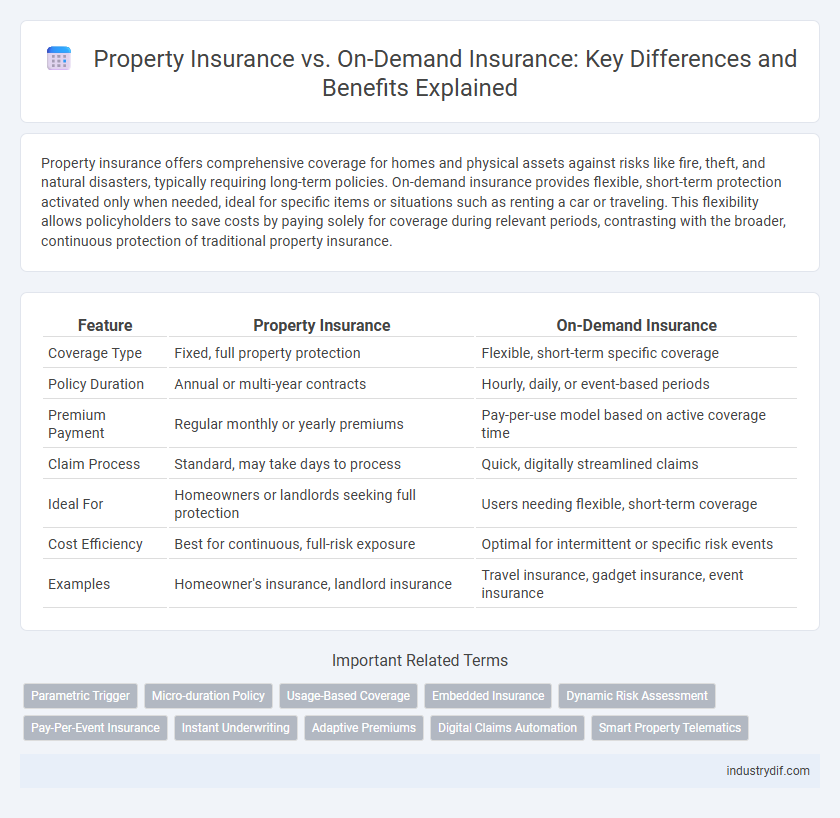

Property insurance offers comprehensive coverage for homes and physical assets against risks like fire, theft, and natural disasters, typically requiring long-term policies. On-demand insurance provides flexible, short-term protection activated only when needed, ideal for specific items or situations such as renting a car or traveling. This flexibility allows policyholders to save costs by paying solely for coverage during relevant periods, contrasting with the broader, continuous protection of traditional property insurance.

Table of Comparison

| Feature | Property Insurance | On-Demand Insurance |

|---|---|---|

| Coverage Type | Fixed, full property protection | Flexible, short-term specific coverage |

| Policy Duration | Annual or multi-year contracts | Hourly, daily, or event-based periods |

| Premium Payment | Regular monthly or yearly premiums | Pay-per-use model based on active coverage time |

| Claim Process | Standard, may take days to process | Quick, digitally streamlined claims |

| Ideal For | Homeowners or landlords seeking full protection | Users needing flexible, short-term coverage |

| Cost Efficiency | Best for continuous, full-risk exposure | Optimal for intermittent or specific risk events |

| Examples | Homeowner's insurance, landlord insurance | Travel insurance, gadget insurance, event insurance |

Definition of Property Insurance and On-Demand Insurance

Property insurance provides coverage for physical assets such as homes, buildings, and personal belongings against risks like fire, theft, or natural disasters, offering long-term protection through a fixed premium. On-demand insurance delivers flexible, short-term coverage activated only when needed, ideal for specific occasions or items and often purchased via mobile apps. Both types address different user needs, with property insurance ensuring continuous asset security, while on-demand insurance offers cost-effective, usage-based protection.

Key Differences Between Property Insurance and On-Demand Insurance

Property insurance provides continuous coverage for homes and buildings against risks like fire, theft, and natural disasters, requiring fixed premiums and annual contracts. On-demand insurance offers flexible, short-term protection activated only when needed, ideal for specific events or periods, with pay-as-you-go pricing models. Key differences include coverage continuity, payment structure, and customization, where property insurance ensures ongoing protection while on-demand insurance caters to intermittent, usage-based needs.

Coverage Scope: Comprehensive vs. Flexible Solutions

Property insurance offers comprehensive coverage designed to protect a wide range of assets including buildings, contents, and liability risks under a single policy. On-demand insurance provides flexible solutions that allow policyholders to activate coverage for specific items or short durations as needed, meeting the demand for tailored protection. The scope of coverage in property insurance is broad and continuous, whereas on-demand insurance prioritizes customization and temporal specificity.

Cost Comparison: Traditional Premiums vs. Pay-Per-Use Models

Traditional property insurance requires fixed monthly or annual premiums, often resulting in higher overall costs for infrequent claims. On-demand insurance offers a flexible pay-per-use model, where policyholders pay only for coverage during specific periods or events, significantly reducing expenses for occasional users. Cost efficiency in on-demand insurance appeals to consumers seeking personalized, short-term protection without long-term financial commitments.

Target Markets for Property Insurance and On-Demand Insurance

Property insurance primarily targets homeowners, renters, and commercial property owners seeking comprehensive, long-term protection against risks such as fire, theft, and natural disasters. On-demand insurance appeals to gig economy workers, short-term renters, and travelers who require flexible, customizable coverage activated only during specific timeframes or events. Insurers leverage data analytics to refine these target markets, optimizing policy offerings based on usage patterns and risk profiles.

Claims Process: Standard Procedures vs. Instant Settlements

Property insurance claims typically follow a standard procedure involving detailed documentation, adjuster inspections, and extended processing times that can span weeks to ensure thorough evaluation. On-demand insurance revolutionizes this process by offering instant settlements through automated assessments and real-time data verification, significantly reducing claim turnaround time. The contrast highlights traditional insurer protocols versus innovative, tech-driven solutions prioritizing speed and efficiency in claims handling.

Technology Integration in Property and On-Demand Insurance

Property insurance increasingly leverages advanced technology such as IoT sensors and AI-driven risk assessment tools to provide real-time monitoring and proactive loss prevention. On-demand insurance capitalizes on mobile app integration, enabling instant policy activation and dynamic coverage tailored to users' immediate needs. Both models harness data analytics and cloud platforms to enhance underwriting accuracy, customer engagement, and claims processing efficiency.

Risk Management and Underwriting Practices

Property insurance involves comprehensive risk management strategies and detailed underwriting practices that assess the long-term value and condition of physical assets to provide continuous coverage. On-demand insurance employs dynamic risk assessment models and flexible underwriting protocols, enabling tailored, short-term protection based on real-time asset usage and exposure. Effective risk management in both approaches relies on accurate data analytics and predictive modeling to minimize losses and optimize premium pricing.

Pros and Cons of Property Insurance vs. On-Demand Insurance

Property insurance offers comprehensive coverage for a wide range of risks including fire, theft, and natural disasters, providing long-term financial protection and peace of mind. On-demand insurance delivers flexibility and cost-efficiency by allowing policyholders to activate coverage only when needed, ideal for short-term or specific asset protection. However, property insurance typically involves higher premiums and less flexibility, while on-demand insurance may have limited coverage scope and potential gaps during inactive periods.

Future Trends in Property and On-Demand Insurance

Future trends in property insurance include increased integration of artificial intelligence for risk assessment and personalized coverage, while on-demand insurance is expanding through mobile platforms offering flexible, usage-based policies. Both sectors are moving towards greater digitalization, with blockchain technology enhancing transparency and claims processing efficiency. The rise of IoT devices also enables real-time monitoring and proactive loss prevention, transforming traditional property insurance models.

Related Important Terms

Parametric Trigger

Property insurance offers traditional coverage based on assessed losses, while on-demand insurance leverages parametric triggers that automatically initiate claims payouts when predefined conditions, such as weather thresholds or seismic activity intensities, are met. Parametric triggers enhance efficiency by reducing claim processing time and providing immediate financial relief without the need for extensive damage assessments.

Micro-duration Policy

Property insurance traditionally offers long-term coverage for physical assets like homes and businesses, while on-demand insurance provides flexible, micro-duration policies that enable users to activate coverage only for specific time frames or events, optimizing cost efficiency and customization. Micro-duration policies cater to dynamic risk scenarios by delivering instant, short-term protection, appealing to consumers seeking tailored insurance solutions without the commitment of extended contracts.

Usage-Based Coverage

Property insurance typically offers comprehensive coverage based on the insured value of the property, while on-demand insurance provides flexible, usage-based coverage that activates only during specific periods or events. Usage-based coverage in on-demand insurance minimizes costs by charging premiums according to actual exposure or usage, contrasting with fixed premiums in traditional property insurance.

Embedded Insurance

Embedded insurance integrates property insurance coverage directly within the purchase of assets, offering seamless protection without separate policy management. This approach contrasts with traditional on-demand insurance by providing proactive, continuous coverage that enhances customer convenience and reduces administrative complexity.

Dynamic Risk Assessment

Property insurance utilizes static risk assessment models based on historical data and fixed property attributes, while on-demand insurance employs dynamic risk assessment, leveraging real-time data and usage patterns to adjust coverage and premiums instantly. This adaptive approach in on-demand insurance enhances risk accuracy and cost efficiency for policyholders by reflecting current environmental and behavioral changes.

Pay-Per-Event Insurance

Pay-per-event insurance offers targeted financial protection by covering specific incidents such as natural disasters or theft, unlike traditional property insurance which provides continuous coverage for a broader range of risks. This on-demand model allows homeowners and renters to activate coverage only when needed, optimizing cost efficiency and tailored risk management.

Instant Underwriting

Property insurance typically involves a detailed underwriting process that can take days to assess risk and determine premiums, while on-demand insurance leverages instant underwriting technology to provide immediate coverage through automated data analysis. This instant underwriting utilizes real-time algorithms and digital verification methods, enabling customers to obtain tailored property insurance policies quickly and efficiently without manual intervention.

Adaptive Premiums

Property insurance typically features fixed premiums based on annual risk assessments and property value, whereas on-demand insurance offers adaptive premiums that fluctuate in real-time according to immediate usage and risk factors. This dynamic pricing model in on-demand insurance enhances cost efficiency and personalized coverage for policyholders.

Digital Claims Automation

Property insurance typically involves traditional claim processes requiring extensive paperwork and manual assessment, whereas on-demand insurance leverages digital claims automation to streamline submissions, reduce processing time, and enhance customer experience through real-time updates and faster settlements. Automated digital platforms in on-demand insurance use AI and machine learning to validate claims instantly, minimizing fraud and operational costs while providing greater flexibility and control to policyholders.

Smart Property Telematics

Smart property telematics enhances Property Insurance by providing real-time monitoring of assets, enabling precise risk assessment and proactive loss prevention. On-Demand Insurance leverages telematics for flexible, usage-based coverage, allowing policyholders to activate protection only when needed.

Property Insurance vs On-Demand Insurance Infographic

industrydif.com

industrydif.com