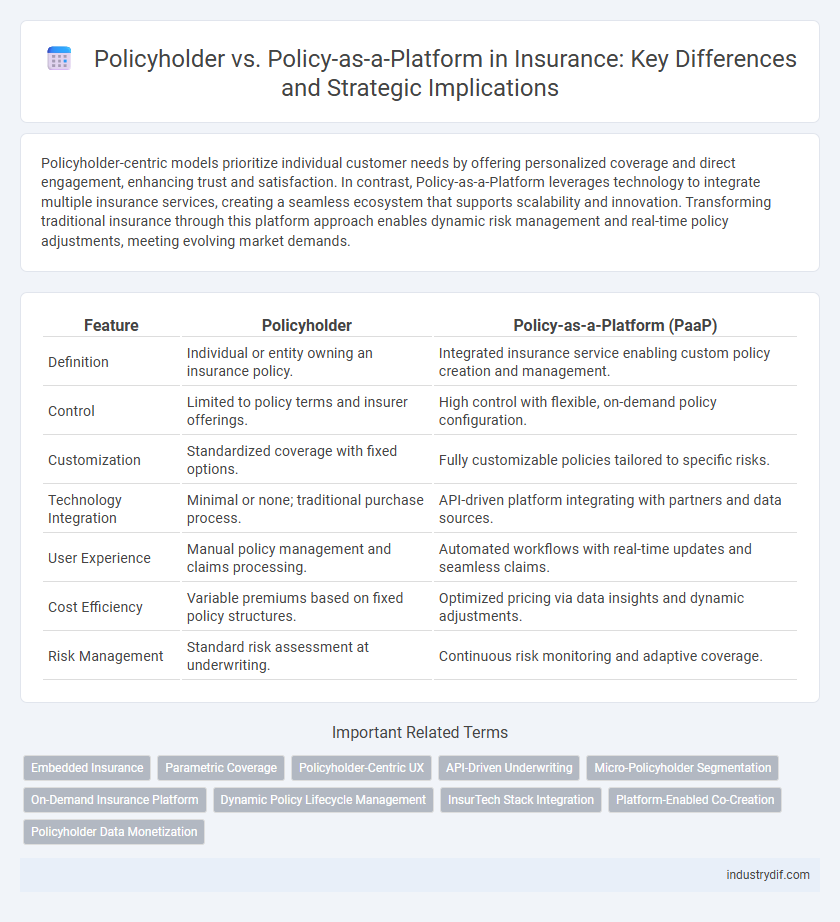

Policyholder-centric models prioritize individual customer needs by offering personalized coverage and direct engagement, enhancing trust and satisfaction. In contrast, Policy-as-a-Platform leverages technology to integrate multiple insurance services, creating a seamless ecosystem that supports scalability and innovation. Transforming traditional insurance through this platform approach enables dynamic risk management and real-time policy adjustments, meeting evolving market demands.

Table of Comparison

| Feature | Policyholder | Policy-as-a-Platform (PaaP) |

|---|---|---|

| Definition | Individual or entity owning an insurance policy. | Integrated insurance service enabling custom policy creation and management. |

| Control | Limited to policy terms and insurer offerings. | High control with flexible, on-demand policy configuration. |

| Customization | Standardized coverage with fixed options. | Fully customizable policies tailored to specific risks. |

| Technology Integration | Minimal or none; traditional purchase process. | API-driven platform integrating with partners and data sources. |

| User Experience | Manual policy management and claims processing. | Automated workflows with real-time updates and seamless claims. |

| Cost Efficiency | Variable premiums based on fixed policy structures. | Optimized pricing via data insights and dynamic adjustments. |

| Risk Management | Standard risk assessment at underwriting. | Continuous risk monitoring and adaptive coverage. |

Understanding the Policyholder: Roles and Responsibilities

Understanding the policyholder involves recognizing their crucial role as the purchaser and beneficiary of an insurance policy, responsible for paying premiums, maintaining accurate information, and initiating claims when necessary. Policy-as-a-platform shifts the traditional model by integrating digital tools that empower policyholders with real-time access to policy details, personalized coverage options, and streamlined communication with insurers. This evolution enhances transparency, accountability, and engagement, ensuring policyholders are more informed and proactive in managing their insurance needs.

Defining Policy-as-a-Platform in Modern Insurance

Policy-as-a-Platform in modern insurance represents a technology-driven framework enabling seamless integration of digital services, real-time data analytics, and personalized customer experiences within a unified insurance ecosystem. This model shifts the focus from traditional policyholder-centric approaches to a dynamic platform architecture that supports on-demand policy customization, automated claims processing, and multi-channel engagement. Leveraging APIs and cloud computing, Policy-as-a-Platform enhances operational efficiency, scalability, and fosters innovation in risk assessment and underwriting.

Core Differences: Policyholder vs Policy-as-a-Platform

Policyholders are individual or corporate entities that own and are protected by insurance policies, directly engaging with insurers for coverage and claims management. Policy-as-a-Platform (PaaP) transforms traditional insurance by offering an integrated digital ecosystem where policies are customizable, data-driven, and connected with third-party services to enhance user experience and operational efficiency. Core differences lie in ownership and interaction: policyholders maintain conventional policy ownership and administration, while PaaP emphasizes platform-based policy distribution, seamless automation, and broader service integration.

Benefits of Policyholder-Centric Insurance Models

Policyholder-centric insurance models prioritize personalized coverage, enhancing customer satisfaction through tailored risk assessments and flexible premium structures. These models improve claims processing efficiency by leveraging real-time data and direct communication, leading to faster settlements and reduced administrative costs. Emphasizing policyholder engagement fosters loyalty and drives long-term retention, resulting in higher lifetime value and consistent revenue growth for insurers.

Innovations Enabled by Policy-as-a-Platform

Policy-as-a-Platform (PaaP) revolutionizes the insurance landscape by integrating advanced technologies such as AI, IoT, and blockchain to deliver personalized, real-time policy management and proactive risk mitigation. This innovation enables seamless data exchange between insurers and policyholders, enhancing claim processing efficiency and fostering customer-centric service models. By shifting from traditional policyholder interactions to dynamic, platform-based ecosystems, insurers can rapidly deploy adaptive coverage, unlocking new revenue streams and improving risk assessment accuracy.

Customer Experience: Traditional Policyholder vs Platform Approaches

Traditional policyholder models often result in fragmented customer experiences due to limited interaction channels and static policy management tools. Policy-as-a-Platform approaches enhance customer experience by offering integrated digital solutions that provide real-time policy updates, personalized recommendations, and seamless claims processing. This platform-centric model leverages AI and data analytics to deliver proactive support, significantly increasing customer engagement and satisfaction.

Technology’s Role in Policy-as-a-Platform Evolution

Policy-as-a-Platform leverages advanced technologies such as AI, cloud computing, and IoT to create dynamic, customizable insurance solutions that surpass traditional policyholder models. These technologies enable real-time data integration, automated underwriting, and personalized risk assessment, enhancing user experience and operational efficiency. The evolution of Policy-as-a-Platform reflects a shift toward digitally-driven ecosystems where insurers and policyholders interact seamlessly through scalable, technology-powered frameworks.

Impact on Personalization and Customization

Policyholder-centric insurance models prioritize individual risk profiles and preferences, enabling tailored coverage and personalized premium calculations that enhance customer satisfaction. Policy-as-a-Platform leverages modular design and digital interfaces to offer adaptable policy components, facilitating on-demand customization and seamless integration with third-party services. This shift enhances personalization by allowing policyholders to actively configure their coverage in real-time, improving engagement and aligning insurance products more closely with evolving personal needs.

Regulatory and Compliance Considerations

Policyholder-centric insurance models prioritize personalized regulatory compliance, ensuring policies adhere to individual privacy laws such as GDPR or HIPAA. Policy-as-a-Platform frameworks streamline compliance management by integrating automated risk assessment tools and real-time regulatory updates to meet evolving industry standards. Both approaches must align with anti-money laundering (AML) regulations and know-your-customer (KYC) requirements to mitigate fraud and enhance transparency.

Future Trends: The Shift from Policyholder to Platform Models

The insurance industry is rapidly evolving from traditional policyholder-centric models to Policy-as-a-Platform (PaaP) frameworks, enhancing customer engagement and operational efficiency. Future trends emphasize leveraging advanced AI analytics, real-time data integration, and modular product offerings that transform policies into dynamic, customizable platforms. This shift enables insurers to deliver personalized risk management solutions, streamline claims processing, and foster continuous value creation beyond conventional policy terms.

Related Important Terms

Embedded Insurance

Embedded insurance integrates coverage options directly into the customer journey, allowing policyholders to access tailored insurance products seamlessly within non-insurance platforms. This approach transforms traditional insurance models by shifting focus from standalone policies to platform-driven, context-aware risk protection solutions that enhance user experience and increase policyholder engagement.

Parametric Coverage

Parametric coverage empowers policyholders with predefined triggers that enable automatic claim payouts based on objective data, reducing the need for traditional claim assessments. Policy-as-a-platform leverages this parametric model by integrating real-time data streams and customizable coverage options, enhancing transparency and efficiency for both insurers and policyholders.

Policyholder-Centric UX

Policyholder-centric UX prioritizes intuitive design and seamless interactions to enhance user engagement and satisfaction, ensuring policyholders easily access, manage, and customize their insurance coverage. Leveraging policy-as-a-platform technology integrates personalized services and real-time data analytics, transforming traditional policies into dynamic digital experiences tailored to individual needs.

API-Driven Underwriting

API-driven underwriting in a Policy-as-a-Platform model significantly enhances automation and risk assessment accuracy compared to traditional policyholder-centric approaches. This seamless integration of real-time data through APIs enables insurers to deliver personalized coverage faster while reducing operational costs and improving overall customer experience.

Micro-Policyholder Segmentation

Micro-policyholder segmentation leverages granular customer data to tailor insurance offerings, enhancing personalization and risk assessment beyond traditional policyholder models. Policy-as-a-platform integrates diverse micro-segments within a scalable ecosystem, enabling dynamic policy customization and real-time adjustments to meet evolving individual needs.

On-Demand Insurance Platform

Policyholders benefit from On-Demand Insurance Platforms by accessing customizable coverage instantly through digital interfaces tailored to their specific needs. These platforms leverage real-time data analytics and API integrations to deliver flexible, usage-based policies that enhance user experience and operational efficiency.

Dynamic Policy Lifecycle Management

Policy-as-a-Platform integrates AI-driven analytics and automated workflows to enhance Dynamic Policy Lifecycle Management, enabling real-time adjustments and personalized coverage for policyholders. This approach reduces claims processing time by up to 30% while increasing customer retention through adaptive policy customization based on evolving risk profiles.

InsurTech Stack Integration

Policyholder engagement intensifies as InsurTech stack integration transforms traditional insurance models, shifting from singular policy management to dynamic Policy-as-a-Platform ecosystems that enable real-time data exchange and personalized coverage. This evolution enhances risk assessment accuracy, streamlines claims processing, and fosters seamless connectivity between insurers, brokers, and technology providers for optimized operational efficiency.

Platform-Enabled Co-Creation

Policy-as-a-Platform enables dynamic platform-enabled co-creation by facilitating interactive collaboration between insurers and policyholders, allowing tailored insurance solutions through real-time data exchange and adaptive coverage options. This shift from traditional policyholder roles fosters personalized risk management, enhances customer engagement, and drives innovation in insurance product development.

Policyholder Data Monetization

Policyholder data monetization leverages advanced analytics and AI-driven platforms to transform raw insurance data into actionable insights, enhancing personalized services and risk assessment accuracy. Policy-as-a-Platform models integrate multiple data sources from policyholders, enabling insurers to optimize pricing strategies, develop tailored products, and create new revenue streams through data partnerships.

Policyholder vs Policy-as-a-Platform Infographic

industrydif.com

industrydif.com