Reinsurance involves transferring portions of risk portfolios to other insurers to reduce exposure and ensure financial stability, while insurtech platforms leverage technology to streamline insurance processes, improve customer experience, and enhance data analytics. Reinsurance focuses on risk management and capital optimization, whereas insurtech platforms prioritize innovation in underwriting, claims processing, and policy administration. Combining reinsurance strategies with insurtech solutions can lead to more efficient risk assessment and operational efficiency in the insurance industry.

Table of Comparison

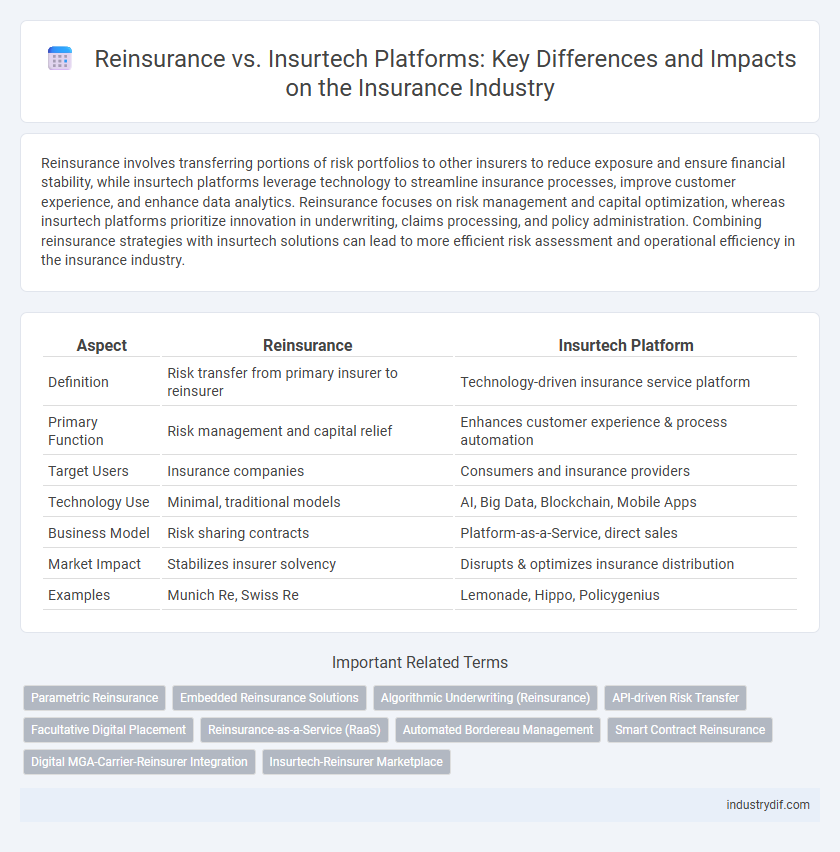

| Aspect | Reinsurance | Insurtech Platform |

|---|---|---|

| Definition | Risk transfer from primary insurer to reinsurer | Technology-driven insurance service platform |

| Primary Function | Risk management and capital relief | Enhances customer experience & process automation |

| Target Users | Insurance companies | Consumers and insurance providers |

| Technology Use | Minimal, traditional models | AI, Big Data, Blockchain, Mobile Apps |

| Business Model | Risk sharing contracts | Platform-as-a-Service, direct sales |

| Market Impact | Stabilizes insurer solvency | Disrupts & optimizes insurance distribution |

| Examples | Munich Re, Swiss Re | Lemonade, Hippo, Policygenius |

Overview of Reinsurance in the Insurance Industry

Reinsurance serves as a critical risk management tool in the insurance industry, allowing primary insurers to transfer portions of their risk portfolios to reinsurers. This process enhances capital efficiency, stabilizes loss experience, and supports underwriting capacity during large-scale claims events. Unlike insurtech platforms that leverage technology to streamline policy management and distribution, reinsurance fundamentally underpins the financial stability and resilience of insurance companies.

What Is an Insurtech Platform?

An insurtech platform leverages advanced technology such as AI, big data, and cloud computing to streamline insurance processes, enhance customer experience, and improve risk assessment. Unlike traditional reinsurance, which involves transferring risk between insurers to mitigate exposure, insurtech platforms focus on digitizing underwriting, claims management, and policy administration. These platforms enable insurers to operate more efficiently, reduce costs, and offer innovative products tailored to evolving market demands.

Key Differences Between Reinsurance and Insurtech

Reinsurance involves insurance companies transferring portions of risk portfolios to other insurers to reduce exposure and stabilize loss potential, whereas insurtech platforms leverage advanced technology like AI, big data, and blockchain to streamline insurance processes and improve customer experience. Reinsurance is primarily concerned with risk management and capital optimization within traditional insurance frameworks, while insurtech focuses on innovation, automation, and digital disruption in policy issuance, claims handling, and underwriting. The core difference lies in reinsurance being a financial risk mitigation tool, contrasted with insurtech serving as a technology-driven solution transforming the insurance value chain.

Traditional Reinsurance Models vs. Digital Platforms

Traditional reinsurance models rely heavily on manual underwriting processes, long contract negotiation cycles, and established relationships within the industry, often resulting in slower claim settlements and less transparency. Insurtech platforms leverage advanced data analytics, AI-driven risk assessment, and real-time digital interfaces to streamline underwriting and claims management, enabling faster decision-making and enhanced customer experience. The shift from legacy reinsurance methods to digital platforms transforms risk transfer efficiency and cost structures, promoting greater agility and innovation in the insurance ecosystem.

Benefits of Reinsurance for Insurance Carriers

Reinsurance provides insurance carriers with vital risk mitigation by spreading potential large losses across multiple entities, enhancing financial stability and protecting capital reserves. It enables insurers to underwrite policies with higher coverage limits and diversifies their risk portfolios, supporting sustainable growth. By leveraging reinsurance, carriers improve solvency margins and compliance with regulatory capital requirements, ensuring long-term operational resilience.

How Insurtech Platforms Disrupt the Insurance Ecosystem

Insurtech platforms leverage advanced technologies like AI, blockchain, and big data analytics to streamline underwriting, claims processing, and customer engagement, significantly enhancing operational efficiency compared to traditional reinsurance models. These platforms enable real-time risk assessment and personalized insurance products, disrupting legacy insurance ecosystems by reducing costs and improving scalability. The integration of digital distribution channels and automated processes challenges conventional reinsurance structures, driving innovation and accelerating market responsiveness.

Technological Innovations in Reinsurance

Technological innovations in reinsurance leverage advanced data analytics, artificial intelligence, and blockchain to enhance risk assessment, underwriting efficiency, and claims management. Unlike insurtech platforms that primarily focus on retail insurance customer experience and distribution, reinsurance technology platforms prioritize complex risk modeling and capital optimization. These advancements enable more accurate risk transfer and improved financial stability for reinsurance companies in a rapidly evolving insurance landscape.

Collaboration and Integration: Reinsurers and Insurtechs

Reinsurers and insurtech platforms are increasingly collaborating to enhance risk assessment and claims processing through advanced data analytics and AI integration. By combining reinsurers' extensive risk management expertise with insurtechs' innovative digital solutions, they streamline underwriting workflows and improve capital efficiency. This partnership accelerates market adaptability and facilitates seamless data exchange, driving sustained growth in the insurance and reinsurance sectors.

Regulatory Considerations for Reinsurance and Insurtech

Reinsurance is heavily regulated to ensure financial stability, requiring compliance with capital adequacy, solvency margins, and reporting standards set by bodies such as the International Association of Insurance Supervisors (IAIS) and local insurance regulators. Insurtech platforms must navigate data privacy laws, licensing requirements, and consumer protection regulations, including GDPR in Europe and various state-specific insurance laws in the U.S., while integrating technology innovations like AI and blockchain. Both fields face evolving regulatory landscapes aimed at managing risk, enhancing transparency, and safeguarding customer interests in an increasingly digital insurance ecosystem.

Future Trends: The Convergence of Reinsurance and Insurtech

The future of insurance lies in the convergence of reinsurance and insurtech platforms, where blockchain technology and AI-driven analytics enhance risk assessment and claims management efficiency. Insurtech innovation enables real-time data integration, fostering dynamic reinsurance contracts tailored to emerging risk patterns. This synergy drives greater transparency, cost reduction, and accelerated underwriting processes, reshaping the risk transfer landscape for global insurance markets.

Related Important Terms

Parametric Reinsurance

Parametric reinsurance offers predefined payouts based on specific trigger events, enhancing claim efficiency compared to traditional indemnity-based reinsurance models. Insurtech platforms leverage advanced data analytics and blockchain technology to facilitate real-time parametric reinsurance transactions, improving transparency and reducing administrative costs.

Embedded Reinsurance Solutions

Embedded reinsurance solutions integrate seamlessly within insurtech platforms, enabling insurers to transfer risk efficiently while enhancing operational agility and customer experience. These platforms leverage advanced data analytics and API-driven connectivity to facilitate real-time risk assessment and automated claims processing, reducing costs and improving capital management.

Algorithmic Underwriting (Reinsurance)

Algorithmic underwriting in reinsurance leverages advanced data analytics and machine learning models to assess risk more accurately, enabling underwriters to price policies and manage portfolios efficiently with enhanced precision. Insurtech platforms, while incorporating algorithmic underwriting, focus on user-friendly interfaces and automation to streamline claims processing and customer engagement, but reinsurance algorithms prioritize complex risk evaluation and capital optimization.

API-driven Risk Transfer

API-driven risk transfer enables seamless integration between traditional reinsurance processes and modern insurtech platforms, enhancing data accuracy and speed in underwriting and claims management. This approach streamlines risk distribution by automating complex transactions and facilitating real-time communication between insurers and reinsurers.

Facultative Digital Placement

Facultative digital placement enhances reinsurance by enabling tailored, on-demand coverage for specific risks through automated, data-driven platforms, improving accuracy and efficiency compared to traditional methods. Insurtech platforms leverage advanced algorithms and real-time analytics to optimize risk assessment and pricing, facilitating faster decision-making and streamlining facultative treaty negotiations.

Reinsurance-as-a-Service (RaaS)

Reinsurance-as-a-Service (RaaS) leverages cloud-based technologies to provide scalable, on-demand risk transfer solutions that enhance traditional reinsurance models by increasing efficiency and reducing capital requirements. Unlike Insurtech platforms focused on customer-facing innovations, RaaS integrates directly with insurer systems to streamline claims processing, underwriting, and risk management through automated data analytics and API-driven connectivity.

Automated Bordereau Management

Automated bordereau management in reinsurance enhances data accuracy and processing speed by systematically capturing and validating transaction details between insurers and reinsurers. Insurtech platforms leverage advanced automation and AI-driven solutions to streamline bordereau submissions, reducing manual errors and improving real-time reporting efficiency.

Smart Contract Reinsurance

Smart Contract Reinsurance leverages blockchain technology to automate claim validation and payout processes, significantly reducing operational costs and enhancing transparency compared to traditional reinsurance models. Insurtech platforms integrating smart contracts enable real-time risk assessment, faster settlement cycles, and improved data security, driving innovation in the reinsurance industry.

Digital MGA-Carrier-Reinsurer Integration

Digital MGA-carrier-reinsurer integration enhances risk transfer efficiency by streamlining underwriting, claims management, and policy issuance across reinsurance and insurtech platforms. Leveraging APIs and cloud-based solutions enables seamless data exchange, improving pricing accuracy and accelerating decision-making in reinsurance contracts and insurtech digital distribution.

Insurtech-Reinsurer Marketplace

The Insurtech-Reinsurer Marketplace revolutionizes traditional reinsurance by integrating advanced digital platforms that enhance risk assessment, pricing accuracy, and claims processing efficiency. Leveraging AI and blockchain technologies, these marketplaces facilitate seamless collaboration between insurers and reinsurers, optimizing capital allocation and accelerating underwriting processes.

Reinsurance vs Insurtech Platform Infographic

industrydif.com

industrydif.com