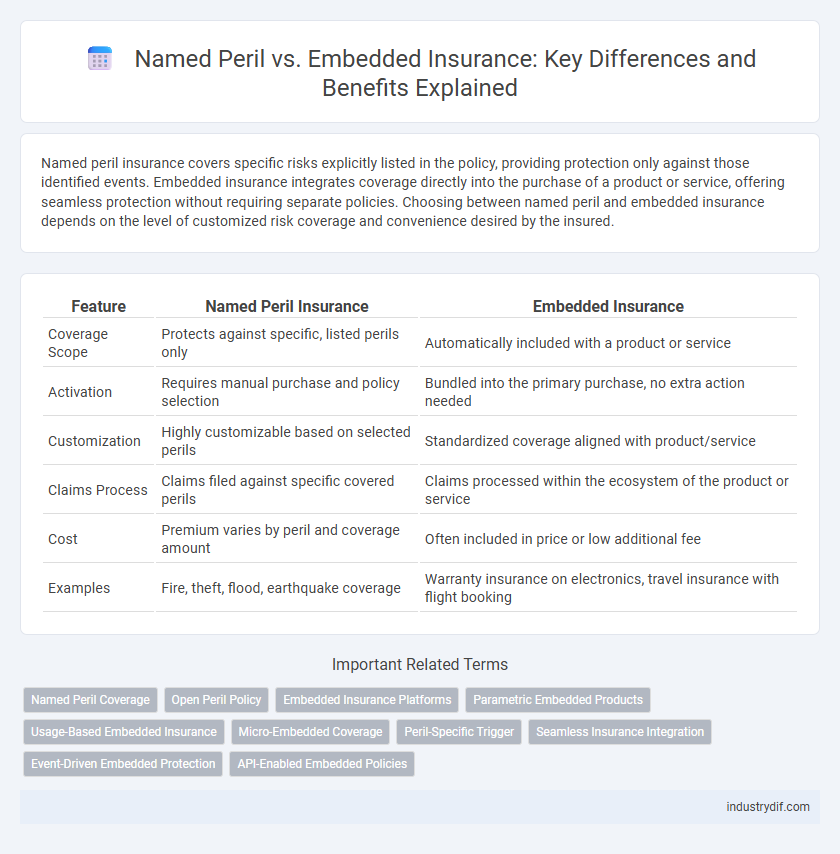

Named peril insurance covers specific risks explicitly listed in the policy, providing protection only against those identified events. Embedded insurance integrates coverage directly into the purchase of a product or service, offering seamless protection without requiring separate policies. Choosing between named peril and embedded insurance depends on the level of customized risk coverage and convenience desired by the insured.

Table of Comparison

| Feature | Named Peril Insurance | Embedded Insurance |

|---|---|---|

| Coverage Scope | Protects against specific, listed perils only | Automatically included with a product or service |

| Activation | Requires manual purchase and policy selection | Bundled into the primary purchase, no extra action needed |

| Customization | Highly customizable based on selected perils | Standardized coverage aligned with product/service |

| Claims Process | Claims filed against specific covered perils | Claims processed within the ecosystem of the product or service |

| Cost | Premium varies by peril and coverage amount | Often included in price or low additional fee |

| Examples | Fire, theft, flood, earthquake coverage | Warranty insurance on electronics, travel insurance with flight booking |

Understanding Named Peril Insurance

Named Peril Insurance provides coverage only for specific risks explicitly listed in the policy, such as fire, theft, or windstorm, making it crucial for policyholders to understand which perils are included and excluded. This type of insurance often results in lower premiums compared to broader policies because it limits coverage to agreed-upon events, necessitating careful assessment of potential risks. Proper knowledge of Named Peril Insurance helps individuals and businesses tailor protection to their unique needs while avoiding unexpected gaps in coverage.

What Is Embedded Insurance?

Embedded insurance integrates coverage directly into the purchase of products or services, streamlining protection by bundling policies with the primary offering. Unlike named peril insurance, which covers specific risks explicitly listed in the policy, embedded insurance provides broader, context-driven protection without requiring separate transactions. This approach enhances customer convenience and ensures seamless claims processing within the ecosystem of the purchased product.

Key Differences Between Named Peril and Embedded Insurance

Named Peril insurance specifically covers risks explicitly listed in the policy, such as fire, theft, or windstorm, while Embedded Insurance is integrated within the purchase of a product or service, automatically providing coverage without a separate policy. Named Peril policies require detailed risk identification, resulting in potentially lower premiums but narrower coverage, whereas Embedded Insurance offers convenience with broader, often standardized protection linked to the associated product. Understanding these differences helps policyholders choose between tailored risk management and seamless, inclusive insurance solutions.

Coverage Scope: Named Peril vs Embedded Insurance

Named peril insurance provides coverage exclusively for risks explicitly listed in the policy, limiting protection to specific events such as fire, theft, or windstorm. Embedded insurance integrates coverage within a broader product or service, often covering a wider range of risks without requiring separate policy declarations. The scope of coverage in embedded insurance tends to be broader and more seamless, offering automatic protection tied to the primary purchase, whereas named peril policies demand precise identification of insured perils to activate coverage.

Advantages of Named Peril Insurance

Named Peril Insurance offers clear coverage by specifically listing insured risks, making it easier for policyholders to understand what is protected. This type of insurance often results in lower premiums compared to embedded insurance, as coverage is limited to identified perils. It provides targeted protection, allowing businesses and individuals to tailor policies to their unique risk profiles and avoid paying for unnecessary coverage.

Benefits of Embedded Insurance Solutions

Embedded insurance solutions streamline the customer experience by integrating coverage directly into the purchase process, increasing convenience and reducing friction. These solutions offer real-time risk protection tailored to specific products or services, improving coverage relevance and satisfaction. By leveraging automation and data analytics, embedded insurance enhances policy customization and lowers operational costs for providers.

Limitations and Exclusions in Each Model

Named Peril insurance restricts coverage to specific risks explicitly listed in the policy, creating clear limitations that exclude any peril not mentioned, which can lead to gaps in protection. Embedded insurance typically offers broader coverage integrated within another product but often includes exclusions tied to the primary service or product's use, limiting benefits under certain conditions. Understanding these limitations and exclusions is crucial for policyholders to ensure adequate risk management and avoid unexpected out-of-pocket expenses.

Customer Experience: Traditional vs Embedded Insurance

Named Peril insurance offers customers coverage for specific risks explicitly listed in the policy, often limiting protection and requiring detailed understanding of exclusions, which can complicate claims and reduce satisfaction. Embedded Insurance integrates coverage seamlessly into products or services customers already use, enhancing convenience and simplifying the purchasing process by removing separate policy management. This streamlined approach improves customer experience by providing immediate, contextual protection and reducing friction in policy administration.

Cost Implications and Premium Structures

Named Peril insurance typically offers lower premiums by covering specific risks listed in the policy, limiting the insurer's exposure and cost. Embedded insurance bundles coverage into a product or service, often resulting in higher premiums reflecting the broader protection and convenience provided. Understanding these cost implications helps policyholders choose between targeted, cost-efficient protection and comprehensive, integrated coverage with potentially higher premiums.

Choosing the Right Insurance Approach for Your Needs

Choosing the right insurance approach depends on your risk profile and coverage requirements. Named Peril insurance covers specific risks explicitly listed in the policy, offering cost-effective protection for known threats but limiting coverage scope. Embedded Insurance integrates comprehensive protection within a primary product, providing seamless, broad-based coverage ideal for those seeking convenience and fewer coverage gaps.

Related Important Terms

Named Peril Coverage

Named Peril coverage in insurance specifically protects against risks explicitly listed in the policy, such as fire, theft, or vandalism, providing targeted protection that requires precise risk identification. Embedded insurance typically integrates coverage within a product or service, offering broader protection but often lacking the specificity of Named Peril policies, which limit claims to defined, documented hazards.

Open Peril Policy

An Open Peril Policy, unlike Named Peril coverage, protects against all risks except those specifically excluded, offering broader protection without the need to list individual threats. This comprehensive approach minimizes gaps in insurance coverage by embedding a wide range of perils automatically into the policy.

Embedded Insurance Platforms

Embedded insurance platforms integrate coverage directly within the purchase process of products or services, offering seamless protection tailored to specific customer needs without requiring separate transactions. Unlike named peril policies that cover explicit risks, embedded insurance typically provides broader, automatic protection bundled with the primary offering, enhancing convenience and customer experience.

Parametric Embedded Products

Named peril insurance covers specific risks explicitly listed in the policy, while embedded insurance integrates coverage within a product or service offering, allowing seamless protection. Parametric embedded products utilize predefined triggers, such as weather data or event metrics, to automatically activate payouts, streamlining claims and reducing administrative friction in insurance delivery.

Usage-Based Embedded Insurance

Usage-based embedded insurance integrates coverage directly into products or services, activating protection automatically based on real-time data such as driving behavior or device usage. Unlike named peril policies that cover specific risks explicitly listed, this model enhances personalized risk assessment, providing dynamic premiums and seamless protection for end-users.

Micro-Embedded Coverage

Micro-embedded coverage within insurance policies offers targeted protection by integrating specific named perils directly into broader plans, ensuring cost-effective risk management for particular exposures. This approach contrasts with traditional named peril insurance by embedding coverage seamlessly into primary policies, enhancing convenience and minimizing coverage gaps.

Peril-Specific Trigger

Named Peril insurance provides coverage exclusively for risks explicitly listed in the policy, activating claims based on specific, predefined perils such as fire, theft, or flood. Embedded insurance integrates these peril-specific triggers within broader products, automatically offering tailored protection for identified risks without the need for separate, explicit listings.

Seamless Insurance Integration

Named Peril insurance covers specific risks explicitly listed in the policy, ensuring targeted protection against clearly defined events, while Embedded Insurance integrates coverage directly into products or services for seamless, automatic risk management. This integration simplifies the claims process and enhances customer experience by providing real-time coverage without requiring separate insurance purchase steps.

Event-Driven Embedded Protection

Event-driven embedded protection in insurance offers automatic coverage triggered by specific incidents, unlike named peril policies which require explicit listing of risks covered. This approach enhances risk management by integrating protection seamlessly within products or services, ensuring immediate response and claims processing when events occur.

API-Enabled Embedded Policies

API-enabled embedded insurance integrates coverage directly within purchasing platforms, streamlining user experience by offering policies tailored to specific risks, unlike traditional named peril insurance that covers only explicitly listed dangers. This innovative approach leverages real-time data exchange and dynamic risk assessment, enhancing policy customization and immediate claim processing within ecosystems such as e-commerce or mobility services.

Named Peril vs Embedded Insurance Infographic

industrydif.com

industrydif.com