Customer service in insurance provides personalized support through human agents who understand complex needs and offer empathy during claims or policy questions. Chatbot assistance delivers instant, 24/7 responses for common inquiries, accelerating resolution times and improving accessibility. Balancing human expertise with AI efficiency enhances overall customer experience while optimizing operational costs.

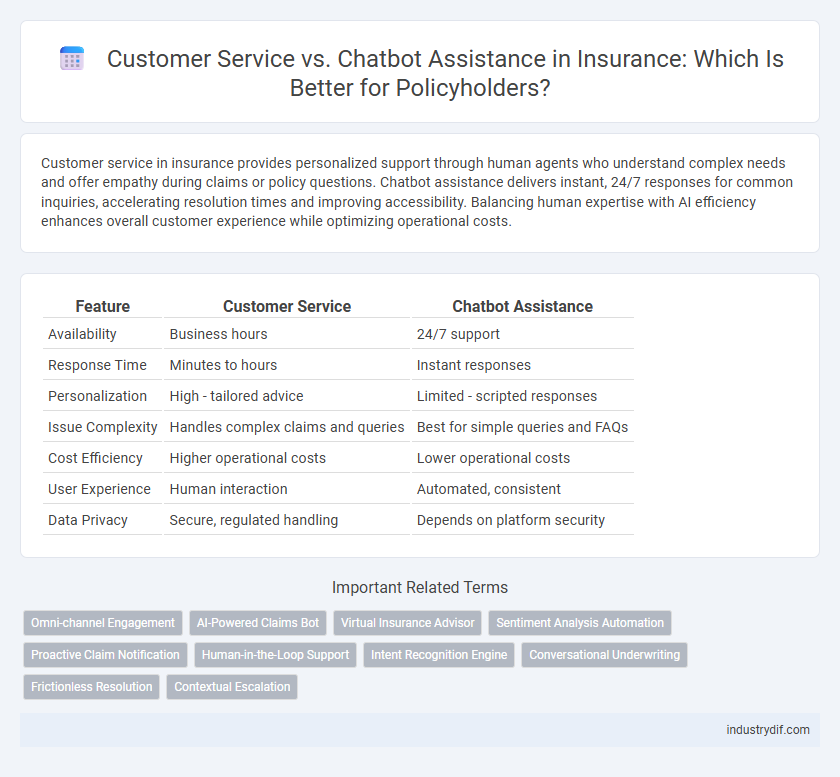

Table of Comparison

| Feature | Customer Service | Chatbot Assistance |

|---|---|---|

| Availability | Business hours | 24/7 support |

| Response Time | Minutes to hours | Instant responses |

| Personalization | High - tailored advice | Limited - scripted responses |

| Issue Complexity | Handles complex claims and queries | Best for simple queries and FAQs |

| Cost Efficiency | Higher operational costs | Lower operational costs |

| User Experience | Human interaction | Automated, consistent |

| Data Privacy | Secure, regulated handling | Depends on platform security |

Overview of Customer Service in Insurance

Customer service in insurance plays a critical role in addressing policy inquiries, claims processing, and personalized support, ensuring customer satisfaction and trust. Traditional customer service relies heavily on human agents to interpret complex policy details and offer tailored advice. Emphasizing empathy and problem-solving, human interaction remains essential for resolving nuanced insurance issues that require detailed understanding and discretion.

Emergence of Chatbot Assistance in the Insurance Sector

The emergence of chatbot assistance in the insurance sector is revolutionizing customer service by providing instant, 24/7 support for claims processing, policy inquiries, and premium calculations. AI-driven chatbots utilize natural language processing to handle complex queries efficiently, reducing wait times and operational costs for insurance providers. This technological advancement enhances customer satisfaction by delivering personalized interactions while freeing human agents to focus on more intricate issues requiring empathy and expert judgment.

Key Differences Between Human Agents and Chatbots

Human agents in insurance customer service provide personalized support by understanding complex inquiries and offering tailored advice based on emotional intelligence and nuanced policy knowledge. Chatbot assistance excels in handling routine tasks such as policy status updates, claim tracking, and FAQs with instant responses and 24/7 availability. The key differences lie in human agents' ability to manage complex problem-solving and empathy, while chatbots optimize efficiency through automation and consistent performance in standard interactions.

Efficiency and Response Times: Human vs AI

Customer service in insurance traditionally relies on human agents who provide personalized support but may experience longer response times due to call volumes and complex queries. Chatbot assistance powered by AI offers rapid response times, handling routine inquiries instantly and improving overall efficiency in claim processing and policy information retrieval. Combining human expertise with AI-driven chatbots optimizes customer experience by balancing personalized service and immediate assistance.

Personalization in Insurance Customer Interactions

Personalization in insurance customer interactions drives higher satisfaction by tailoring policy recommendations and claims support to individual needs. Customer service representatives excel at understanding complex emotions and offering empathetic responses, while chatbots provide instant, data-driven assistance for routine inquiries. Leveraging AI-powered chatbots alongside skilled agents creates a seamless, personalized experience that balances efficiency with human touch.

Data Security and Privacy in Chatbot Assistance

Chatbot assistance in insurance leverages advanced encryption protocols and AI-driven access controls to ensure data security and privacy, minimizing the risk of unauthorized access. Unlike traditional customer service, chatbots store and process personal information within secure, compliant cloud environments, adhering to regulations such as GDPR and HIPAA. This automated system reduces human error and limits data exposure, providing a safer channel for sensitive insurance inquiries and transactions.

Common Use Cases for Chatbots in Insurance

Chatbots in insurance excel at handling common use cases such as policy inquiries, claims filing, and premium payments by providing instant, 24/7 support that reduces wait times and operational costs. They streamline customer service by automating routine tasks like policy renewals, coverage verification, and appointment scheduling, enhancing efficiency and accuracy. By leveraging natural language processing and machine learning, chatbots offer personalized assistance, improving customer engagement and satisfaction in the insurance sector.

Challenges Faced by Human and AI Support

Customer service representatives in insurance often face challenges such as handling complex claims, emotional customer interactions, and maintaining personalized communication, which can lead to high stress and burnout. Chatbot assistance struggles with understanding nuanced inquiries, providing accurate context-based solutions, and managing exceptions beyond programmed algorithms, resulting in potential customer frustration. Balancing human empathy with AI efficiency remains a critical challenge for enhancing overall insurance customer support.

Customer Satisfaction: Traditional vs Automated Service

Customer satisfaction in insurance hinges on the balance between personalized customer service and efficient chatbot assistance. Traditional service offers customized solutions through human agents, fostering trust and nuanced understanding, while automated chatbots deliver rapid responses and 24/7 availability, enhancing convenience. Data shows that combining both approaches can improve overall customer satisfaction by addressing complex inquiries with expert agents and routine questions through AI-powered chatbots.

Future Trends: Blending Human and Chatbot Support in Insurance

The future of insurance customer service is poised to integrate advanced AI chatbots with human representatives to enhance efficiency and personalization. AI-driven chatbots enable rapid claim processing and 24/7 support, while human agents provide empathy and complex problem-solving. This blended approach leverages machine learning algorithms and natural language processing to optimize customer satisfaction and operational cost-effectiveness in insurance.

Related Important Terms

Omni-channel Engagement

Omni-channel engagement in insurance enhances customer service by seamlessly integrating chatbot assistance across platforms like mobile apps, websites, and call centers to provide consistent, real-time support. Leveraging AI-powered chatbots alongside human agents increases efficiency, reduces response times, and personalizes interactions, improving overall policyholder satisfaction and loyalty.

AI-Powered Claims Bot

AI-powered claims bots in insurance streamline the customer service experience by providing instant, accurate claim processing and 24/7 support, reducing wait times and human errors. These intelligent chatbots leverage natural language processing and machine learning to handle complex queries, enhance policyholder satisfaction, and optimize operational efficiency for insurers.

Virtual Insurance Advisor

Virtual insurance advisors leverage advanced AI to provide personalized policy recommendations and real-time claim support, enhancing customer satisfaction while reducing wait times. Compared to traditional customer service, chatbot assistance ensures 24/7 availability and consistent information delivery, streamlining the insurance purchase and management process.

Sentiment Analysis Automation

Sentiment analysis automation in insurance customer service enhances real-time understanding of policyholders' emotions, enabling tailored responses and improved satisfaction rates. Implementing AI-driven chatbots equipped with sentiment analysis reduces response times and accurately identifies urgent issues, boosting overall claim resolution efficiency.

Proactive Claim Notification

Proactive claim notification through chatbot assistance enhances customer service by instantly alerting policyholders about potential claims, reducing response time and minimizing claim processing delays. Leveraging AI-driven chatbots enables insurers to provide 24/7 support, improve claim accuracy, and increase customer satisfaction compared to traditional service channels.

Human-in-the-Loop Support

Human-in-the-loop support in insurance customer service combines advanced chatbot assistance with expert human intervention to resolve complex claims and policy inquiries efficiently. This hybrid approach enhances customer satisfaction by providing instant responses through AI while ensuring nuanced, empathetic support from skilled agents when needed.

Intent Recognition Engine

Insurance companies leverage intent recognition engines in chatbots to accurately interpret customer inquiries, streamlining claims processing and policy management with rapid, precise responses. Advanced natural language processing models enable chatbots to understand complex insurance terminology and customer intent, enhancing efficiency while maintaining high satisfaction in customer service interactions.

Conversational Underwriting

Conversational underwriting powered by advanced chatbots enhances insurance customer service by delivering real-time, personalized policy evaluations and risk assessments through natural language interactions. This technology reduces processing times, improves accuracy in data collection, and provides customers with instant, clear responses, outperforming traditional human-assisted underwriting workflows.

Frictionless Resolution

Customer service in insurance offers personalized support with complex claim assessments, while chatbot assistance enables frictionless resolution through instant responses and 24/7 availability. Leveraging AI-powered chatbots reduces wait times and streamlines repetitive inquiries, enhancing customer satisfaction and operational efficiency.

Contextual Escalation

Contextual escalation in insurance customer service ensures seamless transition from chatbot assistance to human agents by analyzing user intent and interaction history, improving resolution efficiency and customer satisfaction. Advanced AI-powered chatbots prioritize complex queries for escalation, reducing response time and enhancing personalized support in high-stakes insurance claims and policy inquiries.

Customer Service vs Chatbot Assistance Infographic

industrydif.com

industrydif.com