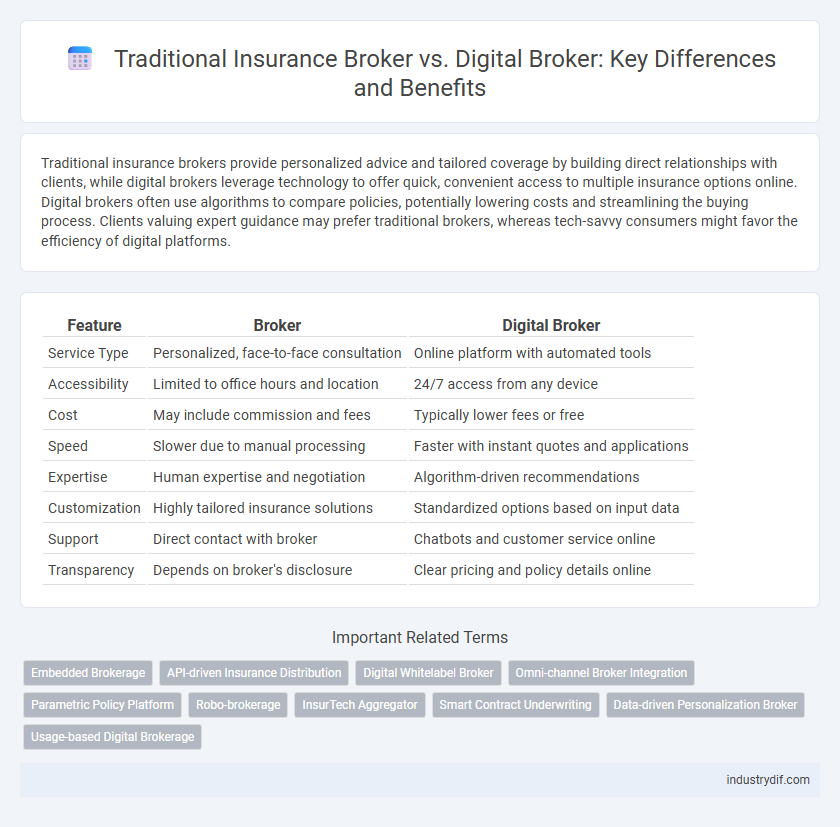

Traditional insurance brokers provide personalized advice and tailored coverage by building direct relationships with clients, while digital brokers leverage technology to offer quick, convenient access to multiple insurance options online. Digital brokers often use algorithms to compare policies, potentially lowering costs and streamlining the buying process. Clients valuing expert guidance may prefer traditional brokers, whereas tech-savvy consumers might favor the efficiency of digital platforms.

Table of Comparison

| Feature | Broker | Digital Broker |

|---|---|---|

| Service Type | Personalized, face-to-face consultation | Online platform with automated tools |

| Accessibility | Limited to office hours and location | 24/7 access from any device |

| Cost | May include commission and fees | Typically lower fees or free |

| Speed | Slower due to manual processing | Faster with instant quotes and applications |

| Expertise | Human expertise and negotiation | Algorithm-driven recommendations |

| Customization | Highly tailored insurance solutions | Standardized options based on input data |

| Support | Direct contact with broker | Chatbots and customer service online |

| Transparency | Depends on broker's disclosure | Clear pricing and policy details online |

Introduction to Insurance Brokers and Digital Brokers

Insurance brokers act as intermediaries between clients and insurance companies, providing personalized advice and tailored insurance solutions by leveraging in-depth market knowledge and client needs. Digital brokers utilize advanced algorithms and online platforms to offer quick, transparent comparisons and streamlined purchasing processes, enhancing accessibility and efficiency for policyholders. The integration of technology in digital brokerage optimizes customer experience by combining extensive data analytics with automated workflows, reducing manual intervention and accelerating policy issuance.

Defining Traditional Insurance Brokers

Traditional insurance brokers act as intermediaries between clients and insurance companies, offering personalized advice and tailored coverage options based on individual risk assessments. They rely on established relationships with insurers to negotiate policies and provide claims assistance, often emphasizing face-to-face interactions. These brokers focus on comprehensive service, leveraging industry expertise to guide clients through complex insurance requirements.

What Is a Digital Insurance Broker?

A digital insurance broker leverages advanced technology platforms to streamline the insurance purchasing process, offering personalized policy recommendations through data analytics and AI-driven tools. Unlike traditional brokers, digital brokers provide instant quotes, seamless online comparisons, and efficient policy management directly via mobile apps or websites. This approach increases accessibility, reduces administrative overhead, and enhances customer experience by delivering faster, more transparent insurance solutions.

Core Differences: Broker vs Digital Broker

Traditional insurance brokers offer personalized advice and establish direct client relationships through face-to-face interactions, leveraging their expertise to navigate complex insurance policies. Digital brokers operate primarily through online platforms, providing streamlined, user-friendly access to insurance products with automated comparisons and instant quotes, enhancing speed and convenience. The core difference lies in the delivery method: traditional brokers emphasize human interaction and tailored service, while digital brokers prioritize scalability, efficiency, and technology-driven solutions.

Services Offered by Traditional Brokers

Traditional insurance brokers provide personalized consultation by assessing individual risk profiles and tailoring coverage options to clients' specific needs. They offer in-depth expertise in navigating complex policies and claims processes, often facilitating direct communication with insurers for customized solutions. These brokers also deliver ongoing support, including policy reviews and risk management advice, ensuring continuous alignment with clients' evolving requirements.

Key Features of Digital Insurance Brokers

Digital insurance brokers leverage advanced algorithms and artificial intelligence to provide personalized policy recommendations faster than traditional brokers. They offer seamless online platforms with 24/7 accessibility, enabling clients to compare quotes, manage policies, and file claims efficiently. Integration with big data analytics enhances risk assessment accuracy and pricing transparency, optimizing customer experience and cost savings.

Customer Experience: Personal Touch vs Automation

Traditional insurance brokers offer a personalized customer experience through direct interaction, tailored advice, and relationship-building, which fosters trust and deeper understanding of client needs. Digital brokers leverage automation, AI, and streamlined platforms to provide faster policy comparisons, instant quotes, and 24/7 accessibility, enhancing convenience and efficiency. Combining human expertise with digital tools optimizes customer satisfaction by balancing personal touch and technological innovation.

Technology Adoption and Digital Transformation

Traditional insurance brokers rely heavily on personal relationships and manual processes, while digital brokers leverage advanced technologies such as AI, machine learning, and data analytics to streamline policy comparison and customer onboarding. Digital transformation accelerates efficiency and enhances user experience through automated workflows, real-time quotes, and integrated mobile platforms. Technology adoption in digital brokers enables seamless multi-channel interactions, driving faster decision-making and personalized insurance solutions.

Pros and Cons: Broker vs Digital Broker

Traditional insurance brokers offer personalized advice and tailored policy recommendations, leveraging in-depth market knowledge and human interaction; however, their services may be limited by office hours and potentially higher fees. Digital brokers provide 24/7 access, instant quotes, and streamlined application processes through automated platforms, enhancing convenience and speed but may lack the nuanced guidance required for complex insurance needs. Choosing between a broker and a digital broker depends on balancing the value of personalized expertise against the efficiency and accessibility of digital solutions.

Future Trends in Insurance Brokering

Digital brokers are transforming insurance brokering by leveraging AI-driven analytics and big data to offer personalized policy recommendations and streamlined customer experiences. Traditional brokers face increasing pressure to integrate digital tools and omnichannel platforms to remain competitive in a market shifting towards automation and real-time risk assessment. Emerging technologies like blockchain and IoT are expected to enhance transparency, speed, and accuracy in underwriting and claims processing, signaling a future where hybrid brokerage models dominate.

Related Important Terms

Embedded Brokerage

Traditional brokers offer personalized insurance advice and human touch, while digital brokers leverage technology for faster, automated policy comparison and purchasing. Embedded brokerage integrates insurance services directly within digital platforms, enabling seamless policy access and instant coverage options within non-insurance environments like e-commerce or fintech apps.

API-driven Insurance Distribution

API-driven insurance distribution empowers digital brokers by enabling seamless integration with multiple carriers, streamlining quote generation, policy management, and claims processing. Traditional brokers often rely on manual processes, whereas digital brokers leverage APIs to enhance efficiency, improve customer experience, and accelerate policy issuance through real-time data exchange and automation.

Digital Whitelabel Broker

Digital whitelabel brokers leverage advanced API integrations to offer seamless insurance solutions under a reseller's brand, enhancing user experience and accelerating market entry. Unlike traditional brokers, they provide customizable platforms with automated quoting, policy management, and data-driven analytics that optimize customer acquisition and retention.

Omni-channel Broker Integration

Traditional insurance brokers leverage personalized consultations and established client relationships to navigate complex policy selections, while digital brokers utilize AI-driven platforms for streamlined, data-centric decision-making. Integrating omni-channel broker solutions merges in-person expertise with digital accessibility, enhancing customer experience through seamless interactions across phone, online chat, and mobile apps.

Parametric Policy Platform

Traditional insurance brokers customize coverage through personalized consultations, while digital brokers leverage parametric policy platforms to automate claims processing based on predefined triggers like weather data or market indices. This shift enhances efficiency, reduces claim settlement times, and provides transparent, real-time payout execution for customers.

Robo-brokerage

Robo-brokerage leverages advanced algorithms and AI to provide personalized insurance recommendations quickly, reducing reliance on traditional human brokers. This digital approach enhances efficiency and accessibility, offering clients tailored policy options with minimal manual intervention while maintaining competitive pricing.

InsurTech Aggregator

InsurTech aggregators transform traditional insurance brokerage by providing digital platforms that streamline policy comparison, instant quotes, and seamless purchasing processes, enhancing customer convenience and transparency. Unlike conventional brokers, digital brokers leverage AI and data analytics to deliver personalized insurance solutions, optimize risk assessment, and accelerate claims processing, driving efficiency in the insurance market.

Smart Contract Underwriting

Digital brokers leverage smart contract underwriting to automate policy issuance and claims processing, increasing accuracy and reducing turnaround times compared to traditional brokers. This technology enhances transparency and trust by executing predefined contract terms without manual intervention, streamlining risk assessment and premium calculation.

Data-driven Personalization Broker

Traditional insurance brokers rely on manual assessments and personal relationships, whereas digital brokers leverage advanced algorithms and big data analytics to deliver highly personalized policy recommendations. Data-driven personalization enables digital brokers to analyze customer behavior, preferences, and risk profiles in real-time, optimizing coverage options and pricing transparency.

Usage-based Digital Brokerage

Usage-based digital brokerage leverages telematics and real-time data analytics to tailor insurance premiums according to individual driving behaviors, enhancing personalized risk assessment. Unlike traditional brokers, digital brokers offer seamless, app-based interfaces that facilitate instant policy adjustments, claims processing, and continuous usage monitoring for optimized coverage and cost-efficiency.

Broker vs Digital Broker Infographic

industrydif.com

industrydif.com