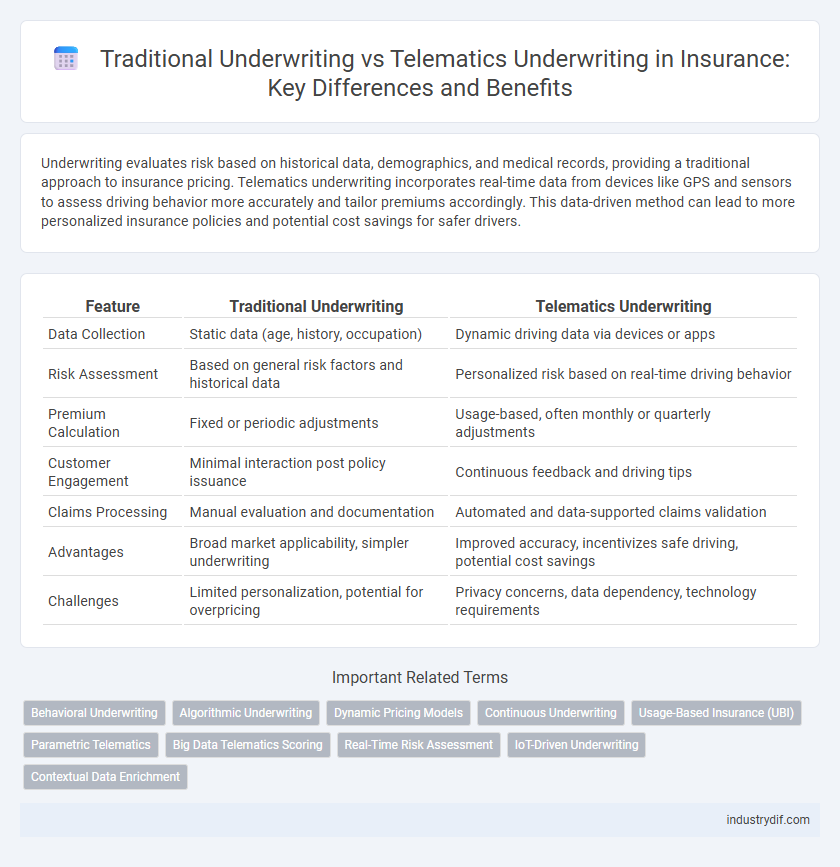

Underwriting evaluates risk based on historical data, demographics, and medical records, providing a traditional approach to insurance pricing. Telematics underwriting incorporates real-time data from devices like GPS and sensors to assess driving behavior more accurately and tailor premiums accordingly. This data-driven method can lead to more personalized insurance policies and potential cost savings for safer drivers.

Table of Comparison

| Feature | Traditional Underwriting | Telematics Underwriting |

|---|---|---|

| Data Collection | Static data (age, history, occupation) | Dynamic driving data via devices or apps |

| Risk Assessment | Based on general risk factors and historical data | Personalized risk based on real-time driving behavior |

| Premium Calculation | Fixed or periodic adjustments | Usage-based, often monthly or quarterly adjustments |

| Customer Engagement | Minimal interaction post policy issuance | Continuous feedback and driving tips |

| Claims Processing | Manual evaluation and documentation | Automated and data-supported claims validation |

| Advantages | Broad market applicability, simpler underwriting | Improved accuracy, incentivizes safe driving, potential cost savings |

| Challenges | Limited personalization, potential for overpricing | Privacy concerns, data dependency, technology requirements |

Introduction to Traditional Underwriting

Traditional underwriting in insurance involves evaluating risk through detailed analysis of an applicant's personal information, medical history, and financial background. Underwriters assess factors such as age, occupation, lifestyle, and credit score to determine policy eligibility and premiums. This manual process relies heavily on historical data and expert judgment to quantify risk and ensure profitability.

What is Telematics Underwriting?

Telematics underwriting integrates real-time data from devices installed in policyholders' vehicles to assess risk more accurately compared to traditional underwriting methods. It analyzes driving behaviors such as speed, acceleration, braking patterns, and mileage, enabling insurers to personalize premiums and improve risk prediction. This data-driven approach enhances pricing precision, reduces fraud, and incentivizes safer driving habits through usage-based insurance models.

Key Differences Between Traditional and Telematics Underwriting

Traditional underwriting relies on demographic data, credit scores, and historical claims to assess risk, while telematics underwriting uses real-time driving behavior data gathered through GPS and sensors. Telematics enables personalized premiums based on actual driving patterns such as speed, braking, and mileage, improving risk accuracy and incentivizing safer driving. The data-driven telematics approach offers dynamic risk assessment, contrasting with the static, generalized models of traditional underwriting.

Data Sources in Underwriting Methods

Traditional underwriting primarily relies on historical data such as credit scores, claims history, and demographic information to assess risk. Telematics underwriting incorporates real-time data collected from devices like GPS trackers and telematics sensors, providing insights into driving behaviors such as speed, braking patterns, and mileage. Leveraging telematics data allows insurers to create more personalized risk profiles and dynamic pricing models based on actual customer behavior.

Risk Assessment Techniques: Manual vs. Data-Driven

Traditional underwriting relies on manual risk assessment techniques involving detailed evaluations of applicant information, medical history, and financial background to determine insurance eligibility and premiums. Telematics underwriting employs data-driven methods by collecting real-time driving behavior metrics such as speed, braking patterns, and mileage through connected devices, enabling more accurate and personalized risk profiling. This shift from subjective manual analysis to objective data-driven insights enhances the precision of risk assessment and supports dynamic premium adjustments.

Impact on Premium Calculation

Traditional underwriting relies on historical data and risk factors such as age, location, and driving history to calculate insurance premiums. Telematics underwriting incorporates real-time driving behavior data, including speed, braking patterns, and mileage, enabling more precise risk assessment and personalized premium calculation. This approach often leads to lower premiums for safe drivers by directly linking driving habits to insurance costs.

Benefits of Telematics Underwriting

Telematics underwriting leverages real-time driving data to provide more accurate risk assessments, enabling personalized insurance premiums that reward safe driving behavior. This approach reduces fraud and claims frequency through continuous monitoring, leading to lower costs for both insurers and policyholders. Enhanced customer engagement and dynamic pricing models are significant benefits that traditional underwriting cannot match, driving improved satisfaction and retention.

Challenges in Implementing Telematics

Implementing telematics underwriting faces challenges such as data privacy concerns, high integration costs, and regulatory compliance across jurisdictions. Insurers must address customer resistance due to perceived invasions of privacy while ensuring secure handling of sensitive driving data. Additionally, establishing reliable telematics data analytics to accurately assess risk requires significant technological investment and expertise.

Regulatory and Privacy Considerations

Traditional underwriting relies on standardized risk assessments and faces stringent regulatory requirements to ensure data privacy and non-discrimination. Telematics underwriting collects personalized driving data through devices or apps, raising concerns about data security, user consent, and compliance with evolving privacy laws like GDPR and CCPA. Insurers must navigate these regulations carefully to balance innovation with protecting consumer rights and maintaining trust.

The Future of Underwriting in the Insurance Industry

The future of underwriting in the insurance industry is rapidly evolving with the integration of telematics underwriting, which leverages real-time data from connected devices to assess risk more accurately than traditional methods. Telematics underwriting enhances personalized insurance pricing by analyzing driving behavior, health metrics, or property usage, leading to more precise risk segmentation and improved loss prediction models. This data-driven approach is expected to increase efficiency, reduce fraud, and foster dynamic policy adjustments, making telematics a central component in the modernization of underwriting practices.

Related Important Terms

Behavioral Underwriting

Behavioral underwriting, a subset of telematics underwriting, leverages real-time driving data to assess risk more accurately than traditional underwriting methods, which rely on static information such as age, credit score, and claims history. By analyzing driving behaviors like speed, braking patterns, and mileage, insurance companies can offer personalized premiums and incentivize safer driving habits.

Algorithmic Underwriting

Algorithmic underwriting leverages advanced data analytics and machine learning algorithms to assess risk more accurately than traditional underwriting methods. Telematics underwriting enhances this process by incorporating real-time driving data, enabling personalized insurance pricing based on actual behavior rather than historical statistics.

Dynamic Pricing Models

Dynamic pricing models in underwriting leverage telematics data to assess risk continuously, enabling insurers to adjust premiums based on real-time driving behavior. Traditional underwriting relies on static historical information, whereas telematics underwriting offers personalized premium adjustments through granular, behavior-driven analytics.

Continuous Underwriting

Continuous underwriting leverages telematics to monitor real-time driving behavior, enabling dynamic risk assessment and personalized premium adjustments. Unlike traditional underwriting, which assesses risk periodically, continuous underwriting enhances accuracy by integrating ongoing data from telematics devices, improving fraud detection and customer retention.

Usage-Based Insurance (UBI)

Underwriting in traditional insurance relies on historical data, demographic factors, and risk assessments, whereas Telematics Underwriting for Usage-Based Insurance (UBI) uses real-time driving behavior, mileage, and vehicle location data to create personalized premiums. UBI enhances risk accuracy and customer engagement by integrating telematics devices and mobile apps, leading to more precise pricing and proactive risk management.

Parametric Telematics

Parametric telematics underwriting leverages real-time data from IoT sensors and telematics devices to assess risk based on predefined parameters, enabling more accurate and dynamic insurance pricing compared to traditional underwriting methods reliant on historical data and manual assessments. This approach enhances risk prediction efficiency and reduces claim processing times by automating coverage triggers linked to specific events such as driving behavior, weather conditions, or accident impact intensity.

Big Data Telematics Scoring

Big Data Telematics Scoring revolutionizes traditional underwriting by incorporating real-time driving data such as speed, acceleration, and braking patterns to assess risk more accurately. This advanced approach enables insurers to personalize premiums based on actual behavior, reducing reliance on historical or demographic data alone.

Real-Time Risk Assessment

Telematics underwriting leverages real-time data from connected devices to provide dynamic risk assessment, enabling insurers to evaluate policyholder behavior with greater accuracy compared to traditional underwriting methods. This continuous monitoring enhances risk prediction, reduces fraud, and allows personalized premium adjustments based on actual driving patterns or asset usage.

IoT-Driven Underwriting

IoT-driven underwriting leverages real-time data from connected devices such as telematics sensors to provide precise risk assessment, improving underwriting accuracy compared to traditional methods relying on historical data. This integration of telematics enables insurers to offer personalized premiums and dynamic policy adjustments based on actual behavior and usage patterns.

Contextual Data Enrichment

Traditional underwriting relies heavily on static data such as credit scores and claims history, while telematics underwriting enhances risk assessment through real-time driving behavior and contextual data enrichment from GPS, speed, and braking patterns. This enriched data enables insurers to create more personalized policies, improve pricing accuracy, and reduce fraudulent claims by capturing detailed context beyond conventional metrics.

Underwriting vs Telematics Underwriting Infographic

industrydif.com

industrydif.com