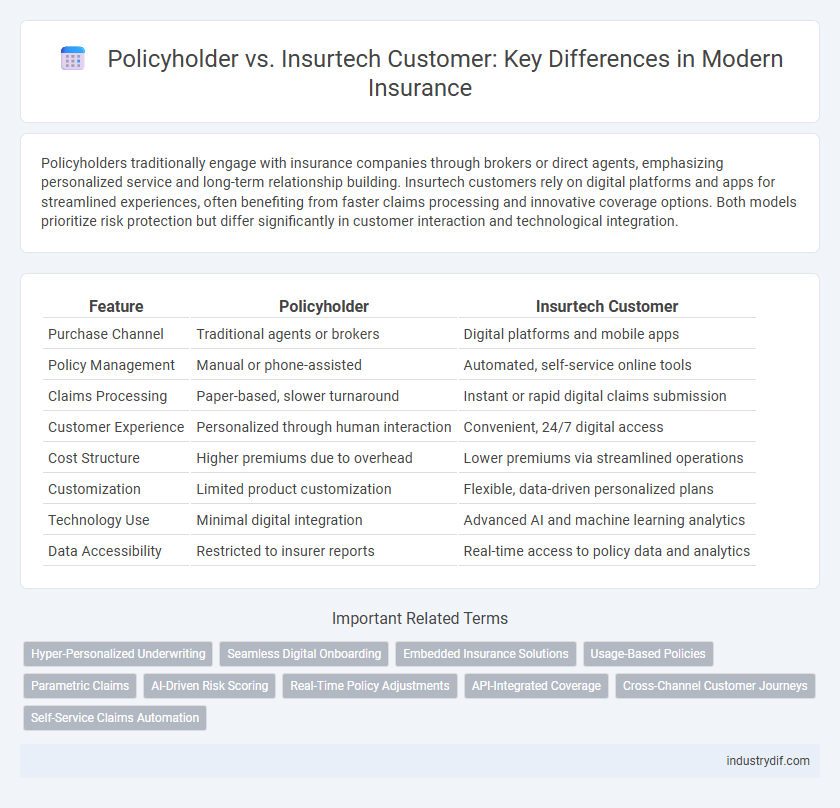

Policyholders traditionally engage with insurance companies through brokers or direct agents, emphasizing personalized service and long-term relationship building. Insurtech customers rely on digital platforms and apps for streamlined experiences, often benefiting from faster claims processing and innovative coverage options. Both models prioritize risk protection but differ significantly in customer interaction and technological integration.

Table of Comparison

| Feature | Policyholder | Insurtech Customer |

|---|---|---|

| Purchase Channel | Traditional agents or brokers | Digital platforms and mobile apps |

| Policy Management | Manual or phone-assisted | Automated, self-service online tools |

| Claims Processing | Paper-based, slower turnaround | Instant or rapid digital claims submission |

| Customer Experience | Personalized through human interaction | Convenient, 24/7 digital access |

| Cost Structure | Higher premiums due to overhead | Lower premiums via streamlined operations |

| Customization | Limited product customization | Flexible, data-driven personalized plans |

| Technology Use | Minimal digital integration | Advanced AI and machine learning analytics |

| Data Accessibility | Restricted to insurer reports | Real-time access to policy data and analytics |

Defining the Policyholder in Traditional Insurance

The policyholder in traditional insurance refers to the individual or entity that owns an insurance policy, assumes the contractual obligation to pay premiums, and has the legal right to file claims. This role is distinct from the insurtech customer, who often interacts with digital platforms emphasizing convenience and real-time engagement. Understanding the policyholder's responsibilities and rights is crucial for assessing risk, policy management, and claims processing in established insurance frameworks.

Understanding the Insurtech Customer

Insurtech customers prioritize seamless digital experiences, valuing real-time policy management and instant claims processing through mobile apps and online platforms. Unlike traditional policyholders, insurtech customers demand personalized insurance products driven by artificial intelligence and data analytics to tailor coverage to individual needs. Their preference for transparency, quick service, and integrated digital ecosystems shapes the future of insurance delivery models.

Key Differences: Policyholder vs Insurtech Customer

Policyholders traditionally engage with insurance providers through conventional channels, holding comprehensive policies that often require in-person interaction and paper documentation. Insurtech customers benefit from digital platforms offering streamlined, technology-driven experiences with real-time policy management, personalized pricing, and rapid claims processing. Key differences include enhanced accessibility, automation of underwriting processes, and integration of artificial intelligence to tailor insurance solutions for insurtech users, contrasting with the manual and standardized approach for policyholders.

Customer Experience in Legacy Insurance vs Insurtech

Legacy insurance policyholders often face complex paperwork, slow claim processing, and limited digital interaction, leading to lower customer satisfaction. Insurtech customers benefit from streamlined onboarding, real-time claims tracking, and personalized digital services powered by AI and big data analytics. This shift improves transparency, speed, and engagement, transforming the overall insurance customer experience.

Digital Onboarding: A New Era for Insurance Customers

Digital onboarding revolutionizes insurance by transforming traditional policyholders into insurtech customers through seamless, paperless processes and real-time data verification. This shift enhances customer experience by enabling instant access to quotes, personalized coverage options, and automated claim submissions via mobile apps and online platforms. Leveraging AI and blockchain technologies ensures security and transparency, fostering trust and driving higher engagement in the digital insurance ecosystem.

Personalization and Data Usage in Insurtech

Insurtech companies leverage advanced data analytics and machine learning to deliver highly personalized insurance products tailored to individual customer behaviors and preferences, differentiating from traditional policyholders who typically receive standardized coverage. By harnessing real-time data from IoT devices, mobile apps, and social media, insurtech customers benefit from dynamic pricing models and customized risk assessments that enhance user experience and coverage accuracy. This data-driven personalization enables insurers to predict claims more effectively, reduce fraudulent activities, and optimize policyholder engagement through targeted communication and services.

Claims Process: Manual vs Automated Solutions

Policyholders typically experience a manual claims process involving paperwork, phone calls, and longer wait times for claim approval and payout. Insurtech customers benefit from automated solutions using AI and machine learning, enabling faster claim submissions, real-time status tracking, and quicker settlements. Automated claims processing reduces errors and operational costs while enhancing customer satisfaction and transparency.

Trust and Transparency in Customer Relationships

Policyholders prioritize trust and transparency as foundational elements in traditional insurance agreements, relying on clear communication and reliable claim processing to maintain confidence. Insurtech customers, benefiting from digital platforms, value transparency through real-time data access and instant policy management that enhance trust via technological innovation. Both emphasize transparency but differ in engagement style, with insurtech focusing on seamless digital experiences and policyholders on personalized service and clarity in coverage terms.

Regulatory Considerations for Policyholders and Insurtech Customers

Policyholders benefit from established regulatory protections such as clear disclosure requirements, claim dispute resolution processes, and mandated coverage standards, ensuring transparency and fairness in traditional insurance contracts. Insurtech customers, while experiencing enhanced convenience through digital platforms, face evolving regulatory landscapes emphasizing data privacy, cybersecurity measures, and compliance with fintech-specific licensing frameworks. Regulators prioritize balancing innovation with consumer protection by enforcing strict regulations on algorithmic underwriting, digital consent protocols, and real-time reporting obligations to mitigate risks unique to insurtech solutions.

The Future of Insurance: Evolving Customer Roles and Expectations

Policyholders traditionally engage with insurers through agents and standardized policies, while insurtech customers demand personalized digital experiences powered by AI and real-time data analytics. The future of insurance emphasizes seamless integration of mobile platforms, enabling customers to manage policies, file claims, and access risk insights independently. This shift drives the industry toward enhanced transparency, faster service delivery, and proactive risk prevention tailored to modern consumer expectations.

Related Important Terms

Hyper-Personalized Underwriting

Hyper-personalized underwriting leverages advanced data analytics and artificial intelligence to tailor insurance policies uniquely for each policyholder, enhancing risk assessment accuracy and customer satisfaction. Insurtech customers benefit from dynamic, real-time adjustments in coverage and premiums, reflecting their individual behaviors and specific risk profiles more precisely than traditional underwriting methods.

Seamless Digital Onboarding

Policyholders traditionally undergo a manual, paperwork-heavy onboarding process, whereas insurtech customers benefit from seamless digital onboarding features like instant identity verification and automated underwriting. This digital transformation enhances user experience, reduces processing time, and minimizes errors, driving higher customer satisfaction and operational efficiency in the insurance industry.

Embedded Insurance Solutions

Policyholders benefit from traditional insurance policies that require active management and direct engagement with insurers, while insurtech customers experience seamless coverage through embedded insurance solutions integrated directly into their purchase journeys. Embedded insurance solutions enhance customer convenience by providing real-time, context-specific protection within digital platforms, streamlining policy activation and claims processing.

Usage-Based Policies

Usage-based policies provide policyholders with personalized insurance premiums based on real-time driving data collected through telematics devices, enhancing risk assessment accuracy. Insurtech customers benefit from seamless digital platforms that offer tailored coverage and instant feedback, promoting safer driving habits and potential cost savings.

Parametric Claims

Parametric claims in insurance streamline payouts by using predefined triggers such as weather data or seismic activity, benefiting both traditional policyholders and insurtech customers through expedited, transparent settlements. While policyholders rely on conventional claim processes requiring loss assessment, insurtech customers experience enhanced automation and real-time claim activation, reducing friction and improving overall satisfaction.

AI-Driven Risk Scoring

AI-driven risk scoring enhances underwriting accuracy by leveraging data analytics to predict policyholder risk profiles with greater precision, enabling insurers to tailor premiums and coverage more effectively. Insurtech customers benefit from streamlined policy issuance and personalized recommendations, as AI algorithms continuously refine risk assessments based on real-time behavior and external data sources.

Real-Time Policy Adjustments

Policyholders traditionally experience delays in policy modifications due to manual processing, whereas insurtech customers benefit from real-time policy adjustments enabled by advanced digital platforms and AI-driven algorithms. This instant adaptability enhances customer satisfaction, reduces administrative costs, and ensures accurate coverage reflecting current risk profiles.

API-Integrated Coverage

Policyholders benefit from traditional insurance frameworks with standard coverage options, while insurtech customers gain access to API-integrated coverage that enables real-time policy management and seamless claims processing. API integration empowers insurtech platforms to deliver personalized insurance products, automate underwriting, and enhance customer experience through faster, data-driven decision-making.

Cross-Channel Customer Journeys

Policyholders traditionally engage with insurance companies through offline channels like agents and call centers, while insurtech customers prefer digital platforms such as mobile apps and online portals, necessitating seamless integration across channels to enhance experience and retention. Optimizing cross-channel customer journeys requires leveraging data analytics and AI-driven personalization to synchronize touchpoints, ensuring consistent communication and tailored offerings regardless of the interaction medium.

Self-Service Claims Automation

Policyholders benefit from self-service claims automation by quickly submitting and tracking claims through intuitive digital platforms, reducing wait times and administrative errors. Insurtech customers experience enhanced user engagement and satisfaction as automated workflows streamline claim approvals, leveraging AI to personalize the process and improve transparency.

Policyholder vs Insurtech Customer Infographic

industrydif.com

industrydif.com