Smart contracts revolutionize insurance by automating claims processing and reducing human error, unlike traditional paper policies that rely heavily on manual intervention and documentation. Paper policies often lead to delays and increased administrative costs, whereas smart contracts enable real-time execution and transparent tracking of policy terms. Embracing smart contracts enhances trust, accelerates payouts, and minimizes fraud in the insurance industry.

Table of Comparison

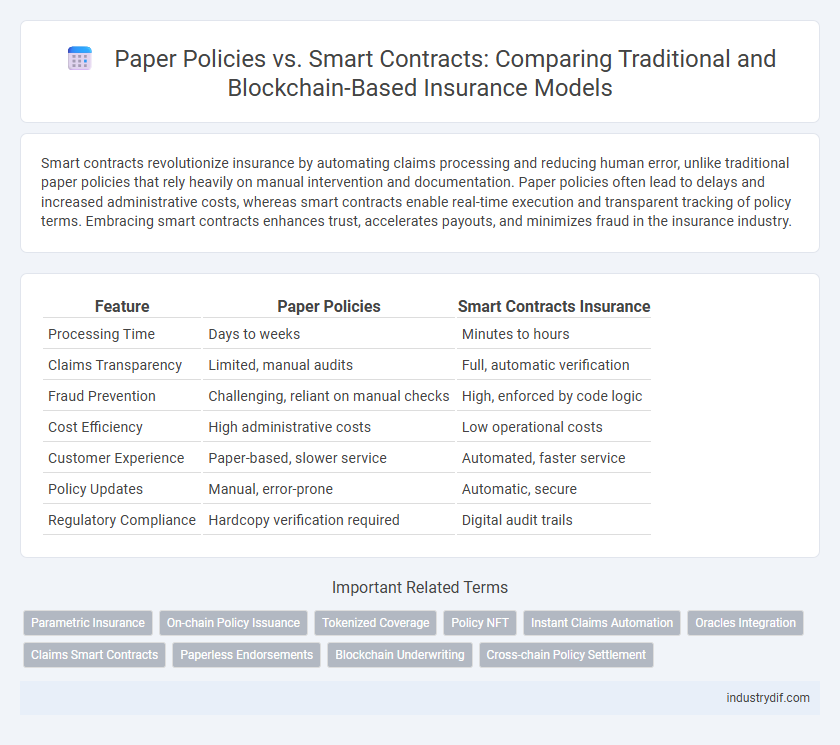

| Feature | Paper Policies | Smart Contracts Insurance |

|---|---|---|

| Processing Time | Days to weeks | Minutes to hours |

| Claims Transparency | Limited, manual audits | Full, automatic verification |

| Fraud Prevention | Challenging, reliant on manual checks | High, enforced by code logic |

| Cost Efficiency | High administrative costs | Low operational costs |

| Customer Experience | Paper-based, slower service | Automated, faster service |

| Policy Updates | Manual, error-prone | Automatic, secure |

| Regulatory Compliance | Hardcopy verification required | Digital audit trails |

Evolution of Insurance: From Paper Policies to Smart Contracts

The evolution of insurance has shifted from traditional paper policies to blockchain-based smart contracts, enhancing transparency and automating claim processing. Smart contracts reduce human error and fraud by executing terms automatically when predefined conditions are met, accelerating settlement times. This transition leverages decentralized technology to improve efficiency, accuracy, and trust within insurance frameworks.

Key Differences Between Traditional and Smart Contract Insurance

Traditional insurance policies rely on paper documentation and manual processing, leading to slower claim settlements and higher administrative costs. Smart contract insurance utilizes blockchain technology to automate claim verification and payouts, ensuring transparency, efficiency, and reduced fraud risks. This shift enhances customer trust by enabling real-time tracking and immutable contract enforcement.

Benefits of Paper-Based Insurance Policies

Paper-based insurance policies provide a tangible, physical document that policyholders can easily review and store, ensuring clarity and reducing digital vulnerabilities like cyberattacks or data breaches. They enable straightforward legal verification and acceptance in jurisdictions where electronic contracts may lack formal recognition or robust regulatory frameworks. Additionally, paper policies support individuals without reliable internet access or technological proficiency, enhancing inclusivity and accessibility within the insurance market.

Advantages of Smart Contract Insurance Solutions

Smart contract insurance solutions offer unparalleled transparency and efficiency by automating claims processing through blockchain technology, significantly reducing fraud and human error. These self-executing contracts enable real-time settlements without intermediaries, lowering administrative costs and enhancing customer trust. Moreover, smart contracts provide immutable records and faster payouts, improving overall policyholder experience compared to traditional paper-based insurance policies.

Common Challenges Facing Paper Policies

Paper insurance policies often suffer from manual processing errors, delayed claim settlements, and difficulty in verifying policy authenticity, leading to inefficiencies and fraud risks. The reliance on physical documents increases administrative costs and complicates record-keeping, making it challenging for insurers to quickly adapt to customer needs. Limited transparency and lack of real-time updates further hinder effective communication between insurers and policyholders.

Security Considerations in Smart Contract Insurance

Smart contract insurance enhances security by leveraging blockchain's immutability and transparency, reducing fraud and error prevalent in traditional paper policies. Despite these benefits, vulnerabilities such as coding bugs, oracle failures, and potential cyberattacks require rigorous auditing and robust security protocols. Implementing multi-signature wallets, formal verification, and decentralized oracle systems strengthens the resilience of smart contract insurance against manipulation and unauthorized access.

Claims Processing: Manual vs Automated Approaches

Claims processing in paper policies relies heavily on manual verification, resulting in longer approval times and increased human error risks. Smart contracts insurance automates claims handling through pre-programmed blockchain protocols, ensuring faster settlements and transparent audit trails. This automation reduces operational costs and enhances customer satisfaction by minimizing delays in claims payouts.

Regulatory Implications for Both Insurance Models

Paper policies are subject to established regulatory frameworks that require physical documentation, manual record-keeping, and compliance audits, often resulting in slower claim processing and increased administrative costs. Smart contract insurance operates within the evolving legal landscape of blockchain technology, raising challenges regarding jurisdiction, enforceability, and data privacy while promising automated, transparent claim settlements. Regulators are increasingly tasked with balancing innovation and consumer protection by developing guidelines that accommodate the decentralized nature and real-time execution of smart contracts alongside traditional insurance regulations.

Cost Efficiency: Traditional Insurance vs Smart Contracts

Traditional paper insurance policies involve high administrative costs due to manual processing, paperwork, and human error, leading to increased premiums. Smart contracts in insurance leverage blockchain technology to automate policy execution and claims processing, significantly reducing operational expenses and fraud-related costs. This automation enhances cost efficiency by minimizing intermediaries and streamlining verification, enabling lower premiums and faster claim settlements.

Future Trends in Insurance: Digital Transformation and Blockchain

Smart contracts in insurance leverage blockchain technology to automate claim processing, reduce fraud, and enhance transparency compared to traditional paper policies. The future of insurance is increasingly digital, with integration of AI, IoT, and decentralized ledgers enabling personalized, real-time risk assessment and policy management. Blockchain's immutable records and programmable contracts promise to streamline underwriting and claims, driving efficiency and customer trust in the evolving insurance landscape.

Related Important Terms

Parametric Insurance

Parametric insurance leverages smart contracts to automatically trigger payouts based on predefined parameters such as weather data, eliminating the delays and disputes often associated with traditional paper policies. This innovative approach enhances transparency, reduces administrative costs, and ensures faster claims settlement by directly linking event occurrences to compensation without the need for manual claims processing.

On-chain Policy Issuance

On-chain policy issuance leverages blockchain technology to automate and securely record insurance contracts, eliminating the inefficiencies and risks associated with traditional paper policies. This digital approach enhances transparency, reduces fraud, and enables real-time updates and claims processing through smart contract execution, revolutionizing the insurance policy lifecycle.

Tokenized Coverage

Tokenized coverage in smart contracts insurance revolutionizes traditional paper policies by enabling automated, transparent, and tamper-proof policy management on blockchain networks. This digital innovation enhances security, reduces administrative costs, and allows instant claims processing, transforming the insurance industry with real-time, verifiable coverage data.

Policy NFT

Policy NFTs revolutionize insurance by replacing traditional paper policies with secure, tamper-proof digital assets on the blockchain, enabling instant verification, automated claims processing, and seamless transfers. This innovation enhances transparency, reduces fraud, and lowers administrative costs compared to conventional insurance documentation.

Instant Claims Automation

Instant claims automation in smart contract insurance leverages blockchain technology to process claims immediately upon trigger events, reducing processing time from days to seconds compared to traditional paper policies. This seamless automation enhances transparency and accuracy by eliminating manual paperwork and minimizing human errors in claims validation.

Oracles Integration

Smart contracts in insurance leverage oracles to seamlessly integrate real-world data, enhancing accuracy and automation in claims processing compared to traditional paper policies constrained by manual verification. Oracle integration enables real-time risk assessment and transparent, tamper-proof contract execution, fostering increased trust and efficiency in insurance operations.

Claims Smart Contracts

Claims smart contracts automate the insurance claims process by using blockchain technology to verify and execute claim payments instantly based on predefined conditions, reducing errors and fraud compared to traditional paper policies. This automation streamlines claim settlements, enhances transparency, and accelerates payout speeds while minimizing administrative costs.

Paperless Endorsements

Smart contracts insurance enables instant, paperless endorsements by automating policy adjustments on a decentralized blockchain, enhancing accuracy and reducing administrative costs compared to traditional paper policies that rely on manual processing and physical documentation. This digital transformation improves claim processing speed and policyholder transparency while minimizing the risk of human error and document loss inherent in conventional insurance endorsements.

Blockchain Underwriting

Blockchain underwriting enhances smart contracts insurance by automating claims processing and ensuring transparent, tamper-proof records unlike traditional paper policies, which are prone to human error and fraud. This decentralized approach reduces administrative costs and accelerates policy issuance, improving efficiency and trust in the insurance ecosystem.

Cross-chain Policy Settlement

Cross-chain policy settlement enables automated claim validation and payment across multiple blockchain networks, enhancing the efficiency and transparency of smart contract insurance compared to traditional paper policies. This interoperability reduces settlement times and minimizes errors, allowing seamless integration of diverse insurance products within decentralized finance ecosystems.

Paper Policies vs Smart Contracts Insurance Infographic

industrydif.com

industrydif.com