A traditional risk pool aggregates premiums from many insured individuals to spread potential losses across a large group, providing financial stability and predictable coverage. Decentralized risk pools leverage blockchain technology to create transparent, trustless insurance funds where participants directly share risks without intermediaries. This approach enhances security, reduces administrative costs, and enables more flexible, peer-to-peer risk sharing compared to conventional insurance models.

Table of Comparison

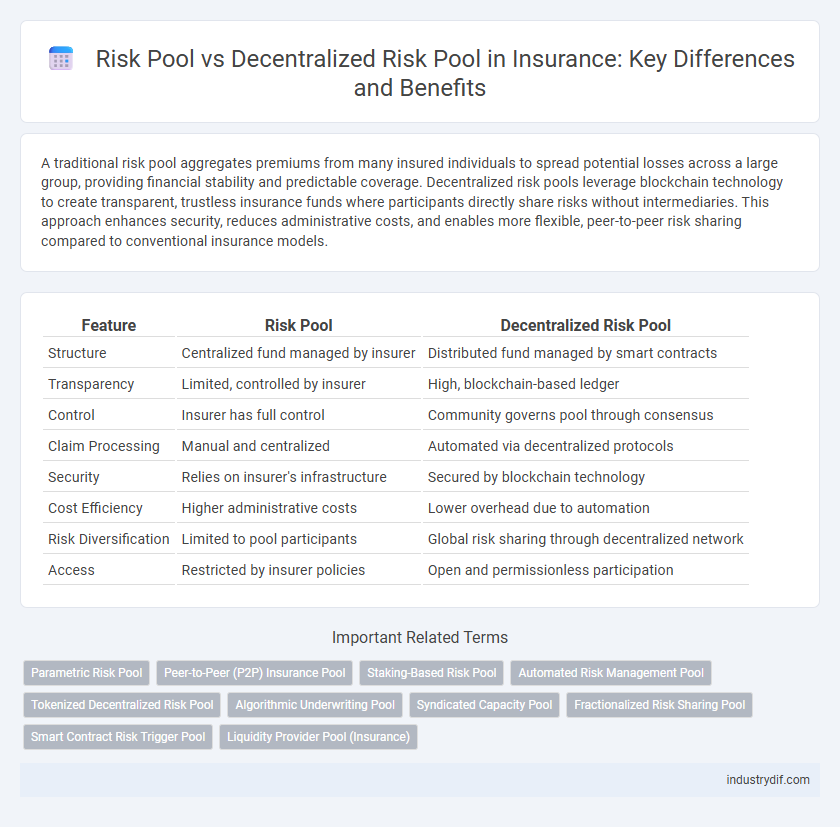

| Feature | Risk Pool | Decentralized Risk Pool |

|---|---|---|

| Structure | Centralized fund managed by insurer | Distributed fund managed by smart contracts |

| Transparency | Limited, controlled by insurer | High, blockchain-based ledger |

| Control | Insurer has full control | Community governs pool through consensus |

| Claim Processing | Manual and centralized | Automated via decentralized protocols |

| Security | Relies on insurer's infrastructure | Secured by blockchain technology |

| Cost Efficiency | Higher administrative costs | Lower overhead due to automation |

| Risk Diversification | Limited to pool participants | Global risk sharing through decentralized network |

| Access | Restricted by insurer policies | Open and permissionless participation |

Understanding Traditional Risk Pools in Insurance

Traditional risk pools in insurance aggregate premiums from numerous policyholders to collectively cover losses, distributing risk across a broad base. This centralized approach enables insurers to predict claims more accurately using actuarial data, ensuring adequate reserves for compensation. Such pools rely heavily on regulatory oversight and established claims processes to maintain financial stability and protect participants.

What is a Decentralized Risk Pool?

A Decentralized Risk Pool is a blockchain-based insurance model where participants share risks and premiums without a central authority, enhancing transparency and trust. This system leverages smart contracts to automate claims processing and fund distribution, reducing fraud and administrative costs. By enabling peer-to-peer risk sharing, decentralized risk pools create more efficient and accessible insurance solutions.

Key Differences Between Traditional and Decentralized Risk Pools

Traditional risk pools aggregate premiums and claims through centralized insurance companies, managing risk using actuarial models and fixed policies. Decentralized risk pools leverage blockchain technology to distribute risk dynamically via smart contracts, enabling transparency and community governance without intermediaries. This shift enhances trust, reduces administrative costs, and offers real-time claim processing compared to conventional methods.

How Traditional Risk Pooling Works

Traditional risk pooling in insurance operates by aggregating premiums from a large group of policyholders into a collective fund used to pay claims, effectively spreading financial risk across participants. This centralized mechanism relies on an insurance company or mutual organization to manage the pool, underwriting policies, assessing risks, and handling claims processing. The efficiency of traditional risk pools depends on accurate risk assessment, actuarial analysis, and regulatory oversight to maintain solvency and ensure fair premium pricing.

Blockchain and the Rise of Decentralized Risk Pools

Blockchain technology revolutionizes traditional insurance by enabling decentralized risk pools that eliminate intermediaries and enhance transparency. Decentralized risk pools leverage smart contracts to automate claim processing and reduce fraud, increasing efficiency and trust among participants. This shift fosters greater risk-sharing and access to insurance services globally, challenging conventional centralized risk pool models.

Advantages of Decentralized Risk Pools for Policyholders

Decentralized risk pools enhance transparency and trust by leveraging blockchain technology to securely and immutably record all transactions, reducing the risk of fraud for policyholders. They offer greater control and fairness, allowing participants to directly influence risk-sharing terms and claim assessments without reliance on central authorities. Lower administrative costs and automated smart contracts result in faster claim payouts and more affordable premiums, improving overall user experience and financial protection.

Potential Drawbacks of Decentralized Risk Pools

Decentralized risk pools in insurance face potential drawbacks such as reduced liquidity and increased vulnerability to manipulation due to lower participant numbers compared to traditional risk pools. The lack of centralized oversight can lead to governance challenges, making dispute resolution and claim verification more complex. Smart contract vulnerabilities and slower decision-making processes may also hinder efficiency and trust among participants.

Risk Assessment: Centralized vs. Decentralized Models

Centralized risk pools consolidate risk assessment data through a single authority, enabling uniform underwriting standards and faster premium calculations while potentially limiting transparency. Decentralized risk pools distribute risk evaluation across multiple independent nodes, enhancing transparency and reducing single points of failure but possibly increasing variability in risk pricing and assessment accuracy. The choice between these models impacts claim processing efficiency, fraud detection capabilities, and overall insurance market stability.

Future Trends in Risk Pooling for Insurance

Future trends in risk pooling for insurance emphasize the rise of decentralized risk pools leveraging blockchain technology to enhance transparency, reduce fraud, and improve claim processing efficiency. Traditional risk pools consolidate premiums to cover losses within a defined group, but decentralized models redistribute risk through peer-to-peer networks, enabling more inclusive and dynamic coverage options. Advancements in smart contracts and data analytics are driving innovation by automating claims and customizing risk assessments, signaling a shift toward more resilient and consumer-centric insurance ecosystems.

Choosing the Right Risk Pool Model for Your Insurance Needs

Selecting the right risk pool model is crucial for optimizing insurance coverage and cost-efficiency. Traditional risk pools aggregate premiums from multiple policyholders, distributing losses across a centralized group, which offers stability but limited transparency. Decentralized risk pools leverage blockchain technology to enhance transparency, reduce administrative costs, and allow participants greater control over risk sharing, making them ideal for innovative insurers seeking flexibility and trust.

Related Important Terms

Parametric Risk Pool

Parametric risk pools leverage predefined triggers based on measurable data to enable swift, transparent payouts, contrasting traditional risk pools that aggregate premiums and losses through centralized management. Decentralized risk pools utilize blockchain technology to distribute risk and claims processing across participants, enhancing trust and reducing administrative costs in parametric insurance models.

Peer-to-Peer (P2P) Insurance Pool

Risk pools aggregate premiums from multiple policyholders to spread financial risk, whereas decentralized risk pools leverage blockchain technology to facilitate transparent, trustless peer-to-peer (P2P) insurance agreements without traditional intermediaries. P2P insurance pools enhance efficiency and reduce costs by enabling members to share risks directly, improving claims processing speed and fostering community-driven risk management.

Staking-Based Risk Pool

A staking-based risk pool leverages blockchain technology to distribute insurance risk among participants who stake digital assets, enhancing transparency and security compared to traditional centralized risk pools. This decentralized approach enables risk sharing without intermediaries, reducing operational costs and increasing trust through smart contract automation.

Automated Risk Management Pool

Automated Risk Management Pools leverage decentralized blockchain technology to enhance transparency and efficiency in risk sharing compared to traditional centralized risk pools. This approach reduces counterparty risk and enables real-time smart contract execution for claims processing, optimizing insurance risk mitigation.

Tokenized Decentralized Risk Pool

Tokenized decentralized risk pools enhance traditional risk pooling by leveraging blockchain technology to distribute risk across a network of token holders, increasing transparency and liquidity. These pools enable real-time risk assessment and shared governance, reducing reliance on centralized intermediaries and improving efficiency in the insurance ecosystem.

Algorithmic Underwriting Pool

Algorithmic underwriting pools leverage machine learning models to assess risk more dynamically compared to traditional risk pools, enabling real-time premium adjustments based on vast data inputs. Decentralized risk pools distribute underwriting decisions across multiple stakeholders using blockchain technology, enhancing transparency, reducing moral hazard, and democratizing access to risk-sharing mechanisms.

Syndicated Capacity Pool

Syndicated Capacity Pools aggregate risk exposure across multiple insurers to enhance underwriting capacity and diversify risk, leveraging centralized management for streamlined claims handling and premium distribution. In contrast, decentralized risk pools distribute risk-sharing and decision-making among individual participants, promoting transparency and reducing counterparty risk through blockchain or smart contract-based mechanisms.

Fractionalized Risk Sharing Pool

Fractionalized risk sharing pools in decentralized insurance enable participants to share risks proportionally by dividing exposure into smaller, tradable units, enhancing liquidity and diversification compared to traditional risk pools. These decentralized structures leverage blockchain technology to ensure transparency, reduce counterparty risk, and facilitate efficient, trustless risk distribution among a global network of stakeholders.

Smart Contract Risk Trigger Pool

Smart Contract Risk Trigger Pools leverage decentralized risk pooling to enhance transparency and automate claim verification through blockchain technology, reducing reliance on centralized underwriters. This innovative mechanism mitigates systemic risks by allowing multiple participants to share and manage insurance coverage trustlessly, improving efficiency and security in decentralized finance (DeFi) insurance models.

Liquidity Provider Pool (Insurance)

A Risk Pool aggregates premiums from multiple policyholders to collectively cover claims, while a Decentralized Risk Pool leverages blockchain technology to distribute risk and payouts transparently without central intermediaries. Liquidity Provider Pools in insurance enable participants to supply capital directly, enhancing claim coverage capacity and earning yields through decentralized staking mechanisms.

Risk Pool vs Decentralized Risk Pool Infographic

industrydif.com

industrydif.com