protection?

Premium financing involves borrowing funds to pay insurance premiums upfront, potentially reducing immediate financial strain but increasing risk if the insured's creditworthiness deteriorates. Pay-as-you-go insurance, by contrast, ties payments directly to actual usage or exposure, allowing for continuous risk adjustment and enhanced alignment with real-time risk profiles. This dynamic risk assessment in pay-as-you-go models offers superior protection by ensuring that coverage and costs adapt fluidly to changing risk factors, unlike the static nature of premium-financed policies.

Regulatory Considerations in Premium Financing and Pay-as-you-go

Premium financing is subject to stringent regulatory oversight, including state-specific licensing requirements and disclosure obligations to protect consumers from excessive interest rates and fees. In contrast, pay-as-you-go insurance operates under regulatory frameworks emphasizing transparent billing based on real-time usage data, promoting fairness and accuracy in premium charges. Both models must comply with insurance and financial regulations, but premium financing carries additional scrutiny due to the credit risk and financial obligations involved.

Ideal Business Profiles for Each Insurance Model

Premium financing suits established businesses with strong credit and steady cash flow seeking to preserve working capital while securing large insurance policies. Pay-as-you-go insurance benefits small to medium enterprises or startups with variable payroll costs, enabling premium payments that align with actual risk exposure and fluctuating revenue streams. Each model optimizes cash management based on business size, financial stability, and risk predictability.

Common Pitfalls and How to Avoid Them

Premium financing risks include high interest costs and potential loan default, which can lead to policy lapses or loss of coverage; thorough credit evaluation and clear repayment plans help mitigate these issues. Pay-as-you-go insurance risks involve fluctuating premiums and potential coverage gaps due to irregular payments; maintaining consistent communication with the insurer and budgeting for variable costs prevent coverage interruptions. Understanding contract terms, staying informed about payment schedules, and choosing financing options aligned with financial capacity are crucial strategies to avoid common pitfalls in premium payments.

Making the Right Choice: Factors to Consider When Selecting Insurance Payment Models

Choosing between premium financing and pay-as-you-go insurance depends on cash flow flexibility, risk tolerance, and overall financial goals. Premium financing allows policyholders to spread large insurance costs over time, often benefiting those with high-value policies or limited upfront capital. Pay-as-you-go insurance suits individuals seeking cost alignment with actual usage or exposure, minimizing upfront payments but potentially leading to variable monthly expenses based on risk factors.

Related Important Terms

Collateralized Premium Financing

Collateralized premium financing allows policyholders to secure large insurance premiums through loans backed by collateral, reducing upfront costs and preserving liquidity. This method contrasts with pay-as-you-go insurance, where premiums are paid incrementally based on usage or exposure, offering flexibility but often without leveraging collateral for financing.

Non-Recourse Premium Loans

Non-recourse premium loans in premium financing allow policyholders to borrow funds where repayment is tied solely to the insurance policy's cash value or proceeds, minimizing personal financial risk compared to pay-as-you-go insurance structures that require continuous payments without leveraging loan options. This financing strategy benefits businesses or high-net-worth individuals seeking to preserve capital while maintaining comprehensive coverage, as loan defaults do not impact personal assets beyond the policy itself.

Parametric Pay-as-you-go Policies

Parametric Pay-as-you-go insurance policies leverage real-time data triggers, such as weather events or flight delays, to automatically pay claims without traditional loss assessments, offering faster, transparent, and cost-efficient coverage. Premium financing typically involves borrowing to cover upfront insurance costs, whereas parametric models reduce financial friction by aligning payments directly with actual risk exposure and event occurrence.

Usage-Based Premium Billing

Usage-based premium billing leverages telematics data to adjust insurance costs according to actual driving behavior, offering personalized and potentially lower premiums compared to fixed financing options. This model enhances cost efficiency by aligning payments with usage patterns, reducing upfront financial burden while maintaining coverage flexibility.

On-Demand Coverage Activation

Premium financing enables policyholders to secure full insurance coverage upfront while spreading payments over time, ensuring continuous protection without large initial costs. Pay-as-you-go insurance activates coverage on-demand based on real-time usage, offering flexible premiums that align directly with actual risk exposure.

Dynamic Underwriting Models

Dynamic underwriting models leverage real-time data analytics and predictive algorithms to tailor premium financing options, optimizing risk assessment and cash flow management compared to traditional static models in pay-as-you-go insurance. This approach enhances pricing accuracy and customer segmentation, enabling insurers to offer flexible payment plans while maintaining profitability and reducing default risk.

InsurTech-Driven Payment Platforms

InsurTech-driven payment platforms revolutionize premium financing by offering seamless, automated installment options that enhance cash flow management and reduce upfront costs for policyholders. Pay-as-you-go insurance leverages real-time data analytics and IoT integration to deliver usage-based premiums, enabling personalized risk assessment and cost efficiency.

Embedded Installment Insurance

Embedded installment insurance integrates premium financing directly into the policy, allowing insured parties to spread payments over time without separate loans or credit checks, enhancing affordability and cash flow management. This contrasts with traditional pay-as-you-go insurance, where premiums are paid based on actual usage but typically require full upfront payments or separate financing arrangements.

Micro-Premium Adjustments

Premium financing allows policyholders to spread large upfront insurance costs over time through loans, while pay-as-you-go insurance adjusts premiums based on actual usage or risk exposure, offering flexibility with micro-premium adjustments that align payments more closely with real-time behavior and needs. These micro-premium adjustments enhance affordability and cash flow management by reducing overpayment risks and ensuring that premiums accurately reflect the evolving risk profile of insured assets.

Real-Time Policy Float

Premium financing allows policyholders to secure insurance coverage by borrowing the premium amount, enabling immediate policy activation with deferred payment, which enhances cash flow management. Pay-as-you-go insurance offers real-time policy float by adjusting payments based on actual usage or exposure, providing dynamic premium calculation and minimizing upfront costs.

Premium Financing vs Pay-as-you-go Insurance Infographic

industrydif.com

industrydif.com